On December 5, 2016, Symons Capital launched Symons Concentrated Small Cap Value Fund. It is, so far, available only as an institutional offering with a $1 million minimum.

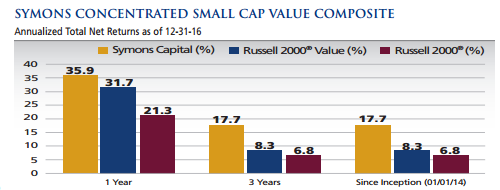

The fund is an extension of the Symons Concentrated Small Cap Value composite. As of 12/30/2016, that composite reflected quite healthy investment performance.

It’s particularly interesting that the fund’s 2:1 outperformance compared to its benchmark came without heightened volatility. Symons Concentrated SCV composite had a standard deviation of 11.15% while the Russell 2000 Value, its benchmark, clocked-in at 15.5%.

It goes beyond “interesting” to “impressive” when you add in the fact that the separate account composite holds only 18 stocks and the fund intends to hold about the same. This makes Symons Concentrated SCV the most concentrated small cap fund in existence; the only small cap funds with fewer listed holdings are funds-of-funds and, effectively, hold hundreds of stocks. The plan is to purchase fewer than 20 stocks with market capitalizations of less than $3 billion across a broad sector allocation.

They describe themselves as ‘traditional deep value manager with a risk management focus.” Their target universe is “sad stocks,” that is, the temporarily depressed stocks of firms with good products and services. Given the managers preference for companies with long-term sustainable competitive advantages, the description might be: systematically searching for the best and saddest small-cap blue chips.

The fund is managed Colin Symons. In our December Elevator Talk with Mr. Symons, we described him as “a serial over-achiever. Mr. Symons graduated from Williams College, arguably the best liberal arts college in America, in only three years. He started his career as a software developer, working with and writing code for both the IRS and major financial services firms such as Chase Manhattan Bank. He eventually earned recognition as a Microsoft Certified Solution Developer, a globally recognized designation. His interests grew beyond financial software into financials; he learned security analysis and earned his CFA. At Symons Capital he manages $483 million in their Value, Small Cap Value and Concentrated Small Cap Value strategies and funds.”

Institutional shares of the fund carry 1.61% expense ratio, after waivers. The minimum initial investment is $1 million.

The fund’s website is Symons Funds, but you might find a somewhat richer discussion and details about the SMA composite at the adviser’s main site, Symons Capital. In both cases there’s an iconic picture of Pittsburgh which makes me happily nostalgic.