Updates

Effective January 1, 2019, Castle Financial & Retirement Planning Associates discontinued its voluntary fee waiver for All-Terrain Opportunity (TERIX) and will not seek reimbursement of any fees it voluntarily waived.

Welcome back to our readers employed by the Securities and Exchange Commission! The whole “shut the government down” thing struck me as unproductive lunacy and ended up with a number of our readers (most visibly the SEC folks) furloughed.

Briefly Noted . . .

Thanks, as ever, to The Shadow for his tireless review of thousands of SEC filings monthly. For all my care in reviewing that same database, I’m forever amazed by the amount that he finds (and shares) that slips past me.

SMALL WINS FOR INVESTORS

Baird Funds announced recent fee reductions for four of their funds. Chautauqua International Growth Fund (CCWIX/CCWSX) will change from 0.95% to 0.80% for the institutional share class and from 1.20% to 1.05% for the investor share class. Chautauqua Global Growth Fund (CCGIX/CCGSX) will go from 0.95% to 0.80% for the institutional share class and from 1.20% to 1.05% for the investor share class. Baird Small/Mid Cap Value Fund (BMVIX/BMVSX) drops from 0.95% to 0.85% for the institutional share class and from 1.20% to 1.10% for the investor share class. And, more modestly, Baird SmallCap Value Fund (BSVIX/BSVSX) will change from 1.00% to 0.95% for the institutional share class and from 1.25% to 1.20% for the investor share class.

Effective at the start of business on January 10, 2019, the First Eagle Overseas Fund (SGOVX) again began accepting new investors “without special restriction.”

Grandeur Peak Global Opportunities Fund, Grandeur Peak International Opportunities Fund, and Grandeur Peak Global Reach Fund will re-open to existing shareholders and to new shareholders who purchase directly from Grandeur Peak Funds. Check out our separate story on the openings.

Invesco Developing Markets Fund (GTDDX) to reopen to new investors at the end of February. (Why wait?) Morningstar laments its “recent dismal performance” (2018 didn’t go well) while remaining hopeful and affirming its Bronze rating.

Longleaf Partners Fund (LLPFX) is open to new investors.

CLOSINGS (and related inconveniences)

Effective January 28, 2019, Clarkston Select Fund (CIDDX) closed to investment by new and existing shareholders ahead of a merge with Clarkston Fund (CILGX ).

OLD WINE, NEW BOTTLES

At the end of February, Ashmore Emerging Markets Corporate Debt Fund will be renamed Ashmore Emerging Markets Corporate Income Fund.

Cedar Ridge Unconstrained Credit Fund (CRUPX) has become a Shelton Capital Fund, though I know not which quite yet.

On January 16, 2019, Timpani Capital Management entered into a purchase agreement with Calamos Advisors under which Calamos will acquire Timpani, As a result Frontier Timpani Small Cap Growth Fund (FTSCX) will get a new moniker soon.

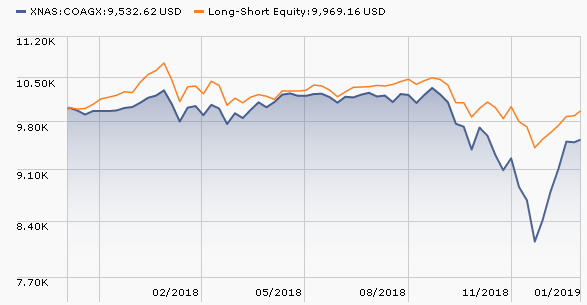

Caldwell & Orkin Market Opportunity Fund (COAGX) has become Caldwell & Orkin – Gator Capital Long/Short Fund. They have announced changes to the fund’s investment strategy and I wish them well. Here’s the fund’s performance since the Gator managers joined in 2017:

The Nushares, which always sounded like a knock-off shoe brand, are no more. Nu officially admits to being Nuveen:

| Current Fund Name | New Fund Name |

| Nushares ESG Large-Cap Growth ETF | Nuveen ESG Large-Cap Growth ETF |

| Nushares ESG Large-Cap Value ETF | Nuveen ESG Large-Cap Value ETF |

| Nushares ESG Mid-Cap Growth ETF | Nuveen ESG Mid-Cap Growth ETF |

| Nushares ESG Mid-Cap Value ETF | Nuveen ESG Mid-Cap Value ETF |

| Nushares ESG Small-Cap ETF | Nuveen ESG Small-Cap ETF |

On January 18, 2019, the Tocqueville International Value Fund (TIVFX) became the American Beacon Tocqueville International Value Fund.

On (or about) March 28, 2019, two WisdomTree ETFs shift from passive to active. WisdomTree Dynamic Currency Hedged Europe Equity Fund (DDEZ) will become WisdomTree Europe Multifactor Fund (EUMF) and WisdomTree Dynamic Currency Hedged Japan Equity Fund (DDJP) becomes WisdomTree Japan Multifactor Fund (JAMF). The only substance that Wisdom Tree owns up to is that the new funds will use “a model-based approach.”

OFF TO THE DUSTBIN OF HISTORY

Aberdeen Asia Bond Fund (AEEAX) will be liquidated on or about February 21, 2019.

Brown Advisory-WMC Japan Alpha Opportunities Fund (BIAJX) will be liquidated on February 22, 2019.

Effective immediately, Cincinnati Asset Management Funds Broad Market Strategic Income Fund (CAMBX) has terminated the public offering of its shares and will discontinue its operations effective February 25, 2019.

Cornerstone Advisors Public Alternatives Fund, Cornerstone Advisors Real Assets Fund and Cornerstone Advisors Income Opportunities Fund all joined the heavenly choir on January 31, 2019.

On January 28, 2019, the Board of Directors of TD Asset Management approved the liquidation of each of the Epoch U.S. Small-Mid Cap Equity Fund and TD Global Low Volatility Equity Fund, both in mid-March, 2019.

Hatteras Alpha Hedged Strategies Fund is slated to merge with and into STAAR Disciplined Strategies Fund (SITAX, formerly STAAR Alternative Categories Fund) on or about March 25, 2019.

Highmore Managed Volatility Fund (HMVZX) was liquidated on January 31, 2019.

Hodges Pure Contrarian Fund (HDPCX) will reach its contrarian conclusion on February 28, 2019.

James Purpose Based Investment ETF (JPBI) will liquidate on February 7, 2019. Lost its sense of purpose, perhaps?

Leland Currency Strategy Fund (GHCAX) will liquidate on February 25, 2019. Morningstar’s John Rekenthaler recently nominated multi-currency funds as one of the five worst “liquid alts” options, mostly because their returns have not been much better than cash.

Neuberger Berman Long Short Credit Fund (NLNAX) “will cease its investment operations, liquidate its assets and make a liquidating distribution, if applicable, to be on or about February 27, 2019 .” Very thorough of them.

Neuberger Berman Core Plus Fund (NCPAX) will be dispatched similarly on February 27.

On or about February 22, 2019, Perritt Low Priced Stock Fund (PLOWX) will be reorganized into the Perritt MicroCap Opportunities Fund (PRCGX). It find it curious that the board of directors was “pleased to announce” the demise of a tiny, underperforming fund except in an “out of its misery” way.

ProSports Sponsors ETF(FANZ) liquidated on January 17, 2019. In general, I think all of these freakish little niche funds – the investing equivalent of the cheaply made, here-for-a-season “fast fashion” clothes – improve the world with their passing. Fortunately, the market arranges that with some frequency.

Putnam Europe Equity Fund (PEUGX) will merge into Putnam Europe Equity Fund on or about May 20, 2019.

REX BKCM ETF (BKC) is expected to cease operations and liquidate on or about February 7, 2019

Royce Special Equity Multi-Cap Fund (RSEMX) will liquidate on February 25, 2019. The official word is “The Fund is being liquidated primarily because it has not maintained assets at a sufficient level for it to be viable.”

Satuit Capital U.S. Emerging Companies Fund (SATMX), once a tiny titan in the microcap space, liquidated on January 21, 2019.

Effective January 1, 2019, the Thomson Horstmann & Bryant MicroCap Fund (THBVX) changed to the THB Asset Management MicroCap Fund.

On December 21, 2018, the board of trustees for Vanguard Convertible Securities Fund (VCVSX) approved a proposal to dissolve and liquidate the Fund on or about March 19, 2019. It was a Bronze-rated fund with Oaktree at the helm and a billion in assets. Clearly too little for Vanguard to tolerate.

Volshares Large Cap ETF (VSL) liquidated immediately after the close of business on January 30, 2019. No Happy Hour for them, eh?