Dear friends,

Welcome to the dog days.

“Dog days” didn’t originally have anything to do with dogs, of course. It derived from the ancient belief shared by Egyptians, Greeks and Romans that summer weather was controlled by Sirius, the Dog Star. Why? Because Sirius rises just at dawn in the hottest, most sultry months of the year.

FreeImages.com/superburg

In celebration of the fact that the dog days of summer have arrived and you should be out by the pool with family, we’re opening our annual summer-weight issue with some good news.

MFO is a charity case

And you just thought we were a basket case!

As a matter of economic and administrative necessity, the Observer has always been organized as a sole proprietorship. We’re pleased to announce that, in June, our legal status changed. On June 29, we became a non-profit corporation (Mutual Fund Observer, Inc.) under Iowa law. On July 6, the Internal Revenue Service “determined that [we’re] exempt from federal income tax under Internal Revenue Code Section 501(c)(3).”

Why does that matter?

- It means that all contributions to the Observer are now tax-deductible. We’ve always taken a moment to send hand-written thanks to folks for their support; going forward, we’ll include a card for their tax records.

- It means that any contribution made on or after May 27, 2015 is retroactively tax deductible. After this issue is live and we’ve handled the monthly cleanup chores, we’ll begin sending the appropriate documents to the folks involved.

- It means we’re finding ways to become a long-term source of commentary and analysis.

It’s no secret that the Observer’s annual operating budget is roughly equivalent to what some … hmmmm, larger entities in the field spend on paperclips. That works as long as highly talented individuals work pro bono (technically pro bono publico, literally, “for the public good”). As we turn more frequently to outsiders, whether for access to fund data or programming services, we’ll need to strengthen our finances. These changes are part of that effort.

Other changes in the media environment lead us to conclude that there’s an increasingly important role for an independent, authoritative public voice speaking for (and to) smaller investors and smaller fund firms. At the June Morningstar conference, there was quiet, nervous conversation about the prospect that The Wall Street Journal staff had been forced to re-apply for their own jobs. The editors of the Journal announced, in June, a plan to reduce personal finance coverage in the paper:

We will be scaling back significantly our personal finance team, though we will continue to provide high quality reporting and commentary on topics of personal financial interest to our readers.

These closures and realignments do not reflect on the quality of the work done by these teams but simply speak to the pressing need to become more focused as a newsroom on areas we believe are ripe for growth.

We will be better-equipped and better able to exploit the opportunities that exist in the fastest growing parts of our business: with enhanced and improved coverage of the news that we know translates into additional circulation and long-term growth.

Details of the restructuring emerged in July. At base, resources are being moved from serving individual investors to serving financial advisors. While that’s good for the Journal’s profits and might be good for the 300,000 or so financial advisers in the country (a number that’s dropping steadily), it represents a further shift from serious service to the rest of us. (Thanks to Ari Weinberg for leading us to good coverage of these changes.)

Being a non-profit makes sense for us. It allows us to maintain our independence and focus (a nonprofit corporation is legally owned by all the people of a state and chartered to serve the public interest).

The Observer has always tried to act responsibly and our new legal status reflects that commitment. In addition to that whole “giving voice to the voiceless” thing, we consciously try to act as good stewards. By way of examples:

We work hard to minimize the stress we place on the planet and its systems. We travel very little and, when we do, we purchase carbon offsets through Carbonfund. Carbonfund allows individuals or businesses to calculate the amount of carbon released by their activities and to offset them with investments in a variety of climate-friendly projects from building renewable power systems to recapturing the methane produced in landfills and helping farmers control the effects of animal containment facilities. They’re a non-profit, seem to generate consistently high ratings from folks who assess their operations and write sensibly. In general, we tend to be carbon-negative.

We work hard to minimize the stress we place on the planet and its systems. We travel very little and, when we do, we purchase carbon offsets through Carbonfund. Carbonfund allows individuals or businesses to calculate the amount of carbon released by their activities and to offset them with investments in a variety of climate-friendly projects from building renewable power systems to recapturing the methane produced in landfills and helping farmers control the effects of animal containment facilities. They’re a non-profit, seem to generate consistently high ratings from folks who assess their operations and write sensibly. In general, we tend to be carbon-negative.

The Observer is hosted by GreenGeeks. They host over 300,000 sites and are distinguished for the environmental commitment. They promise “if we pull 1X of power from the grid we purchase enough wind energy credits to put back into the grid 3X of power having been produced by wind power. Your website hosted with GreenGeeks will be powered by 300% wind energy, making your website’s carbon footprint negative.”

The Observer is hosted by GreenGeeks. They host over 300,000 sites and are distinguished for the environmental commitment. They promise “if we pull 1X of power from the grid we purchase enough wind energy credits to put back into the grid 3X of power having been produced by wind power. Your website hosted with GreenGeeks will be powered by 300% wind energy, making your website’s carbon footprint negative.”

We think of food banks as something folks need mid-winter, which misses the fact that many children receive their only hot meal of the day (sometimes, only meal of the day) as part of their school’s breakfast and lunch programs. That’s led some charities to characterize summer as “the hungriest time of the year” for children. There’s a really worthy federal summer meals program, but it only reaches 15% of the kids who are fed during the regular school year.

We think of food banks as something folks need mid-winter, which misses the fact that many children receive their only hot meal of the day (sometimes, only meal of the day) as part of their school’s breakfast and lunch programs. That’s led some charities to characterize summer as “the hungriest time of the year” for children. There’s a really worthy federal summer meals program, but it only reaches 15% of the kids who are fed during the regular school year.

We use the same approach here as we do in investing: make a commitment and automate it. On the last day of every month, there’s an automatic transfer from our checking to the River Bend FoodBank. It’s a good group that spends under 3% on administration. Our contribution is not major – enough to provide 150 meals for hungry families – but it’s the sort of absolutely steady inflow that allows an organization to help folks and do a meaningful planning.

All of which is, by the way, exciting and terrifying.

If you’d like to support the Mutual Fund Observer, you have two options:

- To make a tax deductible contribution, please use our PayPal button on the right, or visit our Support Us page for our address to mail a check. You’ll receive a thank you with a receipt for your tax records.

- We also strongly encourage everyone who shops at Amazon, now America’s largest retailer (take that Walmart!), to bookmark our Amazon link. Every time you buy anything at Amazon, using our link, we get a small percentage of the sale, and it costs you nothing.

Finding a family’s first fund

I suspect that very few of our readers need advice on selecting a “first fund.” But I’m very certain that you know people who are, or should be, starting their first investment account. Our faithful research associate David Welsch is starting down that road: first “real” job, the prospect of his first modest apartment and the need for starting to put money aside. The contractor who did a splendid job rebuilding my rotted deck admitted that up until now he’s had to spend everything he’s made to support his family and company, but now is in a place to start (just start) thinking about the future. A friend had a passing conversation with a grocery cashier (we’re in the Midwest, this sort of stuff happens a lot) who was saddened by an elderly friend struggling with money in his 70s; my friend suggested that the young lady ought to begin a small account for her own sake. “I know,” she sighed, “I knooow.” For the young men and women serving in the armed forces and making $20,000-30,000 a year, the challenge is just as great.

Mostly they think it’s hard, don’t know where to start, don’t know who to ask and can’t imagine it will make a difference. And you’re feeling a bit guilty because you haven’t been as much help as you’d like.

Here’s what to do. Read the article below. Print it out (we’ve even created a nice .pdf of it for you). Hand it to a young friend with the simple promise, “this will make it easy to get started.”

![]()

“The journey of a thousand miles begins …

with one step.” Lao-Tzu.

Good news: you’re ready to take that step and we’re here to help make it happen. We’re going to guide you through the process of setting up your first investment account. There are only two things you need to know:

It’s easy and

It will make a big difference. You’ll be glad you did it.

It’s easy. A mutual fund is simply a way of sharing with others in the costs of hiring a professional to make investments on your behalf. Mostly your manager will invest in either stocks or bonds. Stocks give you part-ownership in a company (Apple, Google, Ford); if the value of the company rises, the value of your shares will rise too. Some companies will soar; others will crash so it’s wiser for investors to invest broadly in a bunch of companies than to try to find individual winners. Bonds are ways for governments or companies to borrow money and pay it back, with interest, over time. “Iffy” borrowers have to pay a bit more in interest, so you earn a bit more on loans to them; high quality borrowers pay you a bit less but you can be pretty sure that they’ll repay their borrowings promptly and fully.

It’s easy. A mutual fund is simply a way of sharing with others in the costs of hiring a professional to make investments on your behalf. Mostly your manager will invest in either stocks or bonds. Stocks give you part-ownership in a company (Apple, Google, Ford); if the value of the company rises, the value of your shares will rise too. Some companies will soar; others will crash so it’s wiser for investors to invest broadly in a bunch of companies than to try to find individual winners. Bonds are ways for governments or companies to borrow money and pay it back, with interest, over time. “Iffy” borrowers have to pay a bit more in interest, so you earn a bit more on loans to them; high quality borrowers pay you a bit less but you can be pretty sure that they’ll repay their borrowings promptly and fully.

Over very long periods, stocks make more money than bonds but, over shorter periods, stocks can lose a lot more money than bonds. Your best path is to own some of each, rather than betting entirely on one or the other. If you look back over the last 65 years, you can see the pattern: stocks provide the most long-term gain but also the greatest short-term pain.

| Average performance, 1949-2013 | 80% stocks / 20% bonds & cash | 60% stocks / 40% bonds & cash | 40% stocks / 60% bonds & cash |

| Average annual gain | 10.5% | 9.3 | 8.1 |

| How often did it lose money? | 14 times | 12 times | 11 times |

| How much did it lose in bad years? | 8.8% | 6.4% | 3.0% |

| How much did it lose in its worst year? | 28.7% | 20.4% | 11.5% |

How do you read the table? As you double your exposure to stocks, going from 40% to 80%, you add 2.4% to your average annual return. That’s good, though the gain is not huge. At the same time, you increase by 30% the chance of finishing a year in the red and you triple the size of the loss you might expect.

We searched through about 7000 mutual funds on your behalf, looking for really good first funds. We looked for four virtues:

- They can handle stormy weather. All investments rise and fall; we found ones that won’t fall far and long.

- They can handle sunny weather. Over time, things get better. The world’s economy grows, people have better lives and the world’s a richer place. We found funds that earned good returns over time so you could benefit from that growth.

- They don’t overcharge you. Your mutual fund is a business with bills to pay; as a shareholder in the fund you help pay those bills. Paying under 1% a year is reasonable. While 1% doesn’t seem like a lot, if your fund only makes 6% gains, you’d be returning 17% of those profits to the manager.

- They require only a small investment to get started. As low as $50 a month seemed within reach of folks who were determined to get started.

Getting the account set up requires about 20 minutes, a two page form and knowing your checking account numbers.

It will make a difference. How much can $50 a month get you? In one year, not so much. Over time, a surprising lot. Here’s how much your account might grow using three pretty conservative rates of return (5-7% per year) and four holding periods.

| 5% | 6% | 7% | |

| One year | $ 667 | 670 | 673 |

| Ten years | 7,850 | 8,284 | 8,750 |

| Twenty years | 20,700 | 23,268 | 26,250 |

| Forty years | 76,670 | 100,120 | $ 132,100 |

You read that correctly: if you’re a young investor able to put $50 a month away between now and retirement, just that contribution might translate to $100,000 or more.

Two things to remember: (1) Patience is your ally. Markets can be scary; sometimes they’re going down and you think they’ll never go up again. But they do. Always have. Here’s how to win: set up your account with a small automatic monthly investment, check in on it every year or so, add a bit more as your finances improve and go enjoy your life. (2) Small things add up over time. In the example above, if your fund pays you just 1% more it makes a 30% difference in how much you’ll have over the long term. Buying a fund with low expenses can make that 1% difference all by itself, and so can a small increase in the percentage of your account invested in stocks.

Three funds to consider. The August 2015 issue of Mutual Fund Observer, available free on-line, provides a more complete discussion of each of these funds. In addition to our own explanation of them, we’ve provided links to the form you’d need to complete to open an account, the most recent fact sheet provided by the fund company (it’s a two page “highlights of our fund” document) and a link to the fund’s homepage.

James Balanced: Golden Rainbow (ticker symbol: GLRBX). The fund invests about half of its money in stocks and half in bonds, though the managers have the ability to become much more cautious or much more daring if the situation calls for it. Mostly they’ve been cautious, successful investors; they’ve made about 6.9% per year over the past decade, with less risk than their peers. During the very bad period in 2008, the stock market fell about 40% while Golden Rainbow lost less than 6%. The fund’s operating expenses average 1.01% per year, which is low. Starting an account requires a monthly investment of $500 or a one-time investment of $2,000.

James Balanced: Golden Rainbow (ticker symbol: GLRBX). The fund invests about half of its money in stocks and half in bonds, though the managers have the ability to become much more cautious or much more daring if the situation calls for it. Mostly they’ve been cautious, successful investors; they’ve made about 6.9% per year over the past decade, with less risk than their peers. During the very bad period in 2008, the stock market fell about 40% while Golden Rainbow lost less than 6%. The fund’s operating expenses average 1.01% per year, which is low. Starting an account requires a monthly investment of $500 or a one-time investment of $2,000.

Why consider it? Very low starting investment, very cautious managers, very solid returns.

| Profile | Fact Sheet | Application |

TIAA-CREF Lifestyle Conservative (TSCLX). TIAA-CREF’s traditional business has been providing low cost, conservatively managed investment accounts for people working at hospitals, universities and other non-profit organizations. Today they manage about $630 billion for investors. The Lifestyle Conservative Fund invests about 40% of its money in stocks and 60% in bonds. It does that by investing in other TIAA-CREF mutual funds that specialize in different parts of the stock or bond market. This fund has only been around for four years but most of the funds in which it invests have long, solid records. The fund’s operating expenses average 0.87% per year, well below average. Starting an account requires a monthly investment of $100 or a one-time investment of $2,500.

TIAA-CREF Lifestyle Conservative (TSCLX). TIAA-CREF’s traditional business has been providing low cost, conservatively managed investment accounts for people working at hospitals, universities and other non-profit organizations. Today they manage about $630 billion for investors. The Lifestyle Conservative Fund invests about 40% of its money in stocks and 60% in bonds. It does that by investing in other TIAA-CREF mutual funds that specialize in different parts of the stock or bond market. This fund has only been around for four years but most of the funds in which it invests have long, solid records. The fund’s operating expenses average 0.87% per year, well below average. Starting an account requires a monthly investment of $100 or a one-time investment of $2,500.

Why consider it? The most conservative stock-bond mix in the group, solid lineup of funds it invests in, low expenses and a rock-solid advisor.

| Profile | Fact Sheet | Application |

Vanguard STAR (VGSTX). Vanguard has a unique corporate structure; it’s owned by the shareholders in its funds. As a result, it has been famous for keeping its expenses amazingly low and its standards consistently high. They now manage over $3 trillion, which represents a powerful vote of confidence on the part of millions of investors. STAR is designed to be Vanguard’s first fund for beginning investors. STAR invests about 60% of its money in stocks and 40% in bonds. It does that by investing in other Vanguard funds. Over the past 10 years, it has earned about 6.8% per year and it lost 25% in 2008. The fund’s operating expenses are 0.34% per year, which is very low. Starting an account requires a one-time investment of $1,000.

Vanguard STAR (VGSTX). Vanguard has a unique corporate structure; it’s owned by the shareholders in its funds. As a result, it has been famous for keeping its expenses amazingly low and its standards consistently high. They now manage over $3 trillion, which represents a powerful vote of confidence on the part of millions of investors. STAR is designed to be Vanguard’s first fund for beginning investors. STAR invests about 60% of its money in stocks and 40% in bonds. It does that by investing in other Vanguard funds. Over the past 10 years, it has earned about 6.8% per year and it lost 25% in 2008. The fund’s operating expenses are 0.34% per year, which is very low. Starting an account requires a one-time investment of $1,000.

Why consider it? The lowest expenses in the group, one-stop access to many of the best funds offered by the firm many consider the best in the world.

| Profile | Fact Sheet | Application |

We’re targeting funds for you whose portfolios are somewhere around 40-60% stocks. Why so cautious? You might be thinking, “hey, these are Old People funds! I’m young. I’ve got time. I want to invest in stocks, exciting 3D printing stocks!” Owning too many stocks is bad for your financial health. Imagine that you were really good, invested steadily and built a $10,000 portfolio. How would you feel if someone broke in, stole $5,000 from it and the police said that they thought it might take five to ten years to solve the crime and get your money back? In the meantime, you were out of luck. That’s essentially what happens from time to time in the stock market and it’s really discouraging. Those 3D printing stocks that seem so exciting? They’ve lost two-thirds of their value in the past year, many will never recover.

If you balance your portfolio, you get much better odds of success. Remember Table One, which gives you the tradeoff? Balancing gives you a really good bargain, especially for the first step in your journey.

So what’s the next step? It’s easy. Pick the one that makes the most sense to you. Take 20 minutes to fill out a short account set-up form online. Tell them if you want to start by investing a little money or a lot. Fill it out, choose the option that says “reinvest my gains, please!” and go back to doing the stuff you really enjoy.

![]()

Two bits of follow-up for our regular readers. You might ask, why didn’t we tell folks to start with a six-month emergency fund? Two reasons. First, they are many good personal finance steps folks need to take: build a savings account, avoid eating out frequently, pay down high interest rate credit card debt and all. Since we’re not personal finance specialists, we decided to start where we could add value. Second, a conservative fund can act as a supplement to a savings account; if you’ve got a conservative $5,000 that will still hold $4,000-4,500 at the trough of a bear does provide emergency backup. In my own portfolio, I use T. Rowe Price Spectrum Income (RPSIX) and RiverPark Short-Term High Yield (RPHYX, closed) as my cash-management accounts. Both can lose money but both thump CDs and other “safe” choices most years while posting manageable losses in the worst of times.

Second, there may be other funds out there which would fit our parameters and provide a more-attractive profile than one of the three we’ve highlighted. If so, let us know at [email protected]! I’d love to follow-up next month with suggestions for other ways to help young folks who have neither the confidence nor the awareness to seek out a fully qualified financial advisor. One odd side-note: there are several “Retirement Income” funds with really good profiles; I didn’t mention them because I figured that 99% of young folks would reject them just for the name alone.

Where else might small investors turn for a second or third fund?

Once upon a time, the fund industry had faith in the discipline of average investors so they offered lots of funds with minuscule initial investments. The hope was that folks would develop the discipline of investing regularly on their own.

Oops. Not even I can manage that feat. As the industry quickly and painfully learned, if it’s not on auto-pilot, it’s not getting funded.

That’s a real loss, even if a self-inflicted one, for small investors. Nonetheless, there remain about 130 funds accessible to folks with modest budgets and the willingness to make a serious commitment to improving their finances. By my best reading, there are thirteen smaller fund families still taking the risk of getting stiffed by undisciplined investors. The families willing to waive their normal investment minimums are:

| Family | AIP minimum | Notes |

| Ariel | $50 | Four value-oriented, low turnover funds , one international fund and one global fund |

| Artisan | $50 | Fifteen uniformly great, risk-conscious equity funds, with eight still open to new investors. Artisan tends to close their funds early and a number are currently shuttered. |

| Aston funds | $50 | Aston has 27 funds covering both portfolio cores and a bunch of interesting niches. They adopted some venerable older funds and hired institutional managers to sub-advise the others. |

| Azzad | $50 | Two socially-responsible funds, one midcap and one (newer) small cap. The Azzad Ethical Fund maintains a $50 minimum for AIPs, while the minimum for the Azzad Wise Capital Fund is now $300. |

| Gabelli/GAMCO | $100 | On AAA shares, anyway. Gabelli’s famous, he knows it and he overcharges. That said, these are really solid funds. |

| Homestead | $0 | Eight funds (stock, bond, international), solid to really good performance, very fair expenses. |

| Icon | $100 | 18 funds whose “I” or “S” class shares are no-load. These are sector or sector-rotation funds. |

| James | $50 | Four very solid funds, the most notable of which is James Balanced: Golden Rainbow (GLRBX), a quant-driven fund that keeps a smallish slice in stocks |

| Manning & Napier | $25 | The best fund company that you’ve never heard of. Fourteen diverse funds, all managed by the same team. Pro-Blend Conservative (EXDAX) probably warrants a spot on the “first fund” list. |

| Parnassus | $50 | Six socially-responsible funds, all currently earn four or five stars from Morningstar. I’m particularly intrigued by Parnassus Endeavor (PARWX) which likes to invest in firms that treat their staff decently. You will need a $500 initial investment to open your account. |

| USAA | $50 | USAA primarily provides financial services for members of the U.S. military and their families. Their funds are available to anyone but you need to join USAA (it’s free) in order to learn anything about them. That said, 26 funds, so quite good. |

Potpourri

by Edward A. Studzinski

by Edward A. Studzinski

Some men are born mediocre, some men achieve mediocrity, and some men have mediocrity thrust upon them.

Joseph Heller

We are now at the seven month mark. All would not appear to be well in the investing world. But before I head off on that tangent, there are some housekeeping matters to address.

First, at the beginning of the year I suggested that the average family unit should own no more than ten mutual funds, which would cover both individual and retirement assets. When my long-suffering spouse read that, the question she asked was how many we had. I stopped counting when I got to twenty-five, and told her the results of my search. I was then told that if I was going to tell others they should have ten or less per family unit, we should follow suit. I am happy to report that the number is now down to seventeen (exclusive of money market funds), and I am aiming to hit that ten number by year-end.

Obviously, tax consequences play a big role in this process of consolidation. One, there are tax consequences you can control, in terms of whether your ownership is long-term or short-term, and when to sell. Two, there are tax consequences you can’t control, which are tied in an actively-managed fund, to the decision by the portfolio manager to take some gains and losses in an effort to manage the fund in a tax-efficient manner. At least that is what I hope they are doing. There are other tax consequences you cannot control when the fund in question’s performance is bad, leading to a wave of redemptions. The wave of redemptions then leads to forced selling of equity positions, either en masse or on a pro rata basis, which then triggers tax issues (hopefully gains but sometimes not). The problem with these unintended or unplanned for tax consequences, is that in non-retirement accounts, you are often faced with a tax bill that you have not planned for at filing time, and need to come up with a check to pay the taxes due. A very different way to control the tax consequences, especially if you are of a certain age, is to own passive index funds, whose portfolios won’t change except for those issues going into or leaving the index. Turnover and hence capital gains distributions, tend to be minimized. And since they do tend to own everything as it were, you will pick up some of the benefit of merger and acquisition activity. However, index funds are not immune to an investor panic, which leads to forced selling which again triggers tax consequences.

In this consolidation process, one of the issues I am wrestling with is what to do with money market funds, given that later this year unless something changes again, they will be allowed to “break the buck” or no longer have a constant $1 share price. My inclination is to say that cash reserves for individuals should go back into bank certificates of deposit, up to the maximum amounts of the FDIC insurance. That will work until or unless, like Europe, the government through the banks decides to start charging a negative interest rate on bank deposits. The other issue I am wrestling with is the category of balanced funds, where I am increasingly concerned that the three usual asset classes of equities, fixed income, and cash, will not necessarily work in a complementary manner to reduce risk. The counter argument to that of course, is that most people investing in a balanced (or equity fund for that matter) investment, do not have a sufficiently long time horizon, ten years perhaps being the minimum commitment. If you look at recent history, it is extraordinary how many ten year returns both for equity funds and balanced funds, tend to cluster around the 8% annualized mark.

Morningstar, revisited:

One of the more interesting lunch meetings I had around the Morningstar conference that I did not attend, was with a Seattle-based father-son team with an outstanding record to date in their fund. One of the major research tools used was, shock of shock, the Value Line. But that should not surprise people. Many of Buffet’s own personal investments were, as he relates it, arrived at by thumbing through things like a handbook of Korean stocks. I have used a similar handbook to look at Japanese stocks. One needs to understand that in many respects, the purpose of hordes of analysts, producing detailed models and exhaustive reports is to provide the cover of the appearance of adequate due diligence. Years ago, when I was back in the trust investment world, I used to have various services for sale by the big trust banks (think New York and Philadelphia) presented to me as necessary. Not necessary to arrive at good investment decisions, but necessary to have as file drawer stuffers when the regulators came to examine why a particular equity issue had been added to the approved list. Now of course with Regulation FD, rather than individual access to managements and the danger of selective disclosure of material information, we have big and medium sized companies putting on analyst days, where all investors – buy side, sell side, and retail, get access to the same information at the same time, and what they make of it is up to them.

So how does one improve the decision making process, or rather, get an investment edge? The answer is, it depends on the industry and what you are defining as your circle of competency. Let’s assume for the moment it is property and casualty reinsurance. I would submit that one would want to make a point of attending the industry meetings, held annually, in Monte Carlo and Baden-Baden. If you have even the most rudimentary of social skills, you will come away from those events with a good idea as to how pricing (rate on line) is going to be set for categories of business and renewals. You will get an idea as to whose underwriting is conservative and whose is not. And you will get an idea as to who is under-reserved for prior events and who is not. You will also get a sense as to how a particular executive is perceived.

Is this the basis for an investment decision alone? No, but in the insurance business, which is a business of estimates to begin with, the two most critical variables are the intelligence and integrity of management (which comes down from the top). What about those wonderfully complex models, forecasting interest rates, pricing, catastrophic events leading to loss ratios and the like? It strikes me that fewer and fewer people have taken sciences in high school or college, where they have learned about the Law of Significant Numbers. Or put another way, perhaps appropriately cynical, garbage in/garbage out.

Now, many of you are sitting there thinking that it really cannot be this simple. And I will tell you that the finest investment analyst I have ever met, a contemporary of mine, when he was acting as an analyst, used to do up his research ideas by hand, on one or one and a half sheets of 8 ½ by 11 paper.

There would be a one or two sentence description of the company and lines of business, a simple income statement going out maybe two years beyond this year, several bullet points as to what the investment case was, with what could go right (and sometimes what could go wrong), and that was generally it, except for perhaps a concluding “Reasons to Own. AND HIS RETURNS WERE SPECTACULAR FOR HIS IDEAS! People often disbelieve me when I tell them that, so luckily I have saved one of those write-ups. My point is this – the best ideas are often the simplest ideas, capable of being presented and explained in one or two declarative sentences.

What’s coming?

And finally, for a drop of my usual enthusiasm for the glass half empty. There is a lot of strange stuff going on in the world at the moment, much of it not going according to plan, for governments, central banks, and corporations as one expected in January. Commodity prices are collapsing. Interest rates look to go up in this country, perhaps sooner rather than later. China may or may not have lost control of its markets, which would not augur well for the rest of us. I will leave you with something else to ponder. The “dot.com” crash in 2000 and the financial crisis of 2007-2008-2009 were water-torture events. Most of the people running money now were around for them, and it represents their experiential reference point. The October 1987 crash was a very different animal – you came in one day, and things just headed down and did not stop. Derivatives did not work, portfolio insurance did not work, and there was no liquidity as everyone panicked and tried to go through the door at once. Very few people who went through that experience are still actively running money. I bring this up, because I worry that the next event (and there will be one), will not necessarily be like the last two, where one had time to get out in orderly fashion. That is why I keep emphasizing – do not put at risk more than you can afford to lose without impacting your standard of living. Investors, whether professional or individual, need to guard mentally against always being prepared to fight the last war.

Top developments in fund industry litigation

![]() Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized, searchable, and filtered as never before. For the complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized, searchable, and filtered as never before. For the complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

New Lawsuit

- A new excessive-fee lawsuit targets five State Farm LifePath target-date funds. Complaint: “The nature and quality of Defendant’s services to the LifePath Funds in exchange for close to half of the net management fee are extremely limited. Indeed, it is difficult to determine what management services, if any, [State Farm] provides to the LifePath Funds, since virtually all of the investment management functions of the LifePath Funds are delegated” to an unaffiliated sub-adviser. (Ingenhutt v. State Farm Inv. Mgmt. Corp.)

Orders

- A court gave its final approval to the $27.5 million settlement of an ERISA class action that had challenged the selection of proprietary Columbia and RiverSource funds for Ameriprise retirement accounts. (Krueger v. Ameriprise Fin., Inc.)

- In a decision on motion to dismiss, a court allowed a plaintiff to add new Morgan Keegan defendants to previously allowed Securities Act claims regarding four closed-end funds, rejecting the new defendants’ statute-of-limitations argument. (Small v. RMK High Income Fund, Inc.)

- Further extending the fund industry’s losing streak, a court allowed excessive-fee allegations regarding five SEI funds to proceed past motion to dismiss: “While the allegations in the Amended Complaint may well not survive summary judgment, they are sufficient to survive the motion-to-dismiss stage.” (Curd v. SEI Invs. Mgmt. Corp.)

- A court mostly denied the motion by Sterling Capital to dismiss a fraud lawsuit filed by its affiliated bank’s customer. (Bowers v. Branch Banking & Trust Co.)

- A court consolidated excessive-fee litigation regarding the Voya Global Real Estate Fund. (In re Voya Global Real Estate Fund S’holder Litig.)

Briefs

- Parties filed their oppositions to dueling motions for summary judgment in fee litigation regarding eight Hartford mutual funds. Plaintiffs’ section 36(b) claims, first filed in 2011, previously survived Hartford’s motion to dismiss. The summary judgment papers are unavailable on PACER. (Kasilag v. Hartford Inv. Fin. Servs. LLC; Kasilag v. Hartford Funds Mgmt. Co.)

The Alt Perspective: Commentary and news from DailyAlts.

Despite being the summer, there was no slowdown in activity around liquid alternatives in July. Seven new alternative mutual funds and ETFs came to market, bringing the year to date total to 79. And in addition to the new fund launches, private equity titans Apollo and Carlyle both announced plans to launch alternative mutual funds later this year. For Carlyle, this is their second time to the dance and this time they have picked TCW as their partner. Carlyle purchased a majority interest in TCW early 2013 and will wisely be leveraging the firm’s distribution into the retail market. In a similar vein, Apollo has partnered with Ivy and will look to Ivy for distribution leadership.

Despite being the summer, there was no slowdown in activity around liquid alternatives in July. Seven new alternative mutual funds and ETFs came to market, bringing the year to date total to 79. And in addition to the new fund launches, private equity titans Apollo and Carlyle both announced plans to launch alternative mutual funds later this year. For Carlyle, this is their second time to the dance and this time they have picked TCW as their partner. Carlyle purchased a majority interest in TCW early 2013 and will wisely be leveraging the firm’s distribution into the retail market. In a similar vein, Apollo has partnered with Ivy and will look to Ivy for distribution leadership.

Apollo and Carlyle’s plans follow on the heals of KKR’s partnership with Altegris for the launch of a private equity offering for the “mass affluent” earlier this year, and Blackstone’s partnership with Columbia on a multi-alternative fund, also announced earlier this year. Distribution is key, and the private equity shops are starting to figure that out.

Asset Flows

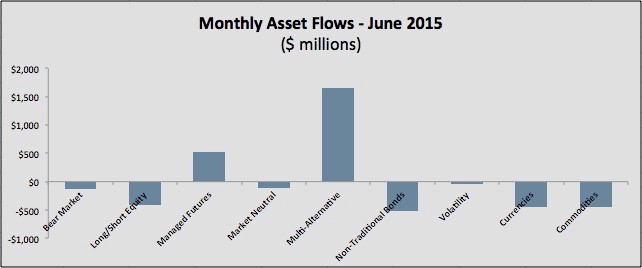

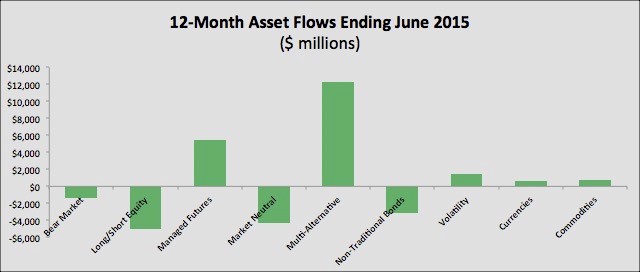

Asset flows into liquid alternative funds (mutual funds and ETFs combined) continued on their positive streak for the sixth consecutive month, with total flows in June of more than $2.2 billion according to Morningstar’s June 2015 U.S. Asset Flows Update report.

For the fifth consecutive month, multi-alternative funds have dominated inflows into liquid alternatives as investors look for a one-stop shop for their alternatives allocation. Both long/short equity and market neutral have experienced outflows every month in 2015, while non-traditional bonds has had outflows in 5 of 6 months this year. Quite a change from 2014 when both long/short equity and non-traditional bonds ruled the roost.

Twelve month flows look fairly consistent with June’s flows with multi-alternative and managed futures funds leading the way, and long/short equity, market neutral and non-traditional bonds seeing the largest outflows.

Trends and Research

There were several worthwhile publications distributed in July that provide more depth to the liquid alts conversation. The firsts is the annual Morningstar / Barron’s survey of financial advisors, which notes that advisors are more inclined to allocate to liquid alternatives than they were last year. A summary of the results can be found here: Morningstar and Barron’s Release National Alternatives Survey Results.

In addition to the survey, both Morgan Stanley and Goldman Sachs published research papers on liquid alternatives. Both papers are designed to help investors better understand the category of investments and how to use them in a portfolio:

- Morgan Stanley Publishes Liquid Alts Investment Primer

- Goldman Sachs: Viewing Liquid Alternatives Through a Hedge Fund Lens

Educational Videos

Finally, we published a series of video interviews with several portfolio managers of leading alternative mutual funds, as well as a three part series with Keith Black, Managing Director of Exams and Curriculum of the CAIA Association. All of the videos can be viewed here: DailyAlts Videos. More will be on the way over the next couple weeks, so check back periodically.

Observer Fund Profiles

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

This month’s profiles are unusual, in that they’re linked to our story on “first funds.” Two of the three are much larger and older than we normally cover, but they make a strong case for themselves.

James Balanced: Golden Rainbow (GLRBX). The fund invests about half of its money in stocks and half in bonds, though the managers have the ability to become much more cautious or much more daring if the situation calls for it. Mostly they’ve been cautious. Their professed goal is “to seek to grow our clients’ assets…while stressing the preservation of principal, and the reduction of risk.” With a loss of just 6% in 2008, they seem to be managing that balance quite well. FYI, this profile was written by our colleague Charles Boccadoro and is substantially more data-rich than most.

TIAA-CREF Lifestyle Conservative (TSCLX). TIAA-CREF’s traditional business has been providing low cost, conservatively managed investment accounts for people working at hospitals, universities and other non-profit organizations. Lifestyle Conservative is a fund-of-funds with about 40% of its money in stocks and 60% in bonds. They’ve got a short track record, but substantially below-average expenses and a solid lineup of funds in which to invest.

Vanguard STAR (VGSTX). STAR is designed to be Vanguard’s first fund for beginning investors. It invests only in Vanguard’s actively-managed funds, with a portfolio that’s about 60% of its money in stocks and 40% in bonds. The fund’s operating expenses are 0.34% per year, which is very low. The combination of Vanguard + low minimum has always had it on my short-list of funds for new investors.

We delayed publication of July’s fund profile while we finished some due diligence. Sorry ‘bout that but we’d rather get the facts right than rush to print.

Eventide Healthcare & Life Sciences (ETNHX): Morningstar’s 2015 conference included a laudatory panel celebrating “up and coming” funds, including the five star, $2 billion Eventide Gilead. And yet as I talked with the Eventide professionals the talk kept returning to the fund that has them more excited, Healthcare & Life Sciences. The fund’s combination of a strong record with a uniquely qualified manager compels a closer look.

Launch Alert

Triad Small Cap Value Fund (TSCVX) launched on June 29, 2015. Triad promises a concentrated but conservative take on small cap investing.

Triad Small Cap Value Fund (TSCVX) launched on June 29, 2015. Triad promises a concentrated but conservative take on small cap investing.

The fund is managed by John Heldman and David Hutchison, both of Triad Investment Management. The guys both have experience managing money for larger firms, including Bank of America, Deutsche Bank and Neuberger Berman. They learned from the experience, but one of the things they learned was that “we’d had enough of working for larger firms … having our own shop means we have a much more flexible organization and we’ll be able do what’s right for our investors.” Triad manages about $130 million for investors, mostly through separate accounts.

The Adviser analyzes corporate financial statements, management presentations, specialized research publications, and general news sources specifically focused on three primary aspects of each company: the degree of business competitive strength, whether management is capable and co-invested in the business, and the Adviser’s assessment of the attractiveness of a security’s valuation.

The guys approach is similar to Bernie Horn and the Polaris team: invest only where you think you can meaningfully project a firm’s future, look for management that makes smart capital allocation decisions, make conservative assumptions and demand a 50% discount to fair value.

That discipline means that some good companies are not good investments. Firms in technology and biotech, for example, are subject to such abrupt disruption of their business models that it’s impossible to have confidence in a three to five year projection. Other fundamentally attractive firms have simply been bid too high to provide any margin of safety.

They’re looking for 30-45 names in the portfolio, most of which they’ve followed for years. The tiny fund and the larger private strategy are both fully invested now despite repeated market highs. While they agree that “there aren’t hundreds of great opportunities, not a huge amount at all,” the small cap universe is so large that they’re still finding attractive opportunities.

The minimum initial purchase is $5,000. The opening expense ratio is 1.5% with a 2.0% redemption fee on shares held under 90 days.

The fund’s website is still pretty rudimentary but there’s a good discussion of their Small Cap Equity strategy available on the advisor’s site. For reasons unclear, Mornignstar’s profile of the fund aims you to the homepage of the Wireless Fund (WIREX). Don’t go there, it won’t help.

Funds in Registration

There are 17 new funds in registration this month. Funds in registration with the SEC are not available for sale to the public and the advisors are not permitted to talk about them, but a careful reading of the filed prospectuses gives you a good idea of what interesting (and occasionally appalling) options are in the pipeline. Funds currently in registration will generally be available for purchase right around the end of September, which would allow the new funds to still report a full quarter’s worth of results in 2015.

The most important new registrations are a series of alternatives funds about to be launched by TCW. They’ve partnered with several distinguished sub-advisers, including our friends at Gargoyle who, at our first reading of the filings, are offered the best options including both Gargoyle Hedged Value and, separately, the unhedged Gargoyle long portfolio as a free-standing fund.

Manager Changes

There are 45 manager changes, at least if you don’t mind a bit of cheating on our part. Wyatt Lee’s arrival as co-manager marginally affected all the funds in the T. Rowe Price retirement series but we called that just one change. None are game-changers.

Updates

The Board at LS Opportunity Fund (LSOFX) just announced their interim plan for dealing with the departure of the fund’s adviser. Jim Hillary of Independence Capital Asset Partners and formerly of Marsico Capital, LLC ran LSOFX side-by-side with his ICAP hedge fund from 2010-2015. It’s been an above-average performer, though not a stunning one. DailyAlts reports that Mr. Hillary has decided to retire and return the hedge fund’s assets to its investors. The LS Board appointed Prospector Partners LLC to sub-advise the fund for now; come fall, they’ll ask shareholders for authority to add sub-advisors.

The Prospector folks come with excellent credentials but a spotty record. The managers have a lot of experience managing funds for White Mountains Insurance, T. Rowe Price (both Capital Appreciation and Growth Stock) and Neuberger Berman (Genesis). Prospector Capital Appreciation (PCAFX) was positioned as a nimbler version of T. Rowe Price Capital Appreciation (PRWCX), run by Cap App’s long-time manager. The fund did well during the meltdown but has trailed 99% of its peers since. Prospector Opportunity (POPFX) has done better, also by limiting losses in down markets at the price of losing some of the upside in rising ones.

The Board of Trustees has approved a change Zeo Strategic Income’s investment objective. Right now the fund seeks “income and moderate capital appreciation.” Effective August 31, 2015, the Fund’s investment objective will be to seek “low volatility and absolute returns consisting of income and moderate capital appreciation.” From our conversations with the folks at Zeo, that’s not a change; it’s an editorial clarification and a symbolic affirmation of their core values.

Briefly Noted . . .

Effective August 1, Value Line is imposing a 0.40% 12(b)1 fee on a fund that hasn’t been launched yet (Centurion) but then offers a 0.13% 12(b)1 waiver for a net 12(b)1 fee of 0.27%. Why? At the same time, they’ve dropped fees on their Core Bond Fund (VAGIX) by two basis points (woo hoo!). Why? Because the change drops them below the 1.0% expense threshold (to 0.99%), which might increase the number of preliminary fund screens they pass. Hard to know whether that will help: over the five years under its current management, the fund has been a lot more volatile (bigger maximum drawdown but much faster recovery) and more profitable than its peers; the question is whether, in uncertain times, investors will buy that combo – even after the generous cost reduction.

Thanks, as always, to The Shadow’s irreplaceable assistance on tracking down the following changes!

SMALL WINS FOR INVESTORS

Effective August 1, 2015, Aspiriant Risk-Managed Global Equity Fund’s (RMEAX) investment advisory fee will be reduced from 0.75% to 0.60%.

CLOSINGS (and related inconveniences)

Invesco International Growth Fund (AIIEX) will close to new investors on October 1, 2015. Nothing says “we’re serious” quite like offering a two-month window for hot money investors to join the fund. The $9 billion fund tends to be a top-tier performer when the market is falling and just okay otherwise.

Tweedy, Browne Global Value Fund II (TBCUX) has closed to new investors. Global Value II is the sibling to Global Value (TBGVX). The difference between them is that Global Value hedges its currency exposure and Global Value II does not. I don’t anticipate an extended closure. Global II has only a half billion in assets, against $9.3 billion in Global, so neither the size of the portfolio nor capacity constraints can explain the closure. A likelier explanation is the need to manage a large anticipated inflow or outflow caused, conceivably, by gaining or losing a single large institutional client.

OLD WINE, NEW BOTTLES

Effective July 9, 2015, the 3D Printing and Technology Fund (TDPNX) becomes the 3D Printing, Robotics and Technology Fund. The fact that General Electric is the fund’s #6 holding signals the essential problem: there simply aren’t enough companies whose earnings are driven by 3D printing or robotics to populate a portfolio, so firms where such earnings are marginal get drawn in.

Effective September 9, 2015, Alpine Accelerating Dividend Fund (AAADX) is getting renamed Alpine Rising Dividend Fund. The prospectus will no longer target “accelerating dividends” as an investment criterion. It’s simultaneously fuzzier and clearer on the issue of portfolio turnover: it no longer refers to the prospect of 150% annual turnover (the new language is “higher turnover”) but is clear that the strategy increases transaction costs and taxable short-term gains.

Calvert Tax-Free Bond Fund (CTTLX) has become Calvert Tax-Free Responsible Impact Bond Fund. “Impact investing” generally refers to the practice of buying the securities of socially desirable enterprises, for example urban redevelopment administrations, as a way of fostering their mission. At the start of September, Calvert Large Cap Value (CLVAX) morphs into Calvert Global Value Fund. The globalization theme continues with the change of Calvert Equity Income Fund (CEIAX) to Calvert Global Equity Income Fund. Strategy tweaks follow.

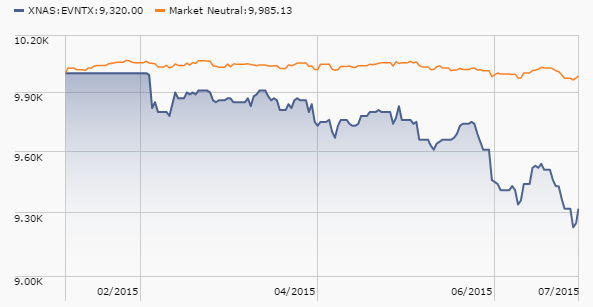

On September 22, 2015, Castlerigg Equity Event and Arbitrage Fund (EVNTX) becomes Castlerigg Event Driven and Arbitrage Fund. In addition to the name change, Castlerigg made what appear to be mostly editorial changes to the statement of investment strategies. It’s not immediately clear that either will address this:

Eaton Vance Small-Cap Value Fund has been renamed Eaton Vance Global Small-Cap Fund (EAVSX). Less value, more global. The fund trails more than 80% of its peers over pretty much every trailing measurement period. They’ve added Aidan M. Farrell as a co-manager. Good news: he’s managed Goldman Sachs International Small Cap (GISSX). Bad news: it’s not very good, either.

Effective July 13, 2015 Innovator Matrix Income® Fund became Innovator McKinley Income Fund (IMIFX), with the appointment of a new sub-advisor, McKinley Capital Management, LLC. The fund’s strategy was to harvest income primarily from high income securities which included master limited partnerships and REITs. The “income” part worked and the fund yields north of 10%. The “put the vast majority of your money into energy and real estate” has played out less spectacularly. The new managers bring a new quantitative model and modest changes in the investment strategy, but the core remains “income from equities.”

OFF TO THE DUSTBIN OF HISTORY

Effective October 23, 2015, Alpine Equity Income Fund (the “Fund”) and Alpine Transformations Fund (the “Fund”) will both be absorbed by Alpine Accelerating Dividend Fund. At the same time Alpine Cyclical Advantage Property Fund (the “Fund”) disappears into Alpine Global Infrastructure Fund (the “Acquiring Fund”).

Fidelity Fifty merged into Fidelity Focused Stock Fund (FTQGX) on July 24, 2015, just in case you missed it.

Forward is liquidating their U.S. Government Money Fund by the end of August.

MassMutual Select Small Company Growth Fund will be liquidated by September 28, 2015.

Neuberger Berman Global Thematic Opportunities Fund will disappear around August 21, 2015.

RiverNorth Managed Volatility Fund (RNBWX) is scheduled for a quick exit, on August 7, 2015.

The $1.2 million Stone Toro Long/Short Fund (STVHX) will be liquidated on or about August 19, 2015 following the manager’s resignation from the advisor.

UBS Equity Long-Short Multi-Strategy Fund (BMNAX) takes its place in history alongside the carrier pigeon on September 24, 2015. Advisors don’t have to explain why they’re liquidating a fund. In general, either the fund sucks or nobody is buying it. No problem. I do think it’s bad practice to go out of your way to announce that you’re about to explain your rationale and then spout gibberish.

Rationale for liquidating the Fund

Based upon information provided by UBS … the Board determined that it is in the best interests of the Fund and its shareholders to liquidate and dissolve the Fund pursuant to a Plan of Liquidation. To arrive at this decision, the Board considered factors that have adversely affected, and will continue to adversely affect, the ability of the Fund to conduct its business and operations in an economically viable manner.

Our rationale is that we “considered factors that have adversely affected, and will continue to adversely affect” the fund. Why is that even worth saying? The honest statement would be “we’re in a deep hole, the fund has been losing money for the advisor for five year and even the stronger performance of the past 18 months hasn’t made a difference so we’re cutting our losses.”

In Closing . . .

In the months ahead we’ll add at least a couple new voices to the Observer’s family. Sam Lee, a principal of Severian Asset and former editor of Morningstar’s ETF Investor, would like to profile a fund for you in September. Leigh Walzer, a principal of Trapezoid LLC and a former member of Michael Price’s merry band at the Mutual Series funds, will join us in October to provide careful, sophisticated quantitative analyses of the most distinguished funds in a core investment category.

In the months ahead we’ll add at least a couple new voices to the Observer’s family. Sam Lee, a principal of Severian Asset and former editor of Morningstar’s ETF Investor, would like to profile a fund for you in September. Leigh Walzer, a principal of Trapezoid LLC and a former member of Michael Price’s merry band at the Mutual Series funds, will join us in October to provide careful, sophisticated quantitative analyses of the most distinguished funds in a core investment category.

We’ve mentioned the development of a sort of second tier at the Observer, where we might be able to provide folks with access to some interesting data, Charles’s risk-sensitive fund screener and such. We’re trying to be very cautious in talking about any of those possibilities because we hate over-promising. But we’re working hard to make good stuff happen. More soon!

Our September issue will start with the following argument: it’s not time to give up on managers who insist on investing in Wall Street’s most despised creature: the high-quality, intelligently managed U.S. corporation. A defining characteristic of a high-quality corporation is the capital allocation decisions made by its leaders. High-quality firms invest intelligently, consistently, successfully, in their futures. Those are “capital expenditures” and investors have come to loathe them because investing in the future thwarts our desire to be rich, rich, rich, now, now, now. In general I loathe the editorial pages of The Wall Street Journal since they so often start with an ideologically mandated conclusion and invent the necessary supporting evidence. William Galston’s recent column, “Hillary gets it right on short-termism” (07/29/2015) is a grand exception:

Too many CEOs are making decisions based on short-term considerations, regardless of their impact on the long-run performance of their firms.

Laurence Fink is the chairman of BlackRock … expressed his concern that “in the wake of the financial crisis, many companies have shied away from investing in the future growth of their companies,” choosing instead to reduce capital expenditures in favor of higher dividends and increased stock buybacks.

His worries rest on a sound factual foundation. For the 454 companies listed continuously in the S&P 500 between 2004 and 2013, stock buybacks consumed 51% of net income and dividends an additional 35%, leaving only 14% for all other purposes.

It wasn’t always this way. As recently as 1981, buybacks constituted only 2% of the total net income of the S&P 500. But when economist William Lazonick examined the 248 firms listed continuously in this index between 1984 and 2013, he found an inexorable rise in buybacks’ share of net income: 25% in the 1984-1993 decade; 37% in 1994-2003; 47% in 2004-13. Between 2004 and 2013, some of America’s best-known corporations returned more than 100% of their income to shareholders through buybacks and dividends.

He cites a 2005 survey of CEOs, 80% of whom would cut R&D and 55% would avoid long-term capex if that’s what it took to meet their quarterly earnings expectations. We’ve been talking with folks like David Rolfe of Wedgewood, Zac Wydra of Beck, Mack and others who are taking their lumps for refusing to play along. We’ll share their argument as well as bring our modestly-delayed story on the Turner funds, Sam’s debut, and Charles’ return.

We’ll look for you.