“Timing, perseverance, and ten years of trying

will eventually make you look like an overnight success.”

Biz Stone

Objective and Strategy

The AlphaCentric Income Opportunities Fund seeks to provide current income. Presently, it invests in often overlooked (some call “pejorative”) segments of non‐agency (private label) residential mortgage-backed securities (RMBS), specifically in seasoned (2007 or earlier) subprime mortgages with floating rate coupons.

The irony is that 10 years after the housing collapse these bonds, once highly discounted if not feared worthless, represent one of the more sought after asset classes, as described nicely in Claire Boston’s Bloomberg article “Goldman and Pimco Are Loading Up on Mortgage Bonds.” Basically, this asset class has become desirable because of healthy yield in a low interest rate environment, uncorrelated behavior to traditional fixed income, and stable to improving credit worthiness, including lower home loan to values.

Consider the following:

-

- Housing prices since 1948 have increased 4% per year, mirroring the consumer price index and avoiding recession, except for the tragedy of 2008 … they have been increasing sharply since 2011

- Mortgage delinquencies, which went from under 3% in 2005 to nearly 12% in 2009, have been decreasing steadily since 2011, now nearly back to historical levels and decreasing faster than other household debt

- Loan-to-values (LTVs) have gone from 110% as recently as 2011 to under 70% through September 2017 and with it the attendant increase in homeowner equity and decrease in mortgage debt to household assets

- Voluntary prepayments (refinancings) have gone from just 3% in 2010 to 8% today

- Lower priced homes have outperformed more expensive ones due to inventory shortage in nearly all of the largest metropolitan areas and inventories remain historically low

- Mortgage rates also remain historically low, even at 4-4.5%, helping keep home ownership affordable.

- All this translates into a very opportunistic environment for this strategy to excel, or as its most senior principal adviser Tom Miner describes: “It’s been lightning in a bottle.”

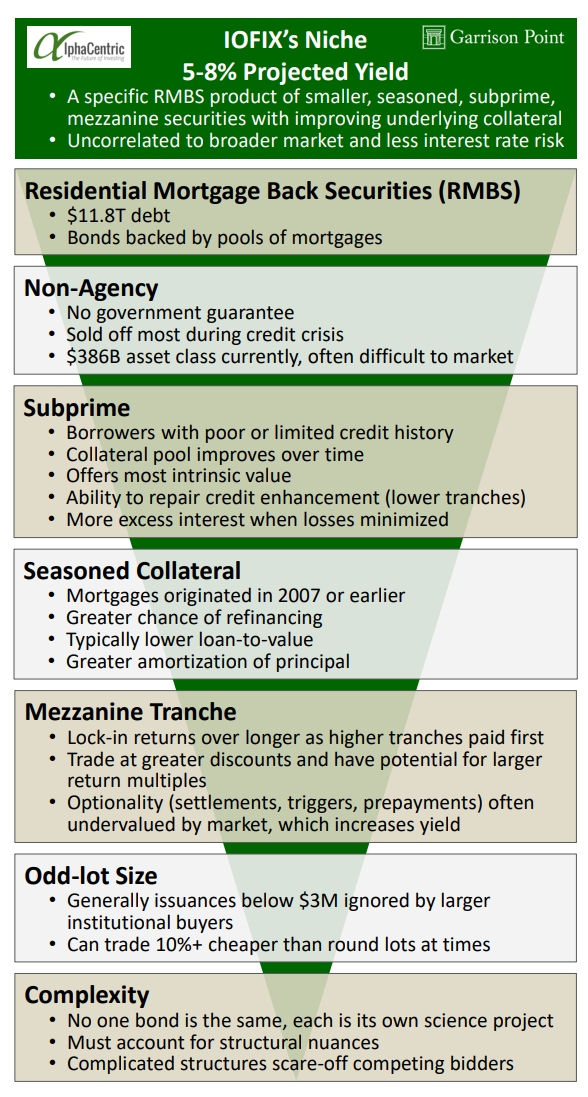

While the fund’s prospectus allows for a broader mandate of asset-backed securities, IOFIX currently maintains a clearly defined RMBS niche, summarized here and depicted below: smaller, seasoned, subprime, mezzanine securities with improving underlying collateral, uncorrelated to broader market with less interest rate risk, producing a high income strategy yielding 5-8% annually. Its total return, however, since inception has been much higher.

Adviser

The adviser is AlphaCentric Advisors LLC. The sub-adviser is Garrison Point Capital, LLC (“Garrison Point or GPC”), an investment advisory firm founded in 2012 and located in Walnut Creek, California, about a half hour BART ride from San Francisco’s financial district. Fortunately, AlphaCentric leaves GPC independent to manage the fund’s day-to-day operations, including its thoughtful briefings and quarterly conference calls summarizing fund strategy and performance. (Here’s link to latest Quarterly Report.)

I visited its office twice and spoke directly to the principals at GPC without the need for AlphaCentric oversight or investment relations/media representative. In addition to acting as sub-adviser on IOFIX, GPC provides investment advice to individuals, high net worth individuals, trusts, businesses and charitable organizations.

It runs a very successful strategy similar to IOFIX called Garrison Point Enhanced Yield for separately managed accounts (see historical performance on Pages 58-59 in the Prospectus), a smaller hedge fund called Garrison Point Opportunities I focused on a different asset class, and manages assets for an insurance company. The firm manages $1.8B all up, but most is in its Income Opportunities mutual fund.

GPC moved from 100 Pine Street to Walnut Creek in December 2016, a bit more that a year ago. A cheaper space and much easier commute for the two most senior partners whose homes are in nearby Danville. Their current office space is open and utilitarian and just a few minutes’ walk from the BART station.

Managers

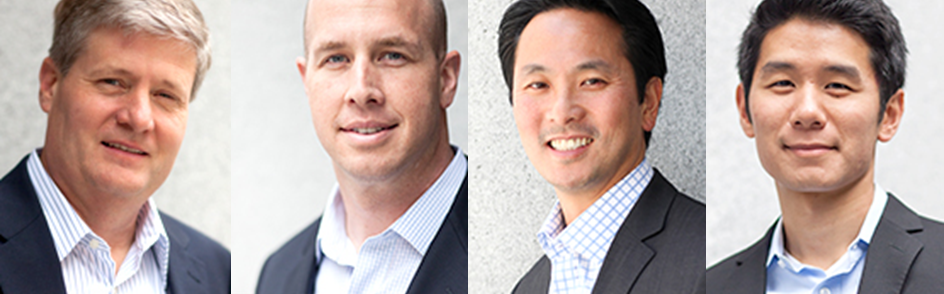

Tom Miner, Garrett Smith, Brian Loo are jointly and primarily responsible for the day-to-day management of IOFIX’s portfolio. Jonathan Tran is chief analyst. Tom, Garrett, and Jonathan launched GPC in 2012. Tom and Garrett worked together briefly at Lehman Brothers in 2007 and again at Barclay’s from 2009 to 2012.

Tom, who enjoys this infectious enthusiasm for what he does (the kind my colleagues David and Ed describe when they champion fund managers), retired from Lehman after 20 years in structured fixed income products the year before its collapse. Garrett, who had just joined Lehman, was not so lucky. But it was Garrett who talked Tom out of retirement to join Barclays’ where together, along with Jonathan, they built one of the firm’s larger high net worth businesses and supervised nearly $2B in fixed income assets, employing much the same strategy they ultimately used to launch GPC.

Brian came to GPC from TCW after it had acquired MetWest, a fixed income firm he helped launch. Brian seems to be the first person folks talk to when they call the firm, like I did, asking about its strategy. He works from a remote office in LA.

Tom holds an MBA from the University of Utah where he is also an Adjunct Professor of Finance teaching Fixed Income Analysis and Venture Capital. Garrett is a United States Naval Academy graduate with MBA from Northwestern University. As a flight officer in the U.S. Navy, he logged over 400 carrier landings … over 200 at night! Brian holds a BS in Math/Applied Science from UCLA, an MS from the Carnegie Mellon’s Tepper School of Business, and is a CFA charterholder. Jonathan received a B.S. in Finance from The University of Virginia’s McIntire School of Business.

The four are partners in the firm, and together they represent more than 70 years’ experience in securitized products, with Tom’s experience making up nearly half. The team impresses me with their clarity, openness, and passion for what they do.

Strategy Capacity and Closure

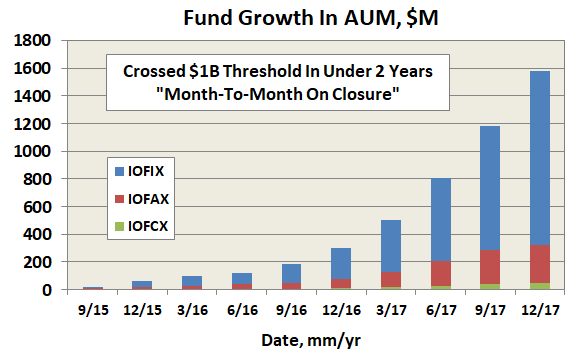

The fund has achieved something few funds do … crossing the $1B threshold of assets under management (AUM) in less than two years. It attracted more capital in last quarter of 2017 than in the first six quarters of its existence. It ended the year with $1.6B, five times the level it started the year.

The GPC team seems intent on letting market opportunities decide the capacity and not an assets-gathered goal. Given the enormity of inflows, “closure is month-to-month at this point,” Tom explains. While the overall subprime market segment is nearly $400B, it is becoming harder to find bonds at a price GPC is willing to pay. But not yet impossible.

They remain in near continuous contact with 30-40 dealers and do substantial business with about half of them. Their current portfolio comprises nearly 300K mortgages with an average loan balance of $155K across more than 400 securities purchased at an average price of just $60.72 (par being $100). Fortunately, about $1B in non-agency RMBS are exchanged each day with 550 market trades made monthly. So, the typical trade of perhaps $2M is under the radar for institutional buyers with say $100B portfolios.

During their most recent conference call, they shared that the market’s fragmentation actually aids them in sourcing securities, as does patience. So far they are still able to buy securities that meet their price target and risk, the latter based on scenario assessment modelling. But if that changes, they will close.

Tom insists they will not be tempted to accept fast money only to disappoint investors. “We’d rather keep fewer investors longer term.” He also believes AlphaCentric will support GPC’s closure recommendation if and when it happens. My suspicion is that the fund will be capacity tested soon. Come May, IOFIX will reach the three-year mark, prompting rating coverage from Morningstar. Given its current performance level, it will debut with five stars, creating even greater demand.

Management’s Stake in the Fund

Per the latest SAI, as of March 2017, Tom Miner owned over $1M, Garrett Smith over $50K, and Brian Loo over $10K. Tom and Garrett stated that the team’s stake will be much higher, “like 10 times,” when the SAI is updated this year. Mr. Jerry Szilagyi, AlphaCentric’s controlling member and an interested trustee of the Income Opportunities Fund, which is one of several under the Mutual Fund Series Trust, holds over $100K.

Opening Date

May 28, 2015. All three share classes: IOFIX, IOFAX, and IOFCX. Lipper categorizes the fund as “Multi-Sector Income: Funds that seek current income by allocating assets among several different fixed income securities (with no more than 65% in any one sector except for defensive purposes), including U.S. government and foreign governments, with a significant portion of assets in securities rated below investment-grade.” Morningstar has it in same category.

That said: As of 31 December 2017, the fund maintains 94% of its portfolio in the subprime mortgage sector … and Garrison is bullish on it. Certainly more than the 65% referenced in Lipper’s category definition.

Lipper tracks 104 MultiSector Income funds. The elephant in the category is PIMCO’s Income Fund (PIMIX) with $108B in AUM. IOFIX ranks 25th in the category by AUM. Ten multisector funds have launched since IOFIX, including two GPC lists or have listed as competitors: Deer Park Total Return Credit (DPFNX) and Wilshire Income Opportunities (WIOPX). Others are Angel Oak Multi-Strategy Income (ANGLX), Performance Trust Strategic Bond (PTIAX) and Voya Securitized Credit (VCFIX). The last two are MFO five- and three-year Great Owls, respectfully, in the General Bond and US Mortgage categories.

Minimum Investment

The fund imposes only a $2500 minimum investment on all share classes, including the institutional IOFIX shares, which is good news. There is also a very low $100 minimum for automatic investments. I verified these minimums at Fidelity. At Schwab, however, it offers the normally 4.75% front-loaded share class IOFAX via No-Load/No Transaction Fee, but imposes a $100K minimum on the IOFIX institutional shares. So, caveat ēmptor.

Expense Ratio

IOFIX is 1.5% with AUM of $461.6M, as of June 2023. IOFAX is 1.75% reflecting a 12b-1 distribution fee. A 4.75% front-load on this class is waived above $50K. IOFCX sports an egregious 2.5% expense ratio. That this latter class even exists reflects poorly on the advisor and the industry generally. All are net prospectus expenses after waivers. Fortunately, the preponderance of AUM is in IOFIX.

Given that the average expense ratio in the category is 0.85% (oldest share class only), these levels are undeniably high. But its performance has been so strong by any measure, nobody cares.

Focusing on IOFIX, the adviser pays 0.33% “other” (mostly administrative and servicing). The remaining 1.16% “management fee” (after a 0.01% acquired fund fee) is then split between AlphaCentric and Garrison Point, or 0.58% each. Since another Jerry Szilagyi company “MFund Services LLC,” also gets paid to manage the overall trust, Szilagyi’s firms appear to receive more fee from the fund than GPC does.

There are five AlphaCentric Funds, all less than four years old. “The Future of Investing … We seek to offer financial advisors and their clients access to best-in-class, style-forward managers in open-end mutual fund format, the types of products that were once only available to institutions and large endowments.” This last sentence is typically code for we charge high fees. Arguing that it’s still less than what hedge funds traditionally charge at 2% yearly plus a 20% performance fee. Only IOFIX has yet to attract significant assets, 96% in fact of the fund family. Average AlphaCentric fees: 1.84%, oldest share class only, or 2.10%, all share classes.

Interestingly, AlphaCentric is listed along with Eventide, Pinnacle and Advisory Research as a strategic partner in a firm called Multi-Funds, which describes itself as “A Premier Marketing, Consulting and Distribution Firm.” While this channel may indeed have helped bring attention to IOFIX, allowing the sub-adviser to focus on its strategy and portfolio management … what it loves to do, Multi-Funds hasn’t helped other funds in the AlphaCentric family achieve anywhere near the assets attracted by IOFIX.

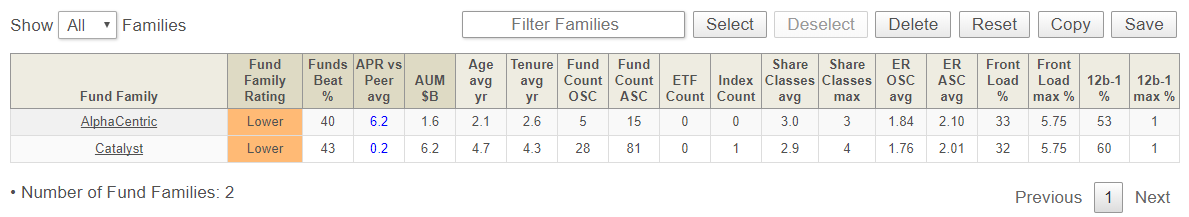

Jerry Szilagyi also runs Catalyst Funds, a collection of “Intelligent Alternatives … We understood that the market did not need another traditional family of mutual funds … we endeavor to offer unique investment products to meet the needs of discerning financial advisers and their clients … specialized strategies seeking to produce income and equity-oriented returns while attempting to limit risk and volatility.” There are 28 Catalyst Funds comprising $6.2B in AUM. Average age just under 5 years. Most come in three classes, including those imposing 4.75% front-loads and 12b-1 fees. Average fees: 1.76% (oldest share class, 2.01% all share classes).

Here are the lifetime scorecard metrics from the MFO Premium site (click image to enlarge):

Are the high fees justified by overall fund family performance at AlphaCentric and Catalyst? Absolutely not.

Both AlphaCentric and Catalyst receive a “Lower” MFO Fund Family Score, which means most of their funds since inception underperform their categories on an absolute return basis. Risk adjusted performance is not any better. More than a third of their funds are bottom quintile performers based on Martin and 60% are in the bottom two quintiles. The four oldest surviving funds at Catalyst, which date back to 2006, sport absolutely abysmal performance.

Do they offer some winners? Yes, and one is IOFIX hands-down.

Comments

It’s been a perfectly behaved fund. It goes up or stays flat. It rarely goes down. It’s delivered what most alternative funds promise but rarely deliver: equity-like returns with bond-like volatility. It provides nearly 5% annualized dividend paid monthly. Last year its total return was 14%, after fees, to investors, beating its peers by 8.1% … about what the long outstanding PIMIX delivered in total. It delivered top quintile absolute return and risk adjusted returns based on Sortino and Martin ratios.

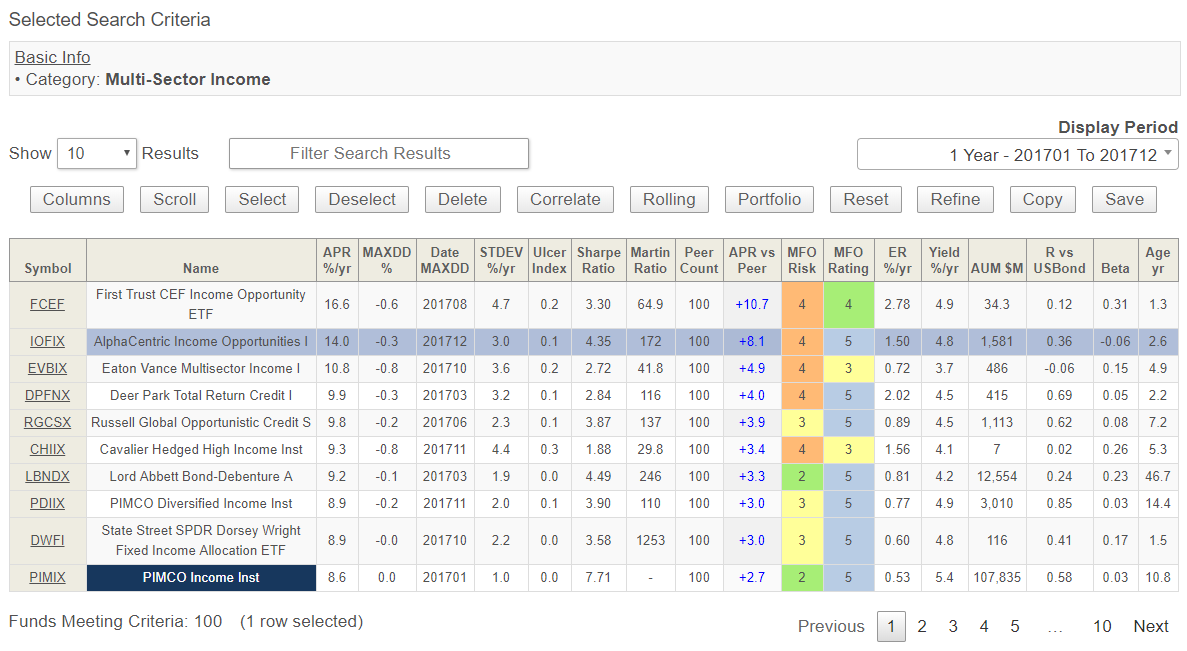

Here are last year’s risk and return metrics for the top 10 performers in Multi-Sector Income category, using our MultiSearch screener (click image to enlarge):

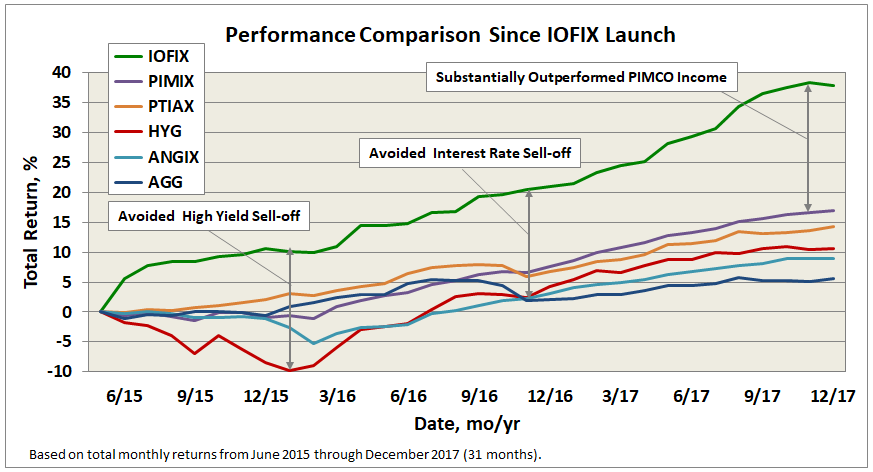

Since inception, the fund’s outperformance is even more impressive. It’s beaten AGG (iShares Core US Aggregate Bond ETF), HYG (iShares iBoxx $ High Yield Corporate Bond ETF), and PIMCO’s Income Fund (PIMIX) … all by substantial margins. It’s even beaten the S&P500, which few equity funds have done recently let alone fixed income funds.

“But more than its overall return, what we’re most proud of,” said Garrett during the latest conference call, “is the consistency of return.” The up-only behavior is similar to PIMIX’s only more so. Why? Because the underlining assets in the IOFIX portfolio are behaving that way; specifically, return on subprime mortgages generally has been 20.4% the past two years, out-performing so-called “Alt-A” mortgages at 18.8% and prime mortgages at “only” 12.1%.

My colleague Sam Lee suggests another reason may contribute to the attractive behavior of funds like IOFIX and PIMIX. Matrix pricing of less liquid, harder to value assets may provide a steadier appearance than those in more highly traded markets. Similar to private equity or the value of your home, which is not marked-to-market daily, like holdings in your Schwab account.

IOFIX is priced daily by an independent but publicly traded company, called Intercontinental Exchange (ICE). Brian explains that the 3rd party pricing prevents any temptation to “meddle.”

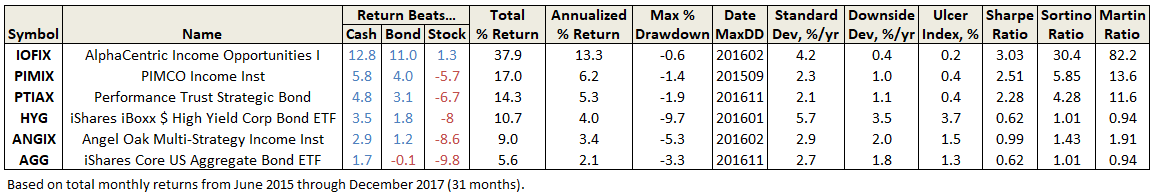

Here’s summary of risk and return metrics in tabular form, from IOFIX launch through December 2017 (click image to enlarge):

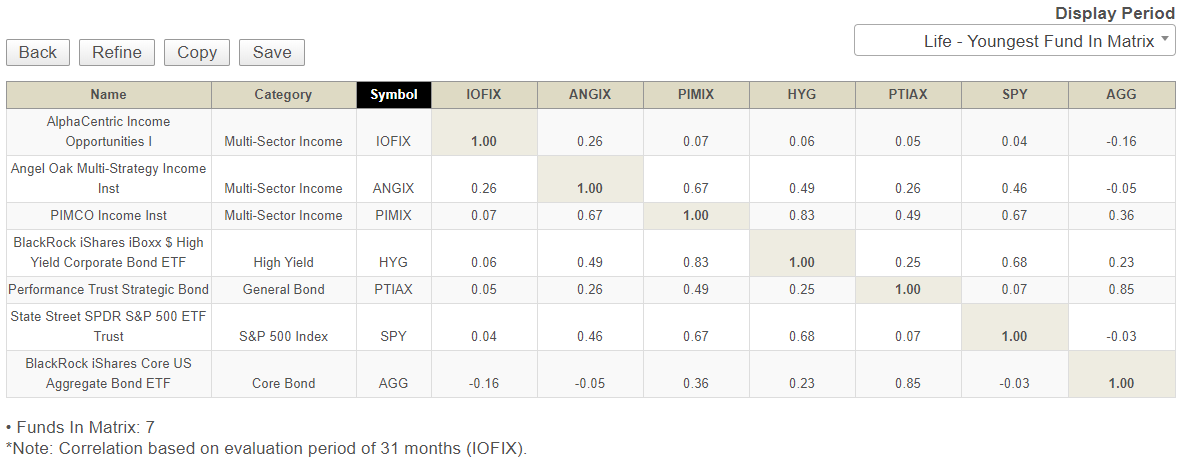

The fund has demonstrated resilience during sell-offs in high yield and core bonds. The following correlation table for these same funds, plus SPY (S&P500 ETF), helps explain why. IOFIX is indeed negatively correlated with core bonds and uncorrelated with most others (click image to enlarge).

More fundamentally, IOFIX will be more resilient to factors affecting traditional core and high yield bonds, because of its variable coupon structure and its reliance on housing market versus corporate profits or balance sheets. That’s both the fund’s strength and potential weakness, but since launch it’s definitely been its strength.

Brian doesn’t expect conditions to change much in 2018. “Perhaps not as quite as much rate compression or improving credit [which enhanced the fund’s returns last year], but then we seem to say that every year.”

Tom emphasizes: “Even if housing prices stop increasing, amortization pays down the debt reducing loan to value every month!” Recent tax reform will benefit subprimes more because those loans are well below the deduction threshold, enabling its owners to have more money after taxes to further pay their mortgage. He also believes that since these mortgages are seasoned, originating 10-12 years ago, the owners are probably no longer “subprime” borrowers.

Greatest risk to the fund? Capacity. It is a shrinking market, at a rate of 15% per year, since “they don’t issue subprime mortgages anymore.” Because of daily trading volume and high demand, liquidity has not been an issue. But as a precaution, the firm secured a $200M line of credit recently to help mitigate any unexpected redemption pressure.

Other risks? If credit spreads rise because riskier assets like equities or high yield bonds are considered overpriced, or if home prices collapse perhaps because of a downturn in jobs. But given the appreciation in home prices, limited inventory, and decreases in LTVs, the asset class seems well positioned not lose money during another downturn.

If rates rise too much because of an overheated economy, the swath of underlining variable rate mortgages in these securities could make it harder for owners to make payments or even trigger caps, but then that’s balanced by the increase in home prices … the inflation of real assets.

Brian summarizes: “It’s really a mitigated credit story … the seasoned nature of these bonds provides a powerful stabilizing mechanism.”

Bottom Line

“The secret to riches, lab rats, is the same as the secret to comedy: timing,” Max Skinner tells his bond trading desk in the 2006 movie “A Good Year.”

The folks at Garrison Point have produced the perfect strategy at the perfect time. Their background, team work, risk/return models, and passion appear perfectly suited to exploit this current fixed income market niche.

So far, they have picked the right sectors and subsectors (tranches) and the right securities within those subsectors. Securities that have been called at par resulting in higher yield. Securities protected by subordination (tranches with lower rating absorbing any losses first) and benefiting from excess interest unique to this asset class. Securities enhanced by favorable legal settlements.

While IOFIX is fairly young, the team has prosecuted similar strategies very successfully at Barlcay’s for high net worth individuals and in their separately managed accounts since launching the firm. And, they continue to examine other “overlooked” asset-backed classes for opportunities to deliver “asymmetric yield.”

Were it not wrapped in an AlphaCentric logo, which means investors are paying perhaps 50 pps more than they should, it would be the perfect fund. But as long as IOFIX is producing at these levels, as long as it continues to handsomely outperform say PIMIX, the performance is worth the higher fees.

If you are looking to diversify your fixed income portfolio with uncorrelated assets, or looking to diversify your overall portfolio with real assets, consider IOFIX while you still can.

Fund Website

The website is a convenient place to get latest fund documents, including fact sheet, prospectus, etc. The best info though is the quarterly briefing. And, the opportunity to sign-up for the quarterly conference calls under the events tab. Beyond that, the Garrison Point team is very approachable and happy to field questions directly. Just give them a call at 415-887-1410.

Disclosure

I’ve been heavy IOFIX since early July 2017 in my retirement account.