On October 02, 2017, Northern Trust Asset Management launched Northern U.S. Quality ESG Fund. It strikes me as a particularly interesting fund which combines two separately valuable commitments in a single low-cost platform.

The case for investing in high quality companies is almost definitional. No sensible person buys low quality anything when, for about the same price, they can get a high quality alternative. The key is having a viable definition of “quality” and a clear sense of how much of a premium a quality company might charge. Northern has done a good job of navigating those waters. The quality metrics here are comparable to those at Northern Income Equity Fund (NOIEX). NOIEX shares one of NUESX’s managers, Jeff Sampson. Income Equity has earned four stars from Morningstar (as of 10/30/17) and it has managed to combine consistently low volatility with consistently above average returns. Northern incorporates the “quality” screen in a number of other funds, as well: Northern Small Cap Core Fund (NSRGX), Northern Small Cap Value Fund (NOSGX), Northern Large Cap Core Fund (NOLCX), Northern Large Cap Value Fund (NOLVX) and Northern International Equity Fund (NOINX).

Northern Trust Asset Management has made a major commitment to responsible investing. This fund will be the latest in a series of launches by Northern, which offers a global ESG index fund, Global Sustainability Index Fund (NSRIX) and, as of July 14, 2016, two ETFs: FlexShares STOXX US ESG Impact Index Fund (ESG) and FlexShares STOXX Global ESG Impact Index Fund (ESGG). More important, Northern uses the strategy behind their U.S. Quality ESG fund in accounts offered to high net-worth individuals. Northern Trust reports:

We manage an investment strategy, Quality US ESG, for institutional and HNW clients, that has a similar investment process with the same portfolio management team. From its 09/10/15 inception through 9/30/17, this strategy has outperformed its benchmark–the Russell 1000 Index. Also as of 9/30/17, it has outperformed YTD and for one year. AUM is $141 million as of 9/30/17.

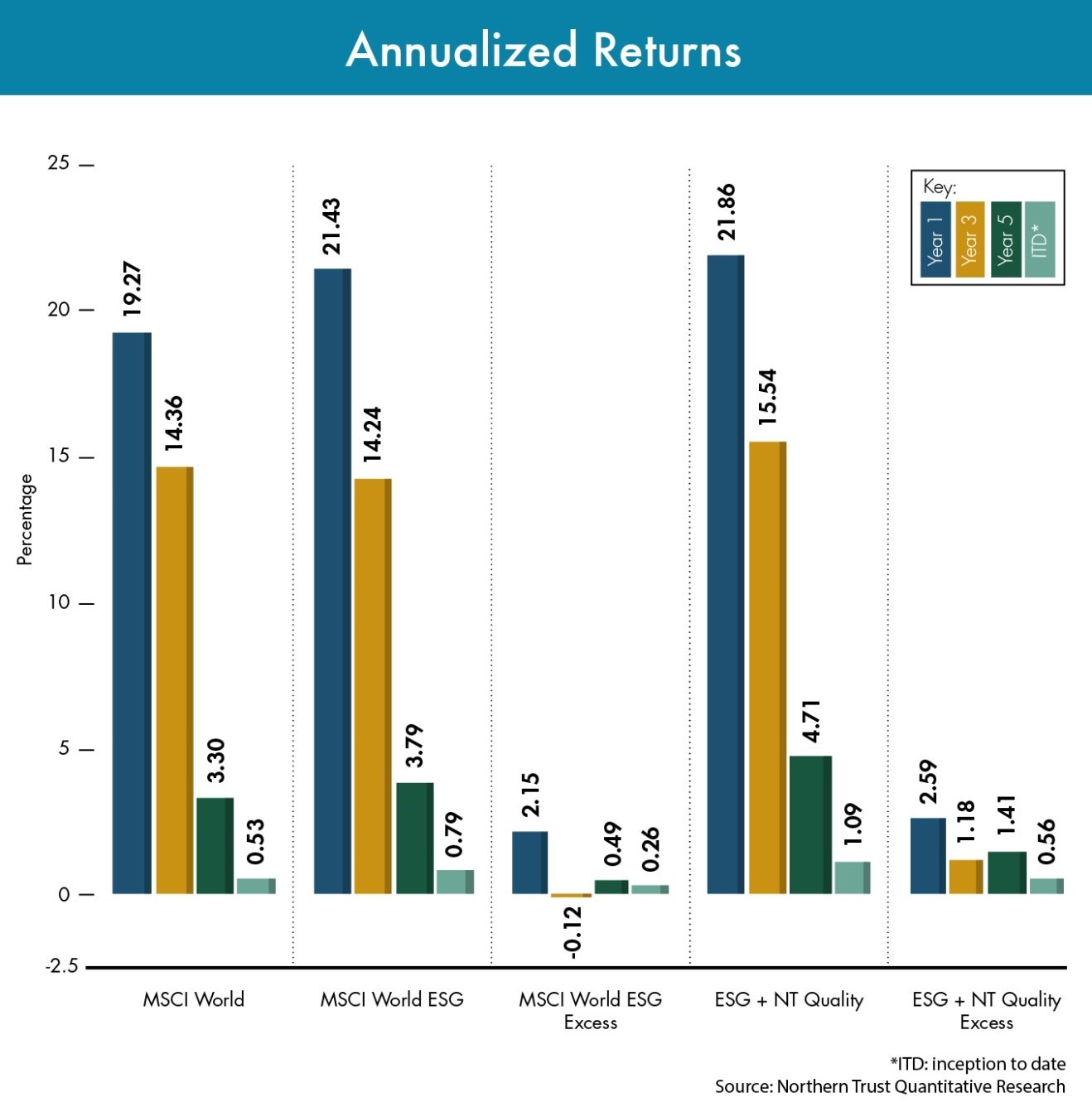

Northern’s research, graphed below, shows that good corporate citizens tend to inch out average citizens most years. That’s shown in the third column, ESG Excess, which shows the difference in performance between ESG and non-ESG securities in the same index. In the preceding three years, ESG-qualified securities performed quite well (14.24% annualized returns) but marginally worse than non-ESG securities. That said, in most years and in most markets, good citizens that are also exceptionally well-managed corporations tend to lead the pack, sometimes substantially (column five).

The new fund will invest in 150-200 mid- to large-cap US stocks. The portfolio screening process will be largely quantitative. The screens look for a good ESG record, including the ability to avoid high-profile controversies, and for measures of strong corporate performance, including strength of the management team and of cash flows. Finally there’s a risk-management overlay that operates at the security, sector and portfolio level. It will be managed by Jeff Sampson and Peter Zymali. Mr. Sampson joined Northern in 1999, and Mr. Zymali joined in 2001. Mr. Sampson joined the team managing Northern Income Equity Fund in July 2017. For the past decade he’s been a senior manager on the Global Equity Team, responsible for $5 billion in ESG investments for Northern’s core high net worth clientele. For about the same period, Mr. Zymali has been a manager in the quantitative investing group, specializing in tax-advantaged investing.

In truth, the fate of the world hangs in the balance. Where doubt about the human role in climate change was once the province of thoughtful skeptics (I was, 20 years ago, among them), it’s increasingly the demesne of a coterie of ideologues who have surrendered any passing concern for the truth. Their conscious, reckless distortion of the evidence appalls me.

We can neither precisely predict, nor reverse, over the next century anyway, the damage we are doing to our planet’s life-support system. We can only seek now to minimize, anticipate and mitigate it. MFO’s commitment to using a “green” server won’t save the world nor will your decision to invest in an ESG-sensitive fund. But we each make dozens of decisions each day about what we value and what we will bequeath to our children’s children. This might represent one of them. Northern’s commitments, to low cost investing, rigorous research, risk sensitivity and, quite broadly, to “conscience driven investing” makes this is good place to look for investors worried both about their portfolios and their planet.

The fund’s minimum initial investment is $2500, lowered to $500 for tax-advantaged accounts and $250 for an account established with an automatic investing plan. The opening expense ratio, after waivers, is 0.43%.

The fund’s homepage: Northern Funds U.S. Quality ESG.