Originally published in February 1, 2016 Commentary

David invariably cuts to the chase when it comes to assessing mutual funds. It’s a gift he shares with us each month.

So, in evolving the MFO Premium site, he suggested we provide lists of funds satisfying interesting screening criteria to help users get the most from our search tools.

Last month we introduced two such lists: “Best Performing Rookie Funds” and “Dual Great Owl & Honor Roll Funds.”

This month our MultiSearch screener incorporates three more: “Smallest Drawdown Fixed Income Funds,” “Shortest Recovery Time Small Caps,” and “Lowest Ulcer Moderate Allocation Funds.”

Smallest Drawdown Fixed Income Funds generates a list of Fixed Income (e.g., Bond, Muni) funds that have experienced the smallest levels of Maximum Drawdown (MAXDD) in their respective categories. More specifically, they are in the quintile of funds with smallest MAXDD among their peers.

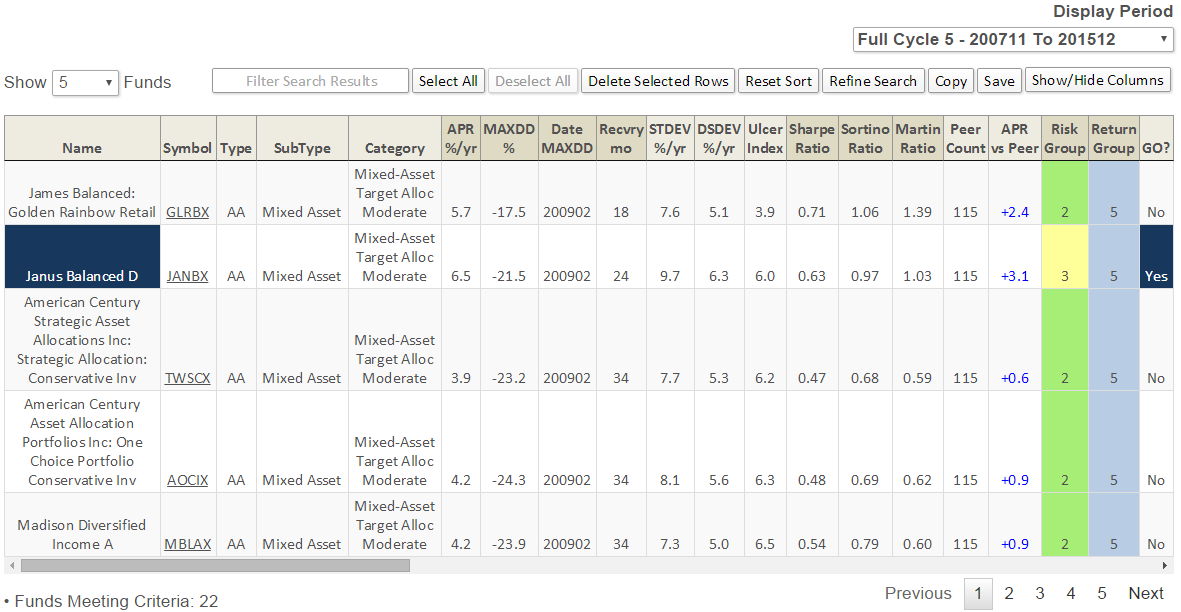

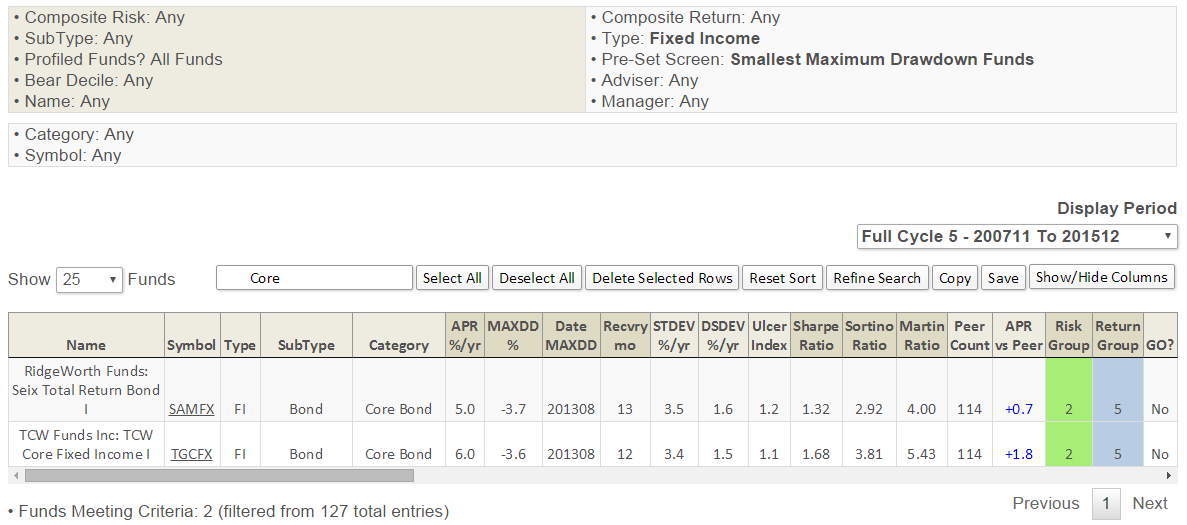

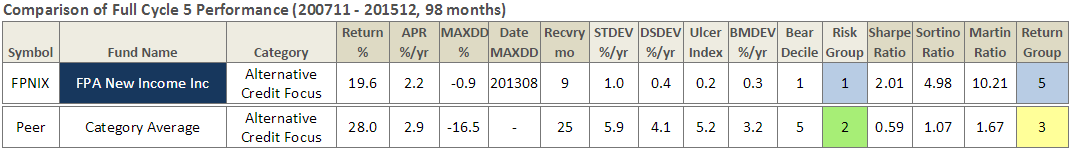

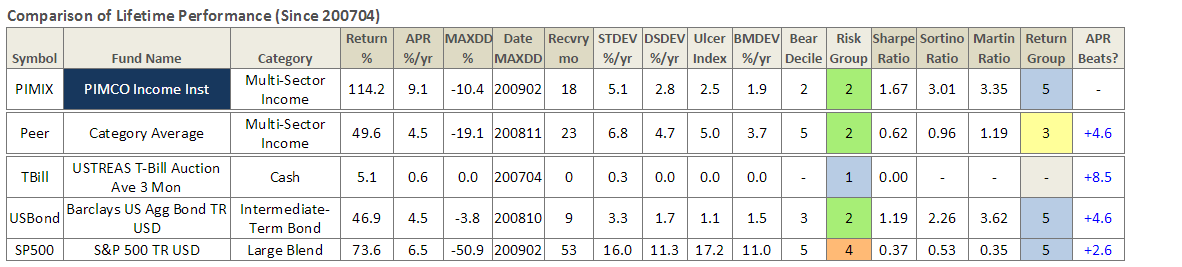

Looking back at performance since the November 2007, which represents the beginning of the current full market cycle, we find 147 such funds. Two top performing core bond funds are TCW Core Fixed-Income (TGCFX) and RidgeWorth Seix Total Return (SAMFX). The screen also uncovered notables like First Pacific Advisors’ FPA New Income (FPNIX) and Dan Ivascyn’s PIMCO Income (PIMIX).

Here are some risk/return metrics for these Fixed Income funds (click on images to enlarge):

TCW Core Fixed-Income (TGCFX) and RidgeWorth Seix Total Return (SAMFX)

First Pacific Advisors’ FPA New Income (FPNIX)

PIMCO Income (PIMIX)

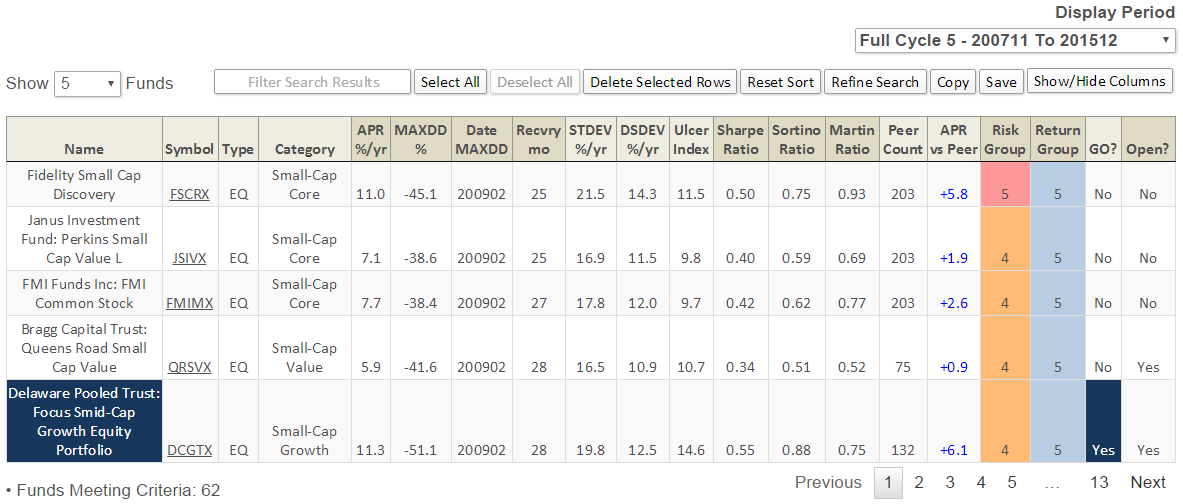

Shortest Recovery Time Small Caps generates a list of Small Cap (Small Core, Small Value, Small Growth) funds that have incurred shortest Recovery Times (number of months a fund retracts from previous peak) in their respective categories.

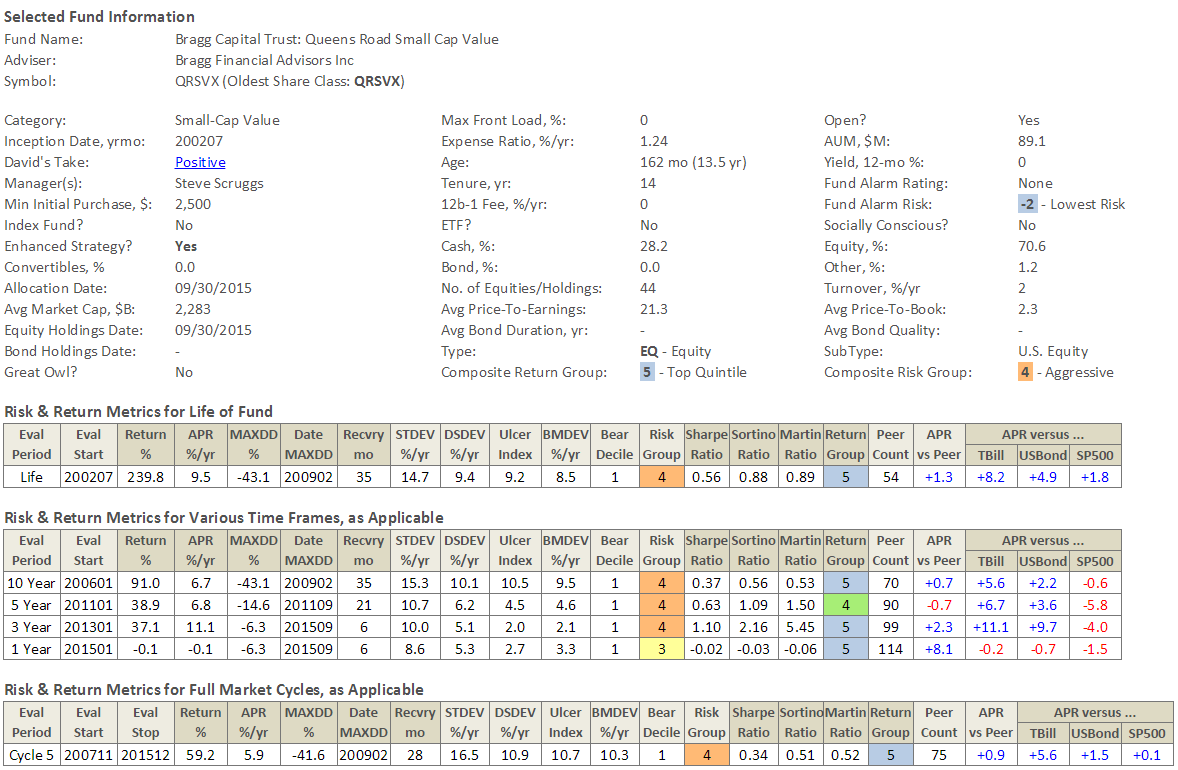

For Full Cycle 5, this screen produces 62 such funds through December 2015. Among the best performing funds with shortest Recovery Times, under 30 months, only one remains open and/or accessible: Queens Road Small Cap Value (QRSVX). It was profiled by David in April 2015.

Here’s a short list and risk/return numbers for QRSVX across various timeframes:

Queens Road Small Cap Value (QRSVX)

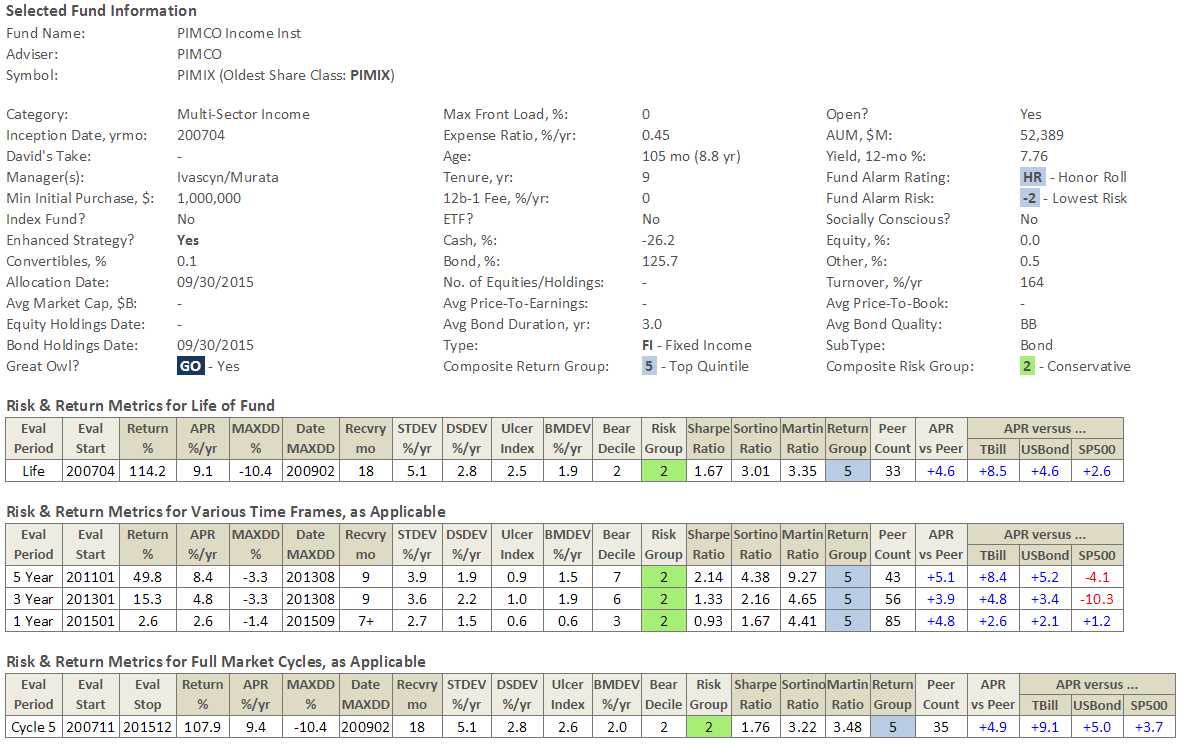

Lowest Ulcer Moderate Allocation Funds generates a list of Mixed Asset Moderate Allocation funds that have incurred the lowest Ulcer Indices in their respective categories.

Topping the list (fund with lowest UI) is James Balanced: Golden Rainbow (GLRBX), profiled last August :