Objective and strategy

The fund seeks “above-average” long-term capital appreciation by investing in 40-45 small cap stocks. For their purposes, “small caps” have a market capitalization under $3.4 billion at the time of purchase. The manager is authorized to invest up to 25% of the portfolio in foreign stocks and to invest, without limit, in convertible securities (but he plans to do neither). Across all their portfolios, Mairs & Power invests in “carefully selected, quality growth stocks” purchased “at reasonable valuation levels.”

Adviser

Mairs & Power, Inc. Mairs and Power, headquartered in Minneapolis and chartered in 1931, manages approximately $8.5 billion in assets. The firm provides investment services to individuals, employee benefit plans, endowments, foundations and over 50,000 accounts in three no-load mutual funds (Growth, Balanced and Small Cap).

Manager

Andrew Adams and Allen Steinkopf. Mr. Adams joined Mairs & Power in 2006 and has managed Small Cap from its inception. From August 2004 to March 2007, he helped manage Nuveen Small Cap Select (EMGRX). Before that he was the co-manager of the large cap growth portfolio at Knelman Asset Management Group in Minneapolis. Mr. Steinkopf joined Mairs & Power in 2013 after co-managing Nuveen Small Cap Select for 10 years. He was appointed as co-manager on this fund in 2015.

Allen D. Steinkopf has passed away at the age of 61. Otherwise it’s a three-person team: Andrew R. Adams, Christopher D. Strom, and Michael C. Marzolf.

Strategy capacity and closure

The fund will close to new investors on September 30, 2016.

Management’s stake in the fund

The fund was launched with $2 million in seed money that Mr. Adams garnered by, as he put it, “passing the hat” at a staff meeting. Insiders continue to have substantial financial commitments to the fund. Mr. Adams has between $500,000 – $1,000,000 invested in the fund. Mr. Steinkopf has between $10,000 – 50,000. Each of the fund’s six trustees has over $100,000 invested in it.

Opening date

August 11, 2011.

Minimum investment

$2500, reduced to $1000 for various tax-sheltered accounts.

Expense ratio

0.92% on assets of $345.2 million, as of July 17, 2023.

Comments

We underestimated Mairs & Power Small Cap. Shortly after launch we warned investors, “If you’re looking for excitement, look elsewhere. If you want the next small cap star, go away. It’s not here.” Based on Mairs & Power’s discipline, manifested in two other funds, we suggested “Small Cap will, almost certainly, grow into a solidly above-average performer that lags a bit in frothy markets, leads in soft ones and avoids making silly mistakes.”

It has been all that and more.

There is a rare degree of unanimity surrounding Mairs & Power Small Cap. Morningstar’s analysts recognize it as a Silver medalist and its rating system gives it five stars. Lipper designates it as a Lipper Lead for both total return and consistency of returns. The Observer endorsed it at launch and it has earned the Great Owl designation for its consistent outperformance.

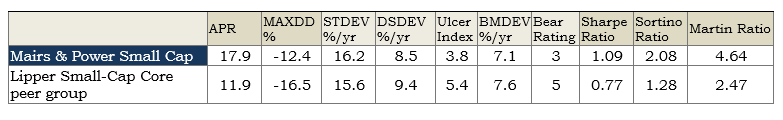

A quick review of its performance from inception through July 2016 substantiates the case:

Here’s how to read that table: since August 2011, Small Cap has generated 6% greater annual returns that its Lipper peers while exposing shareholders to less risk. Its maximum drawdown was significantly smaller, its downside volatility was lower, its performance in bear market months was better and the length and magnitude of its losses (which is what the Ulcer Index measures) was less. It follows then that all of the measures of risk-adjusted returns (the Sharpe, Sortino and Martin ratios) are higher. It’s particularly noteworthy that the measures which are most sensitive to downside risk (Sortino and Martin) show greater advantage than does the standard Sharpe ratio.

Here’s how to read that table: since August 2011, Small Cap has generated 6% greater annual returns that its Lipper peers while exposing shareholders to less risk. Its maximum drawdown was significantly smaller, its downside volatility was lower, its performance in bear market months was better and the length and magnitude of its losses (which is what the Ulcer Index measures) was less. It follows then that all of the measures of risk-adjusted returns (the Sharpe, Sortino and Martin ratios) are higher. It’s particularly noteworthy that the measures which are most sensitive to downside risk (Sortino and Martin) show greater advantage than does the standard Sharpe ratio.

Three factors contribute to that strong showing:

- They like buying good quality, but they’re not willing to overpay.

- They like buying what they know best. About 90% of the Small Cap portfolio are companies based in the upper Midwest, 50% in the State of Minnesota alone. They are unapologetic about their affinity for Midwestern firms: “we believe there are an unusually large number of attractive companies in this region that we have been following for many years. While the Funds have a national charter, their success is largely due to our focused, regional approach.”

- And once they’ve bought, they keep it. Turnover over the past five years has averaged 17%, far below the 63% typical of small cap funds. That’s consistent with the record at Growth (10%) and Balanced (16%, with most of their bonds held all the way to maturity).

Messrs. Adams and Steinkopf embody the corporate ethos: they are looking for consistent performers, won’t sacrifice quality to get growth and won’t let “investment decisions [be] based on day-to-day news,” whether Brexit, Yellen or elections.

Bottom Line

There are few investment firms with this combination of quiet focus and discipline. Much was made of the fact that this is Mairs and Power’s first new fund in 50 years. Less has been said about the fact that this fund had been under consideration for more than five years before they felt comfortable launching it. This is not a firm that rushes into anything. While I wouldn’t normally suggest that investors rush into anything, the fund’s imminent closure means that folks considering the future of their small cap exposure need to move it to the top of their due diligence agenda.

Fans of passive investing might benchmark the fund against iShares Core S&P Small-Cap ETF (IJR), over which Mairs & Power maintains a small but consistent advantage in risk-adjusted performance.