Seafarer Overseas Growth & Income (SFGIX/SIGIX) closing to new investors

On August 31, 2016, Seafarer announced the imminent closure of its flagship Seafarer Overseas Growth & Income fund. The closure is set to become effective on September 30, 2016.

Highlights of the announcement:

- The fund will soft-close on September 30, so that existing investors will still be able to add to their accounts. There are the usual exceptions to the closure.

- The strategy capacity is currently estimated to be around $4 billion. As the fund approaches that threshold, Seafarer will pursue strategies to control inflows from existing shareholders. A capacity constraint is, in Mr. Foster’s judgment, “a real and material constraint for an investment strategy, much the way a wall is real and material constraint to a car.” The plan is to slow the metaphorical car down now, through a soft closure, in hopes to avoid running into the wall and being forced to hard-close the fund later.

- The minimum initial investment for Seafarer’s lower cost institutional shares has been reduced from $100,000 to $25,000. That applies to both this fund and their new Seafarer Overseas Value Fund (SIVLX).

- As part of their ongoing commitment to pass economies of scale along to their investors, Seafarer is reducing their management fee on assets of about $1.5 billion from 0.75% to 0.70%.

The change in institutional minimum will allow Investor Class shareholders with more than $25,000 but less than $100,000 in their accounts to move into the lower-cost shares. In addition, folks who invest directly with Seafarer can gain access to the low-cost Institutional share class (which Mr. Foster would prefer to designate as the Universal Share Class) by investing at least $1500 and signing up for an automatic investing plan through their Institutional Class Waiver Program.

For those unfamiliar with the fund, Seafarer is a four year old diversified emerging markets fund; its manager, Andrew Foster, has a long and distinguished track record as manager and is incessantly committed to helping his shareholders. He’s been evangelical about lowering expenses whenever conditions permit and his shareholder communications are singularly clear and thoughtful. He believes that emerging market economies are characterized by unreliable capital markets; that is, firms cannot count on being able to raise capital quickly and efficiently when they need it. As a result, one of his strong preferences is for firms that generate sufficient free cash flow to cover their capital needs internally.

For those unfamiliar with the fund, Seafarer is a four year old diversified emerging markets fund; its manager, Andrew Foster, has a long and distinguished track record as manager and is incessantly committed to helping his shareholders. He’s been evangelical about lowering expenses whenever conditions permit and his shareholder communications are singularly clear and thoughtful. He believes that emerging market economies are characterized by unreliable capital markets; that is, firms cannot count on being able to raise capital quickly and efficiently when they need it. As a result, one of his strong preferences is for firms that generate sufficient free cash flow to cover their capital needs internally.

The fund has had strong returns and muted volatility, relative to its EM peers. Morningstar recognizes it as a Bronze medalist with a five-star rating. The Observer has repeatedly profiled the fund, most recently in 2015. Additional resources about the fund are on Seafarer’s Featured Fund page. The indefatigable Ted, Linkster and senior member of our discussion board, also points folks to Chuck Jaffe’s August 2016 interview with Mr. Foster.

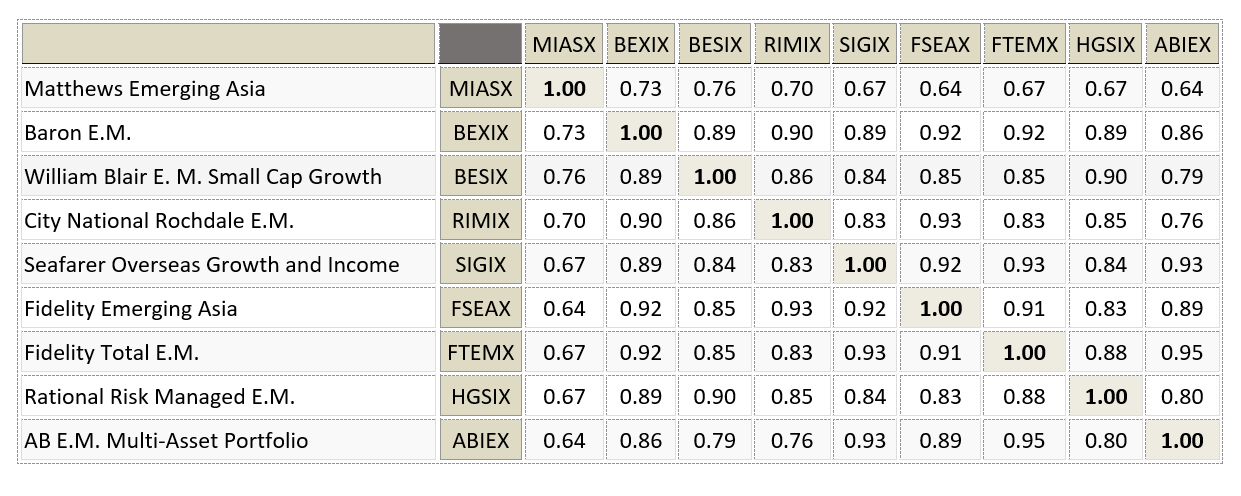

For those asking “if not Seafarer, who?” I used at the multi-search tool at MFO Premium to generate a list of the E.M. funds with the highest Sharpe ratios, a measure of risk-adjusted returns, over the past three years. Seafarer was fifth on that list. We then used our new fund correlation matrix generator to look at the relationship between the different top-ranked funds.

The list below excludes one fund, a China-India index, because it struck us as too narrow and quirky to offer a meaningful comparison. In each case the results are for the fund’s oldest share class, which often means the Institutional share class.

A couple things stand out:

- The funds with the highest and lowest correlations to Seafarer are both “Emerging Asia” funds, Fidelity and Matthews, respectively.

- Seafarer acts rather more like a “balanced” fund than most, that’s reflected in its high correlation with the EM balanced funds from Fidelity and Alliance Bernstein (AB). We’ve argued before that more EM equity investors should look closely at the option of balanced or hedged EM exposure.

With regard to the list in general:

- The William Blair fund is also closed to new investors

- The City National Rochdale fund is a bit pricey (1.61%) and a bit tough to access; Scottrade, for example, has it as a transaction-fee only fund.

- The AllianceBernstein and Rational Risk (formerly Huntington) funds carry sales loads

- Baron E.M., managed by Michael Kass, has about $2.3 billion in assets and charges about 30 basis points more than does Seafarer. It is, otherwise, a very solid fund with a very experienced manager.

I don’t want to complicate Mr. Foster’s task by encouraging inappropriate inflows, neither “hot money” nor folks who don’t understand what he’s up to and what they’d be investing in. That said, he’s given potential investors the gift of a month’s time to consider their options. I’d use it.