In a February 2012 Wall Street Journal piece, I nominated MASNX as one of the three most-promising new funds released in 2011. In normal times, investors might be looking at a moderate stock/bond hybrid for the core of their portfolio. In extraordinary times, there was a strong argument for looking here as they consider the central building blocks for their strategy. Our profile of the fund that year argued

these really do represent the “A” team in the “alternatives without idiocy” space. That is, these folks pursue sensible, comprehensible strategies that have worked over time. Many of their competitors in the “multi-alternative” category pursue bizarre and opaque strategies (“hedge fund index replicant” strategies using derivatives) where the managers mostly say “trust us” and “pay us.” On whole, this collection is far more reassuring.

Five years on, the fund’s performance has borne us out.

| Annual Ret. | MaxDD | Recvry mo | StdDev | DSDev | Ulcer Index | BMDEV %/yr | Sharpe Ratio | Sortino Ratio | Martin Ratio | |

| Litman Gregory Masters Alt Strategies | 5.2% | -5.4% | 14 | 3.3% | 1.7% | 1.5 | 1.1 | 1.54 | 2.95 | 3.42 |

| Alternative Multi-Strategy Peer Group | 3.5 | -7.1 | 18 | 4.7 | 2.8 | 2.6 | 1.8 | 0.69 | 1.23 | 1.64 |

Here’s the quick translation. From inception through September 2016, MASNX incurs less risk than its Lipper peers (maximum drawdown is smaller, standard deviation and downside deviation is lower, performance in sharply falling periods is stronger and its Ulcer Index is lower), produces greater returns (measured by its annualized returns) and has a far better risk-adjusted return profile (reflected in the Sharpe, Sortino and Martin ratios).

The Observer designates MASNX as a Great Owl Fund for superior risk-adjusted performance in all trailing measurement periods.

In an invitation to a conference call with Jeff Gundlach, Litman writes:

Now, after reaching the five-year mark, we are proud to be the sole five-star, analyst recommended fund in the Morningstar multi-alternative category, and with the highest risk-adjusted return.

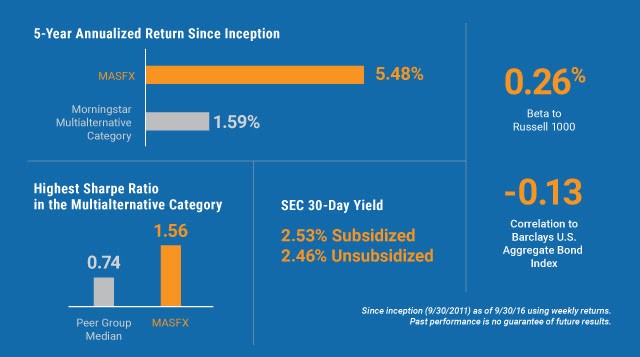

Which they supplement with a nice infographic:

Interested parties have been invited to join the Litman Gregory folks on November 10 at 1:00 p.m. Pacific for the Alternative Strategies Fund 5-Year Webinar with DoubleLine’s Jeffrey Gundlach. If you click the link, you’ll be taken to a registration page so you can get an access code. If you’d like to read more before committing, check out their Q&A page.