By Charles Boccadoro

At the time of publication, this fund was named Litman Gregory Masters Alternative Strategies.

Objective and Strategy

The Litman Gregory Masters Alternative Strategies Fund seeks to provide attractive “all-weather” returns relative to conservative benchmarks, but with lower volatility than the stock market. It seeks this objective through a combination of skilled active managers, high conviction “best ideas,” hedge fund strategies, low beta, and low correlation to stock and bond market indices.

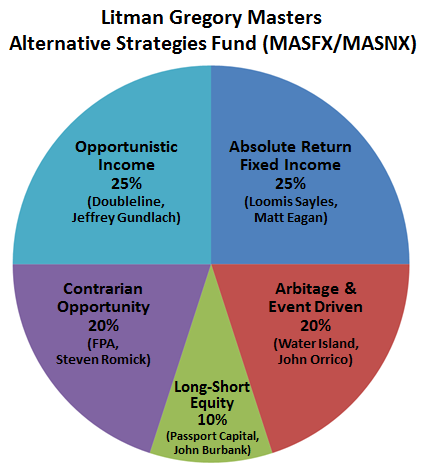

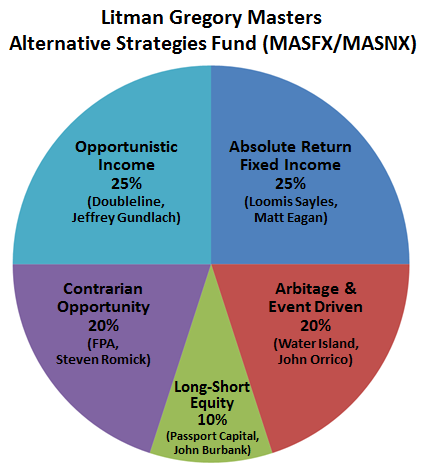

The fund’s risk-averse managers, asset allocations, and hedging strategies position it as an alternative to traditional 80/20% or 60/40% bond/stock portfolios for conservative or moderately conservative investors. The advisor’s strategy is to divide the fund’s assets up between five sub-advisor teams, up from the original four, each pursuing distinct but complementary strategies. The chart below depicts the five teams, strategic title, allocation, firm and lead.

A summary of the five strategies:

- Opportunistic Income will often focus on mortgage related securities;

- Strategic Alpha focuses on the tactical allocation of long and short global fixed income opportunities and currencies;

- Contrarian Opportunity allows tactical investments throughout the capital structure (stocks and bonds), asset classes, market capitalization, industries and geographies;

- Arbitrage & Event Driven focuses on mergers and other “special situations” (restructuring and refinancing); and,

- Long-Short Equity focuses on liquid global equities based on macroeconomic analysis, fundamental research, and quantitative tools for portfolio construction.

Advisor

Litman Gregory Fund Advisors, LLC, Walnut Creek, California, moving from Orinda in fall of 2016. As profiled originally and with all its “Masters Funds,” Litman Gregory 1) conceives of the fund, 2) selects the outside sub-advisors who will manage portions of the portfolio, and 3) determines how much of the portfolio each team gets.

The other three Masters Funds are Equity (MSEFX/MSENX), International (MSILX/MNILX), and Smaller Companies (MSSFX). Collectively, the funds hold about $2.7 billion in assets, with the lion’s share in Alternative Strategies (MASFX/MASNX). Two previous Masters Funds, Focused Opportunity and Value, were merged into Equity in 2013 due to some overlap in sub-advisors and low assets under management. A new Alternative High Income Masters Fund is in registration.

The firm was co-founded in 1987 by Ken Gregory and Craig Litman with a newsletter called No-Load Fund Analyst. The newsletter was retired and rolled into the firm’s AdvisorIntelligence offering. Today the firm formally advises its Masters Funds series, provides investment management services for separate accounts, publishes investment research for financial advisors (aka AdvisorIntelligence), and maintains portfolio strategies on selected platforms. Ken Gregory remains active with the firm, while Craig Litman recently retired.

The premise behind its Masters Funds? Litman Gregory believes over the long term:

- Experienced, world class investment managers are likely to outperform passive benchmarks, and

- Portfolios comprised by these skilled managers’ highest-conviction ideas are likely to outperform their more diversified, lower active-share portfolios.

The firm emphasizes that the distinctive portfolios created by the investment managers who run the individualized sleeves in each Master Fund are not fund of funds and cannot be replicated by “building” comparable mix of existing funds normally available to most investors.

Litman Gregory believes it can identify such skilled managers based on years of due diligence, it combines them to provide diversification at the fund level, and creates an environment of minimal constraints but with enough oversight to ensure commitment to its Masters Funds concept.

In the alternative fund space, Litman Gregory found few compelling options back in 2011. What it did find was high costs, lack of liquidity, lack of track record, no clear investment edge, lack of transparency and questionable quality.

So, it launched its own.

Managers

Jeremy DeGroot, Litman Gregory’s Chief Investment Officer and a Principal. He’s ultimately responsible for sub-advisor due diligence and selection, day-to-day coordination with the sub-advisors, monitoring the individual performance and capabilities of the investment managers, and fund administration. He joined Litman Gregory in 1999. He holds the CFA designation, a BS in Economics from University of Wisconsin, and an MS in Economics from Berkeley.

Jason Steuerwalt, a Senior Research Analyst at Litman Gregory appears to be DeGroot’s lieutenant. He too holds the CFA designation and a BA in Economics from Brown. He joined Litman Gregory in 2013.

The daily investments of the fund, however, are determined by its five teams, led by Jeff Gundlach of DoubleLine, Steve Romick of FPA, Matt Eagan of Loomis Sayles, John Orrico of Water Island Capital, and John Burbank III of Passport Capital. All leads except one have been with the fund since inception; Mr. Burbank, the newcomer, started October 24, 2014.

All highly respected managers whom Litman Gregory believes are among the best in their strategies. Google any of them and one would be hard-pressed to disagree. A characteristic of Masters Funds is a long-term relationship between Litman Gregory and the sub-advisors, often predating their tenure on the fund.

Strategy Capacity and Closure

Litman Gregory believes the fund’s capacity as it stands now is approximately $3B, at which point, we would likely “soft close.” The main constraint appears to be with Gundlach’s sleeve due to availability and selection in his preferred spaces of the mortgage market. Romick too “isn’t finding a whole lot to like right now …” As of December 2016, Romick’s Contrarian Opportunity sleeve held 37% cash.

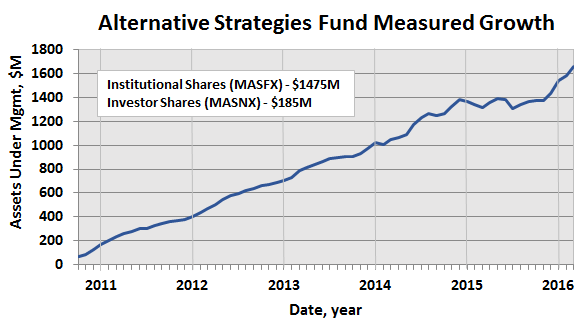

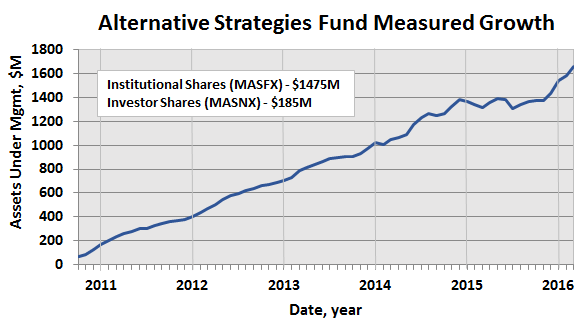

The fund currently stands at $1.7B and has grown steadily since inception, as depicted below. The preponderance is in institutional shares.

Management’s Stake in the Fund

Per last April’s SAI filing, Jeremy DeGroot maintained $100 – 500K in the fund. Water Island’s Gregg Loprete has between $50 – 100K and Todd Munn has between $10 – 50K. Four of the funds’ six directors, including co-founder Ken Gregory, have more than $100K in the fund.

A company spokesman stresses that each sub-advisor also invests directly in their own internal strategies. “Gundlach has publicly stated that his largest personal holding is the Opportunistic Income strategy, which is the hedge fund he runs at DoubleLine and is essentially the same sleeve he runs for this fund.” Similar expectations apply to Romick, Eagan, Orrico, and Burbank.

The spokesman adds Jason Steuerwalt has 10% of his personal assets in the fund. And, Litman Gregory employees and associates buy the same institutional shares and pay the same fees as everybody else.

An updated SAI is expected to be published shortly.

Opening Date

September 30, 2011 for both share classes, making it one of the earlier so-called alternative funds.

Lipper shows only 19 funds as old as Litman Gregory Alternative Strategies in the Multi-Strategy Alternative fund category, which it defines as follows:

Funds that, by prospectus language, seek total returns through the management of several different hedge-like strategies. These funds are typically quantitatively driven to measure the existing relationship between instruments and in some cases to identify positions in which the risk-adjusted spread between these instruments represents an opportunity for the investment manager.

Today, 75 such funds exist.

Minimum Investment

Institutional shares impose a $100,000 minimum initial investment for regular accounts, but a very reasonable $5,000 level for retirement accounts, and only $2,500 for automatic investment accounts. The investor shares minimum seems to range from $500 to $2,500, depending on platform and account type.

Expense Ratio

July 2023: The institutional class share is 1.44% and the investor class share is 1.69% on assets under management of $903 million. The investor net expense ratio includes a 0.25% 12b-1 fee.

The fund’s annual net expense ratio is 1.47% on institutional shares (MASFX) and 1.72% on investor shares (MASNX). The latter reflects industry’s ubiquitous 12b-1 0.25% fee to facilitate “no fee” transactions on platforms like Fidelity and Schwab.

While not published previously, Litman Gregory’s COO reports: “We signed a fee waiver agreement effective 1/1/17 that contractually caps our retained fees on the Alt Strats fund at 50 bps on the first $2 billion, 40 bps on the next billion, 35 bps on the next …” These limits will be published in the April 2017 prospectus.

The prospectus has previously published the fund’s aggregate sub-advisor fee of 0.82%. And, for 2016, operating expenses to independent service providers (eg., the trust’s custodian State Street, Boston Financial Data Services, legal, audit, etc.) were 0.15%. So, net expense ratio = 0.50 + 0.82 + 0.15 = 1.47%.

Like with most hedged strategies, the fund typically incurs an additional annual expense for short sales and borrowing costs on leverage. It runs 0.36% or gross expense ratios of 1.83% and 2.12%, respectively, for the two share classes.

There is no load, thankfully, and Schwab for one charges no short-term redemption fee on institutional shares.

The net expenses to investors appear to be higher than the broader versions of these strategies run at the sub-advisors’ shops for three of the five sleeves: FPA Crescent Fund (FPACX) with er = 1.09%, Water Island’s Arbitrage Fund (ARBNX) with er = 1.22%, and Loomis Sayles Strategic Alpha Fund (LASYX) with er = 0.85%. The other two sleeves (DoubleLine and Passport) appear both cheaper to investors and are simply not available to regular investors, since they are so strongly rooted in their hedge funds. The hedge fund industry typically charges 2% annually and 20% on any profit earned.

For the record, Gundlach’s Opportunistic Income sleeve does not compare well with DoubleLine’s flagship Total Return Bond Fund (DBLTX) or any other DoubleLine fixed income fund for that matter; in fact, the Opportunistic Income sleeve crushes DBLTX with 59% return versus 23% over past 21 quarters through December 2016.

Comments

David Snowball originally profiled the fund in April 2012, shortly after it launched. Here are a couple excerpts:

- Alternative Strategies is likely to fare better than its siblings because of the weakness of its peer group … most of the “multi-alternative” funds are profoundly unattractive and there are no low-cost, high-performance competitors in the space as there is in domestic equities.

- In a Wall Street Journal article, I nominated MASNX as one of the three most-promising new funds released in 2011. In normal times, investors might be looking at a moderate stock/bond hybrid for the core of their portfolio. In extraordinary times, there’s a strong argument for looking here as they consider the central building blocks for their strategy.

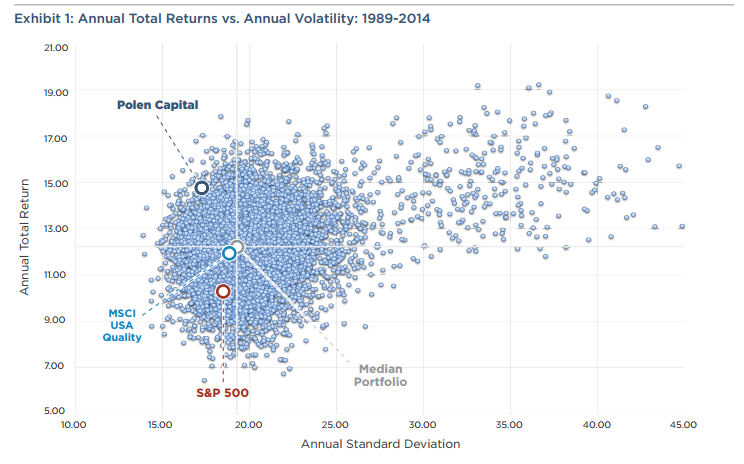

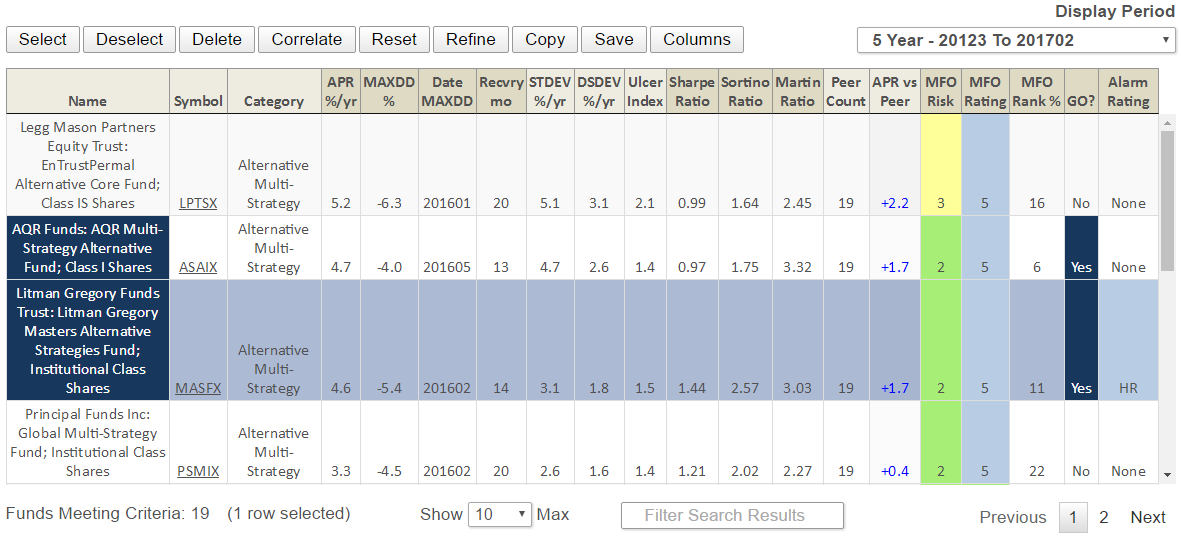

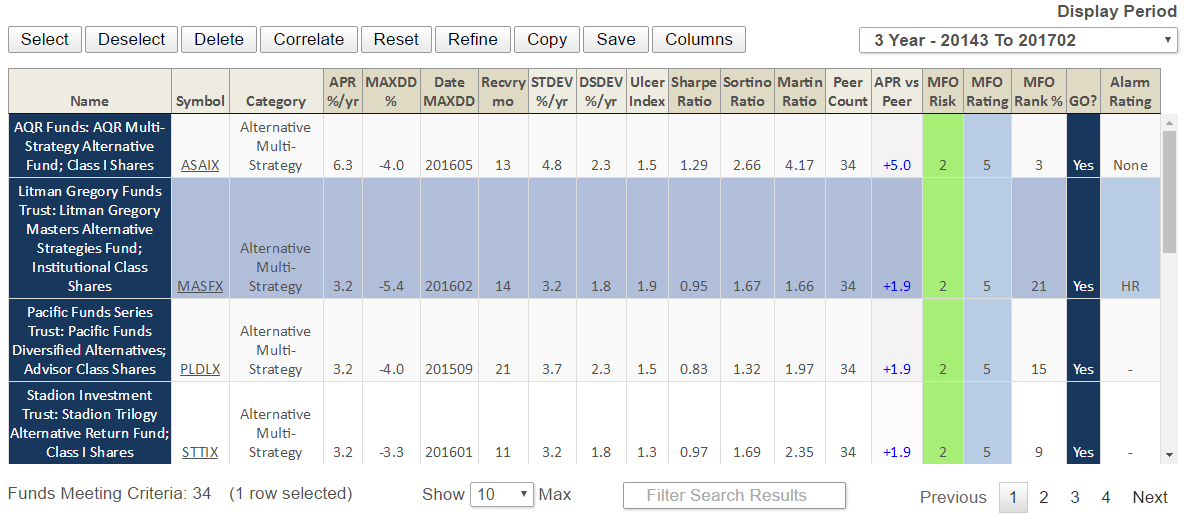

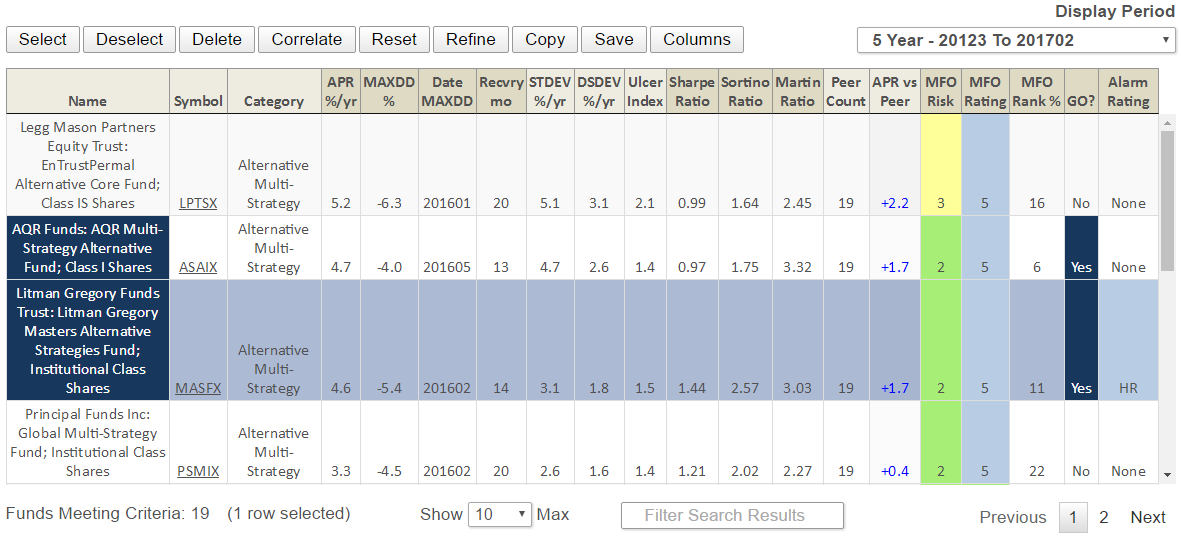

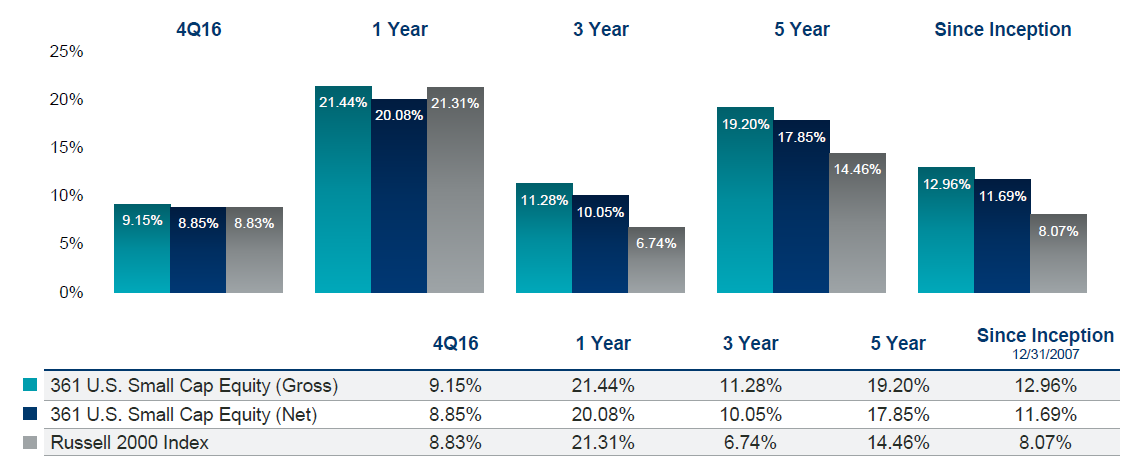

Since inception, the fund has indeed delivered as promised: A top three absolute return performer in its category for each of the past 5, 3, and 1 year evaluation periods with concurrent top quintile risk adjusted returns.

As of month ending February, it holds both the MFO Great Owl (GO) and Honor Roll (HR) designations. The former recognizes consistent top quintile risk adjusted returns, while the latter recognizes consistent top quintile absolute returns. It is the only fund in its category of 75 funds to do so. The fund also receives Morningstar’s Five-Star designation. It has consistently maintained low volatility, coming in on the low end of its target range of 4 to 8%.

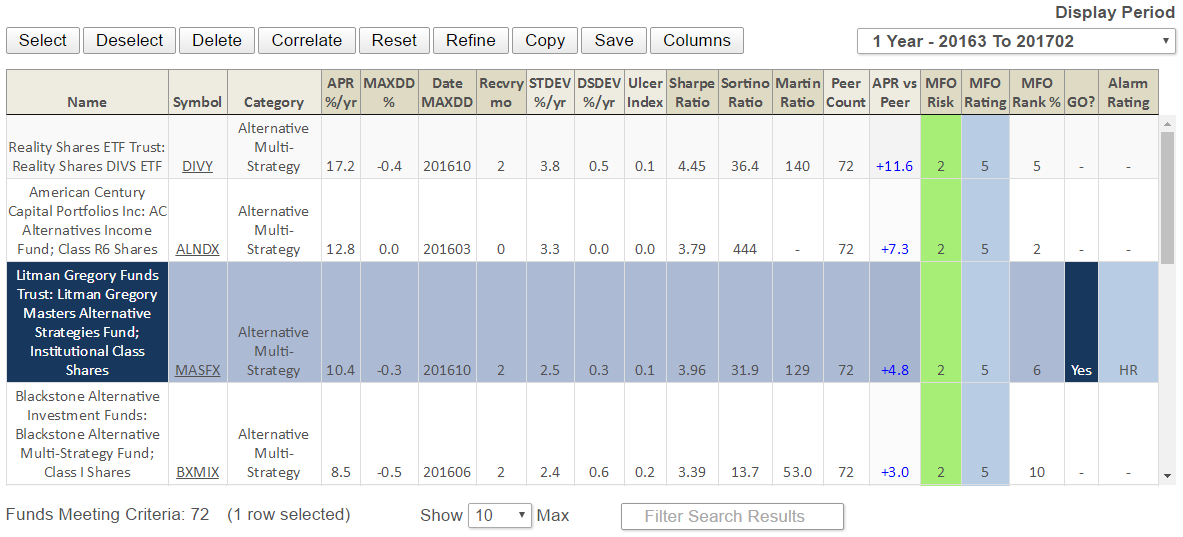

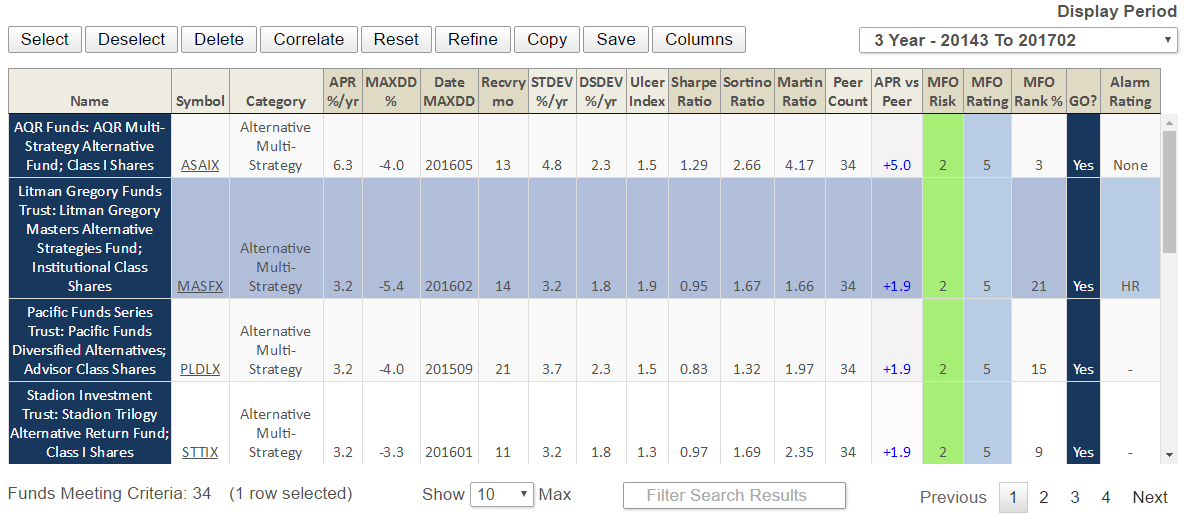

Here are some five-year metrics from our MFO Premium site for the top performing funds in the Alternative Multi-Strategy category of 19 (click on graphic to enlarge):

Here are three-year metrics for the top funds in the category of 34:

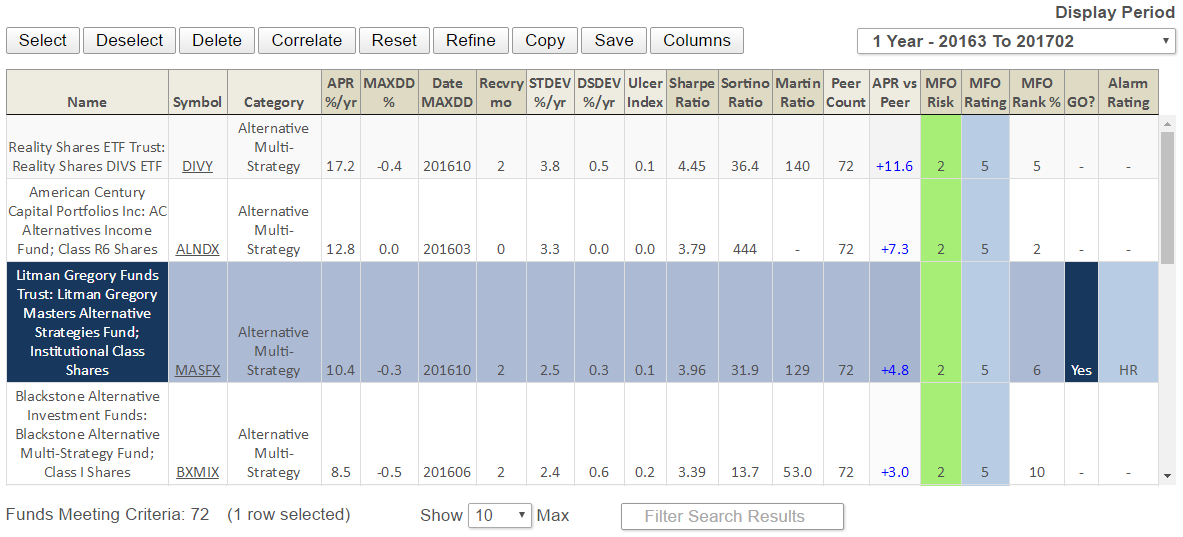

Finally, here are past year metrics of top funds within the category of 72:

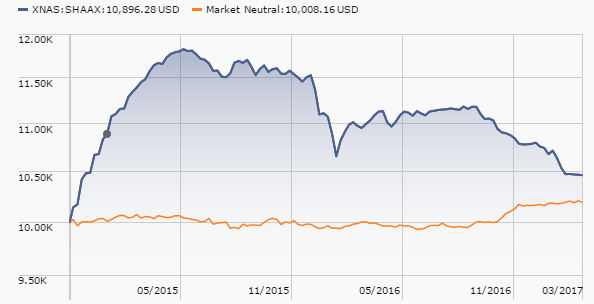

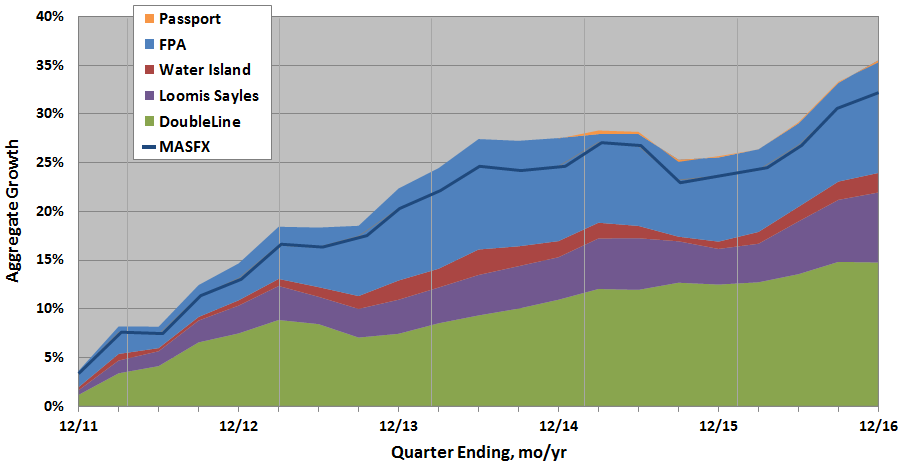

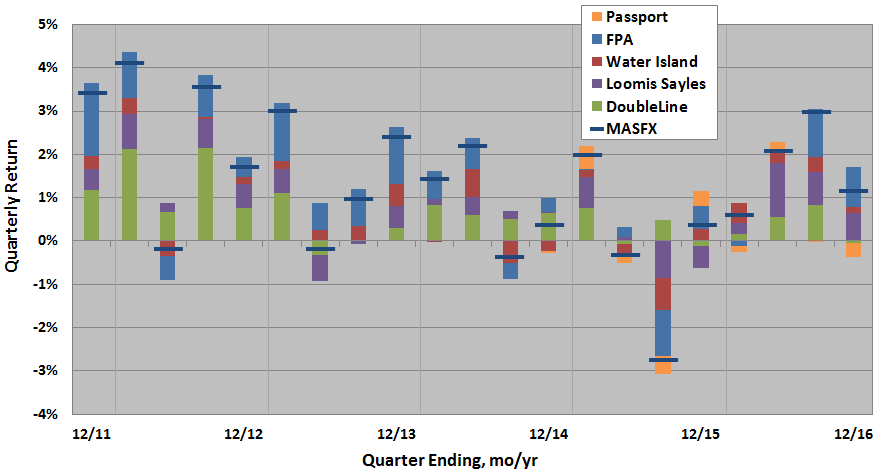

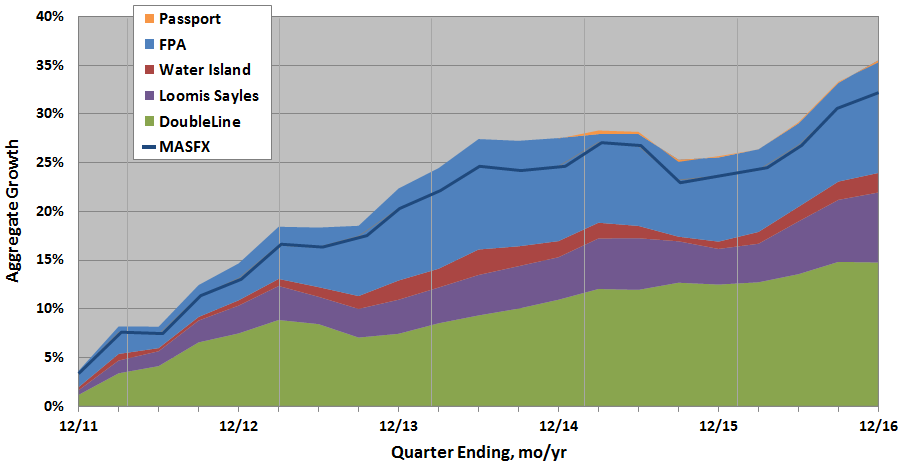

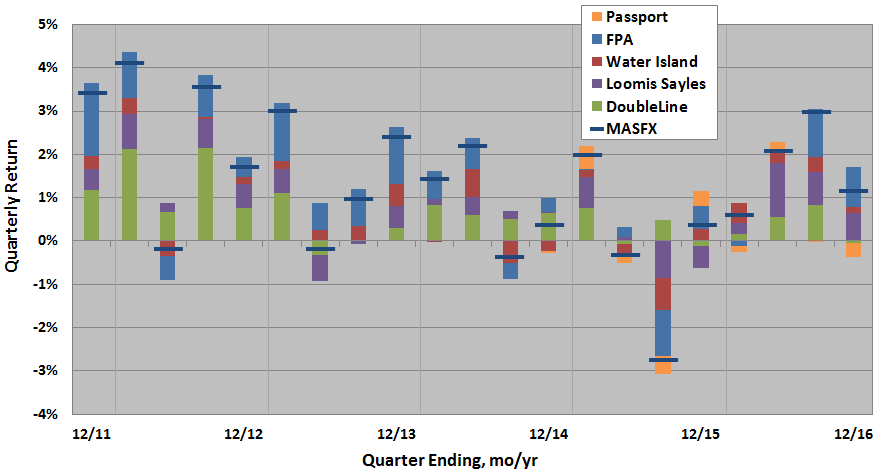

The two next charts breakout performance by sub-advisor, first aggregate growth and then quarterly return. Note that the sub-advisor breakouts do not include Litman Gregory’s fee, which is reflected in the dark blue lines for institutional share performance (MASFX).

The fund managed healthy positive or only slightly negative returns in just about every quarter except the fall of 2014, when the S&P 500 dropped 8.3% in yet another dark October. The Alternative Strategies fund also weathered well the “taper tantrum” of 2013 when US aggregate bonds dropped 3.7%.

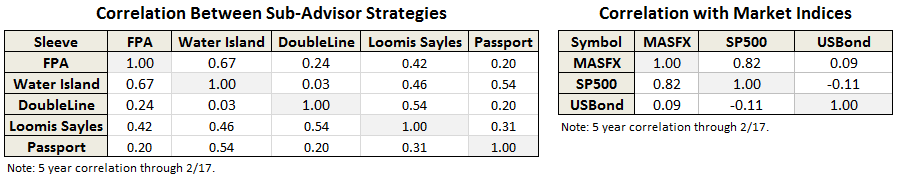

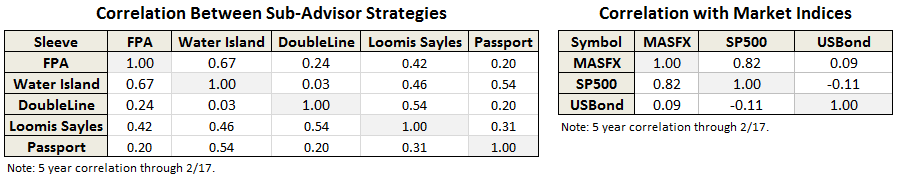

The five sleeves appear fairly uncorrelated over the past five years, but ironically and perhaps fortunately this time MASFX remained largely correlated with the S&P 500 but negatively correlated with US aggregate bonds. Litman Gregory explains the alignment was a bit of a surprise, since stock market beta remains low, but it expects the correlation to vary over time given its managers’ “opportunistic approaches.”

It notes the fund’s correlation to stocks was lower during drawdowns; indeed, the fund’s Bear Market Deviation (BMDEV) remained well below that of the S&P 500 over the past five years. Litman Gregory summarizes: “The fund’s volatility more closely matches that of aggregate bonds than of equities, so far anyway, yet it is negatively correlated to aggregate bonds and delivered a meaningfully higher return with a very similar net yield.”

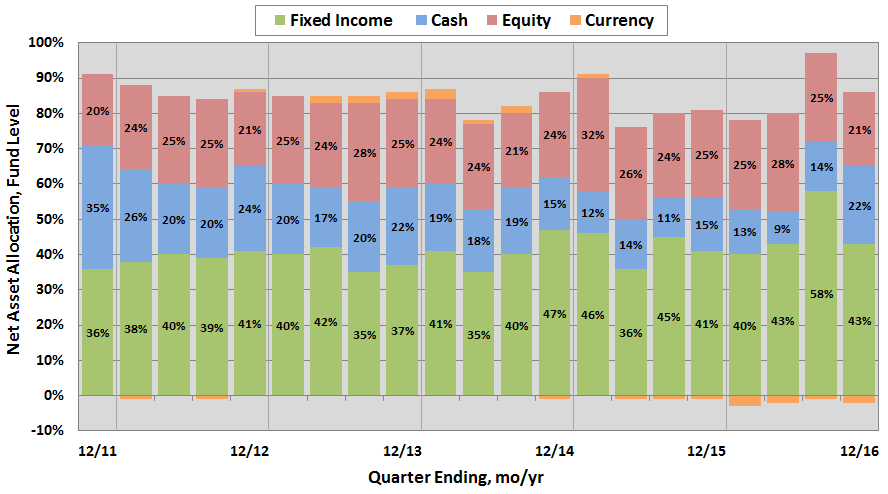

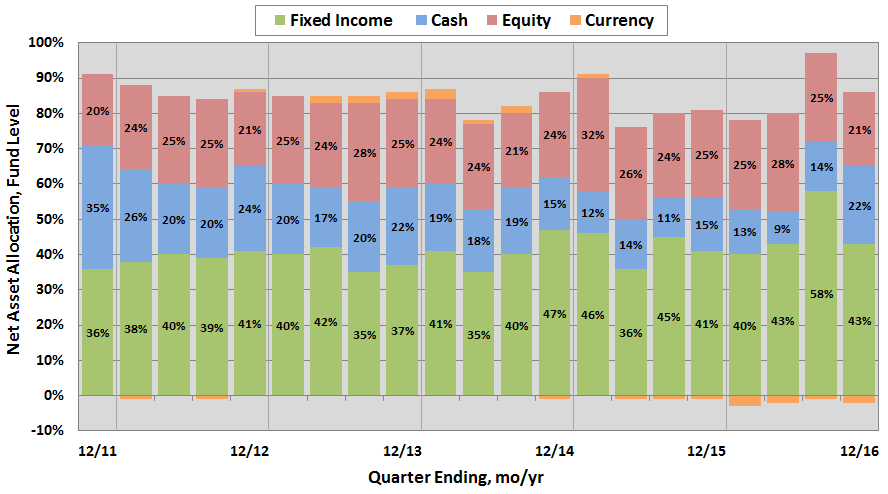

The final chart below shows net asset allocation shifts at the fund level by quarter. Short exposure ran about -30% in 2016, up from previous -20% nominally. Long exposure also increased in 2016 to about 110% and higher (132% in 3rd quarter), up from previous 105% and under.

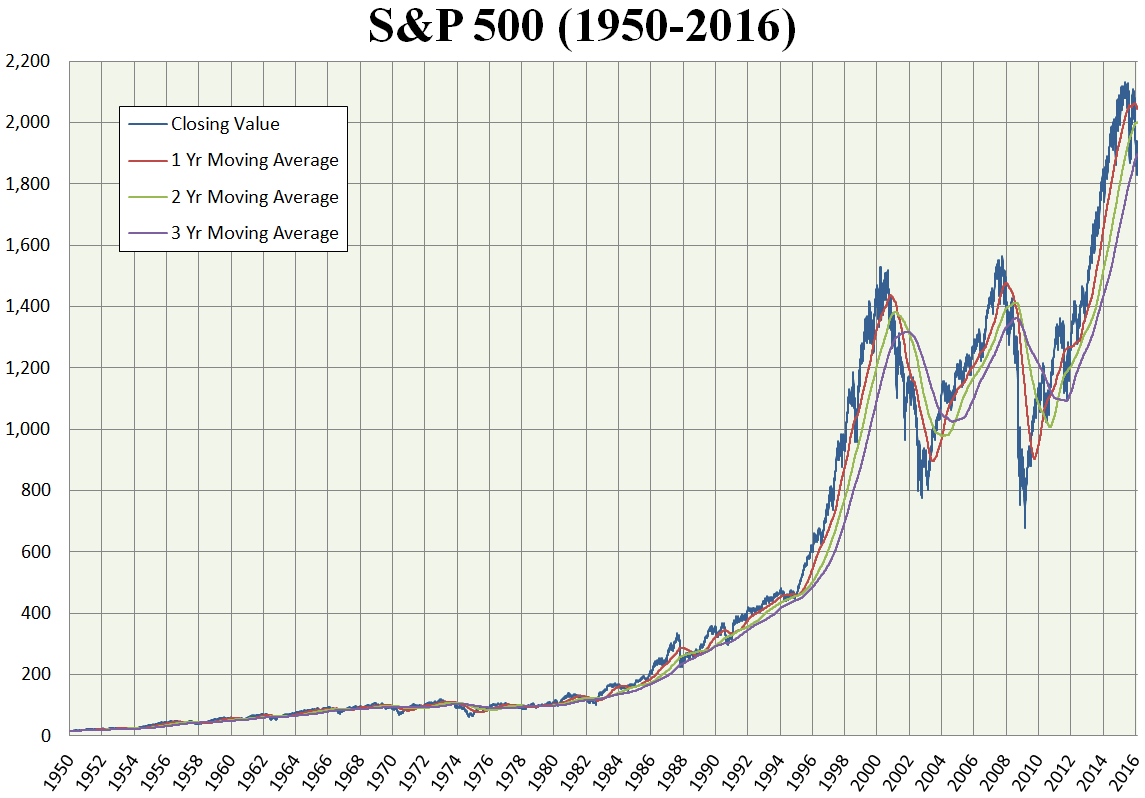

Alternative funds proliferated after investors experienced two extreme drawdowns in equities the past fifteen years, one bottoming out in August 2002 with the S&P 500 down 45% and another in February 2009 down 50%. Many have called the current up cycle, now more than 8 years old, the most hated bull market in history. Several well know fund managers who weathered 2009 just fine, have well underperformed in the intervening years.

Respected shops like GMO, Research Affiliates, and Leuthold warn that US equities remain overvalued with attendant low expected returns (premiums) going forward, if not heavy retractions. While others warn of the end of our decades long bond bull market, suggesting the performance of traditionally conservative bond-heavy allocations, like the Vanguard’s stellar Wellesley Fund (VWINX/VWAIX), may not fare so well in future. To pile on, risk-free returns are at historic lows.

What’s an investor to do? Enter alt funds! In the space, there is no question Litman Gregory has delivered an outstanding fund in the first five years since inception, with just about everything promised … hats-off to them. Other shops, like short-lived Whitebox Funds, with experienced and highly respected managers failed to make the conversion from hedge fund to mutual fund success.

On the other hand, quant shops like AQR Funds, are finding success similar to Litman Gregory’s, although they would likely attribute it to their portfolio constructions being based on “factor premia.” (Disclaimer: While personally I’m a Cliff Asness fan, I’ve experienced a chronic lack of transparency from AQR Funds, which makes it hard for me to recommend it.)

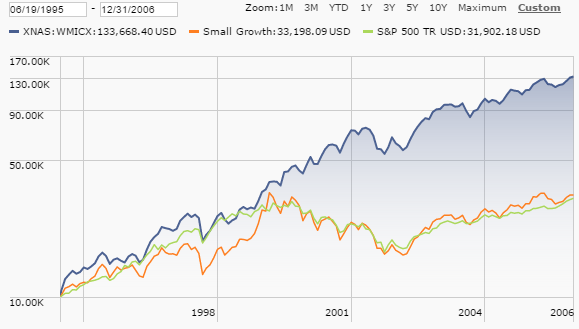

In their new book, “Your Complete Guide To Factor-Based Investing,” Andrew Berkin and Larry Swedroe argue that if a factor is to be deemed worthy of investment (as distinguished from the “factor zoo”) it must be persistent, pervasive, robust, investable, and intuitive. So, is Litman Gregory’s Masters Funds approach worthy of investment? Does its strategy persistent across different fund categories for example? Fact is performance as yet of its long-time Equity and Smaller Cap Masters Funds is undistinguished, unlike that of its Alternative Strategies and International Masters Funds.

Our colleague Ed Studsinski remains skeptical: “You are paying a higher than average fee for the benefit of the vendor’s due diligence, which can be very thorough but … are you really getting the five best ideas from each of the sub-advisors?” He adds: “The other thing we have seen with Vanguard is that a multiple manager situation can often result in the cancelling each other out.”

Indeed, at the simply outstanding Litman Gregory Masters Funds Due Diligence Forum for the Alternative Strategies Fund held recently in San Francisco, Jeffery Gundlach’s outlook could not have been more different than that of John Burbank’s. Here are some examples:

- Gundlach stated he’s “completely out of financials,” while Burbank stated he’s “never been more bullish on financials.”

- Gundlach thinks “oil is in a perpetual bear market.” Basically, while tech can bring down cost of extraction, OPEC can drop prices to where profits remain nil for any competition. Burbank is bullish on oil.

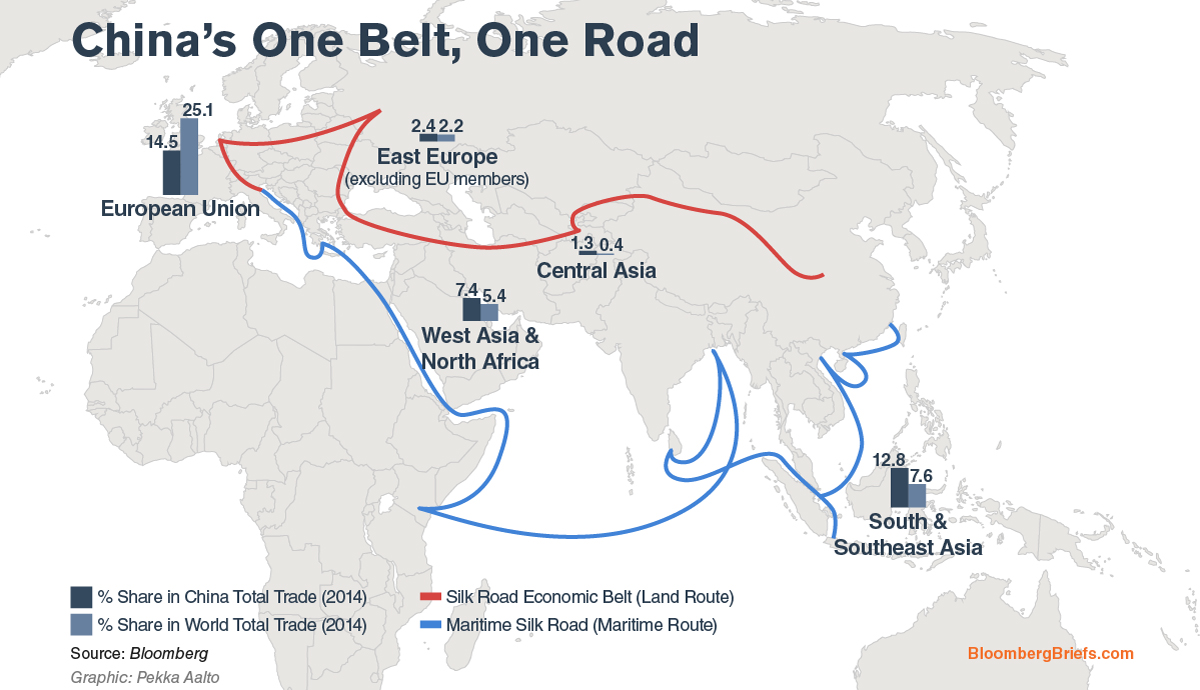

- Gundlach thinks EM is one of few undervalued markets. Burbank thinks EM will get crushed as republicans push through their America First agenda, including the border tax.

- Gundlach is skeptical on China, but bullish on India. Burbank is bullish on China.

The irony is that access to the hedge fund strategies run by both these money managers represents one of the more compelling reasons to own Alternative Strategies.

Bottom Line

Will Litman Gregory’s Alternative Strategies Fund protect investors during the next significant equity drawdown? Will it protect investors from raising interest rates? Will it deliver attractive returns relative to conservative and moderately-conservative benchmarks, like 3-Month LIPOR, Barclay’s US Aggregate Bond Index, and traditional 80/20% or 60/40% bond/equity allocations … across “all weather” markets with volatility below equities?

Answer: Many indications suggest it will.

Fund Website

Litman Gregory continues to maintain a good website filled with background and updates on its Master Funds. I remain impressed with the firm’s openness, transparency with shareholders, and responsiveness to our many inquiries.

Sam Lee and

Sam Lee and

Third Avenue Management, Marty Whitman and former president David Barse have agreed to a $14.25 million cash settlement of a lawsuit brought on behalf of investors in Third Avenue Focused Credit. The fund, if you recall, made headlines first through huge losses in the completely illiquid positions that dominated the portfolio, then by moving all of its assets into a locked trust which kept investors from reclaiming their money. The plan was to liquidate the illiquid when “rational” prices prevailed; after about 18 months, that process is still not complete. The whole mess has cost Third Avenue over $3 billion in assets and threatened its survival. (

Third Avenue Management, Marty Whitman and former president David Barse have agreed to a $14.25 million cash settlement of a lawsuit brought on behalf of investors in Third Avenue Focused Credit. The fund, if you recall, made headlines first through huge losses in the completely illiquid positions that dominated the portfolio, then by moving all of its assets into a locked trust which kept investors from reclaiming their money. The plan was to liquidate the illiquid when “rational” prices prevailed; after about 18 months, that process is still not complete. The whole mess has cost Third Avenue over $3 billion in assets and threatened its survival. ( Mark Mobius is finally stepping back. Franklin Templeton has announced that Mr. Mobius, now 80 years old, is stepping away from management of 12 strategies including four funds available to U.S. investors. He’s stepping aside from his flagship Developing Market Trust (TEDMX), which he and Tom Wu began managing in 1991. In all that time, TEDMX had only one other person on the management team, Allan Lam (1991-2004, 2011 – present). For now, he remains co-manager, with Mr. Wu, of Templeton Frontier Markets Fund (TFMAX). It’s curious that he’s been retained only on the weakest of all his funds.

Mark Mobius is finally stepping back. Franklin Templeton has announced that Mr. Mobius, now 80 years old, is stepping away from management of 12 strategies including four funds available to U.S. investors. He’s stepping aside from his flagship Developing Market Trust (TEDMX), which he and Tom Wu began managing in 1991. In all that time, TEDMX had only one other person on the management team, Allan Lam (1991-2004, 2011 – present). For now, he remains co-manager, with Mr. Wu, of Templeton Frontier Markets Fund (TFMAX). It’s curious that he’s been retained only on the weakest of all his funds.