Dear friends,

They’re baaaaaack!

My students came rushing back to campus and, so far as I can tell, triggered some sort of stock market rout upon arrival. I’m not sure how they did it, but I’ve learned not to underestimate their energy and manic good spirits.

They’re a bright bunch, diverse in my ways. While private colleges are often seen as bastion of privilege, Augustana was founded to help the children of immigrants make their way in a new land. Really that mission hasn’t much changed in the past 150 years: lots of first-generation college students, lots of students of color, lots of kids who shared the same high school experience. They weren’t the class presidents so much as the ones who quietly worked to make sure that things got done.

It’s a challenge to teach them, not because they don’t want to learn but because the gulf between us is so wide. By the time they were born, I was already a senior administrator and a full-blown fuddy duddy. But we’re working, as always we do, to learn from each other. Humility is essential, both a sense of humor and cookies help.

Your first and best stop-loss order

The week’s events have convinced us that you all need to learn how to execute a stop-loss order to protect yourself in times like these. A stop-loss order is an automatic, pre-established command which kicks in when markets gyrate and which works to minimize your losses. Generally they’re placed through your broker (“if shares of X fall below $12/share, sell half my holdings. If it falls below $10, liquidate the position”) but an Observer Stop Loss doesn’t require one. Here’s how it works:

- On any day in which the market falls by enough to make you go “sweet Jee Zus!”

- Step Away from the Media

- Put Down your Phone

- Unhand that Mouse

- And Do Nothing for seven days.

Well, more precisely, “do nothing with your portfolio.” You’re more than welcome to, you know, have breakfast, go to the bathroom, wonder what it’s going to take for anyone to catch the Cardinals, figure out what you’re going to do with that ridiculous pile of tomatoes and all that.

My Irish grandfather told me that the worst time to fix a leaky roof is in a storm. “You’ll be miserable, you might break your neck and you’ll surely make a hames of it.” (I knew what Gramps meant and didn’t get around to looking up the “hames” bit until decades later when I was listening to the thunder and staring at a growing damp spot in the ceiling.)

The financial media loves financial cataclysm to the same extent, and for the same reason, that The Weather Channel loves superstorms. It’s a great marketing tool for them. It strokes their egos (we are important!). And it drives ratings.

Really, did you think this vogue for naming winter storms came from the National Weather Service? No, no, no. “Winter Storm Juno” was straight from the marketing folks at TWC.

If CNBC’s ratings get any worse, I’m guessing that we’ll be subjected to Market Downturn Alan soon enough.

By and large, coverage of the market’s recent events has been relentlessly horrible. Let’s start with the obvious: if you invested $10,000 into a balanced portfolio on August 18, on Friday, August 28 you had $9,660.

That’s it. You dropped 3.4%.

(Don’t you feel silly now?)

The most frequently-invoked word in headlines? “Bloodbath.”

MarketWatch: What’s next after market’s biggest bloodbath of the year ? (Apparently they’re annual events.)

ZeroHedge: US Market Bouncing Back After Monday’s Bloodbath (hmm, maybe they’re weekly events?)

Business Insider: Six horrific stats about today’s market bloodbath. (“Oil hit its lowest level since March 2009.” The horror, the horror!)

ZeroHedge: Bloodbath: Emerging Market Assets Collapse. (Ummm … a $10,000 investment in an emerging markets balanced fund, FTEMX in this case, would have “collapsed” to $9872 over those two weeks.)

RussiaToday: It’s a Bloodbath. (Odd that this is the only context in which Russia Today is willing to apply that term.)

By Google’s count, rather more than 64,000 market bloodbaths in the media.

Those claims were complemented by a number of “yeah, it could get a lot worse” stories:

NewsMax: Yale’s Shiller, “Even bigger” plunge may follow.

Brett Arends: Dow 5,000? Yes, it could happen. (As might a civilization-ending asteroid strike or a Cubs’ World Series win.)

Those were bookended with celebratory but unsubstantiated claims (WSJ: U.S. stock swings don’t shake investors; Barry Ritholz: Mom and pop outsmart Wall Street pros) that “mom ‘n’ pop” stood firm.

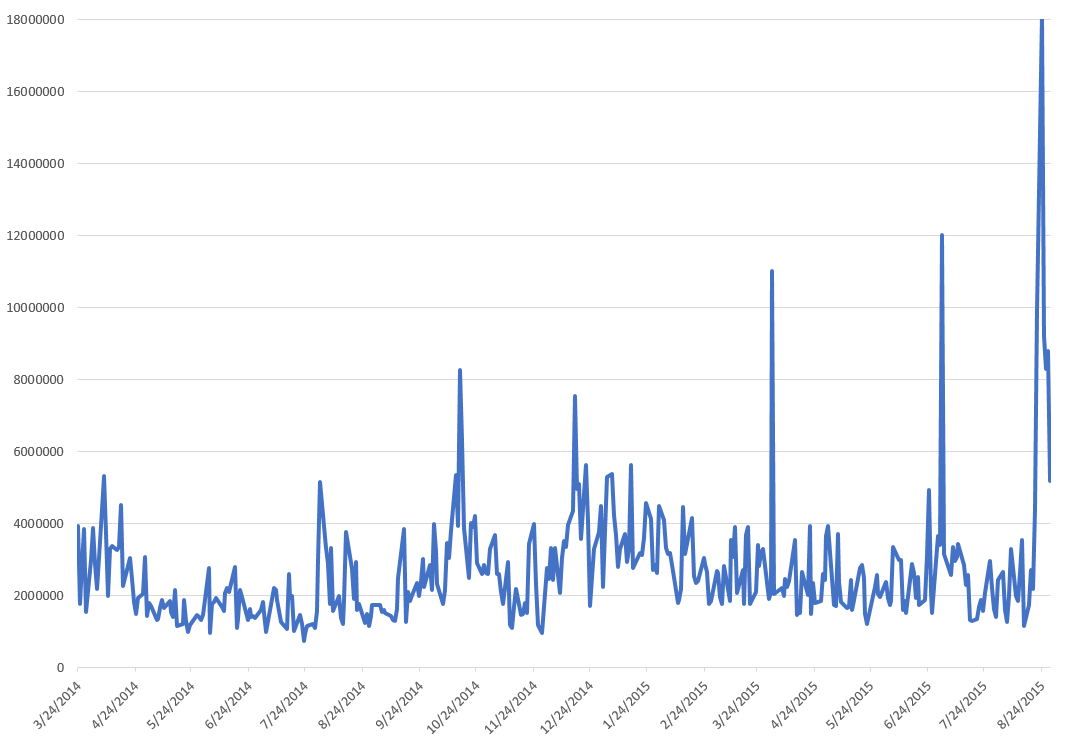

Bottom line: nothing you read in the media over the past couple weeks improved either your short- or long-term prospects. To the contrary, it might well have encouraged you (or your clients) to do something emotionally satisfying and financially idiotic. The markers of panic and idiocy abound: Vanguard had to do the “all hands on deck” drill in which portfolio managers and others are pulled in to manage the phone banks, Morningstar’s site repeatedly froze, the TD Ameritrade and Scottrade sites couldn’t execute customer orders, and prices of thousands of ETFs became unmoored from the prices of the securities they held. We were particularly struck by trading volume for Vanguard’s Total Stock Market ETF (VTI).

That’s a 600% rise from its average volume.

Two points:

- Winter is coming. Work on your roof now!

Some argue that a secular bear market started last week. (Some always say that.) Some serious people argue that a sharp jolt this year might well be prelude to a far larger disruption later next year. Optimists believe that we are on a steadily ascending path, although the road will be far more pitted than in recent memory.

Use the time you have now to plan for those developments. If you looked at your portfolio and thought “I didn’t know it could be this bad this fast,” it’s time to rethink.

Questions worth considering:

- Are you ready to give up Magical Thinking yet? Here’s the essence of Magical Thinking: “Eureka! I’ve found it! The fund that makes over 10% in the long-term and sidesteps turbulence in the short-term! And it’s mine. Mine! My Preciousssss!” Such a fund does not exist in the lands of Middle-Earth. Stop expecting your funds to act as if they do.

- Do you have more funds in your portfolio than you can explain? Did you look at your portfolio Monday and think, honestly puzzled, “what is that fund again?”

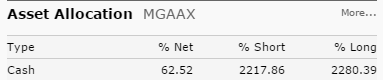

- Do you know whether traditional hybrid funds, liquid alt funds or a slug of low-volatility assets is working better as your risk damper? Folks with either a mordant sense of humor or stunted perspective declared last week that liquid alts funds “passed their first test with flying colors.” Often that translated to: “held up for one day while charging 2.75% for one year.”

- Have you allocated more to risky assets than you can comfortably handle? We’re written before about the tradeoffs embedded in a stock-light strategy where 70% of the upside for 50% of the downside begins to sound less like cowardice and more like an awfully sweet deal.

- Are you willing to believe that the structure of the fixed income market will allow your bond funds to deliver predictable total returns (current income plus appreciation) over the next five to seven years? If critics are right, a combination of structural changes in the fixed-income markets brought on by financial reforms and rising interest rates might make traditional investment-grade bond funds a surprisingly volatile option.

If your answer is something like “I dunno,” then your answer is also something like “I’m setting myself up to fail.” We’ll try to help, but you really do need to set aside some time to plan (goals –> resources –> strategies –>tactics) with another grown-up. Bring black coffee if you’re Lutheran, Scotch if you aren’t.

- If you place your ear tightly against the side of any ETF, you’re likely to hear ticking.

My prejudices are clear and I’ll repeat them here. I think ETFs are the worst financial innovation since the Ponzi scheme. They are trading vehicles, not investment vehicles. The Vanguard Total Stock Market ETF has no advantage over the Vanguard Total Stock Market Index fund (the tiny expense gap is consumed in trading costs) except that it can be easily and frequently traded. The little empirical research available documents the inevitable: when given a trading vehicle, investors trade. And (the vast majority of) traders lose.

Beyond that, ETFs cause markets to move in lockstep: all securities in an ETF – the rock solid and the failing, the undervalued and the overpriced – are rewarded equally when investors purchase the fund. If people like small cap Japanese stocks, they bid up the price of good stocks and bad, cheap and dear, which distorts the ability of vigilantes to enforce some sort of discipline.

And, as Monday demonstrates, ETFs can fail spectacularly in a crisis because the need for instant pricing is inconsistent with the demands of rational pricing. Many ETFs, CEFs and some stocks opened Monday with 20-30% losses, couldn’t coordinate buyers and sellers fast enough and that caused a computer-spawned downward price spiral. Josh Brown makes the argument passionately in his essay “Computers are the new dumb money” and followed it up with the perhaps jubilant report that some of the “quants I know told me the link was hitting their inboxes all day from friends and colleagues around the industry. A few desk traders I talk to had some anecdotes backing my assumptions up. One guy, a ‘data scientist’, was furiously angry, meaning he probably blew himself up this week.”

As Chris Dietrich concludes in his August 29 Barron’s article, “Market Plunge Provides Harsh Lessons for ETF Investors”

For long-term investors unsure of their trading chops, or if uncertainty reigns, mutual funds might be better options. Mutual fund investors hand over their money and let the fund company do the trading. The difference is that you get the end-of-day price; the price of an ETF depends on when you sold or bought it during the trading day. “There are benefits of ETFs, including transparency and tax efficiency, but those come at a cost, which is that is you must be willing to trade,” says Dave Nadig, director of ETFs at FactSet Research Systems. “If you don’t want to be trading, you should not be using ETFs.”

The week’s best

Jack Bogle, Buddhist. Jack Bogle: “I’ve seen turbulence in the market. This is not real turbulence. Don’t do something. Just stand there.” (Thanks for johnN for the link.) Vanguard subsequently announced, “The Inaction Plan.”

All sound and fury, signifying nothing. Jason Zweig: “The louder and more forcefully a market pundit voices his certainty about what is going to happen next, the more likely it is that he will turn out to be wrong.”

Profiting from others’ insanity

Anyone looking at the Monday, 8/24, opening price for, say, General Electric – down 30% within the first few seconds – had to think (a) that’s insanity and (b) hmmm, wonder if there’s a way to profit from it? It turns out that the price of a number of vehicles – stocks, a thousand ETFs and many closed-end funds – became temporarily unmoored from reality. The owners of many ETFs, for example, were willing to sell $10 worth of stock for $7, just to get rid of it.

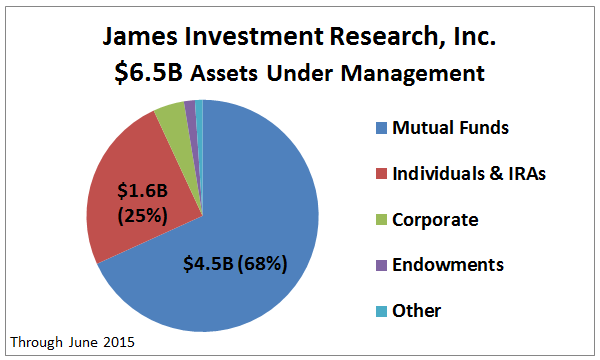

The folks at RiverNorth are experts at arbitraging such insanity. They track the historical discounts of closed-end funds; if a fund becomes temporarily unmoored, they’ll consider buying shares of it. Why? Because when the panic subsides, that 30% discount might contract by two-thirds. RiverNorth’s shareholders have the opportunity to gain from that arbitrage, whether or not the general direction of the stock market is up or down.

I spoke with Steve O’Neill, one of RiverNorth’s portfolio managers, about the extent of the market panic. Contrary to the popular stories about cool-headed investors, Steve described them as “vomiting up assets” at a level he hadn’t seen since the depth of the financial meltdown when the stability of the entire banking sector was in question.

In 2014, RiverNorth reopened their flagship RiverNorth Core Opportunity (RNCOX) fund after a three-year closure. We’ll renew our profile of this one-of-a-kind product in our October issue. In the meanwhile, interested parties really should …

RiverNorth is hosting a live webcast with Q&A on September 17, 2015 at 3:15pm CT / 4:15pm ET. Their hosts will be Patrick Galley, CIO, Portfolio Manager, and Allen Webb, Portfolio Specialist. Visit www.rivernorth.com/events to register.

Update: Finding a family’s first fund

In August, we published a short guide to finding a family first fund. We started with the premise that lots of younger (and many not-so-younger) folks were torn between the knowledge that they should do something and the fear that they were going to screw it up. To help them out, we talked about what to look for in a first fund and proposed three funds that met our criteria: solid long term prospects, a risk-conscious approach, a low minimum initial investment and reasonable expenses.

In August, we published a short guide to finding a family first fund. We started with the premise that lots of younger (and many not-so-younger) folks were torn between the knowledge that they should do something and the fear that they were going to screw it up. To help them out, we talked about what to look for in a first fund and proposed three funds that met our criteria: solid long term prospects, a risk-conscious approach, a low minimum initial investment and reasonable expenses.

How did the trio do in August? Not bad.

|

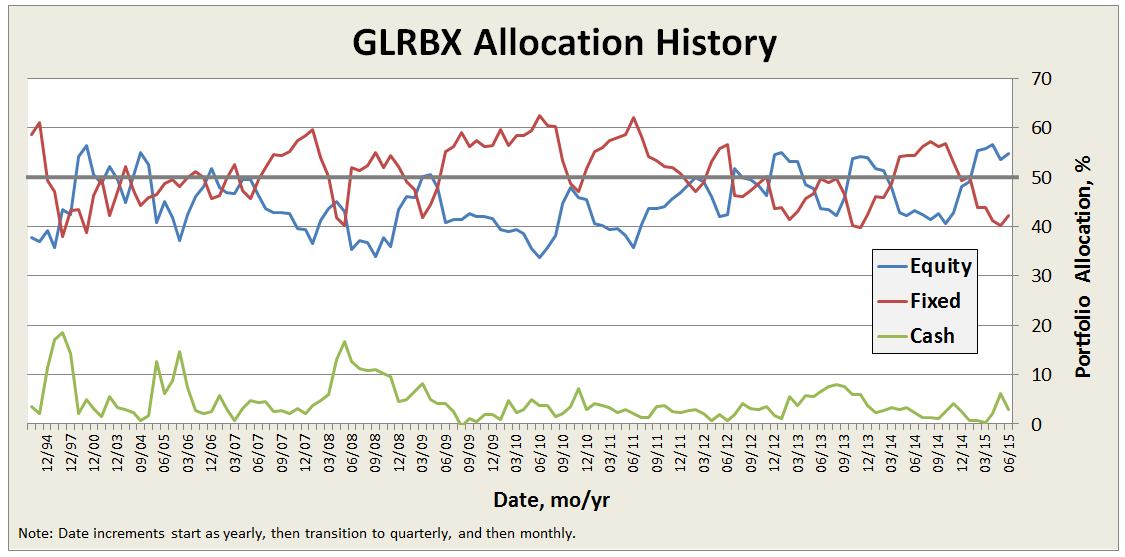

James Balanced: Golden Rainbow GLRBX |

-1.9% |

A bit better than its conservative peers; so far in 2015, it beats 83% of its peers. |

|

TIAA-CREF Lifestyle Conservative TSCLX |

– 2.3% |

A bit worse than its conservative peers; so far in 2015, it beats 98% of its peers. |

|

Vanguard STAR VGSTX |

– 3.1% |

A bit better than its moderate peers; so far in 2015, it beats about 75% of its peers. |

Several readers wrote to commend Manning & Napier Pro-Blend Conservative (EXDAX) as a great “first fund” candidate as well. We entirely agree. Unlike TIAA-CREF and Vanguard, it invests in individual securities rather than other funds. Like them, however, it has a team-managed approach that reduces the risk of a fund going awry if a single person leaves. It has a splendid 20 year record. We’ve added it to our original guide and have written a profile of the fund, which you can get to below in our Fund Profiles section.

We Are Where We Are, Or, If The Dog Didn’t Stop To Crap, He Would Have Caught The Rabbit

We Are Where We Are, Or, If The Dog Didn’t Stop To Crap, He Would Have Caught The Rabbit

“I prefer the company of peasants because they have not been educated sufficiently to reason incorrectly.”

Michel de Montaigne

At this point in time, rather than focus on the “if only” questions that tend to freeze people in their tracks in these periods of market volatility, I think we should consider what is important. For most of us, indeed, the vast majority of us, the world did not end in August and it is unlikely to end in September. Indeed, for most Americans and therefore by definition most of us, the vagaries of the stock market are not that important.

What then is important? A Chicago Tribune columnist, Mary Schmich, recently interviewed Edward Stuart, an economics professor at Northeastern Illinois University as a follow-up to his appearance on a panel on Chicago Public Television’s “Chicago Tonight” show. Stuart had pointed out that the ownership of stock (and by implication, mutual funds) in the United States is quite unequal. He noted that while the stock market has done very well in recent years, the standard of living of the average American citizen has not done as well. Stuart thinks that the real median income for a household size of four is about $40,000 …. and that number has not changed since the late 70’s. My spin on this is rather simple – the move up the economic ladder that we used to see for various demographic groups – has stopped.

If you think about it, the evidence is before us. How many of us have friends whose children went to college, got their degrees, and returned home to live with their parents while they hunted for a job in their chosen field, which they often could not find? When one drives around city and suburban streets, how many vacancies do we see in commercial properties? How many middle class families that used to bootstrap themselves up by investing in and owning apartment buildings or strip malls don’t now? What is needed is a growing economy that offers real job prospects that pay real wages. Stuart also pointed out that student debt is one of the few kinds of debt that one cannot expunge with bankruptcy.

As I read that piece of Ms. Schmick’s and reflected on it, I was reminded of another column I had read a few months back that talked about where we had gone off the rails collectively. The piece was entitled “Battle for the Boardroom” by Joe Nocera and was in the NY Times on May 9, 2015. Nocera was discussing the concept of “activist investors” and “shareholder value” specifically as it pertained to Nelson Peltz, Trian Investments, and a proxy fight with the management and board of DuPont. And Nocera pointed out that Trian, by all accounts, had a good record and was often a constructive force once it got a board seat or two.

Nocera’s concern, which he raised in a fashion that went straight for the jugular, was simple. Have we really reached the point where the activist investor gets to call the tune, no matter how well run the company? What is shareholder value, especially in a company like DuPont? Trian’s argument was that DuPont was not getting a return on its spending on research and development? Yet R&D spending is what made DuPont, given the years it takes to often produce from scientific research a commercial product. Take away the R&D spending argued Nocera, and you have not just a poorer DuPont, but also a poorer United States. He closed by talking with and quoting Martin Lipton, a corporate attorney who has made a career out of disparaging corporate activists. Lipton said, “Activism has caused companies to cut R&D, capital investment, and, most significantly, employment,” he said. “It forces companies to lay off employees to meet quarterly earnings.”

“It is,” he concluded, “a disaster for the country.”

This brings me to my final set of ruminations. Some years ago, my wife and I were guests at a small dinner party at the home of a former ambassador (and patriot) living in Santa Fe. There were a total of six of us at that dinner. One of the other guests raised the question as to whether any of us ever thought about what things would have been like for the country if Al Gore, rather than George W. Bush, had won the presidential election. My immediate response was that I didn’t think about such things as it was just far too painful to contemplate.

In like vein, having recently read Ron Suskind’s book Confidence Men, I have been forced to contemplate what it would have meant for the country if President-elect Barack Obama had actually followed through with the recommendations of his transition advisors and appointed his “A” Economic Team. Think about it – Paul Volcker as Secretary of the Treasury, the resurrection of Glass-Steagall, the break-up of the big investment banks – it too is just too painful to contemplate. Or as the line from T.H. White’s Once and Future King goes, “I dream things that never were, and ask why not?”

Now, a few thoughts about the carnage and how to deal with it. Have a plan and stick to it. Do not panic, for inevitably all panic does is lead to self-inflicted wounds. Think about fees, but from the perspective of correlated investments. That is, if five large (over $10B in assets) balanced funds are all positively correlated in terms of their portfolios, does it really make sense not to own the one with the lowest expense ratio (and depending on where it is held, taxes may come into play)? Think about doing things where other people’s panic does not impact you, e.g., is there a place for closed end funds in a long-term investment portfolio? And avoid investments where the bugs have not been worked out, as the glitches in pricing and execution of trades for ETF’s have shown us over the last few weeks.

There is a wonderful Dilbert cartoon where the CEO says “Asok, you can beat market averages by doing your own stock research. Asok then says, “So … You believe every investor can beat the average by reading the same information? “Yes” says the CEO. Asok then says, “Makes you wonder why more people don’t do it.” The CEO closes saying, “Just lazy, I guess.”

Edward A. Studzinski

Checking in on MFO’s 20-year Great Owls

Checking in on MFO’s 20-year Great Owls

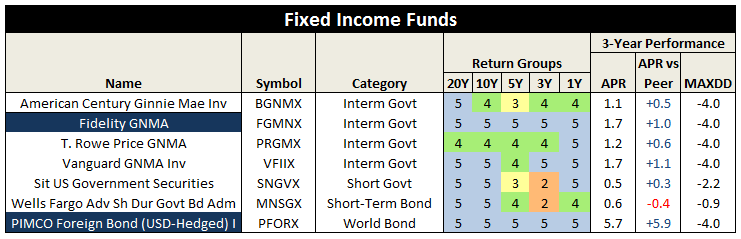

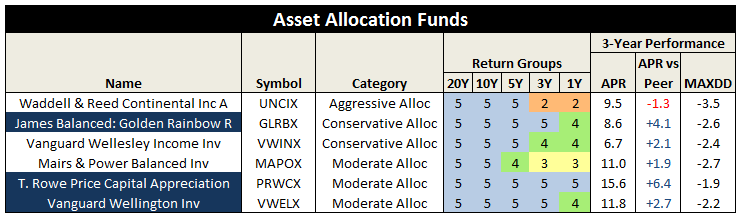

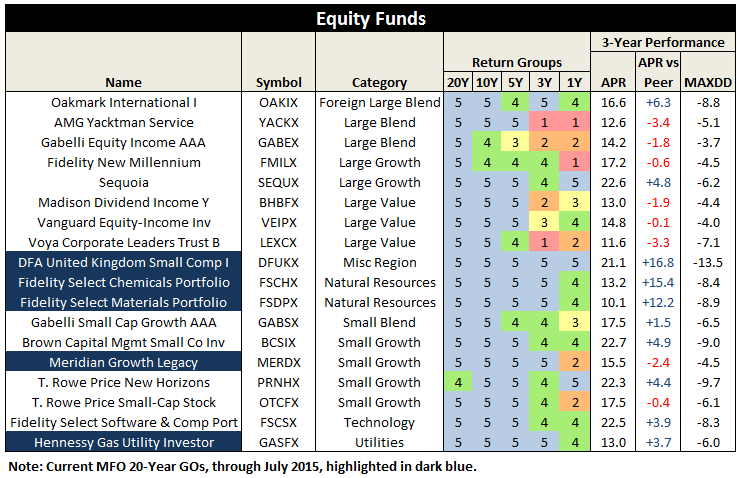

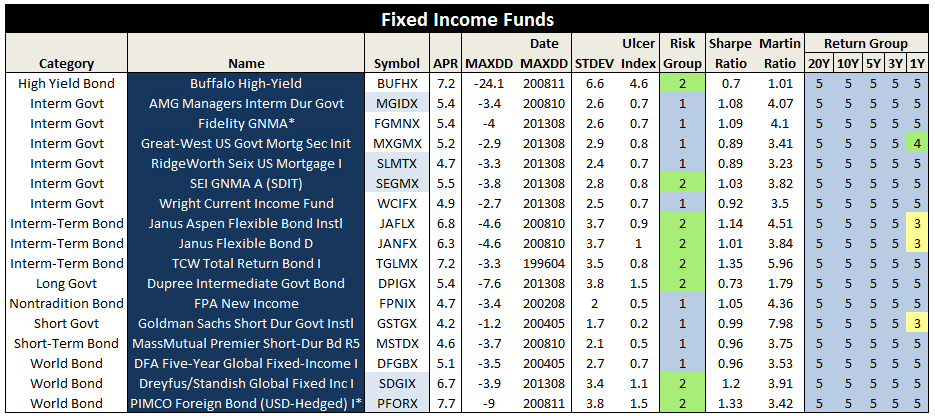

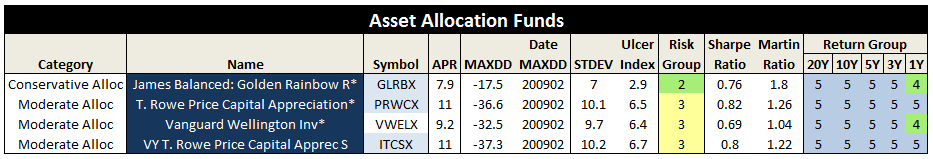

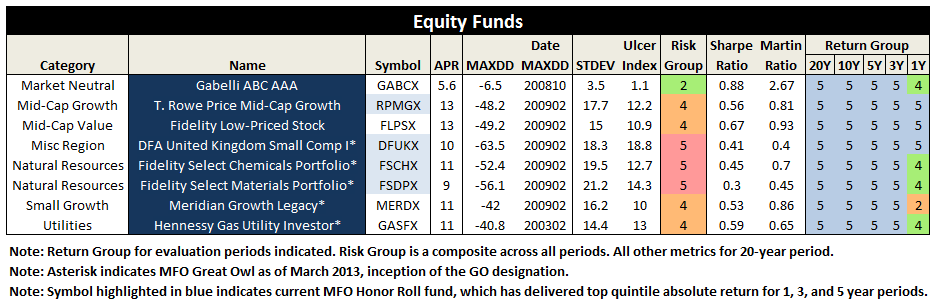

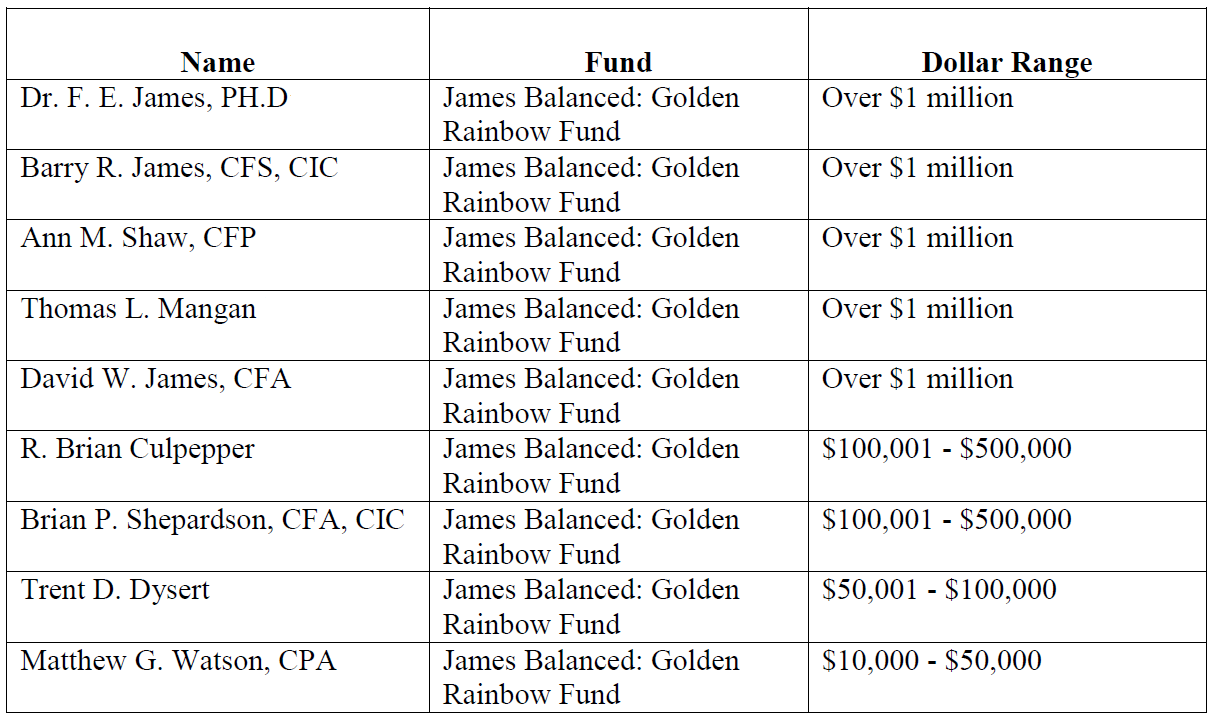

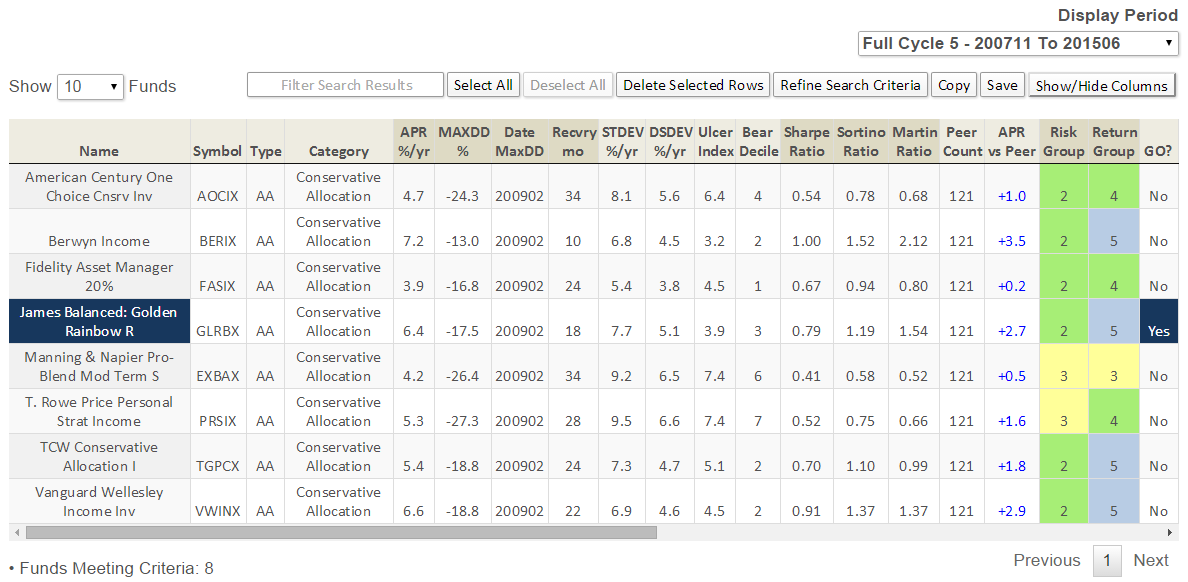

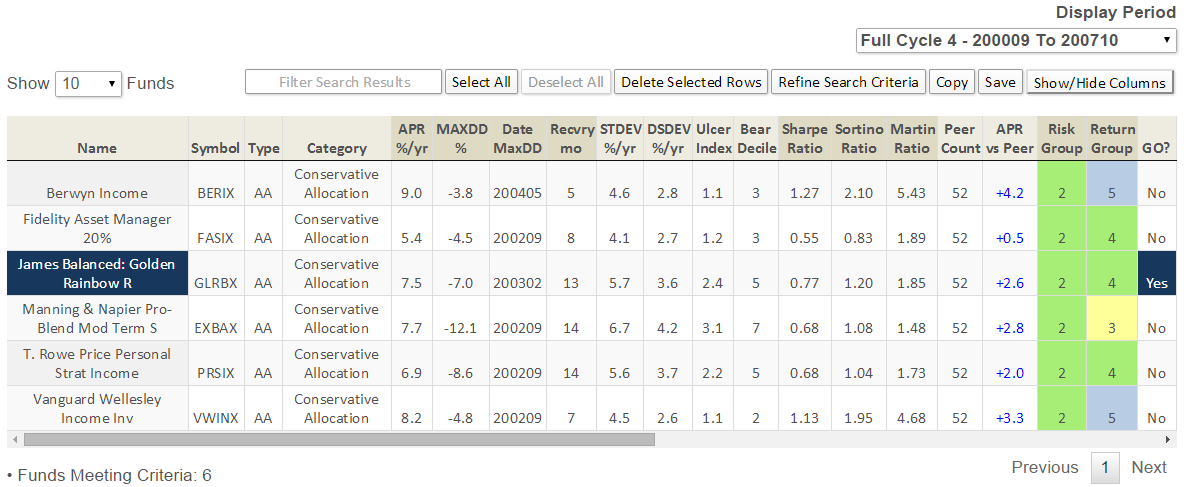

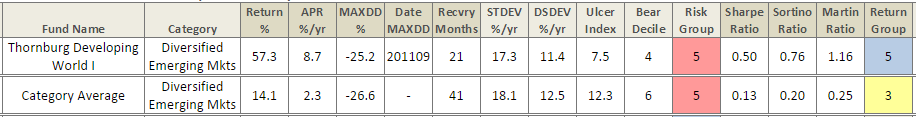

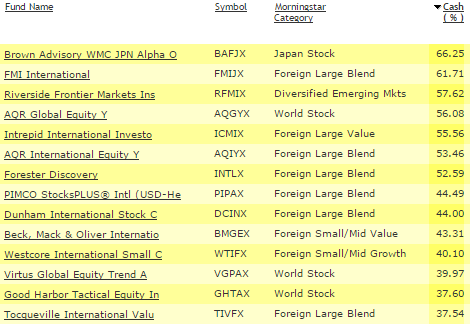

MFO first introduced its rating system in the June 2013 commentary. That’s also when the first “Great Owl” funds were designated. These funds have consistently delivered top quintile risk adjusted returns (based on Martin Ratio) in their categories for evaluation periods 3 years and longer. The most senior are 20-year Great Owls. These select funds have received Return Group ranking of 5 for evaluation periods of 3, 5, 10, and 20 years. Only about 50 funds of the 1500 mutual funds aged 20 years or older, or about 3%, achieve the GO designation. An impressive accomplishment.

Below are the current 20-year GOs (excluding muni funds for compactness, but find complete list here, also reference MFO Ratings Definitions.)

Of the original 20-year GO list of 47 funds still in existence today, only 19 remain GOs. These include notables: Fidelity GNMA (FGMNX), PIMCO Foreign Bond – USD-Hedged I (PFORX), James Balanced: Golden Rainbow R (GLRBX), T. Rowe Price Capital Appreciation (PRWCX), Vanguard Wellington Inv (VWELX), Meridian Growth Legacy (MERDX), and Hennessy Gas Utility Investor (GASFX).

The current 20-year GOs also include 25 Honor Roll funds, based on legacy Fund Alarm ranking system. Honor Roll funds have delivered top quintile absolute returns in its category for evaluation periods of 1, 3, and 5 years. These include: AMG Managers Interm Dur Govt (MGIDX), PIMCO Foreign Bond – USD-Hedged I (PFORX), James Balanced: Golden Rainbow R (GLRBX), T. Rowe Price Capital Appreciation (PRWCX), and T. Rowe Price Mid-Cap Growth (RPMGX).

A closer look at performance of the original list of 20-year GOs, since they were introduced a little more than two years ago, shows very satisfactory performance overall, even with funds not maintaining GO designation. Below is a summary of Return Group rankings and current three-year performance.

Of the 31 funds in tables above, only 7 have underperformed on a risk adjusted basis during the past three years, while 22 have outperformed.

Some notable outperformers include: Vanguard Wellesley Income Inv (VWINX), Oakmark International I (OAKIX), Sequoia (SEQUX), Brown Capital Mgmt Small Co Inv (BCSIX), and T. Rowe Price New Horizons (PRNHX).

And the underperformers? Waddell & Reed Continental Inc A (UNCIX), AMG Yacktman (YACKX), Gabelli Equity Income AAA (GABEX), and Voya Corporate Leaders Trust (LEXCX).

A look at absolute returns shows that 10 of the 31 underperformed their peers by an average of 1.6% annualized return, while the remaining 21 beat their peers by an average of 4.8%.

Gentle reminder: MFO ratings are strictly quantitative and backward looking. No accounting for manager or adviser changes, survivorship bias, category drift, etc.

Will take a closer look at the three-year mark and make habit of posting how they have fared over time.

New Voices at the Observer: The Tale of Two Leeighs

We’re honored this month to be joined by two new contributors: Sam Lee and Leigh Walzer.

Sam is the founder of Severian Asset Management, Chicago. He is also former editor of Morningstar analyst and editor of their ETF Investor newsletter. Sam has been celebrated as one of the country’s best financial writers (Morgan Housel: “Really smart takes on ETFs, with an occasional killer piece about general investment wisdom”) and as Morningstar’s best analyst and one of their best writers (John Coumarianos: “Lee has written two excellent pieces [in the span of a month], and his showing himself to be Morningstar’s finest analyst”). Sam claims to have chosen “Severian” for its Latinate gravitas.

Sam is the founder of Severian Asset Management, Chicago. He is also former editor of Morningstar analyst and editor of their ETF Investor newsletter. Sam has been celebrated as one of the country’s best financial writers (Morgan Housel: “Really smart takes on ETFs, with an occasional killer piece about general investment wisdom”) and as Morningstar’s best analyst and one of their best writers (John Coumarianos: “Lee has written two excellent pieces [in the span of a month], and his showing himself to be Morningstar’s finest analyst”). Sam claims to have chosen “Severian” for its Latinate gravitas.

We’ll set aside, for now, any competing observations. For example, we’ll make no mention of the Severian Asset Management’s acronym. And certainly no reflections upon the fact that Severian was the name of the Journeyman torturer who serves as narrator in a series of Gene Wolfe’s speculative fiction. Nor that another Severian was a popular preacher and bishop. Hmmm … had I mentioned that one of Sam’s most popular pieces is “Losing My Religion”?

You get a better sense of what Sam brings to the table from his discussion of his approach to things as an investment manager:

Investing well is hard. We approach the challenge with a great deal of humility, and try to learn from the best thinkers we can identify. One of our biggest influences is Warren Buffett, who stresses that predictions about the future should be based on an understanding of economic fundamentals and human nature, not on historical returns, correlations and volatilities. He stresses that we should be skeptical of the false precision and unwarranted sense of control that come with the use of quantitative tools, such as Monte Carlo simulations and Markowitz optimizations. We take these warnings seriously.

Our approach is based on economic principles that we believe are both true and important:

- First and foremost, we believe an asset’s true worth is determined by the cash you can pull out of it discounted by the appropriate interest rate. Over the long run, prices tend to converge to intrinsic value … Where we differ with Buffett and other value investors is that we do not believe investment decisions should be made solely on the basis of intrinsic value. It is perfectly legitimate to invest in a grossly overpriced asset if one knows a sucker will shortly come along to buy it … The trick is anticipating what the suckers will do.

- Second, we believe most investors should diversify. As Buffett says, “diversification is protection against ignorance.” This should not be interpreted as a condemnation of the practice. Most investors are ignorant as to what the future holds. Because most of us are ignorant and blind, we want to maximize the protection diversification affords.

- Third, we believe risk and reward are usually, but not always, positively related … Despite equities’ attractive long-term returns, investors have managed to destroy enormous amounts of wealth while investing in them by buying high and selling low. To avoid this unfortunate outcome, we scale your equity exposure to your behavioral makeup, as well as your time horizon and goals.

- Fourth, the market makes errors, but exploiting them is hard.

We prefer to place actively managed funds (and other high-tax-burden assets) in tax-deferred accounts. In taxable accounts, we prefer tax-efficient, low-cost equities, either held directly or through mutual funds. Many exchange-traded funds are particularly tax-advantaged because they can aggressively rid themselves of low cost-basis shares without passing on capital gains to their investors.

In my experience, Sam’s writing is bracingly direct, thoughtful and evidence-driven. I think you’ll like his work and I’m delighted by his presence. Sam’s debut offering is a thoughtful and data rich profile of AQR Style Premia Alternative (QSPIX). You’ll find a summary and link to his profile under Observer Fund Profiles.

Leigh Walzer is now a principal of Trapezoid LLC and a former member of Michael Price’s merry band at the Mutual Series funds. In his long career, Leigh has brought his sharp insights and passion for data to mutual funds, hedge funds, private equity funds and even the occasional consulting firm.

Leigh Walzer is now a principal of Trapezoid LLC and a former member of Michael Price’s merry band at the Mutual Series funds. In his long career, Leigh has brought his sharp insights and passion for data to mutual funds, hedge funds, private equity funds and even the occasional consulting firm.

We had a chance to meet during June’s Morningstar conference, where he began to work through the logic of his analysis of funds with me. Two things were quickly clear to me. First, he was doing something distinctive and interesting. As base, Leigh tried to identify the distinct factors that might qualify as types of managerial skill (two examples would be stock selection and knowing when to reduce risk exposure) and then find the data that might allow him to take apart a fund’s performance, analyze its component parts and predict whether success might persist. Second, I was in over my head. I asked Leigh if he’d be willing to share sort of bite-sized bits of his research so that folks could begin to understand his system and test the validity of its results. He agreed.

Here’s Leigh’s introduction to you all. His first analytic piece debuts next month.

Mutual Fund Observer performs a great service for the investment community. I have found information in these pages which is hard to obtain anywhere else. It is a privilege to be able to contribute.

I founded Trapezoid a few years ago after a long career in the mutual fund and hedge fund industry as an analyst and portfolio manager. Although I majored in statistics at Princeton many moons ago and have successfully modelled professional sports in the past, most of my investing was in credit and generally not quantitative in nature. As David Snowball mentioned earlier, I spent 7 years working for Mutual Shares, led by Michael Price. So the development of the Orthogonal Attribution Engine marks a return to my first passion.

I have always been interested in whether funds deliver value for investors and how accurately allocators and investors understand their managers. My freshman economics course was taught by Burton Malkiel, author of a Random Walk Down Wall Street, who preached that the capital markets were pretty efficient. My experience in Wall Street and my work at Orthogonal have taught me this is not always true. Sometimes a manager or a strategy can significantly outperform the market for a sustained period. Of course, competitors react and capital flows until an equilibrium is achieved, but not nearly as quickly as Malkiel assumes.

There has been much discussion over the years about the active–passive debate. John Bogle was generous in his time reviewing my work. I generally agree with Jack and he is a giant in the industry to whom we all owe a great deal. For those who are ready to throw in the towel of active investing, Bogle makes two (related) assumptions which need to be critically reviewed:

- Even if an active manager outperforms the average, he is likely to revert to the mean.

- Active managers with true skill (in excess of their fee structure) are hard to identify, so investors are better off with an index fund

I try to measure skill in a way which is more accurate (and multi-faceted) than Bogle’s definition and I look at skill as a statistical process best measured over an extended period of time. I try to understand how the manager is positioned at every point in time, using both holdings and regression data, and I try to understand the implications of his or her decisions.

My work indicates that the active-passive debate is less black and white than you might discern from the popular press or the marketing claims of mutual fund managers. The good news for investors is there are in fact many managers who have demonstrated skill over an extended period of time. Using statistical techniques, it is possible to identify managers likely to outperform in the future. There are some funds whose expected return over the next 12 months justifies what they charge. There are many other managers who show investment skill, but not enough to justify their expense structure.

Feel free to check out the website at www.fundattribution.com which is currently in beta test. Over 30,000 funds are modelled; users who register for demo access can see certain metrics measuring historic manager skill and likelihood of future success on a subset of the fund universe.

I look forward to sharing with you insights on specific funds in the coming months and provide MFO readers a way to track my results. Equally important, I hope to give you new insights to help you think about the role of actively managed funds in your portfolio and how to select funds. My research is still a work in process. I invite the readership of MFO to join me in my journey and invite feedback, suggestions, and collaboration. You may contact me at [email protected].

We’re very much looking forward to October and Leigh’s first essay. Thanks to both. I think you’ll enjoy their good spirits and insight.

Top developments in fund industry litigation

![]() Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized, searchable, and filtered as never before. For the complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized, searchable, and filtered as never before. For the complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Court Decisions & Orders

- In the shareholder litigation regarding gambling-related securities held by the American Century Ultra Fund, the Eighth Circuit affirmed the district court’s grant of summary judgment in favor of American Century, agreeing that the shareholder could not bring suit against the fund adviser because the fund had declined to do so in a valid exercise of business judgment. Defendants included independent directors. (Seidl v. Am. Century Cos.)

- Setting the stage for a rare section 36(b) trial (assuming no settlement), a court denied parties’ summary judgment motions in fee litigation regarding multiple AXA Equitable funds. The court cited only “reasons set forth on the record.” (Sanford v. AXA Equitable Funds Mgmt. Group, LLC; Sivolella v. AXA Equitable Life Ins. Co.)

- A court gave its final approval to (1) a $24 million partial settlement of the state-law class action regarding Northern Trust‘s securities lending program, and (2) a $36 million settlement of interrelated ERISA claims. The state-law class action is still proceeding with respect to plaintiffs who invested directly in the program. (Diebold v. N. Trust Invs., N.A.; La. Firefighters’ Ret. Sys. v. N. Trust Invs., N.A.)

- In the long-running fee litigation regarding Oakmark funds that had made it all the way to the U.S. Supreme Court, the Seventh Circuit affirmed a lower court’s grant of summary judgment for defendant Harris Associates. The appeals court cited the lower court’s findings that (1) “Harris’s fees were in line with those charged by advisers for other comparable funds” and (2) “the fees could not be called disproportionate in relation to the value of Harris’s work, as the funds’ returns (net of fees) exceeded the norm for comparable investment vehicles.” Plaintiffs have filed a petition for rehearing en banc. (Jones v. Harris Assocs.)

- Extending the fund industry’s dismal record on motions to dismiss section 36(b) litigation, a court denied PIMCO‘s motion to dismiss an excessive-fee lawsuit regarding the Total Return Fund. Court: “Throughout their Motion, Defendants grossly exaggerate ‘the specifics’ needed to survive a 12(b)(6) motion, essentially calling for Plaintiff to prove his case now, before discovery.” (Kenny v. Pac. Inv. Mgmt. Co.)

- A court granted the motion to dismiss a state-law and RICO class action alleging mismanagement by a UBS investment adviser, but without prejudice to refile the state-law claims as federal securities fraud claims. (Knopick v. UBS Fin. Servs., Inc.)

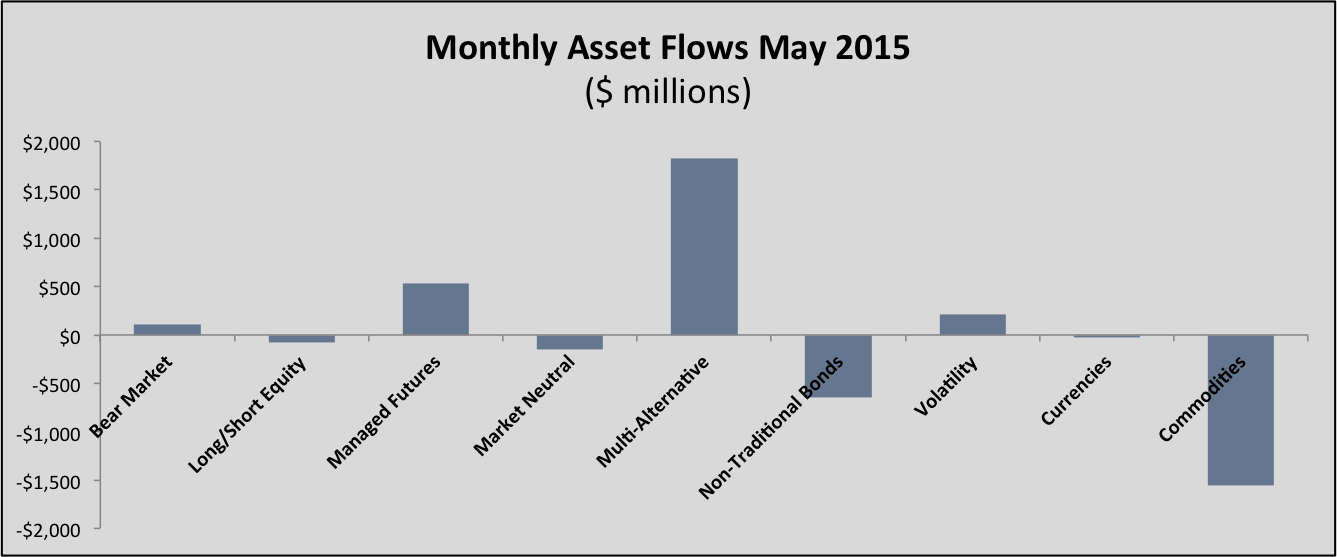

The Alt Perspective: Commentary and news from DailyAlts.

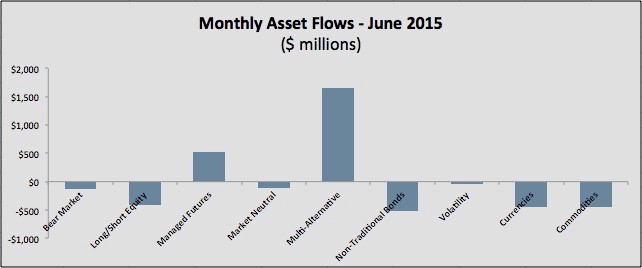

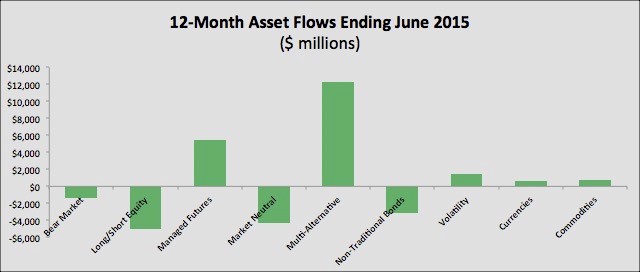

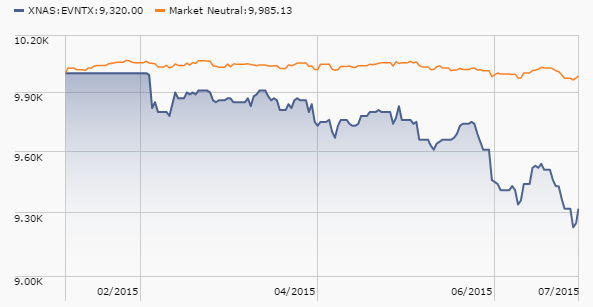

As we all now know, August was anything but calm. Despite starting that way, the month delivered some tough love in the last two weeks, just when we were all supposed to be relaxing with family and friends. Select Morningstar mutual fund categories finished the month with the following returns:

As we all now know, August was anything but calm. Despite starting that way, the month delivered some tough love in the last two weeks, just when we were all supposed to be relaxing with family and friends. Select Morningstar mutual fund categories finished the month with the following returns:

- Large Blend (US Equity): -6.07%

- Intermediate-Term Bond: -0.45%

- Long/Short Equity: -3.57%

- Nontraditional Bonds: -0.91%

- Managed Futures: -2.52%

The one surprise of the five categories above is Managed Futures. This is a category that typically does well when markets are in turmoil and trending down. August proved to be an inflection point, and turned out to be challenging in what was otherwise a solid year for the strategies.

However, let’s take a look at balanced portfolio configurations. Using the above category returns, at traditional long-only 60/40 blend portfolio (60% stocks / 40% bonds) would have returned -3.82% in August, while an alternative balanced portfolio of 50% long/short equity, 30% nontraditional bonds and 20% managed futures would have returned -2.56%. Compare these to the two categories below:

- Moderate Allocation: -4.17%

- Multialternative: -2.22%

Moderate Allocation funds, which are relatively lower risk balance portfolios, turned in the lowest of the balanced portfolio configurations. The Multialternative category of funds, which are balanced portfolios made up of mostly alternative strategies, performed the best, beating the traditional 60/40 portfolio, the 50/30/20 alternative portfolio and the Moderate Allocation category. Overall, it looks like alternatives did their job in August.

August Highlights

Believe it or not, Vanguard launched its second alternative mutual fund in August. The new Vanguard Alternative Strategies Fund will invest across several alternative investment strategies, including long/short equity and event driven, and will also allocate some assets to currencies and commodities. Surprisingly, Vanguard will be managing the fund in-house, but does that the ability to outsource some or all of the management of the fund. Sticking with its low cost focus, Vanguard will charge a management fee of 0.18% – a level practically unheard of in the liquid alternatives space.

In a not quite so surprising move, Catalyst Funds converted its fourth hedge fund into a mutual fund in August with the launch of the Catalyts/Auctos Multi Strategy Fund. In this instance, the firm did go one step beyond prior conversions and actually acquired the underlying manager, Auctos Capital Management. One key benefit of the hedge fund conversion is the fact that the fund can retain its performance track record, which dates back to 2008.

Finally, American Century (yes, that conservative, mid-western asset management firm) launched a new brand called AC Alternatives under which it will manage a series of alternative mutual funds. The firm currently has three funds under the new brand, with two more in the works. Similar to Vanguard, the firm launched a market neutral fund back in 2005, and a value tilted version in 2011. The third fund, an alternative income fund, is new this year.

Let’s Get Together

Two notable acquisitions occurred in August. The first is the acquisition of Arden Asset Management, a long-time institutional fund-of-hedge funds manager, by Aberdeen. The latter has been on the acquisition trail over the past several years, with a keen eye on alternative investment firms. Through the transaction, Arden will get global distribution, while Aberdeen will pick up very specific hedge fund due diligence, manager research and portfolio construction capabilities. Looks like a win-win.

The second transaction was the acquisition of 51% of the Australian-based unconstrained fixed income shop Kapstream Capital by Janus for a cool $85 million. Janus also has the right to purchase the remainder of the firm, which has roughly $6 billion under management. Good for Kapstream as the valuation appears to be on the high end, but perhaps Bill Gross needed some assistance managed his unconstrained portfolios.

The Fall

A lot happens in the Fall. Back to school. Football. Interest rate hike. Changing leaves. Halloween. Thanksgiving. Federal debt ceiling. Maybe there is enough for us all to take our minds off the markets for just a bit and let things settle down. Time will tell, but until next month, enjoy the Labor Day weekend and the beginning of a new season.

Observer Fund Profiles:

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

AQR Style Premia Alternative (QSPIX). AQR’s new long-short multi-strategy fund takes factor investing to its logical extreme: It applies four distinct strategies–value, momentum, carry, and defensive–across stock, bond, commodity, and currency markets. The standard version of the fund targets a 10% volatility and a 0.7 Sharpe ratio while maintaining low to no correlation with conventional portfolios. In its short life, the fund has delivered in spades. Please note, this profile was written by our colleague, Sam Lee.

Manning & Napier Pro-Blend Conservative (EXDAX): this fund has been navigating market turbulences for two decades now. Over the course of the 21st century, it’s managed to outperform the Total Stock Market Index with only one-third of the stocks and one-third of the volatility. And you can start with just $25!

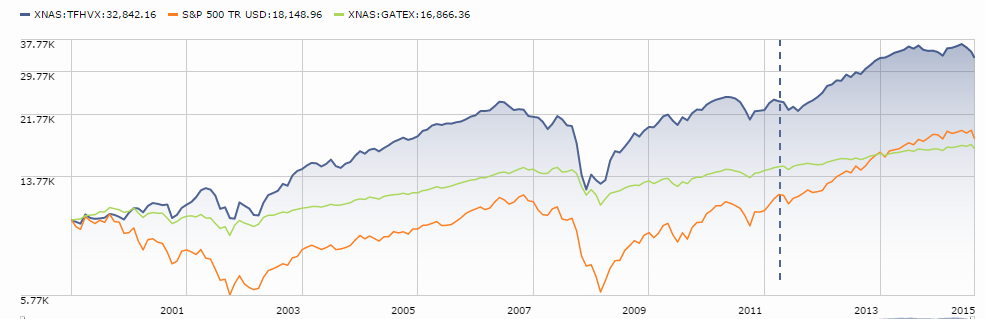

TCW/Gargoyle Hedged Value (TFHVX/TFHIX): if you understand what you’re getting – a first-rate value fund with one important extra – you’re apt to be very happy. If you see “hedged” and think “tame,” you’ve got another thing coming.

Launch Alert: Falcon Focused SCV (FALCX)

The fact that newly-launched Falcon Focused SCV has negligible assets (it’s one of the few funds in the world where I could write a check and become the fund’s largest shareholder) doesn’t mean that it has negligible appeal.

The fact that newly-launched Falcon Focused SCV has negligible assets (it’s one of the few funds in the world where I could write a check and become the fund’s largest shareholder) doesn’t mean that it has negligible appeal.

The fund is run by Kevin Silverman whose 30 year career has been split about equally between stints on the sell side and on the buy side. He’s a graduate of the University of Wisconsin’s well-respect Applied Securities Analysis Program . Early in his career he served as an analyst at Oakmark and around the turn of the century was one of the managers of ABN AMRO Large Cap Growth Fund. He cofounded Falcon Capital Management in April 2015 and is currently one of the folks responsible for a $100 million small cap value strategy at Dearborn Partners in Chicago. They’ve got an audited 14 year record.

I’m endlessly attracted to the potential of small cap value investing. The research, famously French and Fama’s, and common sense concur: this should be the area with the greatest potential for profits. It’s huge. It’s systemically mispriced because there’s so little analyst coverage and because investors undervalue value stocks. Growth stocks are all cool and sexy and you want to own them and brag to all your friends about them. Value stocks are generally goofed up companies in distressed industries. They’re boring and a bit embarrassing to own; on whole, they’re sort of the midden heap of the investing world.

The average investor’s unwillingness or inability to consider them raises the prospect that a really determined investor might find exceptional returns. Kevin and his folks try to build 5 to 10 year models for all of their holdings, then look seriously at years four and five. The notion is that if they can factor emotion out of the process (they invoke the pilot’s mantra, “trust your instruments”) and extend their vision beyond the current obsession with this quarter and next quarter, they’ll find opportunities that will pay off handsomely a few years from now. Their target is to use their models to construct a portfolio that has the prospect for returns “in the mid-20s over the next three years.” Mathematically, that works out to a doubling in just over three years.

I’m not sure that the guys can pull it off but they’re disciplined, experienced and focused. That puts them ahead of a lot of their peers.

The initial expense ratio, after waivers, is 1.25%. The no-load Institutional shares carry a $10,000 minimum, which is reduced to $5000 for tax-advantaged accounts and those set up with an automatic investing plan. The fund’s website is still pretty sparse (okay, just under “pretty sparse”), but you can find a bit more detail and one pretty panorama at the adviser’s website.

Launch Alert: Grandeur Peak Global Stalwarts Fund (GGSOX/GGSYX)

Grandeur Peak launched two “alumni” funds on September 1, 2015. Grandeur Peak’s specialty is global micro- and small-cap stocks, generally at the growth end of the spectrum. If they do a good job, their microcap stocks soon become small caps, their small caps become midcaps, and both are at risk of being ejected from the capitalization-limited Grandeur Peak funds.

Grandeur Peak launched two “alumni” funds on September 1, 2015. Grandeur Peak’s specialty is global micro- and small-cap stocks, generally at the growth end of the spectrum. If they do a good job, their microcap stocks soon become small caps, their small caps become midcaps, and both are at risk of being ejected from the capitalization-limited Grandeur Peak funds.

Grandeur Peak was approached by a large investor who recognized the fact that many of those now-larger stocks were still fundamentally attractive, and asked about the prospect of a couple “alumni” funds to hold them. Such funds are attractive to advisors since you’re able to accommodate a much larger asset base when you’re investing in $10 billion stocks than in $200 million ones.

One investor reaction might be to label Grandeur Peak as sell-outs. They’ve loudly touted two virtues: a laser-like focus and a firm-wide capacity cap at $3 billion, total. With the launch of the Stalwarts funds, they’re suddenly in the mid-cap business and are imagining firmwide AUM of about $10 billion.

Grandeur Peak, however, provided a remarkable wide-ranging, thoughtful defense of their decision. In a letter to investors, dated July 15, they discuss the rationale for and strategies embodied by three new funds:

Grandeur Peak Global Micro Cap Fund (GPMCX): A micro-cap strategy primarily targeting companies in the $50M-350M market cap range across the globe; very limited capacity.

Grandeur Peak Global Stalwarts Fund (GGSOX/GGSYX): A small/mid-cap (SMID) strategy focused on companies above $1.5B market cap across the globe.

Grandeur Peak International Stalwarts Fund (GISOX/GISYX): A small/mid-cap strategy focused on companies above $1.5B market cap outside of the U.S.

They argue that they’d always imagined Stalwarts funds, but didn’t imagine launching them until the firm’s second decade of operation. Their success in identifying outstanding stocks and drawing assets brought high returns, a lot of attention and a lot of money. While they hoped to be able to soft-close their funds, controlling inflows forced a series of hard closes instead which left some of their long-time clients adrift. By adding the Stalwarts funds as dedicated vehicles for larger cap names (the firm already owns over 100 stocks in the over $1.5 billion category), they’re able to provide continuing access to their investors without compromising the hard limits on the micro- and nano-cap products. Here’s their detail:

As you know, capacity is a very important topic to us. We believe managing capacity appropriately is another critical competitive advantage for Grandeur Peak. We plan to initially close the Global Micro Cap Fund at around $25 million. We intend to keep it very small in order to allow the Fund full access to micro and nanocap companies …

Looking carefully at the market cap and liquidity of our holdings above $1.5 billion in market cap, the math suggests that we could manage up to roughly $7 billion across the Stalwarts family without sacrificing our investment strategy or desired position sizes in these names. This $7 billion is in addition to the roughly $3 billion that we believe we can comfortably manage below $1.5 billion in market cap.

Our existing strategies will remain hard closed as we are committed to protecting these strategies and their ability to invest in micro-cap and small-cap companies. We are very aware that many good small cap firms lose their edge by taking in too many assets and being forced to adjust their investment style. We will not do this! We are taking a more unique approach by partitioning the lower capacity, less liquid names and allowing additional assets in the higher capacity, liquid stocks where the impact will not be felt by the smaller-cap funds.

The minimum initial investment is $2000 for the Investor share class, which will be waived if you establish the account with an automatic investment plan. Unlike Global Micro Cap, there is no waiver of the institutional minimum available for the Stalwarts. Each fund will charge 1.35%, retail, after waivers. You might want to visit the Global Stalwarts or International Stalwarts homepages for details.

Funds in Registration

There are 17 new funds in registration this month. Funds in registration with the SEC are not available for sale to the public and the advisors are not permitted to talk about them, but a careful reading of the filed prospectuses gives you a good idea of what interesting (and occasionally appalling) options are in the pipeline. Funds currently in registration will generally be available for purchase in November.

Two of the funds will not be available for direct purchase: T. Rowe Price is launching Mid Cap and Small Cap index funds to use with 529 plans, funds-of-funds and so on. Of the others, there are new offerings from two solid boutiques: Driehaus Turnaround Opportunities will target “distressed” investing and Brown Advisory Equity Long/Short Fund will do about what you expect except that the filings bracket the phrase Equity Long/Short. That suggests that the fund’s final name might be different. Harbor is launching a clone of Vanguard Global Equity. A little firm named Gripman is launched a conservative allocation fund (I wish them well) and just one of the funds made my eyes roll. You’ll figure it out.

Manager Changes

We tracked down 60 or 70 manager changes this month; the exact number is imprecise because one dude was leaving a couple dozen Voya funds which we reduced to just a single entry. We were struck by the fact that about a dozen funds lost women from the management teams, but it appears only two funds added a female manager.

Sympathies to Michael Lippert, who is taking a leave from managing Baron Opportunity (BIOPX) while he recovers from injuries sustained in a serious bicycle accident. We wish him a speedy recovery.

Updates

A slightly-goofed SEC filing led us to erroneously report last month that Osterweis Strategic Investment (OSTVX) might invest up to 100% in international fixed-income. A “prospectus sticker” now clarifies the fact that “at the fund level OSTVX is limited to 50% foreign.” Thanks to the folks at Osterweis for sharing the update with us. Regrets for any confusion.

Morningstar giveth: In mid-August, Morningstar initiated coverage of two teams we’ve written about. Vanguard Global Minimum Volatility (VMVFX) received a Bronze rating, mostly because it’s a Vanguard fund. Morningstar praises the low expenses, Vanguard culture and the “highly regarded–and generally successful–quantitative equity group.” The fund’s not quite two years old but has a solid record and has attracted $1.1 billion in assets.

Vulcan Value Partners (VVPLX) was the other Bronze honoree. Sadly, Morningstar waited until after the fund had closed before recognizing it. The equally excellent Vulcan Value Partners Small Cap (VVPSX) fund is also closed, though Morningstar has declined to recognize it as a medalist fund.

Morningstar taketh away: Fidelity Capital Appreciation (FDCAX) is no longer a Fanny Fifty Fund: it has been doing too well. There’s an incentive fee built into the fund’s price structure; if performance sucks, the e.r. drops. If performance soars, the e.r. rises.

Rewarding good performance sounds to the novice like a good idea. Nonetheless, good performance has had the effect of disqualifying FDCAX as a “Fantastic” fund. Laura Lutton explains why, in “These Formerly ‘Fantastic’ Funds Now Miss the Mark.”

In 2013, the fund outpaced that index by 2.47 percentage points, upping the expense ratio by 4 basis points to 0.81%. This increase moved the fund’s expenses beyond the category’s cheapest quintile…

Uhhh … yup. 247 basis points of excess return in exchange for 4 basis points of expense is clearly not what we expect of Fantastic funds. Out!

From Ira’s “What the hell is that?” file: A rare T Rowe flub

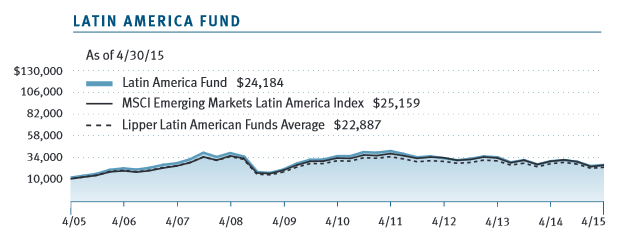

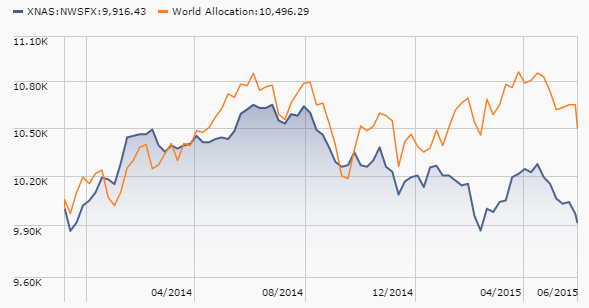

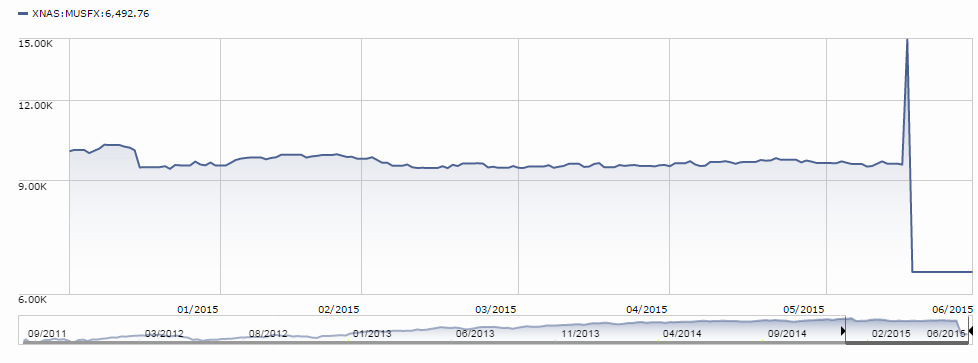

Ira Artman, a long-time friend of the Observer and consistently perceptive observer himself, shared the following WTF performance chart from T. Rowe Price:

Good news: T. Rowe Price Latin America (PRLAX) is magic! It’s volatility-free emerging market fund.

Bad news: the chart is rigged. The vertical axis is compressed so eliminate virtually all visible volatility. There’s a sparky discussion of the chart on our discussion board that provides both uncompressed versions of the chart and the note that the other T. Rowe funds did not receive similarly scaled axes. Consensus on the board: someone deserves a spanking for this one.

Thanks to Ira for catching and sharing.

Briefly Noted . . .

CRM Global Opportunity Fund (CRMWX) is becoming CRM Slightly-Less-Global Opportunity Fund, in composition if not in name. Effective October 28, the fund is changing its principal investment strategy from investing “a majority” of its assets outside the US to investing “at least 40%” internationally, less if markets get ugly. Given that the fund’s portfolio is just 39% global now (per Morningstar), I’m a little fuzzy on why the change will make a difference.

SMALL WINS FOR INVESTORS

Seafarer’s share class model is becoming more common, which is a good thing. Seafarer, like other independent funds, needs to be available on brokerage platforms like Schwab and Scottrade; those platforms allow for lower cost institutional shares so long as the minimum exceeds $100,000 and higher cost retail shares with baked-in 12(b)1 fees to help pay Schwab’s platform fees. Seafarer complied but allows a loophole: they’ll waive the minimum on the institutional shares if you (a) buy it directly from them and (b) set up an automatic investing plan so that you’re moving toward the $100,000 minimum. Whether or not you reach it isn’t the consideration. Seafarer’s preference is to think of their low-cost institutional class as their “universal share class.”

Grandeur Peak is following suit. They intend to launch their new Global Micro Cap Fund by year’s end, then to close it as soon as assets hit $25 million. That raises the real prospect of the fund being available for a day or two. During that time, though, they’ll offer institutional shares to retail investors who invest directly with them. They write:

We want the Global Micro Cap Fund to be available to both our retail and institutional clients, but without the 0.25% 12b-1 fee that comes with the Investor share class. Our intention is to make the Institutional class available to all investors, and waive the minimum to $2000 for regular accounts and $100 for UTMA accounts.

Invesco International Small Company Fund will reopen to all investors on September 11, 2015. Morningstar has a lot of confidence in it (the fund is “Silver”) and it has a slender asset base right now, $330 million, down from its peak of $700 million before the financial crisis. The fund has been badly out of step with the market in recent years, which is reflected in the fact that it has one of its peer group’s best ten-year record and worst five-year records. Since neither the team nor the strategy has changed, Morningstar remains sanguine.

Matthews Pacific Tiger Fund (MAPTX) has reopened to new investors.

Effective July 1, 2015 the shareholder servicing fee for the Investor Class Shares of each of the Meridian Funds was reduced from 0.25% to 0.05%. Somehow I missed it. Sorry for the late notice. The Investor shares continue to sport their bizarre $99,999 minimum initial investment.

Wells Fargo Advantage Index Fund (WFILX) reopens to new investors on October 1. It’s an over-priced S&P 500 Index fund. Assuming you can dodge the front load, the 0.56% expense ratio is a bit more than triple Vanguard’s (0.17% for Investor shares of Vanguard 500, VFINX). That difference adds up: over 10 years, a $10,000 investment in WFILX would have grown to $19,800 while the same money in VFINX grew to $20,700.

CLOSINGS (and related inconveniences)

Acadian Emerging Markets (AEMGX) is slated to close to new investors on October 1. The adviser is afraid that the fund’s ability to execute its strategy will be impaired “if the size of the Fund is not limited.” The fund has lost an average of 3.7% annually for the current market cycle, through July 2015. You’d almost think that losing money, trailing the benchmark and having higher-than-normal volatility would serve as automatic brakes limiting the size of the portfolio.” Apparently not so much.

M.D. Sass 1-3 Year Duration U.S. Agency Bond Fund (MDSHX) is closing the fund’s retail share class and converting them to institutional shares. It’s an okay fund in a low return category, which means expenses matter. Over the past three years, the retail shares trail 60% of their peer group while the institutional shares lead 60% of the group. The conversion will give existing retail shareholders a bit of a boost and likely cut the adviser’s expenses by a bit.

OLD WINE, NEW BOTTLES

Effective August 27, 2015 361 Global Managed Futures Strategy Fund (AGFQX) became the 361 Global Counter-Trend Fund. I wish them well, but the new prospectus language is redolent of magic wands and sparkly dust: “counter-trend strategy follows an investment model designed to perform in volatile markets, regardless of direction, by taking advantage of fluctuations. Using a combination of market inputs, the model systematically identifies when to purchase and sell specific investments for the Fund.” What does that mean? What fund isn’t looking to identify when to buy or sell specific investments?

American Independence Laffer Dividend Growth Fund (LDGAX) has … laughed its last laff? Hmmm. Two year old fund run by Laffer Investments, brainchild of Arthur B. Laffer, the genius behind supply-side economics. Not, as it turns out, a very good two year old fund. At the end of July, American Independence merged with FolioMetrix LLC to form RiskX Investments. Somewhere in the process, the fund was declared to be surplus.

Effective September 1, 2015, the name of the Anchor Alternative Income Fund (AAIFX) will be changed to Armor Alternative Income Fund.

Effective August 7, 2015, Eaton Vance Tax-Managed Small-Cap Value Fund became Eaton Vance Tax-Managed Global Small-Cap Fund (ESVAX).

The Hartford Emerging Markets Research Fund is now Hartford Emerging Markets Equity Fund (HERAX) while The Hartford Small/Mid Cap Equity Fund has become Hartford Small Cap Core Fund (HSMAX). HERAX is sub-advised by Wellington. Back in May they switched out managers, with the new guy bringing a more-driven approach so they’ve also added “quantitative investing” as a risk factor in the prospectus. For HSMAX, midcaps are now out.

In mid-November, three Stratton funds add “Sterling Capital” to their names: Stratton Mid Cap Value (STRGX) becomes Sterling Capital Stratton Mid Cap Value. Stratton Real Estate (STMDX) and Stratton Small Cap Value (STSCX) get the same additions.

Effective September 17, 2015, ROBO-STOXTM Global Robotics and Automation Index ETF (ROBO) will be renamed ROBO GlobalTM Robotics and Automation Index ETF. If this announcement affects your portfolio, consider getting therapy and a Lab puppy.

OFF TO THE DUSTBIN OF HISTORY

American Beacon is pretty much cleaning out the closet. They’ve announced liquidation of their S&P 500 Index Fund, Small Cap Index Fund, International Equity Index Fund, Emerging Markets Fund, High Yield Bond Fund, Intermediate Bond Fund, Short-Term Bond Fund and Zebra Global Equity Fund (AZLAX). With regard to everything except Zebra, the announcement speaks of “large redemptions which are expected to occur by the end of 2015” that would shrink the funds by so much that they’re not economically viable. American Beacon started as the retirement plan for American Airlines, was sold to one private equity firm in 2008 and then sold again in 2015. It appears that they lost the contract for running a major retirement plan and are dumping most of their vanilla funds in favor of their recent ventures into trendier fare. The Zebra Global Equity Fund was a perfectly respectable global equity fund that drew just $5 million in assets.

In case you’re wondering whatever happened to the Ave Maria Opportunity Fund, it was eaten by the Ave Maria Catholic Values Fund (AVEMX) at the end of July.

Eaton Vance announced liquidation of its U.S. Government Money Market Fund, around about Halloween, 2015. As new SEC money market regs kick in, we’ve seen a lot of MMFs liquidate.

Eaton Vance Hexavest U.S. Equity Fund (EHUAX) is promoted to the rank of Former Fund on or about September 18, 2015, immediately after they pass their third anniversary. What is a “hexavest,” you ask? Perhaps a protective garment donned before entering the magical realms of investing? Hmmm … haven’t visited WoW lately, so maybe. Quite beyond that it’s an institutional equity investment firm based in Montreal that subadvises four (oops, three) funds for Eaton Vance. Likely the name derived from the fact that the firm had six founders (Greek, “hex”) who wore vests.

Eaton Vance Hexavest U.S. Equity Fund (EHUAX) is promoted to the rank of Former Fund on or about September 18, 2015, immediately after they pass their third anniversary. What is a “hexavest,” you ask? Perhaps a protective garment donned before entering the magical realms of investing? Hmmm … haven’t visited WoW lately, so maybe. Quite beyond that it’s an institutional equity investment firm based in Montreal that subadvises four (oops, three) funds for Eaton Vance. Likely the name derived from the fact that the firm had six founders (Greek, “hex”) who wore vests.

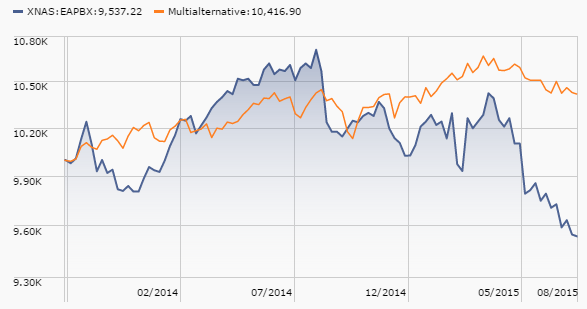

Rather more quickly, Eaton Vance also liquidated Parametric Balanced Risk Fund (EAPBX). The Board announced the liquidation on August 11; it was carried out August 28. And you could still say they might have been a little slow on the trigger:

The Eudora Fund (EUDFX) has closed and will liquidate on September 10, 2015.

Hundredfold Select Equity Fund (SFEOX) has closed and will discontinue its operations effective October 30, 2015. It’s the sort of closure about which I think too much. On the one hand, the manager (described on the firm’s Linked-In page as “an industry visionary”) is a good steward: almost all of the money in the fund is his own (over $1 million of $1.8 million), he doesn’t get paid to manage it, his Simply Distribute Foundation helps fund children’s hospitals and build orphanages. On the other hand, it’s a market-timing fund of funds will an 1100% turnover which has led the fund to consistently capture much more of the downside, and much less of the upside, than its peers. And, in a slightly disingenuous move, the Hundredfold Select website has already been edited to hide the fact that the Select Equity fund even exists.

Ticker symbols are sometimes useful time capsules, helping you unpack a fund’s evolution. Matthews Asian Growth and Income is “MACSX” because it once was their Asian Convertible Securities fund. Hundredfold Select is “SFEOX” because it once was the Direxion Spectrum Funds: Equity Opportunity fund.

KKM Armor Fund (RMRAX) was not, it appears, bullet-proof. Despite a 30% gain in August 2015, the 18 month old, $8 million fund has closed and will liquidate on September 24, 2015. RMRAX was one of only two mutual funds in the “volatility” peer group. The other is Navigator Sentry Managed Volatility (NVXAX). I bet you’re wondering, “why on earth would Morningstar create a bizarre little peer group with only two funds?” The answer is that there are a slug of ETFs that allow you to bet changes in the level of market volatility; they comprise the remainder of the group. That also illustrates why I prefer funds to ETFs: encouraging folks to speculate on volatility changes is a fool’s errand.

The Modern Technology Fund (BELAX) has closed and will liquidate on September 25, 2015.

There’s going to be one less BRIC in the wall: Goldman Sachs has announced plans to merge Goldman Sachs BRIC Fund (GBRAX) into their Emerging Markets Equity Fund (GEMAX) sometime in October. The Trustees unearthed a new euphemism for “burying this dog.” They want “to optimize the Goldman Sachs Funds.” The optimized line-up removes a fund that, over the past five years, turned $10,000 into $8,500 by moving its assets into a fund that turned $10,000 into $10,000.

In an interesting choice of words, the Board of Directors authorized the “winding down” Keeley Alternative Value Fund (KALVX) and the Keeley International Small Cap Value Fund (KISVX). By the time you read this, the funds will already have been quite unwound. The advisor gave Alternative Value about four years to prove its … uhh, alternative value (it couldn’t). It gave International Small Cap all of eight months. Founder John Keeley passed away in June at age 75. The firm had completed their transition planning just a month before his passing.

PIMCO Tax Managed Real Return Fund (PXMDX) will be liquidated on or about October 30, 2015. In addition, three PIMCO ETFs are getting deposited in the circular file: 3-7 Year U.S. Treasury Index (FIVZ), 7-15 Year U.S. Treasury Index (TENZ) and Foreign Currency Strategy Active (FORX) ETFs all disappear on September 30, 2015. “This date may be changed without notice at the discretion of the Trust’s officers.” Their average daily trading volume was just a thousand or two shares.

Ramius Hedged Alpha Fund (RDRAX) will undergo “termination, liquidation and dissolution,” all on September 4, 2015.

A reminder to all muddled Lutherans: your former Aid Association for Lutherans (AAL) Funds and/or your former Lutheran Brother Funds, which merged to become your Thrivent Funds, aren’t exactly thriving. The latest evidence is the decision to merge Small Value and Small Growth into Thrivent Small Cap, Mid Cap Value and Mid Cap Growth into Thrivent Mid Cap Stock and Natural Resources and Technology into Thrivent Large Cap Growth

Toroso Newfound Tactical Allocation Fund (TNTAX) has closed and will liquidate at the end of September, 2015. The promise of riches driven by “a proprietary, volatility-adjusted and momentum driven model” never quite panned out for this tiny fund-of-ETFs.

In Closing . . .

Warren Buffett turned 85 on Sunday. I can only hope that we all have his wits and vigor when we reach a similar point in our lives. To avoid copyright infringement and the risk of making folks ears bleed, I didn’t sing “happy birthday” but I celebrate his life and legacy.

As you read this, I’m boring at bunch of nice folks in Cincinnati to tears. I was asked to chat with the folks at the Ultimus Fund Services conference about growth in uncertain times. It’s a valid concern and I’ll try to share in October the gist of the argument. In late August, a bright former student of mine, Jonathon Woo, had me visit with some of his colleagues in the mutual fund research group at Edward Jones. I won’t tell you what I said to them (it was all Q&A and I rambled) but what I should have said about how to learn (in this case about the prospect of an individual mutual fund) from talking with others. And, if the market doesn’t scramble things up again, we’ll finally run the stuff that’s been in the pipeline for two months.

We’re grateful to the folks who continue to support the Observer, both financially and with an ongoing stream of suggestions. Thanks to Tyler for his recent advice, and to Rick, Kirk, William, Beatrice, Courtney, Thaddeus, Kevin, Virginia, Sunil, and Ira (a donor advised fund – that’s so cool) for their financial support. You guys rock! A number of planning firms have also reaching out with support, kind words and suggestions. So thanks to Wealth Care, LLC, Evergreen Asset Management, and Integrity Financial Planning. I especially need to track down our friends at Evergreen Asset Management for some beta testing questions. Too, we can’t forget the folks whose support comes from the use of our Amazon Affiliate link. Way to go on finding those back-to-school supplies!

I don’t mean to frighten anyone before Halloween, but historically September and October are the year’s most volatile months. Take a deep breath, try to do a little constructive planning on quiet days, pray for the Cubs (as I write, they’re in third place but with a record that would have them leading four of the six MLB divisions), cheer for the Pirates, laugh at the dinner table and remember that we’re thinking of you.

As ever,

We work hard to minimize the stress we place on the planet and its systems. We travel very little and, when we do, we purchase carbon offsets through

We work hard to minimize the stress we place on the planet and its systems. We travel very little and, when we do, we purchase carbon offsets through  The Observer is hosted by GreenGeeks. They host over 300,000 sites and are distinguished for the environmental commitment. They promise “if we pull 1X of power from the grid we purchase enough wind energy credits to put back into the grid 3X of power having been produced by wind power. Your website hosted with GreenGeeks will be powered by 300% wind energy, making your website’s carbon footprint negative.”

The Observer is hosted by GreenGeeks. They host over 300,000 sites and are distinguished for the environmental commitment. They promise “if we pull 1X of power from the grid we purchase enough wind energy credits to put back into the grid 3X of power having been produced by wind power. Your website hosted with GreenGeeks will be powered by 300% wind energy, making your website’s carbon footprint negative.” We think of food banks as something folks need mid-winter, which misses the fact that many children receive their only hot meal of the day (sometimes, only meal of the day) as part of their school’s breakfast and lunch programs. That’s led some charities to characterize summer as “

We think of food banks as something folks need mid-winter, which misses the fact that many children receive their only hot meal of the day (sometimes, only meal of the day) as part of their school’s breakfast and lunch programs. That’s led some charities to characterize summer as “

It’s easy.

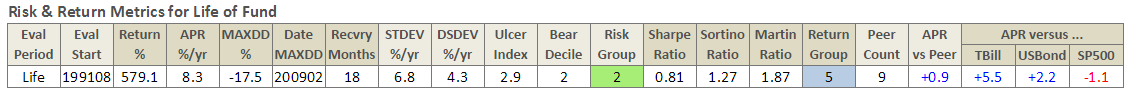

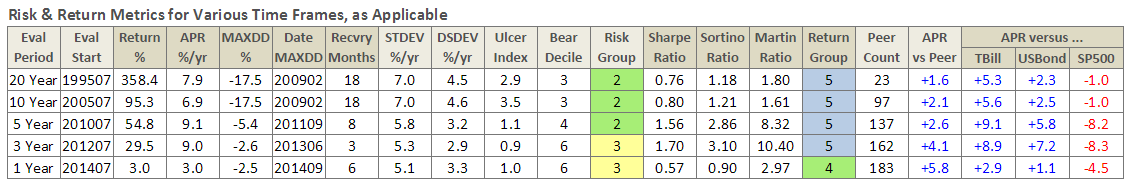

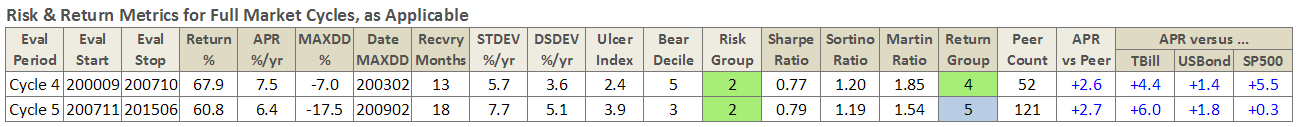

It’s easy. James Balanced: Golden Rainbow (ticker symbol: GLRBX). The fund invests about half of its money in stocks and half in bonds, though the managers have the ability to become much more cautious or much more daring if the situation calls for it. Mostly they’ve been cautious, successful investors; they’ve made about 6.9% per year over the past decade, with less risk than their peers. During the very bad period in 2008, the stock market fell about 40% while Golden Rainbow lost less than 6%. The fund’s operating expenses average 1.01% per year, which is low. Starting an account requires a monthly investment of $500 or a one-time investment of $2,000.

James Balanced: Golden Rainbow (ticker symbol: GLRBX). The fund invests about half of its money in stocks and half in bonds, though the managers have the ability to become much more cautious or much more daring if the situation calls for it. Mostly they’ve been cautious, successful investors; they’ve made about 6.9% per year over the past decade, with less risk than their peers. During the very bad period in 2008, the stock market fell about 40% while Golden Rainbow lost less than 6%. The fund’s operating expenses average 1.01% per year, which is low. Starting an account requires a monthly investment of $500 or a one-time investment of $2,000. TIAA-CREF Lifestyle Conservative (TSCLX). TIAA-CREF’s traditional business has been providing low cost, conservatively managed investment accounts for people working at hospitals, universities and other non-profit organizations. Today they manage about $630 billion for investors. The Lifestyle Conservative Fund invests about 40% of its money in stocks and 60% in bonds. It does that by investing in other TIAA-CREF mutual funds that specialize in different parts of the stock or bond market. This fund has only been around for four years but most of the funds in which it invests have long, solid records. The fund’s operating expenses average 0.87% per year, well below average. Starting an account requires a monthly investment of $100 or a one-time investment of $2,500.

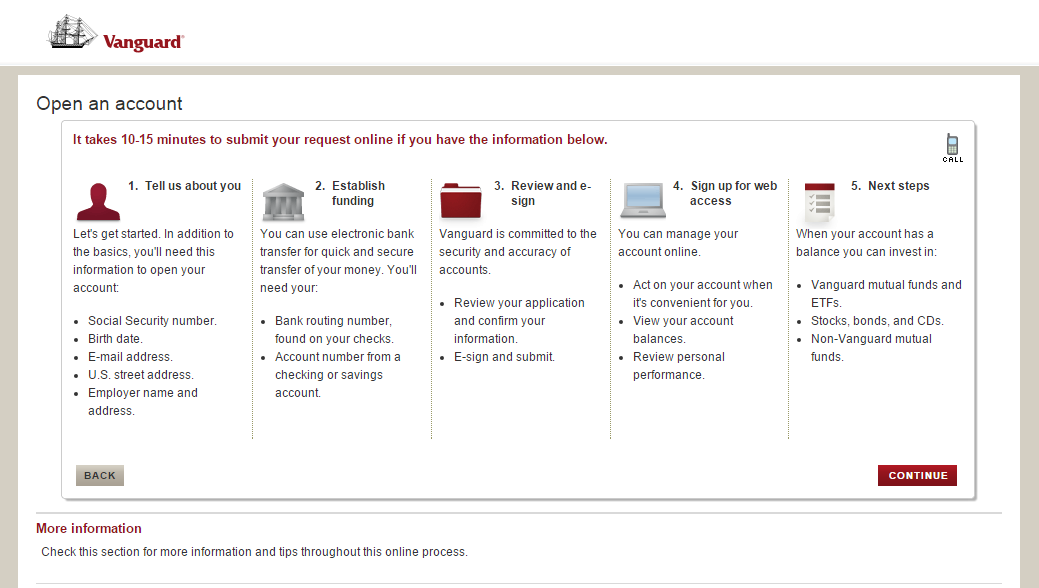

TIAA-CREF Lifestyle Conservative (TSCLX). TIAA-CREF’s traditional business has been providing low cost, conservatively managed investment accounts for people working at hospitals, universities and other non-profit organizations. Today they manage about $630 billion for investors. The Lifestyle Conservative Fund invests about 40% of its money in stocks and 60% in bonds. It does that by investing in other TIAA-CREF mutual funds that specialize in different parts of the stock or bond market. This fund has only been around for four years but most of the funds in which it invests have long, solid records. The fund’s operating expenses average 0.87% per year, well below average. Starting an account requires a monthly investment of $100 or a one-time investment of $2,500. Vanguard STAR (VGSTX). Vanguard has a unique corporate structure; it’s owned by the shareholders in its funds. As a result, it has been famous for keeping its expenses amazingly low and its standards consistently high. They now manage over $3 trillion, which represents a powerful vote of confidence on the part of millions of investors. STAR is designed to be Vanguard’s first fund for beginning investors. STAR invests about 60% of its money in stocks and 40% in bonds. It does that by investing in other Vanguard funds. Over the past 10 years, it has earned about 6.8% per year and it lost 25% in 2008. The fund’s operating expenses are 0.34% per year, which is very low. Starting an account requires a one-time investment of $1,000.

Vanguard STAR (VGSTX). Vanguard has a unique corporate structure; it’s owned by the shareholders in its funds. As a result, it has been famous for keeping its expenses amazingly low and its standards consistently high. They now manage over $3 trillion, which represents a powerful vote of confidence on the part of millions of investors. STAR is designed to be Vanguard’s first fund for beginning investors. STAR invests about 60% of its money in stocks and 40% in bonds. It does that by investing in other Vanguard funds. Over the past 10 years, it has earned about 6.8% per year and it lost 25% in 2008. The fund’s operating expenses are 0.34% per year, which is very low. Starting an account requires a one-time investment of $1,000. by Edward A. Studzinski

by Edward A. Studzinski Despite being the summer, there was no slowdown in activity around liquid alternatives in July. Seven new alternative mutual funds and ETFs came to market, bringing the year to date total to 79. And in addition to the new fund launches, private equity titans Apollo and Carlyle both announced plans to launch alternative mutual funds later this year. For Carlyle, this is their second time to the dance and this time

Despite being the summer, there was no slowdown in activity around liquid alternatives in July. Seven new alternative mutual funds and ETFs came to market, bringing the year to date total to 79. And in addition to the new fund launches, private equity titans Apollo and Carlyle both announced plans to launch alternative mutual funds later this year. For Carlyle, this is their second time to the dance and this time

Triad Small Cap Value Fund (TSCVX) launched on June 29, 2015. Triad promises a concentrated but conservative take on small cap investing.

Triad Small Cap Value Fund (TSCVX) launched on June 29, 2015. Triad promises a concentrated but conservative take on small cap investing.