Sixty-two funds saw partial turnover in their management teams but no high profile manager stalked off or was shown the door, and no rising star was awarded a new charge. Actually there were rather more than 62, since we don’t track boring bond funds (the value added by the third manager on a Massachusetts muni fund is modest enough that we don’t track those teams; sorry, guys) and, this month only, we’re boycotting changes in the Dreyfus funds. Frankly, Dreyfus got annoying. Their announcements show up in the SEC filings under a bunch of labels (including dozens of Dreyfus series, CitizensSelect, Advantage Funds and Strategic Funds) and were poorly written. We ended up with a headache and the decision to share the following announcement: “about a dozen Dreyfus funds shifted teams this month; if you invest with them, you might want to double-check.”

| Ticker | Fund | Out with the old | In with the new | Dt |

| CLSHX | AdvisorOne CLS Shelter Fund | Paula Wieck is no longer listed as a portfolio manager for the fund. | Case Eichenberger, Jackson Lee and Rusty Vanneman will join Gene Frerichs on the management team. | 2/18 |

| TWGTX | American Century All Cap Growth Fund | Marcus Scott and Michael Orndorff are no longer listed as portfolio managers for the fund. | Joseph Reiland and Gregory Woodhams will now manage the fund. | 2/18 |

| TWHIX | American Century Heritage Fund | Michael Orndorff, Marcus A. Scott and Greg Walsh are no longer listed as portfolio managers for the fund. | Robert Brookby will join Nalin Yogasundram on the management team. | 2/18 |

| TWEGX | American Century International Discovery Fund | No one, but . . . | Federico Laffan, oddly, has just been added to the prospectus, though he’s been on the team that manages the fund since 2014. Trevor Gurwich and Pratik Patel are the other 2/3 of the team. | 2/18 |

| AMJVX | American Century Multi-Asset Income Fund | No one, but . . . | John Donner joins Vidya Rajappa, Scott Wilson, Richard Weiss, and Radu Gabudean on the management team. | 2/18 |

| ACFIX | Arbitrage Credit Opportunities Fund | No one, but . . . | John Orrico joins Gregory Loprete and Robert Ryon on the management team.. | 2/18 |

| ARSQX | Aristotle Value Equity Fund | No one, but . . . | Gregory Padilla joins Howard Gleicher on the management team. | 2/18 |

| MDEGX | BlackRock Long-Horizon Equity Fund | No one, but . . . | Jane Holl joins Stuart Reeve and Andrew Wheatley-Hubbard on the management team. | 2/18 |

| EGEAX | Carillon Eagle Smaller Company Fund | Matthew McGeary, Betsy Pecor and Charles Schwartz are no longer listed as portfolio managers for the fund. | James McBride and Timothy Miller will now manage the fund. | 2/18 |

| CLSAX | CLS Global Diversified Equity Fund | Paula Wieck is no longer listed as a portfolio manager for the fund. | Grant Engelbart and Rusty Vanneman will continue to manage the fund. | 2/18 |

| CLERX | CLS Growth and Income Fund | Paula Wieck is no longer listed as a portfolio manager for the fund. | Joshua Jenkins and Rusty Vanneman will continue to manage the fund. | 2/18 |

| CLHAX | CLS International Equity Fund | No one, but . . . | Jackson Lee joins Konstantin Etus and Joe Smith on the management team. | 2/18 |

| CLSHX | CLS Shelter Fund | Paula Wieck is no longer listed as a portfolio manager for the fund. | Gene Frerichs will be joined by Case Eichenberger, Jackson Lee, and Rusty Venneman on the management team. | 2/18 |

| CBSAX | Columbia Mid Cap Growth Fund | William Chamberlain is no longer listed as a portfolio manager for the fund. | John Emerson, Matthew Litfin, and Erika Maschmeyer will now manage the fund. | 2/18 |

| SLMCX | Columbia Seligman Communications and Information Fund | Rahul Narang will no longer serve as a portfolio manager for the fund. | Vimal Patel joins Paul Wick, Shekhar Pramanick, Sanjay Devgan, Jeetil Patel, and Christopher Boova on the management team. | 2/18 |

| SHGTX | Columbia Seligman Global Technology Fund | Rahul Narang will no longer serve as a portfolio manager for the fund. | Vimal Patel joins Paul Wick, Shekhar Pramanick, Sanjay Devgan, Jeetil Patel, and Christopher Boova on the management team. | 2/18 |

| FGMNX | Fidelity GNMA Fund | William Irving no longer serves as lead portfolio manager of the fund. | Sean Corcoran joins Franco Castagliuolo in managing the fund. | 2/18 |

| FINPX | Fidelity Inflation-Protected Bond Fund | William Irving no longer serves as lead portfolio manager of the fund. | Sean Corcoran joins Franco Castagliuolo in managing the fund. | 2/18 |

| FSNGX | Fidelity Select Natural Gas | Ted Davis will no longer serve as a portfolio manager for the fund. | Ben Shuleva will continue to manage the fund. | 2/18 |

| FNARX | Fidelity Select Natural Resources | John Dowd will no longer serve as a portfolio manager for the fund. | Nathan Strik will continue to manage the fund. | 2/18 |

| FSRRX | Fidelity Strategic Real Return Fund | William Irving is no longer listed as a portfolio manager for the fund. | Sean Corcoran joined Franco Castagliuolo, Samuel Wald, Mark Snyderman, Adam Kramer, and Ford O’Neil on the management team. | 2/18 |

| HISIX | Homestead International Equity | No one, but . . . | Scott Crawshaw joins Patrick Todd, Andrew West, Bryan Lloyd, Alexander Walsh, and Ferrill Roll in managing the fund. “Ferrill Roll” is a fascinating name, something worthy of Game of Thrones. |

2/18 |

| WASAX | Ivy Asset Strategy Fund | Cynthia Prince-Fox is retiring, effective April 30th, and will no longer serve as a portfolio manager for the fund. | W. Jeffrey Surles joins F. Chace Brundige on the management team. | 2/18 |

| IGJAX | Ivy Government Securities Fund | No one, but . . . | Susan Regan joins Rick Perry in managing the fund. | 2/18 |

| IWGAX | Ivy Wilshire Global Allocation Fund | Cynthia Prince-Fox is retiring, effective April 30th, and will no longer serve as a portfolio manager for the fund. | W. Jeffrey Surles joins F. Chace Brundige on the management team. | 2/18 |

| Various | John Hancock Funds II Multi-Index Lifestyle Portfolios | Effective immediately, Marcelle Daher no longer serves as a portfolio manager of the funds. | Robert Sykes joins Robert Boyda and Nathan Thooft on the management team. | 2/18 |

| Various | John Hancock Funds II Multi-Index Lifetime Portfolios | Effective immediately, Marcelle Daher no longer serves as a portfolio manager of the funds. | Robert Sykes joins Robert Boyda and Nathan Thooft on the management team. | 2/18 |

| Various | John Hancock Funds II Multi-Index Preservation Portfolios | Effective immediately, Marcelle Daher no longer serves as a portfolio manager of the funds. | Robert Sykes joins Robert Boyda and Nathan Thooft on the management team. | 2/18 |

| Various | John Hancock Funds II Multimanager Lifestyle Portfolios | Effective immediately, Marcelle Daher no longer serves as a portfolio manager of the funds. | Robert Sykes joins Robert Boyda and Nathan Thooft on the management team. | 2/18 |

| Various | John Hancock Funds II Multimanager Lifetime Portfolios | Effective immediately, Marcelle Daher no longer serves as a portfolio manager of the funds. | Robert Sykes joins Robert Boyda and Nathan Thooft on the management team. | 2/18 |

| MVPFX | Marathon Value Portfolio | Marc Heilweil, who’d guided the fund since inception in 2000, will no longer serve as a portfolio manager. | Todd Jones now runs the fund. | 2/18 |

| MITTX | Massachusetts Investors Trust | No one, but . . . | Alison O’Neill Mackey joins Kevin Beatty and Ted Maloney on the management team. | 2/18 |

| DIFAX | MFS Diversified Income Fund | As of September 1, 2018, William Adams will no longer be a portfolio manager of the fund. As of December 31, 2018, Jim Swanson will no longer serve as a portfolio manager for the fund. | Robert Almeida and Michael Skatrud join Ward Brown, David Cole, Rick Gable, Matt Ryan, Jonathan Sage, and Geoffrey Schechter on the management team. | 2/18 |

| MWOFX | MFS Global Growth Fund | No one, but . . . | Joseph Skorski joins David Antonelli and Jeffrey Constantino on the management team. | 2/18 |

| MHOAX | MFS Global High Yield Fund | As of September 1, 2018, William Adams will no longer be a portfolio manager of the fund. | Michael Skatrud will join David Cole, Matt Ryan and William Adams in managing the fund, in anticipation of Mssr. Adams departure. | 2/18 |

| MFEGX | MFS Growth Fund | Matthew Sabel is no longer listed as a portfolio manager for the fund. | Eric Fischman and Paul Gordon will continue to manage the fund. | 2/18 |

| MHITX | MFS High Income Fund | As of September 1, 2018, William Adams will no longer be a portfolio manager of the fund. | Michael Skatrud will join David Cole and William Adams in managing the fund, in anticipation of Mssr. Adams departure. | 2/18 |

| OTCAX | MFS Mid Cap Growth Fund | Matthew Sabel is no longer listed as a portfolio manager for the fund. | Eric Fischman and Paul Gordon will continue to manage the fund. | 2/18 |

| FPPAX | MFS Prudent Investor Fund | No one, but . . . | Edward Dearing joins David Cole and Barnaby Weiner in managing the fund. | 2/18 |

| MFIOX | MFS Strategic Income Fund | As of September 1, 2018, William Adams will no longer be a portfolio manager of the fund. | Michael Skatrud joins Joshua Marston, Ward Brown, Philipp Burgener, David Cole, Alexander Mackey, Robert Persons, and Matt Ryan in managing the fund, in anticipation of Mssr. Adams departure. | 2/18 |

| MFGIX | Monteagle Quality Growth Fund | No one, but . . . | Steven MacNamara joined Tom Sauer, Craig Cairns, Stefan Kip Astheimer, and Brett Winnefeld on the management team. | 2/18 |

| QVGIX | Oppenheimer Global Allocation Fund | Mark Hamilton and Dokyoung Lee will no longer serve as a portfolio managers for the fund. | Alessio de Longis and Benjamin Rockmuller will continue to manage the fund. | 2/18 |

| ODAAX | Oppenheimer Global Multi-Alternatives Fund | Mark Hamilton and Dokyoung Lee will no longer serve as a portfolio managers for the fund. | Alessio de Longis and Benjamin Rockmuller will continue to manage the fund. | 2/18 |

| QMGAX | Oppenheimer Global Multi-Asset Growth Fund | Mark Hamilton and Dokyoung Lee will no longer serve as a portfolio managers for the fund. | Alessio de Longis and Benjamin Rockmuller will continue to manage the fund. | 2/18 |

| QMAAX | Oppenheimer Global Multi-Asset Income Fund | Mark Hamilton and Dokyoung Lee will no longer serve as a portfolio managers for the fund. | Alessio de Longis and Benjamin Rockmuller will continue to manage the fund. | 2/18 |

| OYCIX | Oppenheimer Portfolio Series Conservative Investor Fund | Mark Hamilton and Dokyoung Lee will no longer serve as a portfolio managers for the fund. | Jeffrey Bennett will now run the fund. | 2/18 |

| OYAIX | Oppenheimer Portfolio Series Equity Investor Fund | Mark Hamilton and Dokyoung Lee will no longer serve as a portfolio managers for the fund. | Jeffrey Bennett will now run the fund. | 2/18 |

| OYMIX | Oppenheimer Portfolio Series Moderate Investor Fund | Mark Hamilton and Dokyoung Lee will no longer serve as a portfolio managers for the fund. | Jeffrey Bennett will now run the fund. | 2/18 |

| PNOPX | Putnam Multi-Cap Growth Fund | Richard Bodzy and Robert Brookby are no longer listed as portfolio managers for the fund. | Katherine Collins and R. Sheperd Perkins will now manage the fund. | 2/18 |

| RDMIX | Rational Dynamic Momentum Fund | Michael Ivie and R. Jerry Parker will no longer serve as portfolio managers for the fund. | Adam Butler, Rodrigo Gordillo, and Michael Philbrick will now manage the fund. | 2/18 |

| SIEPX | Saratoga International Equity Fund | Marc Miller is no longer listed as a portfolio manager for the fund. | John Brim, Stephanie Jones, and Stephen Smith are now managing the fund. | 2/18 |

| SITIX | STAAR International Fund | J. Andre Weisbrod is no longer listed as a portfolio manager for the fund. | Brett Boshco now manages the fund. | 2/18 |

| SITAX | STAAR Investment Trust – Alternative Categories Fund | J. Andre Weisbrod is no longer listed as a portfolio manager for the fund. | Brett Boshco now manages the fund. | 2/18 |

| SITLX | STAAR Larger Company Stock Fund | J. Andre Weisbrod is no longer listed as a portfolio manager for the fund. | Brett Boshco now manages the fund. | 2/18 |

| SITSX | STAAR Smaller Company Stock Fund | J. Andre Weisbrod is no longer listed as a portfolio manager for the fund. | Brett Boshco now manages the fund. | 2/18 |

| FPCIX | Strategic Advisers Core Income Fund | Stewart Wong is no longer listed as a portfolio manager for the fund. | Jonathan Dugan joins Gregory Pappas, Jeffrey Moore, Michael Plage, Franco Castagliuolo, Sean Corcoran, and James Herbst on the management team. | 2/18 |

| HMVAX | The Hartford Midcap Value Fund | James Mordy has announced his plan to retire from the fund, effective December 31, 2018. | Gregory Garabedian will continue to manage the fund. | 2/18 |

| USMIX | USAA Extended Market Index Fund | Jennifer Hsui, Rachel Aguirre, Creighton Jue, Alan Mason, and Greg Savage will no longer serve as portfolio managers for the fund. | Richard Brown, Thomas Durante, and Karen Wong will now run the fund. | 2/18 |

| WEEMX | Wells Fargo Factor Enhanced Emerging Markets Fund | No one, but . . . | Monisha Jayakumar is added as a portfolio manager, joining Dennis Bein, Harindra de Silva, and David Krider on the team. | 2/18 |

| WINTX | Wells Fargo Factor Enhanced International Fund | No one, but . . . | Monisha Jayakumar is added as a portfolio manager, joining Dennis Bein, Harindra de Silva, and David Krider on the team. | 2/18 |

| WLECX | Wells Fargo Factor Enhanced Large Cap Fund | No one, but . . . | Monisha Jayakumar is added as a portfolio manager, joining Dennis Bein, Ryan Brown, and Harindra de Silva on the team. | 2/18 |

| WFESX | Wells Fargo Factor Enhanced Small Cap Fund | No one, but . . . | Monisha Jayakumar is added as a portfolio manager, joining Dennis Bein, Ryan Brown, and Harindra de Silva on the team. | 2/18 |

nclude Artisan High Income (top high income fund over three years), DoubleLine Shiller Enhanced CAPE (top LCV over three years), and Towle Deep Value Fund (top SCV over three).

nclude Artisan High Income (top high income fund over three years), DoubleLine Shiller Enhanced CAPE (top LCV over three years), and Towle Deep Value Fund (top SCV over three). Thanks, as always, to The Shadow whose indefatigable sleuthing in the dark hallways of the SEC’s EDGAR database drags dozens of fund changes – most especially liquidations – to light each month. Even when I’ve already caught the changes, it’s incredibly reassuring to have him there … in the shadows … watching.

Thanks, as always, to The Shadow whose indefatigable sleuthing in the dark hallways of the SEC’s EDGAR database drags dozens of fund changes – most especially liquidations – to light each month. Even when I’ve already caught the changes, it’s incredibly reassuring to have him there … in the shadows … watching.

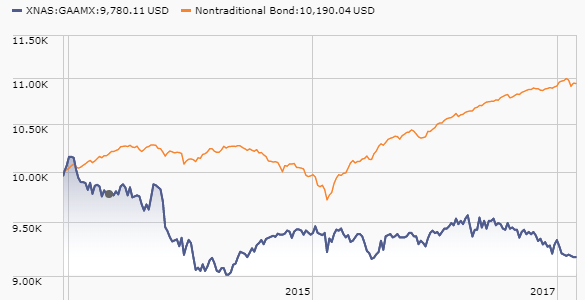

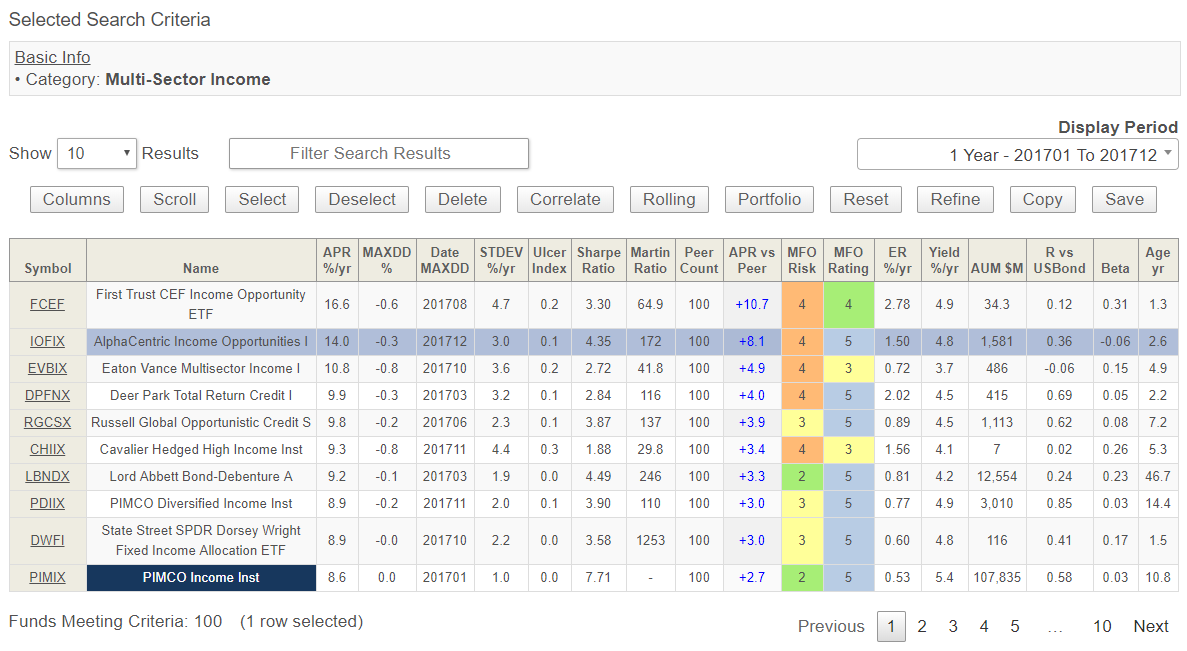

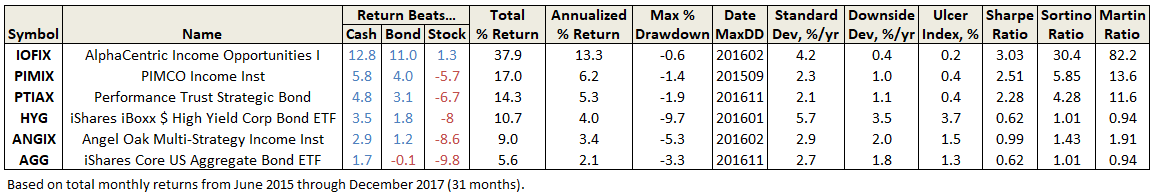

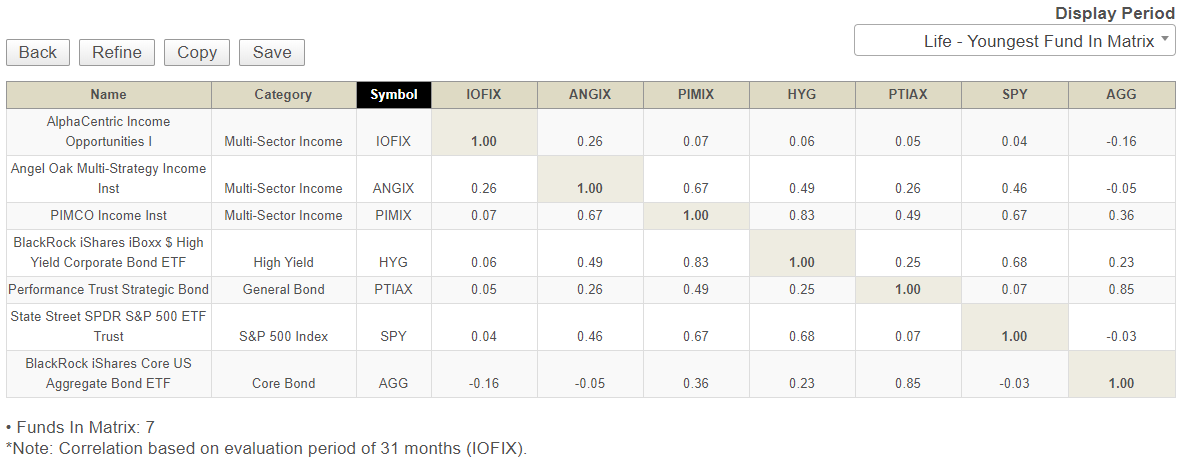

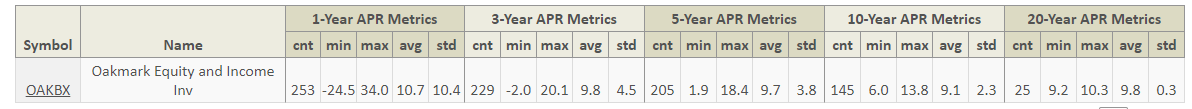

It has two features that most screeners lack, and both of them are Charles! Charles has been thinking about what’s really important for investors to know in order to make the best decisions for themselves and their families. As a result, (1) he’s built in tools – from uncommon risk measures to correlation matrices and rolling return screens – that give you information that’s meaningful. And (2) he revises the site almost monthly to accommodate your needs and interests. Literally: if you write with a concern, you get a prompt answer that actually comes from one or both of us. Quite frequently, you also get new or clarified options added to MFO Premium as a result.

It has two features that most screeners lack, and both of them are Charles! Charles has been thinking about what’s really important for investors to know in order to make the best decisions for themselves and their families. As a result, (1) he’s built in tools – from uncommon risk measures to correlation matrices and rolling return screens – that give you information that’s meaningful. And (2) he revises the site almost monthly to accommodate your needs and interests. Literally: if you write with a concern, you get a prompt answer that actually comes from one or both of us. Quite frequently, you also get new or clarified options added to MFO Premium as a result.

Landon Thomas’s long article in the

Landon Thomas’s long article in the  By their estimation, 60% of all name changes are marketing gimmicks: sinking funds making desperate attempts to appear trendy, hot, cool, cutting edge or relevant. 20% of name changes occur in funds that have repeatedly renamed themselves. Many changes, City National Rochdale Emerging Markets (RIMIX) fund’s renaming pursuant to new ownership, are pretty valid. Others, for example those stapling “opportunity,” “contrarian” or “dynamic” to their names, are often admissions of failure.

By their estimation, 60% of all name changes are marketing gimmicks: sinking funds making desperate attempts to appear trendy, hot, cool, cutting edge or relevant. 20% of name changes occur in funds that have repeatedly renamed themselves. Many changes, City National Rochdale Emerging Markets (RIMIX) fund’s renaming pursuant to new ownership, are pretty valid. Others, for example those stapling “opportunity,” “contrarian” or “dynamic” to their names, are often admissions of failure.