(with special thanks to rforno of MFO’s Discussion Board for the title)

The New York State Attorney General’s office has weighed-in on behalf of investors, and active share. Active share is a measure of the extent of the difference between what’s in fund’s portfolio and what’s in the fund’s benchmark index. If your fund holds all the same stocks in all the same percentage as its benchmark, then its active share is zero. A zero active share is good if you’ve bought – and are being charged for – an index fund. A zero active share is bad is you were sold – and are being charged for – something masquerading as an active fund.

The difference in risks and return between a fund and its benchmark are created by the active part of the fund’s portfolio. A fund that differs in composition only a tiny bit from its benchmark will likely differ in risk or return by only a tiny bit. If you’re paying substantially more for an active fund than you’d be charged for a passive one, they you have reason to expect a substantial difference from the benchmark with the prospect for substantially lower risks or higher returns.

Sadly, many funds – called “closet index funds” – charge for active management then produce index-like portfolios. In March 2018, nearly a year after alerting funds that they were under investigation for misbranding themselves, Britain’s Financial Conduct Authority forced a number of British investment firms to pay their investor £34 million for marketing 64 large funds as “active” when they were closet indexers.

What’s the chance that your fund is a closet index? Large funds are, on whole, less active than small funds and the industry is increasingly dominated by large funds; in consequence, the percentage of industry assets held by closet indexers has grown steadily and is now a third or more of industry assets (Jeffrey Moeller, Closet Indexing and the Concept of Active Share, 2013). Research by Matos, Cremers, Ferreira Starks, published in 2016, sorts through 24,000 funds worldwide, and estimates that about 20% are closet indexes (Indexing and Active Fund Management: International Evidence; a readable report about the research, Active Vs. Passive Funds: The Mutual Fund Shell Game, was published in 2017). That research uses an active share cut-off of 60% to distinguish active funds from closet indexers.

Saving “the active share story without a title”

Sometimes I need … hmm, a little help from my friends. (Mm, I get by with a little help from my friends.) This was one of those times. Interesting story, exhausted author, no clue about what to use for a title. In draft, it remained “the active share story without a title.”

Enter the folks on the MFO Discussion Board. I posted a précis of the story and asked for help finding a title. Ultimately, I asked Chip to review the offerings and she picked rforno’s “New York AG forces fund companies out of the indexing closet,” which struck her as eye-catching and just a little edgy.

We’d like to recognize the runner-up, VintageFreak’s “Get Active, I Say!” Honorable mention is given to Lewis Braham’s “Time to Share that Active Share Data” (though she thought just “Time to Share that Active Share” might have been sharper), David Moran’s “Using the Active Voice” (the editor in him keeps escaping) and Maurice’s “Are Individual Investors Like Mushrooms In The Dark?” (just a touch too allusive). Ted made her chuckle, but might have been a little too edgy. Bee, like me, was feeling sensible and descriptive while Chip was looking for a bit of play.

Thanks to you all, and not just for this one helpful outburst. You make a difference!

The problem is that it’s damnably difficult to find out if you’re one of the people paying for one thing and getting another. Very few large fund companies have been willing to easily disclose that data.

The New York Attorney General’s action might be changing that. In April the office published Mutual Fund Fees and Active Share. The study surveys the expenses and active shares of 2700 mutual funds.

The Attorney General has three major findings.

-

Active share is relevant.

Rather than reviewing the debate on the relevance of active share to a fund’s performance, the AG simply noted that fund firms use this data themselves in determining who to hire and fire and in assessing the performance of their funds. -

Active share and fund expenses are weakly correlated.

It would be nice if paying more guaranteed that you got more active management. It doesn’t. Advisers charge whatever they can get you to pay (it’s the nature of capitalism), so you see bunches of closet index funds (the dots below the 60% line, as a rough illustration) charging high fees. -

Fund firms don’t disclosure active share to peons.

Of 14 major firms surveyed, only one – Fidelity – makes active share information routinely available to retail investors while all 14 use it with their institutional investors. Even with Fidelity, the number is isolated and buried. Here’s their profile of Fidelity Growth Company, you’ll find active share in the right hand column just below “asset allocation.”Independent fund firms, such as Artisan, Touchstone and about 80% of the funds we cover, do routinely and prominently share that information.

Responding to the Attorney General’s pressure, the fund advisors have agreed to publish active share information quarterly.

Following NYOAG’s investigation, 13 of the 14 mutual fund firms surveyed agreed to publish the Active Share metric for their actively managed equity funds available to U.S. investors. The 14th firm surveyed by NYOAG – Fidelity Management & Research Company – was already publishing Active Share for its relevant funds. As a result of these actions by some of the largest mutual fund firms in the United States, all investors will now have access to additional important information about more than 400 actively managed funds.

The firms that have agreed to post Active Share information for their relevant funds on their websites on a quarterly basis are:

- AllianceBernstein

- BlackRock

- Dreyfus

- Capital Group Companies, Inc. (American Funds)

- Columbia

- Eaton Vance

- Goldman Sachs

- JP Morgan Chase

- OppenheimerFunds

- Nuveen

- Rowe Price

- USAA and

- Vanguard.

The industry’s trade group, the Investment Company Institute, promptly did what you’d expect: they denounced both state interference and the importance of relevant information for investors.

“We strongly believe state authorities should not arrogate to themselves the authority to impose inconsistent disclosure requirements,” Paul Schott Stevens, ICI’s president and chief executive, said in an e-mailed statement. “‘Active share’ is not relevant for many funds or investors.” (Rachel Evans, Picking a Mutual Fund Just Got Easier, Thanks to N.Y. Regulator, Bloomberg, 4/6/2018)

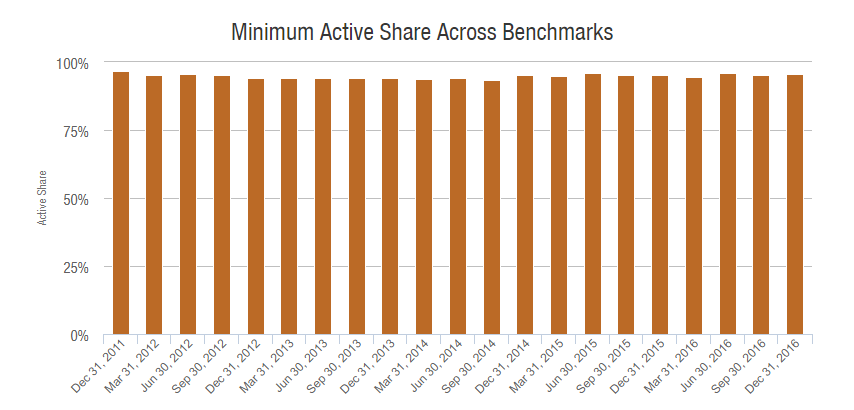

Neither the Attorney General nor Ms. Evans points investors to ActiveShare.Info, but they should. The active share site provides slightly out-of-date active share information for most domestic equity funds. The “slightly out of date” shouldn’t particularly bother you because active share tends to be stable; closet indexers tend to remain closet indexes while highly independent managers tend to remain highly independent. Here, as an illustration, is five years’ worth of data for FPA Capital.

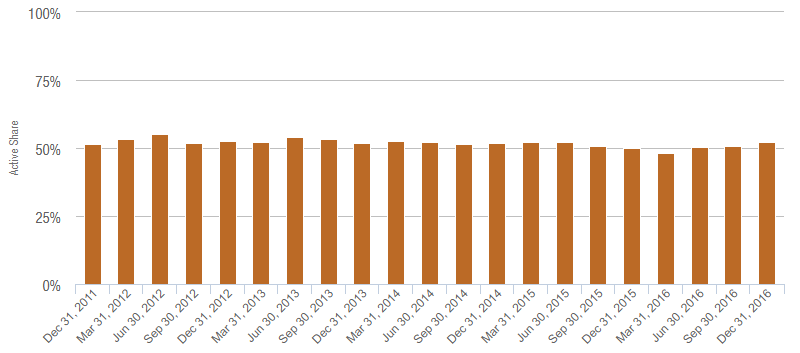

Likewise for Fidelity Growth Company (FCGSX), which Fido reports as having an active share of 54%.

The problem with active share is that calculations are pretty much limited to pure equity funds; the data doesn’t seem to exist for multi-asset and income funds.

Bottom Line: Being active is not the same thing as being good. A manager who wanders off and buys Venezuelan cryptocurrencies and pink-sheet stocks is being active, and actively stupid. That said, managers who are simultaneously active, patient and focused tend to outperform others (Cremers, Active Share and the Three Pillars of Active Management: Skill, Conviction and Opportunity, 2017). Managers who are inactive and expensive represent about the worst possible deal for investors. You owe it to yourself, if nothing else, to find out whether your fate is tethered to such a creature.