Objective and strategy

The managers seek long-term growth of capital favorable to its benchmarks with lower risk – specifically companies with 12-15% earnings growth potential for at least three years. They typically hold 40-60 SMid stocks whose valuations are attractive relative to their growth prospects. SMid caps have market capitalizations between $250 million and $12 billion, and are generally within the range of those in the Russell 2500 Growth Index.

Adviser

Conestoga Capital Advisors. The firm, founded in 2001 by Robert Mitchell and William Martindale, is located in Wayne, PA. It’s a boutique, independent investment firm specializing in managing small cap and mid cap growth stocks. Conestoga advises the two Conestoga mutual funds and approximate 190 separately managed accounts. As of July 31, 2018, total AUM at the firm was $3.87B, $2.46B in mutual funds, $1.35B in separate accounts, and $60M in a pooled retirement vehicle known as a collective investment fund.

Managers

Bob Mitchell, Managing Partner, CIO; Derek Johnston, CFA; and Joe Monahan, CFA.

At Martindale Andres, Mr. Mitchell was a portfolio manager/analyst and Director of Equity Research where he focused his expertise on small capitalization companies. He has 23 years of investing experience.

Mr. Johnston has 22 years of investing experience, 16 years in the small and mid cap space. He also co-manages the firm’s SMid Cap Growth strategy with Mr. Mitchell.

Mr. Monahan is the co-PM on the Small Cap strategy and an analyst on the SMid Cap Growth strategy. He has 36 years of investing experience.

They are supported with research from David Neiderer, CFA, CPA, and Larry Carlin, CFA.

Strategy capacity

Based on market conditions as of July 31, 2018, the capacity for the SMid Cap strategy is approximately $2 billion+ for total strategy assets, which include the fund and separate accounts. As of July 31, 2018, total strategy assets were $131.5 million with $64.4 million in the mutual fund and $67.1 million in separate accounts. The managers would expect $2 billion+ for the foreseeable future unless there was a major disruption in the market.

Active share

95, per FactSet Research, 7/31/18. “Active share” measures the degree to which a fund’s portfolio differs from the holdings of its benchmark portfolio. High active share indicates management which is providing a portfolio that is substantially different from, and independent of, the index. An active share of zero indicates perfect overlap with the index, 100 indicates perfect independence. CCSMX has an active share of 95 which reflects an exceptionally high degree of independence from its benchmark Russell 2500 Growth Index.

Management’s stake in the fund

As of September 30, 2017, Mr. Mitchell owned from $100,001 to $500,000 of the SMid Cap Fund’s shares. Mr. Monahan owned from $50,001 to $100,000 of the SMid Cap Fund’s shares and Mr. Johnston $500,001 to $1,000,000. As of September 5, 2018, four of the fund’s six independent trustees have invested in it, with one newly appointed trustee who would not have had the opportunity to invest yet. One trustee has invested $50,000 – 100,000 while the others are in the $10,000 – 50,000 bracket. The trustees and the officers together hold between 18.8% of the Investor class SMID cap fund and 4.2% of the Institutional class.

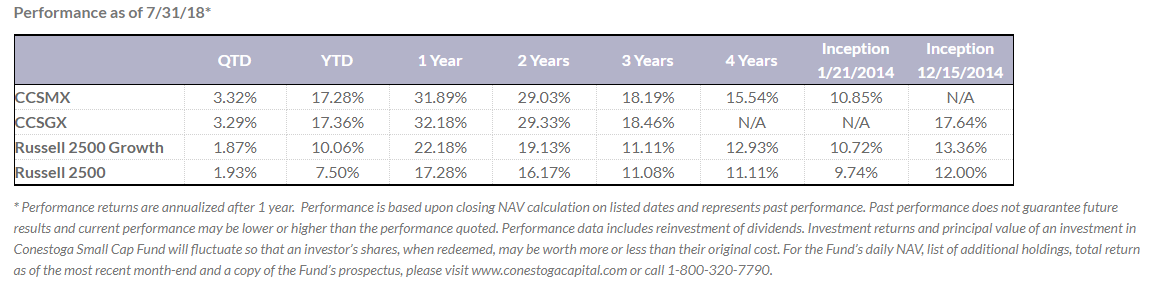

Opening date

The Investor Class (CCSMX) launched on January 21, 2014, the Institutional Class (CCSGX) followed on December 15, 2014.

Minimum investment

CCSMX $2,500 CCSGX $250,000

Brokerage Options

- Vanguard

- CCSMX NTF Basic $3,000; IRA $2,500

- CCSGX TF $20 Basic, IRA $250,000

- TD Ameritrade

- CCSMX NTF Basic, IRA $2,500

- CCSGX Institutional Shareholders Only, TF $49.99, $250,000 Basic, IRA

- Fidelity

- CCSMX NTF Basic, IRA $2,500

- CCSGX TF $49.95 $2,500

- Schwab

- CCSMX NTF Basic, IRA $100

- CCSGX TF $76 $2,500

Expense ratio

0.85% for Institutional shares, 1.10% for Investor shares on assets of $406.2 million, as of July 2023.

Reason for launching the fund

CCSMX is an extension of the firm’s capabilities in the small cap (CCALX/CCASX) space where it can leverage its knowledge. As the market capitalizations of smaller companies continued to drift higher and graduate into the mid cap space, the managers knew many of the names after covering them for so long as small caps. On July 1, 2018, Conestoga partially closed the small cap fund.

The current overlap between the two funds is between 50-55%. The managers expect the overlap to remain in the 50-60% range going forward.

Comments

As a small/mid cap manager, Conestoga has shown that it’s well qualified to find companies early in their history, under-followed by analysts, and then hold them until they reach their full potential. These companies, and their management teams, benefit from secular growth, often exploiting under-served or niche markets.

Because of their high quality focus, the managers have historically favored technology, producer durables, and health care companies — but not biotech — due to lack of profitability.

To mitigate the portfolio against market declines during the current market cycle when valuations are high, they stay true to their focus by only owning high quality, durable businesses and manage position sizes by taking profits in holdings that are expensive in both an absolute sense and relative to their benchmarks. Specifically, these companies are profitable, with high ROE and earnings growth, low debt to capitalization and significant levels of insider ownership, characteristics that they believe lead to better downside protection.

So what happens when their performance suffered, as it did in 2014 for CCSMX (-8.10% vs. +5.65% R2500 Growth Index from inception 1/22/14 to 12/31/14) and CCASX (-8.05% vs. +5.60% R2000 Growth Index) and tested their patience?

They stayed true to their discipline, identified issues in companies that underperformed, didn’t change their stripes or what’s working, and held on to the lion’s share of those companies that disappointed wherein there were no structural problems with the business.

No companies are purchased without a thorough research review prior to investment. Company visits and/or conference calls with a company’s management are a requirement before investing in a company and subsequent visits and calls are made on a periodic basis after initial investment. Their five-person investment team conducts their own internal research examining financial statements and speaking with various customers, suppliers and competitors. They attend industry conferences and trade shows and utilize a network of regional research contacts to supplement their internal research and discussions with company management.

Bottom Line

The managers believe that the SMid Cap Fund offers similar long-term capital appreciation potential as their small cap fund but across a wider capitalization range that incorporates both small and mid-capitalization stocks. What actually supports this view?

CCSMX succeeds from owning high quality conservative companies with stable and sustainable earnings growth, strong balance sheets, and significant management ownership. The team likes to see management ownership of 10% or more of a company in the small cap fund. For CCSMX, however, the hurdle is somewhat lower because it’s more difficult to have that level in larger companies.

Investors often hear about the so-called small cap size effect or premia, i.e., that small stocks outperform large caps over time. But small cap portfolios are not created equally. So what creates this size premia?

Research shows that the quality of companies in a small cap portfolio, their profitability, sustainability of earnings, liquidity, avoiding high beta companies, those with low leverage – in other words – avoiding low quality companies or junk – are responsible for this effect.

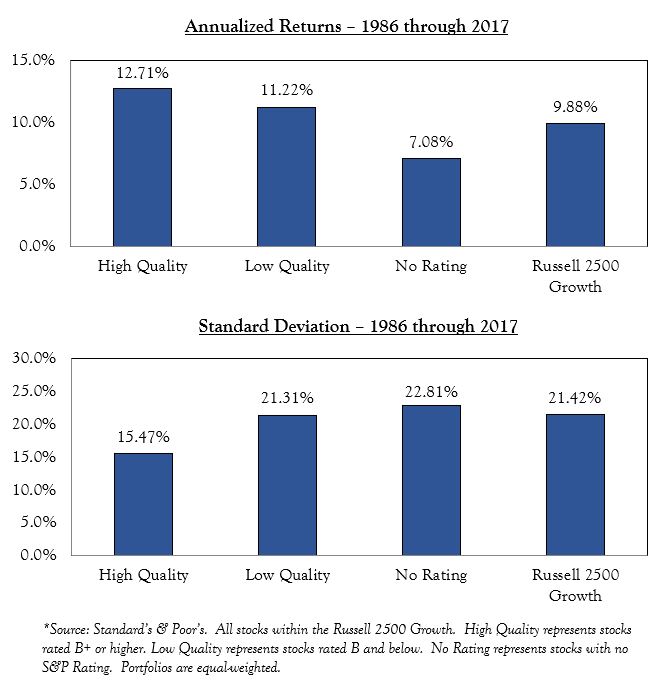

Regarding high-quality small/mid cap stocks, Conestoga has hired Standard & Poor’s (S&P) to conduct an annual study of the performance and volatility of high vs. low quality stocks for the time period of 1986 – 2017 for the Russell 2000 Growth and Russell 2500 Growth Indices. These studies confirm that higher quality names have outperformed lower quality names and have done so with much lower levels of volatility.

Below are the results of these studies from S&P for the Russell 2500 Growth Index:

Also, embedded in the firm’s philosophy is that smaller companies tend to be “underfollowed” by sell-side analysts, which the managers use as an advantage in this inefficient discovery process. For example, fewer than five sell-side analysts cover some of the companies they own in the fund.

Currently about 18% of companies in the Russell 2500 and 23% in the Russell 2500 Growth are unprofitable. The high levels of unprofitable companies in the index work to their advantage because these companies have typically underperformed over long periods of time, thus giving them a higher probability of generating excess returns above the index over a full market cycle — the fund’s main objective.

The managers emphasize a patient, long-term approach to achieving superior returns with low turnover in a small and SMID cap asset class generally characterized as volatile. Forty-nine percent of the names currently in the portfolio have been there since inception of the fund over 4.5 years ago. The annual portfolio turnover is 20-30% annually, 4.4% in the last 12 months as of July 31. This long-term approach to high quality investing is one of the differentiating characteristics of their style relative to other managers in the space.

Investing with high conviction is another hallmark of the Conestoga Funds, which own between 40-60 stocks diversified across economic sectors.

Their last notable characteristics are consistent returns with low volatility and downside protection. Here are capture numbers as of July 31, 2018.

| CCSMX | 3 Yr | Since Inception (1/21/14) |

| Upside Capture Ratio: | 118.4 | 94.7 |

| Downside Capture Ratio: | 83.8 | 94.0 |

| CCSGX | 3 Yr | Since Inception (12/15/14) |

| Upside Capture Ratio: | 119.3 | 95.4 |

| Downside Capture Ratio: | 83.6 | 90.4 |

Both funds have a high-quality conservative growth approach which can protect capital during periods of market uncertainty and higher volatility.

CCSMX/CCSGX is not Conestoga’s first venture into mid-cap investing. They had a short-lived mid-cap fund and separate accounts, but limited demand and market conditions convinced them to close the mutual fund. However, the managers still run a few separate accounts in the Mid Cap Strategy. The team believes the new fund is more flexible than its predecessor and allows them to draw more seamlessly on their small cap expertise.

Because Conestoga executes a quality strategy, it has created excess returns relative to its benchmark index.

Furthermore, the culture of the firm is strong: It is 100% employee-owned, not interested in growing for growth’s sake, but focused on shareholder returns, deliberate about how they grow the business and control their future.

Need an example? They’ve closed the cash window of CCASX to maintain investor returns.

Conestoga has no debt, and as of 2Q18, continues to expand ownership of the firm with one PM and one analyst becoming new members and others increasing their stake.

The five-member team consists of generalists, not five specialists siloed in Wayne, PA to cover separate market sectors.

Its pedigree is CCASX, an Honor Roll Fund since inception in 2002, and has an overall Morningstar 5-star rating.

With CCASX having limited availability, CCSMX gives investors the opportunity to own the approximately 50-60% of what used to be small caps names that the team has owned for seven years. Now, because of their growth and profit runway, they’re too big for the small cap space but remain excellent as mid caps.

Conestoga focuses on long term performance, high quality companies, keeping up with the market when it’s rising, outperforming during periods of volatility, and ultimately beating the Russell 2500 Growth Index by 200 bps over an entire market cycle. For investors, that’s an excellent choice to have.