Reports of the death of the money market fund (“MMF”) are greatly exaggerated. Seven years of financial repression and 7-day yields you can only spot under a microscope have made surprisingly little dent in the popularity of MMF’s. According to data from the Investment Company Institute, MMF flows have been flat the past few years. The share of corporate short term assets deposited in MMFs has remained steady.

However, new regulations will be implemented this October, forcing MMFs holding anything other than government instruments to adopt a floating Net Asset Value. These restrictions will also allow fund managers to put up gates during periods of heavy outflows.

MMFs were foundational to the success of firms like Fidelity, but today they appear to be marginally profitable for most sponsors. Of note, Fidelity is taking advantage of the regulatory change to move client assets from less remunerative municipal MMFs to government money market funds carrying higher fees (management fees net of waived amounts.)

While MMFs offer liquidity and convenience, the looming changes may give investors and advisors an impetus to redeploy their assets. In a choppy market, are there safe places to park cash? A popular strategy over the past year has been high-dividend / low-volatility funds. We discussed this in March edition of MFO. This strategy has been in vogue recently but with a beta of 0.7 it still has significant exposure to market corrections.

Short Duration Funds: Investors who wish to pocket some extra yield with a lower risk profile have a number of mutual fund and ETF options. This month we highlight fixed income portfolios with durations of 4.3 years or under.

We count roughly 300 funds with short or ultraShort Duration from approximately 125 managers. Combined assets exceed 500 billion dollars. Approximately one quarter of those are tax-exempt. For investors willing to risk a little more duration, illiquidity, credit exposure, or global exposure there are roughly 1500 funds monitored by Trapezoid.

Duration is a measure of the effective average life of the portfolio. Estimates are computed by managers and reported either on Morningstar.com or on the manager’s website. There is some discretion in measuring duration, especially for instruments subject to prepayment. While duration is a useful way to segment the universe, it is not the only factor which determines a fund’s volatility.

Reallocating from a MMF to a Short Duration fund entails cost. Expenses average 49 basis points for Short Term funds compared with 13 basis points for the average MMF. Returns usually justify those added costs. But how should investors weigh the added risk. How should investors distinguish among strategies and track records? How helpful is diversification?

To answer these questions, we applied two computer models, one to measure skill and another to select an optimal portfolio.

We have discussed in these pages Trapezoid’s Orthogonal Attribution Engine which measures skill of actively managed equity portfolio managers. MFO readers can learn more and register for a demo at www.fundattribution.com. Our fixed income attribution model is a streamlined adaptation of that model and has some important differences. Among them, the model does not incorporate the forward looking probabilistic analysis of our equity model. Readers who want to learn more are invited to visit our methodology page. The fixed income model is relatively new and will evolve over time.

We narrowed the universe of 1500 funds to exclude not only unskilled managers but fund classes with AUM too small, duration too long, tenure too short (<3 years), or expenses too great (skill had to exceed expenses, adjusted for loads, by roughly 1%). We generally assumed investors could meet institutional thresholds and are not tax sensitive. For a variety of reasons, our model portfolio might not be right for every investor and should not be construed as investment advice.

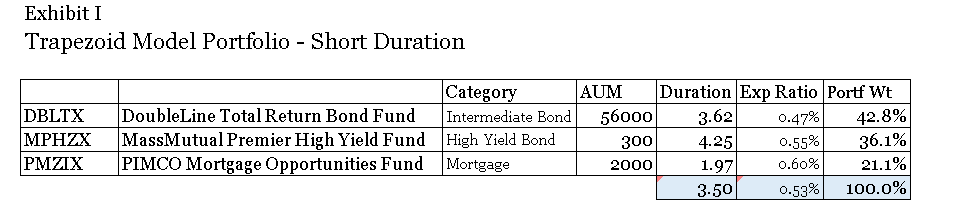

DoubleLine Total Return Bond (DBLTX), MassMutual Premier High Yield Fund (MPHZX), and PIMCO Mortgage Opportunities Fund (PMZIX) all receive full marks from Morningstar and Lipper (except in the area of tax efficiency.) Diversifying among credit classes and durations is a benefit – but the model suggests these three funds are all you need.

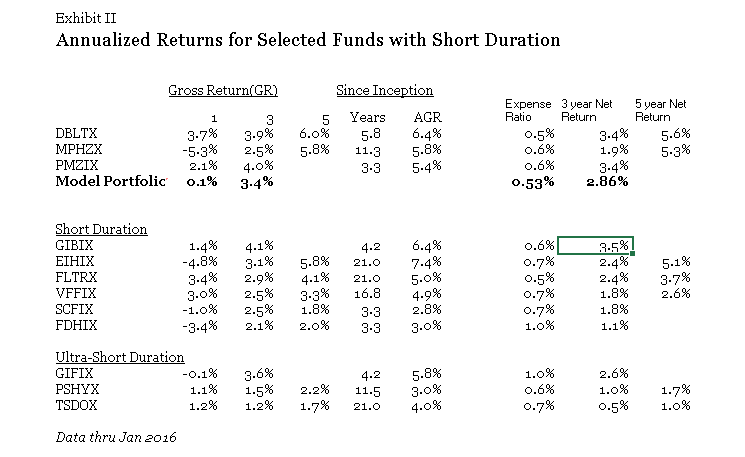

Honorable Mentions: The model finds Guggenheim Total Return Bond Fund (GIBIX) is a good substitute for DBLTX and Shenkman Short Duration High Income Fund (SCFIX) is a serviceable substitute for MPHZX. We ran some permutations in which other funds received allocations. These included: Victory INCORE Fund for Income (VFFIX), Nuveen Limited term Municipal Bond (FLTRX), First Trust Short Duration High Income Fund (FDHIX), Guggenheim Floating Rate Strategies (GIFIX), and Eaton Vance High Income Opportunities Fund (EIHIX).

The Trapezoid Model Portfolio generated positive returns over a 12 and 36-month time frame. (Our data runs through January 2016.) The PIMCO Mortgage fund wasn’t around 5 years ago, but it looks like the five-year yield would have been close to 6%.

The portfolio has an expense ratio of 53 basis points. Our algorithms reflect Trapezoid’s skeptical attitude to high cost managers. There are alternative funds in the same asset classes with expense ratios of 25 basis points of better. But superb performance more than justifies the added costs. Our analysis suggests the rationale for passive managers like Vanguard is much weaker in this space than in equities. However, investors in the retail classes may see higher expenses and loads which could change the analysis.

No Return Without Risk: How much risk are we taking to get this extra return? The duration of this portfolio is just under 3.5 years. There is some corporate credit risk: MPHZX sustained a loss in the twelve months ending January. It is mostly invested in BB and B rated corporate bonds. To do well the fund needs to keep credit loss under 3%/yr. Although energy exposure is light, we see dicey credits including Valeant, Citgo, and second lien term loans. The market rarely gives away big yields without attaching strings.

The duration of this portfolio hurt returns over the past year. What advice can we give to investors unable to take 3.5 years of duration risk? We haven’t yet run a model but we have a few suggestions.

- For investors who can tolerate corporate credit risk, Guggenheim Floating Rate Strategies (GIFIX) did very well over the past 5 years and weathered last year with only a slight loss.

- A former fixed income portfolio manager who now advises clients at Merrill Lynch champions Pioneer Short Term Income Fund (PSHYX). Five-year net return is only 2.2%, but the fund has a duration of only 0.7 years and steers clear of corporate credit risk.

- A broker at Fidelity suggested Touchstone UltraShort Duration Fixed Income Fund (TSDOX) which has reasonable fees and no load.

Short Duration funds took a hit during the subprime crisis. At the trough bond fund indices were down 7 to 10% from peak, depending on duration. Funds with concentrations in corporate credit and mortgage paper were down harder while funds like VFFIX which stuck to government or municipal bonds held up best. MassMutual High Yield was around during that period and fell 21% (before recovering over the next 9 months.) The other two funds were not yet incepted; judging from comparable funds the price decline during the crisis was in the mid-single digits. Our model portfolio is set up to earn 2.5% to 3% when rates and credit losses are stable. Considering that their alternative is to earn nothing, investors deploying cash in Short Duration funds appear well compensated, even weighing the risk of a once-in-a-generation 10% drawdown.

Bottom Line: The impact of new money market fund regulations is not clear. Investors with big cash holdings have good alternatives. Expenses matter but there is a strong rationale for selecting active managers with good records, even when costs are above average. Investors get paid to take risk but must understand their exposure and downside. A moderate amount of diversification among asset classes seems to be beneficial. Our model portfolio is a good starting point but should be tailored to the needs of particular investors.