Updates

In March, we highlighted some notable funds that had received Lipper Fund Awards for their excellence over the past three years. A couple people wrote to note, correctly, that they’d received five-year awards and those were even cooler, despite the fact that I hadn’t mentioned them.

Mea culpa. Mea maxima culpa.

KCM Macro Trends Fund (KCMTX) received recognition of the best five-year performance among all alternative global macro funds.

AQR Multi-Strategy Alternatives (ASANX) led the alternative multi-strategy group. I mention that in recognition of the fact that AQR seems remarkably successful across a range of such funds, none of which particularly welcome smaller investors.

City National Rochdale Emerging Markets (RIMIX) led among EM funds.

Polaris Global Value Fund (PGVFX) received the award for global multi-cap value fund.

Edgewood Growth topped the five year large-cap growth rankings while LSV Value Equity (LSVEX) was tops in large-cap value. Our profiles of them are too old to be worth linking for you, but we’ll check during April to see if we might offer updated profiles.

Broadly speaking, T. Rowe Price dominated the target-date retirement categories, in some cases winning the three-, five- and ten-year awards. TIAA-CREF made a strong showing, with Fidelity and Vanguard pretty much shut out.

For multi-cap core funds, Parnassus Endeavor ran the table, winning the three-, five- and ten-year awards. Love the fund, worry about manager Dodson’s age.

And Oberweis International Opportunities (OBOIX) was the top international small- to mid-cap growth fund over the past 10 years.

Morningstar has initiated analyst coverage on David Sherman’s RiverPark Short Term High Yield Fund (RPHIX/RPHYX)

Briefly Noted . . .

Aberdeen seems to have taken a dislike to the Okies: “Class T shares are not currently available for purchase and not currently sold in any State or to residents of any State, including Oklahoma or to residents of Oklahoma.” Hmmm … perhaps they were afraid that the Oklahomans wouldn’t have figured it out otherwise?

On March 26, 2018, the $140 million Cambria Shareholder Yield ETF (SYLD) gave up its identity as an actively managed quant ETF and became a passively managed index fund tracking the Shareholder Yield index. No decrease in fees accompanied the change.

On April 6, 2018, Direxion Monthly S&P 500® Bull 2x Fund (DXSLX) and Direxion Monthly Nasdaq-100® Bull 2x Fund (DXQLX) will each undergo 5:1 share splits; for every share you own on April 5, you’ll have five on April 7. Since the NAV per share will be precisely one-fifth as high, investors will neither gain nor lose value from the split.

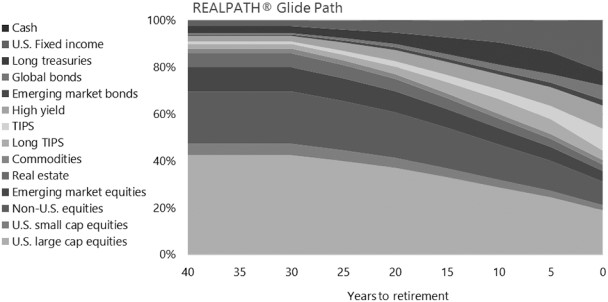

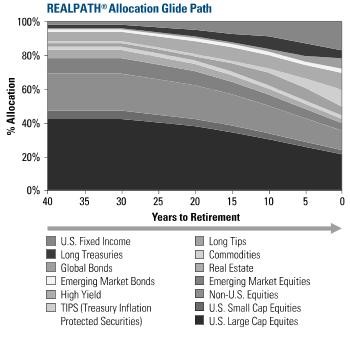

I originally thought that PIMCO had updated the “glide path,” that is, the changes in their retirement funds’ asset allocation strategy, effective at the end of March, 2018.

It actually appears that they’re just updated the picture of the glide path, to the one above from the one below.

Hmmm … well, let’s look at the differences. (1) The new asset allocation glide path has the legend on the left, rather than underneath. And (2) the new glide path is higher res than the old one.

I tingle.

Especially in the face of increasingly unstable markets, many folks have been asking how much equity exposure they should have. PIMCO’s answer is, “it depends.” In particular it depends on how close you are to actually needing some of the money and how the markets are priced. Here’s the short version of their asset allocation guide.

| Years to goal | Stocks | Real assets | Fixed income |

| 40 | 74 ±15 | 10 ±10 | 16 ±15 |

| 30 | 73 ±15 | 10 ±10 | 17 ±15 |

| 20 | 65 ±15 | 10 ±10 | 25 ±15 |

| 10 | 50 +10 to – 20 | 6 ±6 | 44 +20 to -10 |

| 0 | 36 + 10 to -20 | 4 ±4 | 60 +20 to -10 |

What might you take away from these ranges?

-

A 10-year time frame is when you need to move decisively from the “stocks for the long term” mantra. At the 10 year threshold, the weighting on stocks and the potential overweighting of them drop dramatically. PIMCO’s maximum conceivable stock exposure at the 20 year window is 80%; at the 10 year window, it’s 60%.

Why? Because it can take more than 10 years to recover from a bear market. Possibly much more. At this moment, there are 44 funds still in the red 10 years after the 2007-09 crash. An additional 47 funds took 10 years or more (that is, 120 – 122 months) to reach the break-even point. At person who is 58 years old today – that is, a person 10 years from full Social Security benefits – whose retirement is almost entirely equities, is at risk of having a portfolio in 2028 that’s no bigger than it is today. Few of us can afford a lost decade.

Want to check yourself? Easy if you have MFO Premium access (and you should, it’s ridiculously affordable at $100 and you’d be helping keep the lights on here). On the multi-screener, go to the “asset sub type” tab and click “US equity, global equity, international equity and mixed asset.” On the “display period” tab, pick “full cycle 5 – 200711-201802”) and on “period metrics” choose “longest recovery time.” You can sort the resulting tab by “recovery months” (or anything else, for that matter) or you can download it as a spreadsheet.

- Real assets are a hedge against inflation, but are famously volatile. Shorter-term portfolios should contain little or none of them, presumably since the potential losses from rising prices are smaller than the potential losses in a volatile asset class.

- Fixed income should never be less than 50% of an income-oriented portfolio. Granted that most of us spend 15 years or so “in retirement,” but that’s still not a long enough window to warrant the volatility of stocks. That’s not an argument for a bond index fund, whose construction is far more problematic than an equity index’s. Nor is it an argument for loading up on interest-rate sensitive fare. It is a reminder that a bond bear market is far less horrendous than an equity bear, even though it might drag on for decades. Ben Carlson of Ritzholz Wealth (and a “Bloomberg Prophet,” god help us all) wrote a really thoughtful essay at Bloomberg.com about the nature of a bond market bear. The short version: your greatest risk isn’t loss of principal, it’s loss of purchasing power to inflation when your bond yield (which might be positive) is smaller than your cost-of-living rise. Check the cool and scary chart labeled “inflation-adjusted government bond drawdowns, 1926-2017.”

For additional details on the whole “get your asset allocation right or else” thing, you might review the data from T. Rowe Price that we’ve periodically provided in our essays on a stock-light portfolio.

SMALL WINS FOR INVESTORS

FMI International Fund (FMIJX / FMIYX) will reopen to new investors on April 2, 2018.

On March 30, 2018, Gator Focus Fund (GFFAX / GFFIX) redesignated its Investor shares as Institutional shares, and then dropped the minimum initial investment from $100,000 down to $5,000. The new institutional shares serve as a sort of universal share class for the fund, and do not impose 12b-1 fees. Nice people. $3 million fund. Disastrous performance.

Vanguard Convertible Securities Fund (VCVSX) is now open “to new accounts for institutional clients who invest directly with Vanguard.”

CLOSINGS (and related inconveniences)

Vanguard Wellington Fund (VWELX) has closed to all prospective financial advisory, institutional, and intermediary clients (other than clients who invest through a Vanguard brokerage account).

OLD WINE, NEW BOTTLES

Effective April 6, 2018, AllianzGI Small-Cap Blend Fund (AZBAX) will change its name from AllianzGI Small-Cap Fund.

American Century Adaptive All Cap Fund (ACMNX) will be renamed the Adaptive Small Cap Fund, effective May 7, 2018.

Effective immediately, the name of the BlueStar TA-BIGITech Israel Technology ETF (ITEQ) is changed to the BlueStar Israel Technology ETF.

The former Collins Long/Short Credit Fund is now CrossingBridge Long/Short Credit Fund (CLCAX). The fund just received its first Morningstar rating, which placed it as a four-star fund in the long-short credit group. Notwithstanding, Morningstar’s new quantitative rating system (see this month’s “Morningstar Minute” article for details) places a negative rating on the fund for perceived weaknesses in its People, Parent and Price pillars. On the fund’s profile page, Morningstar shows 53 funds in its peer group, up from 50 at the end of 2017, but you get that number only by counting each share class (A, C, advisor, retirement, institutional and so on) of each fund as a separate fund. In reality, there are only 16 “distinct” funds in the group.

Fidelity Strategic Income (FSICX) is reorganizing into Fidelity Advisor Strategic Income (FSRIX), effective April 27, 2018. The Advisor version is several hundred million dollars larger and several basis points costlier, but it’s otherwise the same fund. The 10 year correlation between the two is 100.

The Board of Trustees at GMO approved a change in the name of GMO U.S. Equity Allocation Series Fund (GMUEX) to GMO U.S. Equity Series Fund, but didn’t stipulate a date for the change. The fund’s investment minimums range from $10 million to $750 million, so relatively few of us will be waiting anxiously to learn the date.

After the close of the markets on April 6, 2018, the Guggenheim ETFs all become PowerShares ETFs.

| Fund | Acquiring Fund |

| Guggenheim S&P 100® Equal Weight ETF | PowerShares S&P 100® Equal Weight Portfolio |

| Guggenheim S&P 500® Equal Weight ETF | PowerShares S&P 500® Equal Weight Portfolio |

| Guggenheim S&P 500® Equal Weight Consumer Discretionary ETF | PowerShares S&P 500® Equal Weight Consumer Discretionary Portfolio |

| Guggenheim S&P 500® Equal Weight Consumer Staples ETF | PowerShares S&P 500® Equal Weight Consumer Staples Portfolio |

| Guggenheim S&P 500® Equal Weight Energy ETF | PowerShares S&P 500® Equal Weight Energy Portfolio |

| Guggenheim S&P 500® Equal Weight Financials ETF | PowerShares S&P 500® Equal Weight Financials Portfolio |

| Guggenheim S&P 500® Equal Weight Health Care ETF | PowerShares S&P 500® Equal Weight Health Care Portfolio |

| Guggenheim S&P 500® Equal Weight Industrials ETF | PowerShares S&P 500® Equal Weight Industrials Portfolio |

| Guggenheim S&P 500® Equal Weight Materials ETF | PowerShares S&P 500® Equal Weight Materials Portfolio |

| Guggenheim S&P 500® Equal Weight Real Estate ETF | PowerShares S&P 500® Equal Weight Real Estate Portfolio |

| Guggenheim S&P 500® Equal Weight Technology ETF | PowerShares S&P 500® Equal Weight Technology Portfolio |

| Guggenheim S&P 500® Equal Weight Utilities ETF | PowerShares S&P 500® Equal Weight Utilities Portfolio |

| Guggenheim S&P MidCap 400® Equal Weight ETF | PowerShares S&P MidCap 400® Equal Weight Portfolio |

| Guggenheim S&P SmallCap 600® Equal Weight ETF | PowerShares S&P SmallCap 600® Equal Weight Portfolio |

| Guggenheim MSCI Emerging Markets Equal Country Weight ETF | PowerShares MSCI Emerging Markets Equal Country Weight Portfolio |

| Guggenheim S&P 500® Top 50 ETF | PowerShares S&P 500® Top 50 Portfolio |

| Guggenheim S&P 500® Pure Growth ETF | PowerShares S&P 500® Pure Growth Portfolio |

| Guggenheim S&P 500® Pure Value ETF | PowerShares S&P 500® Pure Value Portfolio |

| Guggenheim S&P MidCap 400® Pure Growth ETF | PowerShares S&P MidCap 400® Pure Growth Portfolio |

| Guggenheim S&P MidCap 400® Pure Value ETF | PowerShares S&P MidCap 400® Pure Value Portfolio |

| Guggenheim S&P SmallCap 600® Pure Growth ETF | PowerShares S&P SmallCap 600® Pure Growth Portfolio |

| Guggenheim S&P SmallCap 600® Pure Value ETF | PowerShares S&P SmallCap 600® Pure Value Portfolio |

| Guggenheim Multi-Factor Large Cap ETF | PowerShares Multi-Factor Large Cap Portfolio |

On May 22, 2018, MainStay MacKay Tax Advantaged Short Term Bond Fund (MYTBX) becomes MainStay MacKay Short Term Municipal Fund. At that point, the management fee drops substantially (from 45 bps to 35 bps) and the investment strategy targets an “actively managed, diversified portfolio of tax-exempt municipal debt securities.”

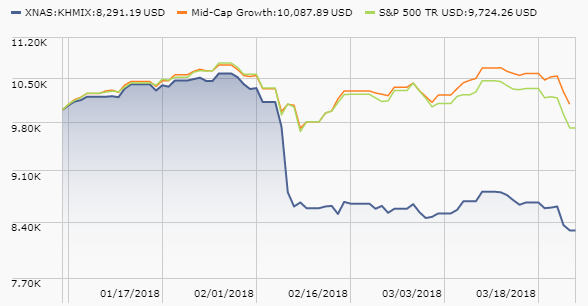

On or about April 30, 2018, MarketGrader 100 Enhanced Index Fund (KHMIX) becomes MarketGrader 100 Enhanced Fund. The fund appears to have suffered an “oops,” and is down 17% YTD as of late March.

The advisor’s website is curiously silent on the collapse illustrated above. That, all by itself, seems a valid reason to avoid the fund.

Effective May 1, 2018, Neuberger Berman Socially Responsive Fund (NBSRX) will change to Neuberger Berman Sustainable Equity Fund. The investment strategy will reorient to focus on mid- and large-cap stocks which survive ESG and valuation screens.

As of March 22, 2018, USCA Shield Fund (SHLDX) was renamed USCA Premium Buy-Write Fund.

Effective April 16, 2018, the name of the Sierra Strategic Income Fund (SSIZX) will be changed to Sierra Tactical Core Income Fund. Since “the investment objective, principal investment strategies and principal investment risks for the Fund have not changed,” we’re left to conclude that Sierra believes “strategic” is the same as “tactical” or, alternately, “strategic” is the same as “tactical core.”

As of April 28, 2018, Strategic Advisers International II Fund (FUSIX) will be renamed Strategic Advisers Fidelity®International Fund.

On May 1, 2018, Voya Global High Dividend Low Volatility Fund (VGLAX) becomes Voya International High Dividend Low Volatility Fund. At that same point, it loses US exposure and allows itself 5 bps of higher expenses:

Footnote 3 to the table entitled “Annual Fund Operating Expenses” of the Fund’s Prospectuses is deleted and replaced with the following:

The adviser is contractually obligated to limit expenses to 0.85%, 0.60%, and 0.85% for Class A, Class I, and Class T, respectively, through March 1, 2019. Effective March 1, 2019, the adviser is contractually obligated to limit expenses to 0.90%, 065% and 0.90% for Class A, Class I, and Class T shares, respectively through March 1, 2020.

OFF TO THE DUSTBIN OF HISTORY

AdvisorShares Meidell Tactical Advantage ETF(MATH) is expected “to cease operations, liquidate its assets, and distribute the liquidation proceeds” on April 6, 2018. I love the thoroughness of some of these “we’re killing it” announcements. A few include the “all references to the fund will be deleted from the prospectus and related documents,” but I am still waiting for “the managers’ images will be obscured, their belongings sold, salt poured deeply upon the places they trod and their names shall ne’er be spoken again.”

ALPS/Alerian MLP Infrastructure Index Fund (ALERX) will be closed and liquidated … with an effective date as determined by a committee of the Board of the Trust.”

American Independence U.S. Inflation-Protected Fund (FFIHX, FNIHX, FCIHX, and/or AIIPX) is merging into BNP Paribas AM U.S. Inflation-Linked Bond Fund (“BNP TIPS Fund”). Both funds are run by the same management team.

The $3 million AMG Chicago Equity Partners Small Cap Value Fund (CESVX) has closed to new investment and will liquidate on May 18, 2018.

Amplify YieldShares Oil-Hedged MLP Income ETF (AMLX) will liquidate after the close of business on April 19, 2018.The fund has been around nine months and has lost about 25%.

Cavanal Hill Intermediate Tax-Free Bond Fund (the “Fund”) goes to a far, far better place on May 30, 2018.

The Trustees of Context Capital Funds have voted to liquidate and terminate Context Strategic Global Equity Fund (CGPGX) effective on or about March 29, 2018 which is to say, it’s gone already.

CRM International Opportunity Fund (CRMIX) will liquidate on April 30, 2018.

The Direxion iBillionaire Index ETF (IBLN) will close on April 6, 2018 and be liquidated within a week. At base, the ETF tried to invest in the same stocks that the 10 most successful billionaire investors or institutional investment managers invested in. Nice idea but the fund only outperformed the average large cap domestic equity fund by 100 bps over the course of three years, an amount insufficient to draw the attention of any billionaire investors, or millionaire investors or, judging from the AUM, even more thousandaire investors.

Fidelity is giving up the ghost on Fidelity Inflation-Protected Bond Fund (FINPX). The fund will be merged in Fidelity Inflation-Protected Bond Index Fund (FSIQX) on or about August 24, 2018. Neither fund is spectacular, but the index fund has nearly twice the assets at about half the cost which accounts for most of its slight performance advantage over FINPX. William Irving no longer serves as lead portfolio manager of the fund.

Hartford Global Equity Income Fund (HLEAX) is slated to merge into Hartford International Equity Fund (HDVAX) on or about June 25, 2018. The Global fund owns about $65 million in US stocks and is merging into a fund with just $70 million in assets; that implies a lot of liquidations and, potentially, a large tax bill for someone.

Janus Henderson Global Allocation Portfolio – Moderate (JMAPX) merges into Janus Henderson Balanced Portfolio (JABLX), hence out of existence, on or about the close of business on April 27, 2018

Janus liquidated and terminated Janus Velocity Volatility Hedged Large Cap ETF (SPXH) and Janus Velocity Tail Risk Hedged Large Cap ETF (TRSK) on March 26, 2018.

Johnson Growth Fund (JGRWX) is merging into the Johnson Equity Income Fund (JEQIX) on or about April 20, 2018.

What’s the rush? JPMorgan Multi-Cap Market Neutral Fund (OGNAX) liquidated on March 23, 2018. That date was moved up twice, from April 6 to March 29, then to March 23.

Lazard US Realty Income Portfolio (LRIOX) will, pending shareholder approval, merge into Lazard US Realty Equity Portfolio (LREOX) on or about June 29, 2018. The funds, between them, have $70 million in assets. Over the past two years, LREOX has had much stronger performance than LRIOX, but they did spend their first seven years neck-and-neck. They’re run by the same two managers, which raises the question of whether LREOX’s recent excellence represents brilliant management or just (temporarily) favorable market conditions.

Lord Abbett Emerging Markets Local Bond Fund (LEMAX) will liquidate and dissolve on or around April 19, 2018. (Fans of EM bond investing really owe it to themselves to look at Teresa Kong’s two funds, Matthews Asia Strategic Income and Matthews Asia Credit Opportunities. She, and they, are absolutely first-rate.)

Lord Abbett Multi-Asset Focused Growth Fund (LDSAX) will merge, at a not-yet-specified moment, into Lord Abbett Multi-Asset Growth Fund (LWSAX). Those affected by the move should note that LWSAX has a substantial bond component (17%) and about a third fewer international stocks than does the disappearing fund. That has translated to higher returns with higher volatility.

MFG Low Carbon Global Fund (MGKGX) and MFG Infrastructure Fund (MGKSX) will liquidate on or about April 27, 2018.

A proposal to merge Nuveen Concentrated Core Fund (NCADX) into Nuveen Large Cap Core Fund (NLACX) will be submitted to shareholders in May. The funds have the same managers, are the same age and have comparable expenses. Concentrated holds 20 stocks, Core holds 100. Core has higher returns and lower volatility but neither is particularly a star.

Nuveen Symphony High Yield Bond Fund (NSYAX) will be liquidated after the close of business on May 11, 2018. Solid fund, victim of the whims of the market, I suspect.

Putnam Investors Fund (PINVX) will close on May 18, 2018 and merge into Putnam Multi-Cap Core Fund (PMYAX), likely on June 25, 2018.

Huh? Putnam Investors launched in 1925 and has over $2 billion in assets, about three times the size of Multi-Cap Core. Statistically, the funds have nearly identical performance over the past five years though that seems like an awfully thin slice of data when you’re dealing with one fund that has a 93 year record. The correlation between the two is 99 and the statistical differences between the two are typically a tenth of a percent. Both have a four-star rating from Morningstar and have the same managers. The only consequential difference is that Investor tends to hold more large-cap names.

While they’re at it, Putnam is merging Putnam Capital Opportunities Fund (PCOAX) into Putnam Small Cap Growth Fund (PNSAX) and liquidating entirely Putnam Low Volatility Equity Fund on or about May 18, 2018.

Shelton European Growth & Income Fund (EUGIX) and Shelton Greater China Fund (SGCFX) are both fated to be eaten by Shelton International Select Equity Fund (SISLX). The two regional funds each has fewer than $10 million in assets.

TCW Focused Equities Fund (TGFVX) will liquidate on or about May 31, 2018. 2008 served as a turning point in the fund’s history; it performed excellently before the crash and miserably thereafter.

Templeton Global Opportunities Trust (TEGOX) is merging into Templeton Growth Fund (TEPLX) or about August 24, 2018. At about the same time, Templeton Foreign Smaller Companies Fund (FINEX) will merge into Templeton Global Smaller Companies Fund (TEMGX).

The merger of the Third Avenue International Value Fund (TAVIX/TVIVX) into the Third Avenue Value Fund (TAVFX/TVFVX) was completed on March 19, 2018.

Pending shareholder approval, Thrivent Growth and Income Plus Fund (TEIAX) will merge into Thrivent Moderately Aggressive Allocation Fund (TMAAX) sometime this year, the filing was not particularly informative on the subject. The move is a good one for shareholders.

On or about April 27, 2018, Virtus Duff & Phelps International Equity Fund (VIEAX), Virtus Horizon International Wealth Masters Fund (VIWAX), Virtus Rampart Global Equity Trend Fund (VGPAX) and Virtus Rampart Low Volatility Equity Fund (VLVAX) will be liquidated.

Subject to various sets of shareholder approvals, Voya Multi-Manager Large Cap Core Portfolio (IPFAX) will merge into Voya Index Plus LargeCap Portfolio (IPLSX) in September.

The Board of the Wasatch Funds Trust has decided to put Wasatch Long/Short Fund (FMLSX – who now remembers the 1st Source Monogram funds whose legacy lived in this ticker symbol?) out of its misery by merging it into Wasatch Global Value Fund (FMIEX – notice the odd coincidence in the ticker, this used to be 1st Source Monogram Income Equity Fund). Wasatch adopted both funds in 2008, assets in long/short popped from $100 million to $1.6 billion in three years, Wasatch replaced its 1st Source managers in 2013 and the fund promptly lost money in three of the next four calendar years. It’s now smaller than when Wasatch purchased it.