THIS IS AN UPDATE OF THE FUND PROFILE ORIGINALLY PUBLISHED IN June 2011. YOU CAN FIND THAT ORIGINAL PROFILE HERE.

Objective and strategy

The fund seeks long-term capital appreciation and income, while trying to maintain a sense of “prudent investment risk over the long-term.” RNCOX is a “balanced” fund with several twists. First, it adjusts its long-term asset allocation in order to take advantage of tactical allocation opportunities. Second, it invests primarily in a mix of closed-end mutual funds and ETFs. Lipper’s designation, as a Global Macro Allocation fund, provides a more realistic comparison than Morningstar’s Moderate Allocation assignment.

Adviser

RiverNorth Capital Management. RiverNorth is a Chicago-based firm, founded in 2000 with a distinctive focus on closed-end fund arbitrage. They have since expanded their competence into other “under-followed, niche markets where the potential to exploit inefficiencies is greatest.” RiverNorth advises three limited partnerships and the four RiverNorth funds: RiverNorth/Oaktree High Income (RNOTX), Equity Opportunity (RNEOX), RiverNorth/DoubleLine Strategic Income (RNDLX) and this one. They manage about $3.0 billion through limited partnerships, mutual funds and employee benefit plans.

Managers

Patrick Galley and Stephen O’Neill. Mr. Galley is RiverNorth’s President, Chairman and Chief Investment Officer. He also manages all or parts of three RiverNorth funds with Mr. O’Neill. Before joining RiverNorth Capital in 2004, he was a Vice President at Bank of America in the Global Investment Bank’s Portfolio Management group. Mr. O’Neill specializes in qualitative and quantitative analysis of closed-end funds and their respective asset classes. Prior to joining RiverNorth in 2007, he was an Assistant Vice President at Bank of America in the Global Investment Bank’s Portfolio Management group. Messrs Galley and O’Neill manage about $1.7 billion in other pooled assets.

Strategy capacity and closure

The fund holds almost as much money as it did when it closed to new investors. The managers describe themselves as “comfortable now” with the assets in the fund. Three factors would affect their decision to close it again. First, market volatility makes them predisposed to stay open. That volatility feeds the CEF discounts which help drive market neutral alpha. Second, strong relative performance will draw “hot money” again, which they’d prefer to avoid dealing with. Finally, they prefer a soft close which would leave “a runway” for advisors to allocate to their clients.

Active share

“Active share” measures the degree to which a fund’s portfolio differs from the holdings of its benchmark portfolio. High active share indicates management which is providing a portfolio that is substantially different from, and independent of, the index. An active share of zero indicates perfect overlap with the index, 100 indicates perfect independence. RiverNorth does not calculate active share, though the distinctiveness of its portfolio implies a very high level of activity.

Management’s stake in the fund

Messrs. Galley and O’Neill each have between $100,000 – 500,000 in the fund. Three of the four independent trustees have relatively modest ($10,000-100,000) investments in the fund while one has no investments with RiverNorth.

Opening date

December 27, 2006. The fund added an institutional share class (RNCIX) on August 11, 2014.

Minimum investment

$5,000, reduced to $1,000 for IRAs.

Expense ratio

3.56% on assets of $45.2 million, as of July 2023. The expense ratio is heavily influenced by the pass-through expense from the closed-end funds in which it invests.

Comments

Normally the phrase “balanced fund” causes investor’s eyes to grow heavy and their heads to nod. Traditional balanced funds make a good living by being deadly dull. They have a predictable asset allocation, 60% equities and 40% bonds. And they execute that allocation with predictable investments in blue-chip domestic companies and investment grade bonds. Their returns are driven more by expenses and avoiding mistakes than any great talent.

Morningstar places RiverNorth Core Opportunity there. They don’t belong. Benchmarking them against the “moderate allocation” group is far more likely to mislead than inform.

RiverNorth’s strategy involves pursuing both long- and short-term opportunities. They set an asset allocation then ask whether they see more opportunities in executing the strategy through closed-end funds (CEFs) or low-cost ETFs. While both CEFs and ETFs trade like stocks, CEFs are more like active mutual funds. Because their price is set by investor demands, a share of a CEF might trade for more than the value of its holdings when greed seizes the market or far less than the value of its holdings when fear does. The managers’ implement their asset allocation with CEFs when they’re available at irrational discounts; otherwise, they use low-cost ETFs.

In general, the portfolio is 50-70% CEFs. Mr. Galley says that it’s rare to go over 70% but they did invest 98% in CEFs toward the end of during the market crisis. That move primed their rocket-like rise in 2009: their 49% gain more than doubled their peer group’s and was nearly double the S&P 500’s 26%. It’s particularly impressive that the fund’s loss in 2008 was no greater than its meek counterparts.

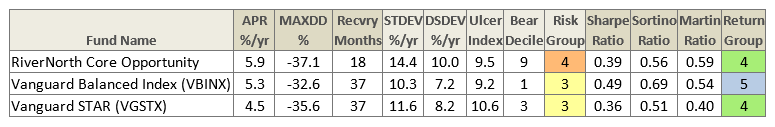

That illustrates an essential point: this isn’t your father’s Buick. It’s distinctive and more opportunistic. Over the fund’s life, it’s handsomely rewarded its investors with outsized returns and quick bounce backs from its declines. Here’s RiverNorth’s performance against the best passive and active options at Vanguard.

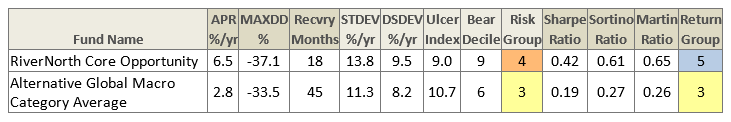

The comparison against Rivernorth’s more opportunistic peer group shows an even more stark advantage.

The fund is underwater by 3.4% in 2015, through October 30, after a ferocious October rally. That places them about 3.5% behind their Morningstar peer group. The short-term question for investors is whether that lag represents a failure of RiverNorth’s strategy or another example of the portfolio-as-compressed-spring? The managers observe that CEF discounts widen to levels not seen since the financial crisis. That’s led them to place 76% of the portfolio in CEFs, many that use leverage in their own portfolios. That’s well above their historic norms and implies a considerable confidence on their part.

Bottom Line

Core Opportunity offers unique opportunity, more suited to investors comfortable with an aggressive strategy than a passive one. Since inception, the fund has outperformed the S&P 500 with far less volatility (beta = 76) and has whomped similarly-aggressive funds. That long-term strength comes at the price of being out of step with, and more volatile than, traditional 60/40 funds. That’s making them look weak now. If history is any guide, that judgment is subject to a dramatic and sudden reversal. It’s well worth investigating.