At the time of publication, this fund was named JOHCM International Select Fund,

Objective and strategy

The fund seeks long-term capital appreciation by investing in a compact portfolio of developed and developing markets stocks. The strategy combines fundamental analysis of individual equities with a top-down overlay which shapes country and sector weights. At the level of individual securities, the managers use a growth-at-a-reasonable-price; they characterize it as “a core investment style with a modest growth tilt.” They target firms with three characteristics:

- positive earnings surprises

- sustainably high or increasing return on equity, and

- attractive valuations.

At the country and sector level, they look for “green lights” in four areas:

- fundamentals

- valuations,

- beta, and

- price trend.

Those inquiries include questions about currency trends. They do not hedge their currency exposure. The portfolio holds around 30 equally-weighted positions. They are not hesitant “to weed out the losers.”

Adviser

J O Hambro Capital Management (JOHCM) is an investment boutique headquartered in London, but with offices in Singapore, New York and Boston. They were founded in 2001 and entered the U.S. market in 2009. As of March 2015, they managed $27.3 billion of assets for clients worldwide. Their US operations had $6.4 billion in AUM, with $3.1 billion in seven mutual funds.

Manager

Christopher Lees and Nudgem Richyal. Mr. Lees joined JOHCM in 2008 after 20 years with Barings Asset Management where he was, among other things, Lead Global High Alpha Manager. Mr. Richyal also joined JOHCM in 2008 from Barings where he ran large global resources and Latin American equity portfolios. Lees and Richyal have been working together for more than 12 years. They manage about $15 billion in assets together, including the much younger, smaller and less accessible Global Equity Fund (JOGEX/JOGIX).

Strategy capacity and closure

$8 billion. As of May, 2015, the fund had about $2.8 billion in assets but the strategy, which is also manifested in separate accounts, was about twice that. In response, the advisor slated a “soft close” for July 2015. They would prefer to avoid a “hard close” but haven’t foreclosed that option. They anticipate reopening only if “we experienced significant redemptions, or if market conditions changed dramatically.”

Active share

94.2. “Active share” measures the degree to which a fund’s portfolio differs from the holdings of its benchmark portfolio. High active share indicates management which is providing a portfolio that is substantially different from, and independent of, the index. An active share of zero indicates perfect overlap with the index, 100 indicates perfect independence. An active share of 94.2 is extremely high for a fund with a large cap portfolio.

Management’s stake in the fund

None, which is understandable since the managers are British and the fund’s only open to U.S. investors. The managers do invest in the strategy through a separate vehicle but we do not know the extent of that investment.

Opening date

July 29, 2009 for the institutional class, March 31, 2010 for the retail class.

Minimum investment

$2,000 for Class II retail shares, $25,000 for Class I institutional shares.

Expense ratio

1.21% for investor shares and 0.98% for institutional shares on assets of $5.9 billion, as of July 2023.

Comments

It’s hard to find fault with JOHCM Select International. As of 31 March 2015, the five-year-old fund has the best performance of any international large growth portfolio:

|

1 year |

Top 1% (rank #1 of 339 funds) |

|

3 year |

Top 1% (rank #1 of 293 funds) |

|

5 year |

Top 1% (rank #1 of 277 funds) |

|

(Morningstar rankings for Class I shares) |

|

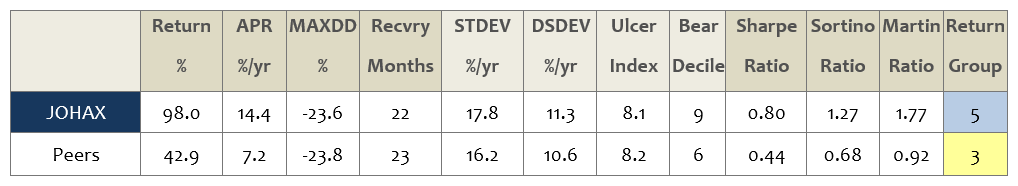

Remarkably, those returns have not come at the expense of heightened volatility. Here’s the Observer’s risk-return profile for JOHAX’s performance against its international large-growth peers since inception.

Here’s the interpretation:

Here’s the interpretation:

- JOHAX has made rather more than twice as much as its peers; 98% total since inception, which comes to 14.4% per year.

- Raw volatility is in-line with its peers; the maximum drawdown, peak-back-to-peak recovery time, the Ulcer Index (which measures a combination of the depth and length of a drawdown) and downside deviation are not noticeably higher than its peers.

- Measures of the risk-return trade-off (the Sharpe, Sortino and Martin ratios) are all uniformly positive.

What about that “bear decile”? On face, it’s bad: the fund has been among the worst 20% of performers during “bear market months.” In reality, it’s somewhere between inconsequential and positive. “Bear markets months” are measured by the movement of the S&P 500, which isn’t the benchmark here, and there have been only eight such months in the fund’s 60 months of existence. So, arguably inconsequential. And it’s potentially positive: JOHAX has such a high degree of independence that it sometimes falls when its benchmark is rising (three months) and rises when its benchmark is falling (3X) and it sometimes falls substantially more (3X) or substantially less (7X) than its benchmark.

JOHAX has thereby earned the highest possible ratings from Morningstar (Five Stars, but no analyst rating because they’re off Morningstar’s radar), Lipper (Lipper Leader, not that anyone really notices, for Total Return and Consistent Returns) and the Observer (it’s a Great Owl, which means it has top-tier risk-adjusted returns than its peers in every trailing measurement period).

How do they do it?

Good question. The portfolio is very distinctive. It currently holds about 30 names, which makes it the most compact international large-growth portfolio on the market and one of the 10 most compact international large cap portfolios overall. The shares are all equally-weighted, which is both rare and useful.

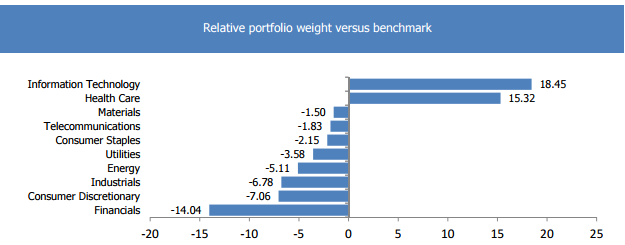

They claim to be benchmark agnostic, and that’s reflected in their sector and country weights. The fund’s most recent portfolio report shows huge divergences from its benchmark in most industry sectors.

Similarly, their regional allocations are distinctive. The average international large cap fund has twice as much in Europe as in Asia; JOHCM weights them equally, at about 42% each. That Asian overweight is likely to become much more pronounced in the near term. When they close out existing positions, they sometimes just add the proceeds to their existing names. As of mid-2015, however, they’re reallocating toward Japan and emerging Asia, where all of their top-down indicators are turning positive.

They describe Japan as “one of the cheapest developed markets in the world, [which] has finally embarked upon significant Western-style corporate restructuring, which is driving some of the fastest-growing earnings revisions and returns on equity in the world.” One spur for the change was the creation of a Nikkei 400 ROE index, which tracks companies “with high appeal for investors, which meet requirements of global investment standards, such as efficient use of capital and investor-focused management perspectives.” They point to tool-maker Amada as emblematic of the dramatic changes, and substantial price appreciation, possible once Japanese corporate leaders decide to reorient their capital policies in ways (the issuance of dividends and stock buybacks) that are shareholder-friendly. Amada failed to be included in the initial index, which led management to rethink and reorient.

They are unwilling to stick with stocks which are deteriorating; they repeated invoke the phrase “weeding out the losers,” which they describe as “selling stocks that were broken fundamentally and technically.” Their process seems to find a fair number of losers, with turnover running between 50-80%. That’s about in-line with comparable funds.

The managers believe they have “an idiosyncratic approach to stock picking that means [they] tend to look in parts of the market largely ignored by more traditional growth investors.” All of the available statistical evidence seems to validate that claim.

Bottom Line

Before you rush to join the party, consider three caveats:

- Independence comes with a price: when you’re structurally out-of-step with the herd, there are going to be periods when your performance diverges sharply from theirs. There will be periods when the managers look like idiots and when you’ll feel (poorly-timed) pressure to cut and run.

- Trees don’t grow to the sky: as both Morningstar’s research and ours has demonstrated, it’s exceedingly rare for managers to decisively outperform their peers for extended periods and impossible for them to do so for much more than three consecutive years. Even Buffett’s longest win streak is just three years, which matches his longest losing streak and perpetually fuels the “has Buffett lost it?” debate.

- Closing is not a panacea: the advisor has determined that it’s in the best interests of current shareholders for the fund to restrict inflows. They’ve made that decision relatively early; they’re closing at about two-thirds of strategy capacity, which is good. Nonetheless, academic and professional research both show that performance at closed funds tends to sag. It’s not universal, but it’s a common pattern.

There are no evident red flags in the fund’s construction, management or performance. There’s an indisputably fine record at hand. Folks interested in an idiosyncratic portfolio of high growth international names should review their options quickly. Investors who are hesitant to act quickly here but can afford a high minimum might consider the team’s other U.S. fund, JOHCM Global Equity (JOGEX). It’s small, comparable to their European global fund and off to a fine start; the downside is that the minimum investment is $25,000.

Fund website

JOHCM International Select. Be patient, the navigation takes a while to get used to. If you click on the “+” in the lower right of each box, new content appears for you. There’s parallel, but slightly different, content on the webpage for the fund’s European version, JOHCM Global Select, which has a bunch US stocks since, for their perspective we are a “foreign” investment.

© Mutual Fund Observer, 2015. All rights reserved. The information here reflects publicly available information current at the time of publication. For reprint/e-rights contact us.