The Closed End Fund (CEF) industry, with $200 billion in assets, is dwarfed in size by the open-ended mutual fund industry. CEFs generally get little attention in Mutual Fund Observer and sites like Bogleheads. Trapezoid monitors most of the closed-end fund universe for manager skill in relation to expense ratio, using the same methodology and database as for open-end mutual funds. (MFO readers are invited to register for a free no-obligation demo which covers several mutual fund sectors)

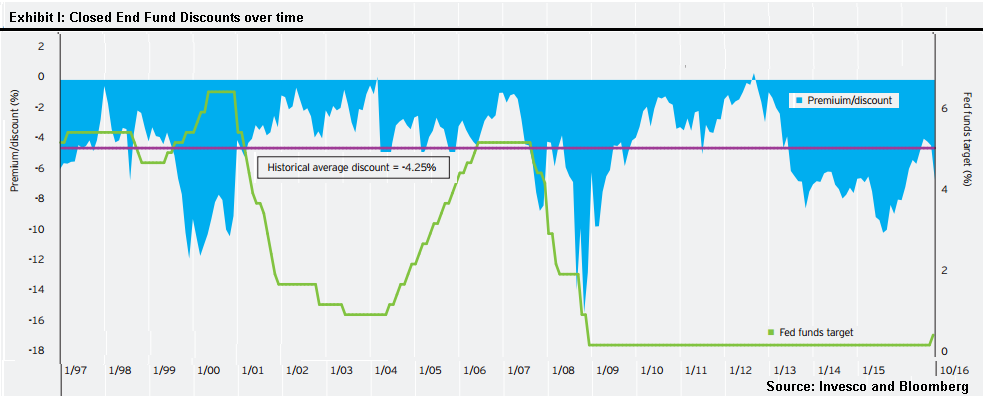

There are many closed end funds trading at discounts to Net Asset Value (NAV). The average fund trades today at a 7% discount. This is not as big as it was a year ago, but still above the historic average. Exhibit I shows the average closed fund discount for all US CEFs (based on equal weighting) We are aware of 100 CEFs trading at discounts of 12% or greater. Sometimes those discounts persist so long they become more or less permanent.

Some people attribute the discount to poor investment performance (we will comment on that later). High fees, lack of liquidity, and dividend yields are also factors. Rising short term rates make CEFs which rely on leverage less attractive.

Phil Goldstein

Whatever the reason, a persistent discount is a source of tension between fund holders and advisors. Many holders would like to see their investments trade at NAV, even if this necessitates opening the redemption window or liquidating the fund completely. The management company ordinarily wants to receive its stream of fees as long as possible.

Since 2014 activism has been heating up in the closed end fund (CEF) space. CEF activism was pioneered by a handful of players including Philip Goldstein of Bulldog Fund. A decade ago Elliot Associates forced Salomon Brothers Fund to open.

Recently, a number of hedge fund players have piled in. Activists have scored successes. As Exhibit II shows, several CEFs were forced to convert to open end funds, others agreed to liquidate or merge. A number of other funds agreed to do large buybacks, often coupled with a standstill agreement which would keep the activist at bay for several years.

Exhibit II – Recent CEF and BDC Activist Plays

| Fund | Activist | Outcome | |

| ACAS | American Capital, Ltd* | Elliott | Ares acquired |

| ACG | AB Income Fund | Karpus | merged into open end fund |

| AYN | Alliance NY Municipal Income Fund | Bulldog | liquidated |

| CMK | MFS InterMarket Income Trust | Karpus, Bulldog | liquidated |

| FTT | Federated Enhanced Treasury Income Fund | Karpus | converted to open end fund |

| FAV | First Trust Dividend and Income Fund | Bulldog | converted to ETF |

| FDI | Fort Dearborn Income Securities (UBS) | Karpus, 1607 | converted to open end |

| FULL | Full Circle Capital Corp* | Bulldog, Sims | Great Elm acquired |

| GHI | Global High Income Fund | Bulldog, Saba | liquidated |

| HYF | Managed High Yield Plus Fund (UBS) | Saba | liquidated |

| JGV | Nuveen Global Equity Income Fund | Bulldog | merged into open end fund |

| KHI | Deutsche High Income Trust | Saba | liquidated |

| XRDC | Crossroads Capital, Inc. (BDCA Venture)* | Bulldog | Bulldog granted BOD seat; proposing liquidation |

| RIT | LMP Real Estate Income Fund | Bulldog | converted to open end fund |

| AVK | Advent Claymore Convertible Securities & Income Fund | Saba, Western | tender, standstill |

| DCA | Virtus Total Return Fund | Bulldog | tender, standstill |

| ERC | Wells Fargo Multi-Sector Income Fund | Saba | tender, standstill |

| FSC | Fifth Street Finance Corp. * | RiverNorth | tender, standstill, side deal |

| FSFR | Fifth Street Senior Floating Rate Corp.* | Ironsides | tender, standstill, side deal |

| GFY | Western Asset Variable Rate Strategic Fund | Relative Value | tender, standstill |

| IRL | New Ireland Fund | Karpus | tender, standstill |

| LCM | Advent/Claymore Enhanced Growth & Income Fund | Bulldog, Western, Saba | tender, standstill |

*Business Development Corporation

But in a minority of cases, the management company has resisted. Some have used delaying tactics. Others made tactical use of dilutive rights offers.

While there are several good examples of what happens when a fund resists activist pressure, we will consider Deutsche Bank as a case in point.

When shareholders and fund directors clash

Art Lipson

Western Investment, a hedge fund manager based in Utah, has been battling funds managed by DIMA (Deutsche Investment Management Americas) since 2009. The manager, Art Lipson, cut his teeth on the fixed income desk at Kuhn Loeb in the 1970s and 80s. A few years ago, Lipson disclosed that 90% of Western’s portfolio was allocated to closed end funds trading at a discount.

DIMA was previously controlled by Zurich (which bought Kemper Insurance) and before that it was known as Scudder.

In 2010, after a protracted battle, Western struck a settlement with DIMA under which they agreed to liquidate two funds and effect partial tenders at several others. As part of the agreement Western agreed to a five-year standstill with Deutsche.

Boaz Weinstein

In April 2015, around the time his standstill was expiring, Saba (a hedge fund managed by Boaz Weinstein) filed a 13D against Deutsche High Income Trust (KHI) with a 12% stake. KHI was another CEF managed by DIMA with assets of $140mm. By February 2016 Deutsche and Saba agreed to a deal which led to the liquidation of KHI late in 2016. By capturing the discount, Saba generated an extra 10-12% over and above what the underlying assets generated; because Saba scaled into and out of the position, the bulk of the capital was tied up for 18-24 months.

Perhaps spurred by Saba’s success, Lipson decided to tangle with Deutsche again. His targets were Deutsche’s two remaining taxable CEF bond funds, Deutsche Multi-Market Income Fund (KMM) and Deutsche Strategic Income Trust (KST). At the time the two funds were trading at discounts to NAV of 15%. The combined net assets of these funds are approximately $250 million. The investment agreement (renewed annually) paid DIMA roughly 1% per year. The board of each fund was identical to KHI

In the run-up to the October 2016 shareholder meeting, Lipson and his partner Benchmark Plus prepared to launch a proxy seeking four board seats and declassification of the board. The board opposed the motion but agreed to ultimately terminate the trust. But, unlike KHI, they asked to preserve the current structure for 2.5 years. Their rationale was that the current CEF structure conferred certain benefits on shareholders including the ability to use leverage.

Lipson’s proxy questioned whether the directors were truly disinterested, since they received considerable fees from 103 Deutsche funds. He also noted the funds have consistently traded at a discount and that Deutsche Bank was financially unstable. The proxy also criticizes the funds’ performance but doesn’t offer much evidence. And it notes that the directors’ business judgement was inconsistent: it moved to liquidate KHI quickly but wants to be much more patient with KMM and KST. The fund’s lawyers sought (and were denied by the SEC) permission to exclude the declassification proposal as well as many of Western’s arguments.

In the October 2016 shareholder vote, Lipson’s slate won a majority of the votes cast for each fund – but only 54% of the shareholders actually bothered to vote. As a result, the board refused to unseat the current directors or declassify the board. In 2009, during Deutsche’s first skirmish with Lipson, the fund amended its by-laws to raise the voting threshold from a plurality of those voting to an absolute majority.

We understand why Deutsche would take this position. DIMA manages $1.6 billion of other CEFs, some of which have attracted attention from other activists. By agreeing to liquidate at the end of 2018, they preserve their fee stream for a couple of years, a time frame they probably believed was short enough to dissuade most activists from litigating; but also, long enough to undermine the economics of future activists.

However, the independent directors are the real decision makers. Their perspective is murkier. Fifty six percent of shareholders who cast a vote supported the activists (blending the two funds.) This seems to evidence a strong desire by shareholders for change.

We spoke to two attorneys who handled similar cases in the past. Rarely are these cases tried in court. The facts and legal venues may differ from case to case. But there is general agreement that without the directive of an absolute majority the directors are obliged to apply their independent judgement to do what is in the best interest of shareholders. The fund might take the position that the activists’ objectives diverge from those of retail shareholders. The two sides would presumably differ over how to interpret a persistent discount and whether shareholders’ interest is well served by following the strategy from the original prospectus. The shareholder base may include many holders with low tax-basis.

We also spoke to Lipson. While some activists are willing to cut deals with managers involving a partial buyback, he has a philosophical tilt toward fund liquidation. “Given the choice, if a fund agrees to terminate in reasonable timeframe, I will support that over a quick fix solution…. Even if it means a slightly lower IRR.”

Currently Western is suing KMM, KST and the two boards. We are not legal analysts. We suspect the business judgment rule gives the directors a lot of latitude. But we would want to better understand why the board (with identical composition) terminated KHI so much more quickly than KMM and KST.

Current Activist Opportunity

Investors have been rattling the cage at a number of other CEFs, trading at a discount. Here is a partial list:

| Fund Name | Discount | Activist | Comment | |

| ADX | Adams Diversified Equity Fund | 16.8 | Gramercy | shareholder proposal defeated |

| AGC | Advent Claymore Convertible Securities & Income Fund II | 14.4 | Saba | |

| BGX | Blackstone/GSO LS Credit Inc | 8.4 | Saba | |

| BIT | BlackRock Multi-Sector Income Trust | 11.0 | Saba | |

| CEE | Central Europe, Russia and Turkey Fund | 12.9 | City of London | Discount Mgmt Program |

| CIF | MFS Intermediate High Income Fund | 9.6 | Saba | |

| CSI | Cutwater Select Income Fund | 6.8 | Karpus | |

| DHG | Deutsche High Income Opportunities Fund | 4.4 | Bulldog, Saba | |

| DNI | Dividend and Income Fund | 17.3 | Karpus, BlueBell, Saba | rights offer as defensive tactic |

| DSU | BlackRock Debt Strategy Fund | 10.0 | Saba | |

| EEA | European Equity Fund | 12.8 | 1607 Capital Partners, Karpus | |

| EMD | Western Asset Emerging Markets Income Fund | 13.7 | Saba | |

| FAM | First Trust/Aberdeen Global Opportunity Income Fund | 8.3 | Karpus | shareholder proposal |

| FPT | Federated Premier Intermediate Municipal Income Fund | 7.4 | Karpus | |

| FSD | First Trust High Income Long/Short Fund | 10.3 | Saba | shareholder proposal to declassify board |

| FTF | Franklin Templeton Duration Income Trust | 9.2 | Saba | |

| GDO | Western Asset Global Corporate Defined Opportunity Fund | 9.5 | Saba | |

| GLO | Clough Global Opportunities Fund | 13.6 | Bulldog | |

| GLQ | Clough Global Equity Fund | 11.5 | Bulldog | |

| GLV | Clough Global Allocation Fund | 11.6 | Bulldog | |

| HYI | Western Asset High Yield Defined Opportunity Fund | 9.1 | Saba | |

| HYT | Blackrock Corp HY Fund | 10.8 | Saba | |

| JFC | JPMorgan China Region Fund | 5.7 | Ancora, City of London | |

| JLS | Nuveen Mortgage Opportunity Term Fund | 4.4 | Saba | |

| KEF | Korean Equity Fund | 8.4 | Bulldog, City of London | |

| KF | Korea Fund | 12.2 | City of London | |

| LBF | Deutsche Global High Income Fund | 3.9 | Bulldog | |

| LGI | Lazard Global Total Return | 12.2 | Bulldog | |

| MCR | MFS Charter Income Trust | 9.8 | Relative Value Partners | |

| MSP | Madison Strategic Sector Premium Fund | 6.7 | Ancora | |

| NRO | Neuberger Berman Real Estate Securities Income Fund | 8.7 | Bulldog | |

| PHF | Pacholder High Yield Fund | 7.9 | Bulldog/Full Value | |

| SWZ | Swiss Helvetia Fund | 13.0 | Karpus, Bulldog | |

| TWN | Taiwan Fund | 13.4 | City of London | |

| ZF | Zweig Fund | 10.7 | Bulldog, Karpus | |

| ZTR | Zweig Total Return | 7.1 | Bulldog, Karpus |

There are also several Business Development Corporations (BDC’s) which have drawn activist interest including

| Ticker | BDC | Activists |

| KCAP | KCAP Financial | DG |

| MVC | MVC Capital | Wynnefield |

| SVVC | Firsthand Technology | Bulldog |

Investors desiring to follow on are advised to do their homework. Many of the smaller CEFs have been taken out; the remaining ones require deeper pockets, more expensive proxy fights, and more patience. Larger hedge funds won’t necessarily join the fray for a variety of reasons. Gramercy stubbed its toe taking on Adams Express Diversified Fund (ADX.) Once an activist files his 13D prices tend to rise and big positions are harder to accumulate. Also note that a few settlements have been crafted narrowly which are more beneficial to the activists than to the shareholders as a class. Sometimes settlements struck by one fund bring standstill relief to sister funds.

In the case of the two Deutsche funds, KMM and KST, we do expect the trusts to liquidate within two years. Even if the expense structure of these funds is a bit rich, investors in these funds should outperform comparable open end short-term bond funds by roughly 3% per year by closing the discount. That will improve if the activists persuade the boards to terminate earlier.

A CEF trading at discount may not be enticing if you dislike the underlying assets. We noted last month that the economic policies of President-elect Trump may not be friendly to the bond market. KMM and KST hold fixed-rate bonds with an effective duration of 4.4 years.

How do CEFs perform?

Do closed end funds trade at a discount because, as the activists say, they are weak performers? Or does the discount reflect structure and illiquidity?

We reviewed the skill of 40 closed end bond funds which were included in our most recent fixed income model. This is not the same as the model featured on fundattribution.com which evaluates equity funds for skill. The fixed income model relies entirely on regression data and has not been tested for predictive validity. But it does control for factors like allocation to fixed income strategies, duration , expense ratio, and reliance on leverage to generate yield. We were surprised to see the performance of CEF bond managers was worse, on average, by roughly 1 standard deviation. Many bond CEFs borrow short term at a spread over LIBOR to invest in longer duration instruments; while that activity may boost current income, we view the spread over LIBOR as a deduction to skill.

Among the 40 CEFs, higher skill correlates with smaller discount as one would expect. But the relationship is weak and there are clearly other factors driving CEF discounts.

We did a similar study of 70 equity CEFs. For this group we used Trapezoid’s sS metric, which measures fund manager skill from security selection for every period after controlling for asset allocations, factor exposures, leverage, systemic risk, and of course expense ratios. More about the methodology behind this metric can be found here. The CEF managers once again underperformed their open-end active manager peers. However, the difference was much less pronounced, only one third of a standard deviation. The equity CEFs include a heavy concentration of foreign funds and infrastructure so it is hard to draw strong conclusions.

Bottom Line

Closed end funds trading at a discount are a traditional value play. Those discounts are explained in part by lousy performance and high expense ratios, by sentiment, by timeliness of the asset class, and by illiquidity. The presence of activist investors could indicate there is a catalyst who will narrow the discount. Following the lead of activists might be a good strategy but patience is required.

Disclosure: the author has investments in certain CEF’s and BDC’s mentioned in this article

What’s the Trapezoid story? Leigh Walzer has over 25 years of experience in the investment management industry as a portfolio manager and investment analyst. He’s worked with and for some frighteningly good folks. He holds an A.B. in Statistics from Princeton University and an M.B.A. from Harvard University. Leigh is the CEO and founder of Trapezoid, LLC, as well as the creator of the Orthogonal Attribution Engine. The Orthogonal Attribution Engine isolates the skill delivered by fund managers in excess of what is available through investable passive alternatives and other indices. The system aspires to, and already shows encouraging signs of, a fair degree of predictive validity.

What’s the Trapezoid story? Leigh Walzer has over 25 years of experience in the investment management industry as a portfolio manager and investment analyst. He’s worked with and for some frighteningly good folks. He holds an A.B. in Statistics from Princeton University and an M.B.A. from Harvard University. Leigh is the CEO and founder of Trapezoid, LLC, as well as the creator of the Orthogonal Attribution Engine. The Orthogonal Attribution Engine isolates the skill delivered by fund managers in excess of what is available through investable passive alternatives and other indices. The system aspires to, and already shows encouraging signs of, a fair degree of predictive validity.

The stuff Leigh shares here reflects the richness of the analytics available on his site and through Trapezoid’s services. If you’re an independent RIA or an individual investor who need serious data to make serious decisions, Leigh offers something no one else comes close to. More complete information can be found at www.fundattribution.com. MFO readers can sign up for a free demo.