The latest vogue in higher education, an industry rife with voguishness, is stackable certificates. Stackable certificates are academic credentials certifying your ability to complete some specific task. Some of the certifications (Craft Brewing) seem modestly more concrete than others (Dream Tending). Since they’re relatively easy to obtain in relatively short periods, students can accumulate a bunch of them while still earning a conventional degree. That’s the “stackable” part.

In order to shore up the Observer’s finances, we’ve decided to capitalize on the trend and launch our new Certificate in E.T.F. Punditry program. In order to become a certified ETFP, you need to be able to demonstrate your ability to execute seven specific tasks. They are:

- Befriend irrelevant numbers

Remember that only a small percentage of active managers beat “the market” over a five-year period. That fact that “beating the market” is irrelevant gamesmanship, unrelated to an investor’s ultimate goals, shouldn’t bother you. Likewise, the fact that every index fund trails the market every year needn’t come up.

- Report on arbitrary periods

Quick question: why does anyone care about five-year performance? Is it because we’re investing for goals in five-year increment, rather like the old Soviet five-year plans? Or perhaps because “five years” captures some meaningful rhythm in the life of the stock market?

Quick answer: nope. Investors need far longer time frames and stock market cycles are more typically seven to nine year affairs. Actually, we focus on five year increments only because we have five fingers; if we had six fingers, the most natural period in the world would be six years.

If you can combine irrelevant numbers with arbitrary periods, you get extra credit: “only 7.33% of domestic equity funds that were in the top quartile of performance in March 2014 were still there two years later” (“Why you should steer clear of actively-managed funds,” Reuters, 8/25/2016).

- Quote only true believers

Larry Swedroe is a quotable favorite, but it’s always good to check in with index providers (the folks at S&P Dow Jones Indices get quoted a lot), ETF sponsors and ETF-dependent websites. Try to avoid Jack Bogle at all costs. Console yourself with the thought that declarations like “ETFs have become the new way to speculate … There’s a lot of junk out there” (“Bogle: Trump is wrong, ETFs are bogus and foreign investing is useless,” 10/16/2015) are just the ramblings of an elderly gentleman who long since lost his way. Or you could join the chorus of true believers who denounced his comments as “confused,” “misplaced,” “self-serving” and “utter nonsense.” (“John Bogle’s stance on ETFs branded ‘utter nonsense’” Financial Times, 3/22/2015).

You will lose certificate points if you snicker when you quote an unnamed ETF industry insider denouncing other people’s statements as “self-serving.”

- Avoid uncomfortable questions with no easy answers

Exchange traded funds are designed to be traded. But we know that trading is the enemy of all investors; professional or amateur, the more you trade, the more you lose. The fact that the average holding period for the S&P 500 EFT is 41 days (and the S&P 500 index fund is closer to 41 months), shouldn’t worry you. After all, regular people aren’t trading their ETF shares, right? All of that trading volume is made up of bad people trading a thousand times a second. All the good people bought a trading vehicle without ever intending to trade it.

- Don’t confuse yourself

Professorial pointy-heads spend excessive time asking confusing questions, like “how do we best assess the risk required to achieve those rewards?” That leads them to long boring formulas and dry boring statistics like Sharpe ratios, Information ratios, Sortino Ratios, Martin Ratios, Ulcer Indexes and probably Radio Ratios. If you try to sort that out your head will hurt and you’ll find yourself looking at unpleasant numbers.

For example, ETFs reign supreme in the domestic large-cap core space, right? Home of the S&P 500. Highly efficient. No chance for puny humans. Unless, of course, you ask confusing questions like “over the past full market cycle (bad! Market cycles are meaningful periods that encompass the combined rhythm of a bull and a bear phase. Avoid talking about them), how many of the top ten large-cap core funds, defined as funds with the best risk-adjusted returns (bad! You’re getting dangerously close to numbers that might have meaning. Don’t do it.) are passive funds?”

Answer: none of the top ten funds are passive. Also none of the top 15 funds are passive. Only one of the top 20 funds. Apparently it’s a bad thing that when there’s a cliff ahead, cap-weighted index funds pretty much hit the gas and fly over the edge.

Ick! 95% of the best performing funds, using a meaningful measure over a meaningful period, are actively managed? That’s so confusing. Pretend it ain’t so and move on.

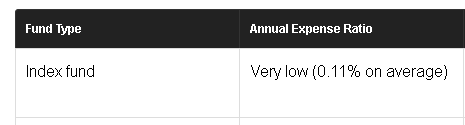

Likewise, on expenses, keep quoting magic numbers:

(“Index funds versus mutual funds,” Fool.com, 8/27/2016)

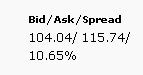

That’s a good number to quote. It would be confusing to mention that only 10 of 1300 index funds have expenses that low and are available to retail investors (that is, folks with under $10,000 to start with). Likewise pointing out that some index funds have expense ratios of 4.46% or that 120 index funds have expense ratios over 2% just muddles things. Trading commissions: muddle. The occasional freakish bid/ask spread: muddle.

- Keep it one-sided

For example, when mutual funds are liquidated, point out “the high ‘death rate’ among poorly performing active funds.” ETFs are liquidated, as illustrated by August’s partial toll:

AccuShares Spot CBOE VIX Up (VXUP)

AccuShares Spot CBOE VIX Down (VXDN)

AccuShares S&P GSCI Crude Oil Excess Return Down (OILD)

AccuShares S&P GSCI Crude Oil Excess Return Up (OILU)

SPDR MSCI EM Beyond BRIC ETF (NYSE: EMBB)

SPDR S&P BRIC 40 (ETF) (NYSE: BIK)

SPDR MSCI EM 50 ETF (SPDR Index Shares Fund) (NYSE: EMFT)

SPDR BofA Merrill Lynch EM Corp. Bond ETF (SPDR Series Trust (NYSE: EMCD)

SPDR Russell Nomura PRIME Japan (ETF) (NYSE: JPP)

SPDR Russell Nomura Small Cap Japan(ETF) (NYSE: JSC).

SPDR Barclays International High Yield Bond ETF (NYSE: IJNK)

SPDR S&P International Mid Cap (ETF) (NYSE: MDD).

SPDR Nuveen Barclays Build America (NYSE: BABS),

SPDR Nuveen Barclays Calif Muni Bond (NYSE: CXA)

SPDR Nuveen Barclays NY Muni Bond (NYSE: INY).

SPDR S&P BRIC 40 ETF

SPDR MSCI EM 50 ETF

SPDR SSGA Risk Aware ETF

WisdomTree Coal Fund (TONS)

WisdomTree Global ex-U.S. Utilities Fund (DBU)

WisdomTree Global Natural Resources Fund (GNAT)

WisdomTree Commodity Currency Strategy Fund (CCX)

WisdomTree Commodity Country Equity Fund (CCXE)

WisdomTree Japan Interest Rate Strategy Fund (JGBB)Studiously ignore it. Certainly avoid reference to the nearly 500 moribund ETFs on this month’s ETF Deathwatch. After all, some might misinterpret having a third of all ETFs in parlous shape as being a bad thing. So hush! Better yet, celebrate it as a sign of virtue: “But don’t panic. This isn’t a sign that the ETF industry is in trouble. Rather like any business, companies need to periodically cull the herd of under-performing product to make room for new ventures.” (“Oops There Goes Another ETF,” 8/26/2016).

- Go for the big finish!

“It’s another nail in the coffin of actively-managed funds.” “They’re dinosaurs.” “50% of them won’t be here in five years.” And as you write those things, try desperately to block out the fact that you’re making a living in an industry that’s imploding. Better to make pronouncements on others than to look too closely around your own space.

Remember: your job is to studiously simplify a complicated story. Don’t ask whether both sorts of investments might make sense as complements. Don’t ask whether metrics like “holding period” are more meaningful than portfolio returns. Don’t ask why almost no one studies the portfolio-level effects of using trading products; well, almost no one: the only study on the question looked at German investors and found that ETF-based portfolios, when controlled by asset allocation, consistently underperformed fund-based portfolios because those silly Germans used their trading vehicles to, well, trade.

And, in the end, you’ll be certifiably clickable.