On August 21, 2017, Driehaus Capital launched Driehaus Small Cap Growth (DVSMX/DNSMX). There’s reason to pay attention.

The fund will target U.S. small cap (sub $6 billion market cap) growth stocks. The “name rule” obliges them to keep at least 80% in small caps; they allow that the other 20% might be in international stocks that trade on U.S. exchanges or larger cap equities. As is common with Driehaus, it’s a growth-centered fund likely with a fairly high portfolio turnover rate.

They’re attempting to find “fundamentally strong companies,” which obliges them to evaluate the company’s competitive position, industry dynamics, potential growth catalysts and its financial strength. They also account for comparative stock valuations and external factors (behavioral and macro-economic) likely to impact the firm’s stock price.

Driehaus Small Cap Growth Fund was created by the merger the Driehaus Institutional Small Cap, L.P., Driehaus Small Cap Investors, L.P., Driehaus Institutional Small Cap Recovery Fund, L.P. and Driehaus Small Cap Recovery Fund, L.P., which were managed by the same investment team using about the same strategy. Like the new fund, the limited partnerships were just some of the vehicles for the strategy. Overall, Driehaus manages more than $200 million in the small group growth strategy. The record of that strategy composite, the combined performance of all of the vehicles following it, points to a couple conclusions.

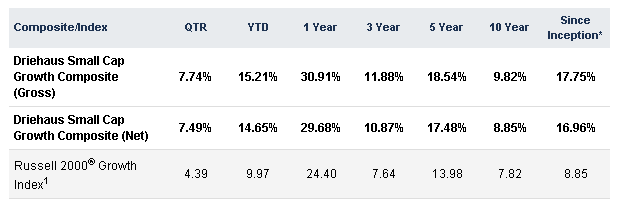

First, the strategy has been successful.

Second, the strategy has been independent. The three-year active share calculation against the Russell 2000 Growth Index is 85.42. As I scan the active share graph from 2008-2015, it appears that active share is never below 80, which indicates a high degree of independence from its benchmark.

The strategy has volatility that’s modestly higher than its benchmarks (beta of 1.05) but returns with was substantially higher (alpha of 3.22), which means it’s got a strong risk-return profile. Driehaus’s analysis of rolling five-year returns shows that the outperformance is “fairly consistent throughout the strategy’s history.” While the strategy is not the fund per se, the strategy’s performance should give you a good insight into what the fund brings to the table.

The fund is managed by Jeffrey James and Michael Buck. Mr. James is the portfolio manager for the Micro Cap Growth, Small Cap Growth and Small/Mid Cap Growth strategies. He began his career with Lehman Brothers, had a six year stint at the Federal Reserve Bank of Chicago and joined Driehaus in 1997. Mr. Buck, the assistant portfolio manager, is also a senior micro- and small-cap analyst with responsibility for the consumer discretionary, consumer staples and financials sectors. The portfolio team includes six analysts and a dedicated risk manager.

The fund begins life with about $37 million in assets, of which $36 million are in the institutional shares. The minimum initial investment in the Investor share class is $10,000, Institutional is $500,000. The opening expense ratios are 1.20% and 0.95%, respectively.

The Driehaus Small Cap Growth homepage is, as yet, thin on content but it does offer the essential information. Readers interested in understanding the underlying strategy will find a lot of useful information linked to the Driehaus Small Cap Growth strategy page.