Originally published in March 1, 2015 Commentary

Portfolio managers Andrew Redleaf and Dr. Jason Cross, along with Whitebox Funds’ President Bruce Nordin and Mike Coffey, Head of Mutual Fund Distribution, hosted the 4th quarter conference call for their Tactical Opportunities Fund (WBMIX) on February 26. Robert Vogel and Paul Twitchell, the fund’s third and fourth portfolio managers, did not participate.

Prolific MFO board contributor Scott first made us aware of the fund in August 2012 with the post “Somewhat Interesting Tiny Fund.” David profiled its more market neutral and less tactical (less directionally oriented) sibling WBLFX in April 2013. I discussed WBMIX in the October 2013 commentary, calling the fund proper “increasingly hard to ignore.” Although the fund proper was young, it possessed the potential to be “on the short list … for those who simply want to hold one all-weather fund.”

WBMIX recently pasted its three year mark and at $865M AUM is no longer tiny. Today’s question is whether it remains an interesting and compelling option for those investors looking for alternatives to the traditional 60/40 balanced fund at a time of interest rate uncertainty and given the two significant equity drawdowns since 2000.

Mr. Redleaf launched the call by summarizing two major convictions:

- The US equity market is “expensive by just about any measure.” He noted examples like market cap to GDP or Shiller CAPE, comparing certain valuations to pre great recession and even pre great depression. At such valuations, expected returns are small and do not warrant the downside risk they bear, believing there is a “real chance of 20-30-40 even 50% retraction.” In short, “great risk in hope of small gain.”

- The global markets are fraught with risk, still recovering from the great recession. He explained that we were in the “fourth phase of government action.” He called the current phase competitive currency devaluation, which he believes “cannot work.” It provides temporary relief at best and longer term does more harm than good. He seems to support only the initial phase of government stimulus, which “helped markets avert Armageddon.” The last two phases, which included the zero interest rate policy (ZIRP), have done little to increase top-line growth.

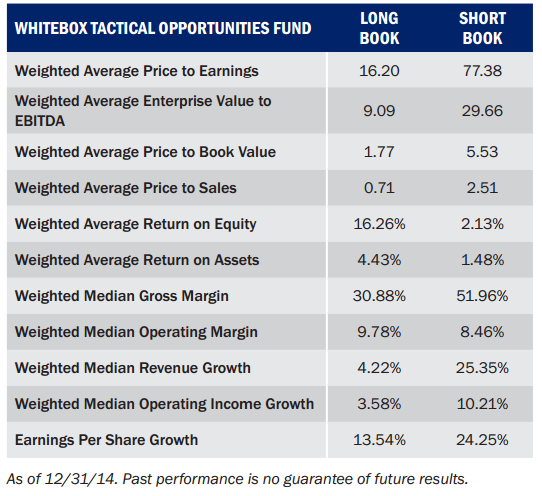

Consequently, toward middle of last year, Tactical Opportunities (TO) moved away from its long bias to market neutral. Mr. Redleaf explained the portfolio now looks to be long “reasonably priced” (since cheap is hard to find) quality companies and be short over-priced storybook companies (some coined “Never, Nevers”) that would take many years, like 17, of uninterrupted growth to justify current prices.

The following table from its recent quarterly commentary illustrates the rationale:

Mr. Redleaf holds a deep contrarian view of efficient market theory. He works to exploit market irrationalities, inefficiencies, and so-called dislocations, like “mispriced securities that have a relationship to each other,” or so-called “value arbitrage.” Consistently guarding against extreme risk, the firm would never put on a naked short. Its annual report reads “…a hedge is itself an investment in which we believe and one that adds, not sacrifices returns.”

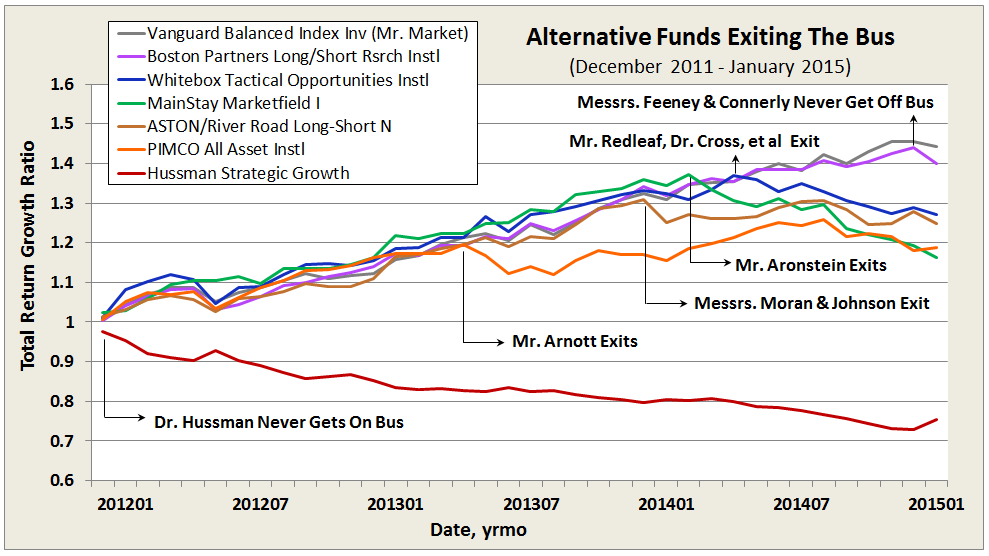

But that does not mean it will not have periods of underperformance and even drawdown. If the traditional 60/40 balanced fund performance represents the “Mr. Market Bus,” Whitebox chose to exit middle of last year. As can be seen in the graph of total return growth since WBMIX inception, Mr. Redleaf seems to be in good company.

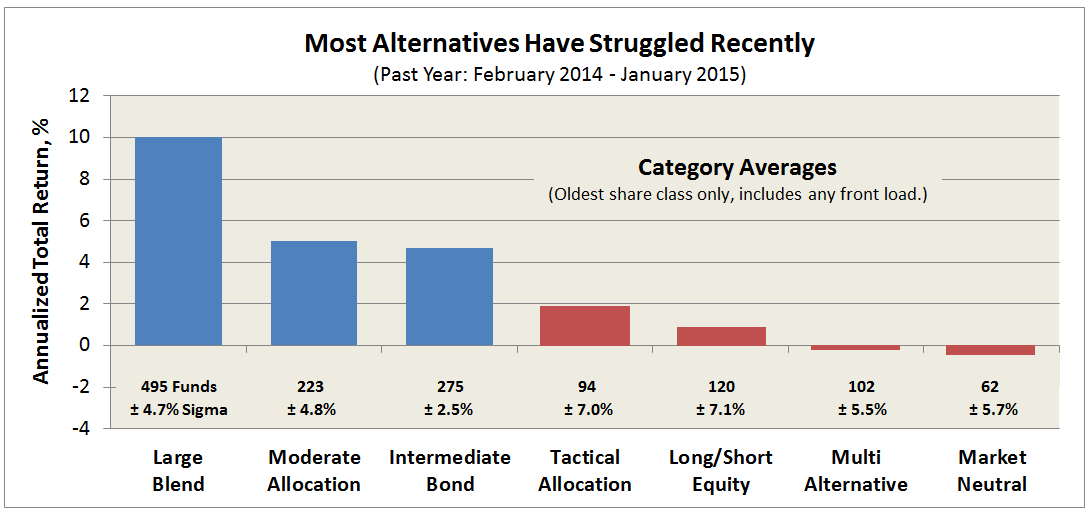

Whether the “exit” was a because of deliberate tactical moves, like a market-neutral stance, or because particular trades, especially long/short trades went wrong, or both … many alternative funds missed-out on much of the market’s gains this past year, as evidenced in following chart:

But TO did not just miss much of the upside, it’s actually retracted 8% through February, based on month ending total returns, the greatest amount since its inception in December 2011; in fact, it has been retracting for ten consecutive months. Their explanation:

Our view of current opportunity has been about 180 degrees opposite Mr. Market’s. Currently, we love what we’d call “intelligent value” while Mr. Market apparently seems infatuated with what we’d call “unsustainable growth.”

Put bluntly, the stocks we disfavored most (and were short) were among the stocks investors remained enamored with.

A more conservative strategy would call for moving assets to cash. (Funds like ASTON RiverRoad Independent Value, which has about 75% cash. Pinnacle Value at 50%. And, FPA Crescent at 44%.) But TO is more aggressive, with attendant volatilities above 75% of SP500, as it strives to “produce competitive returns under multiple scenarios.” This aspect of the fund is more evident now than back in October 2013.

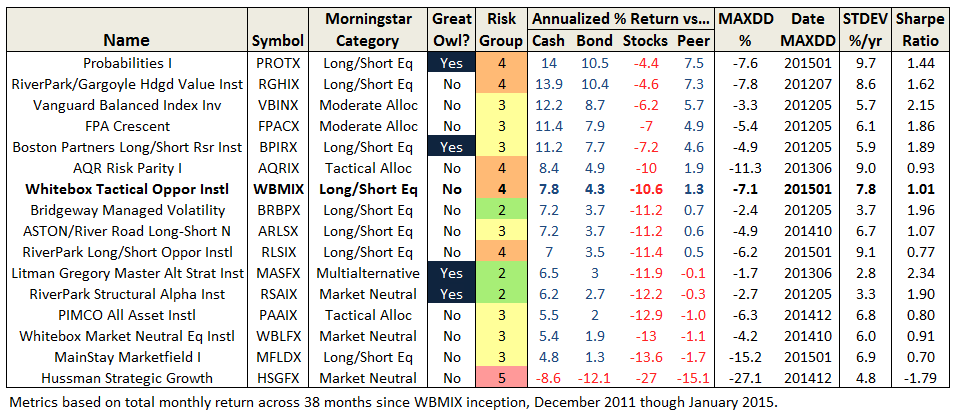

Comparing its performance since launch against other long-short peers and some notable alternatives, WBMIX now falls in the middle of the pack, after a strong start in 2012/13 but disappointing 2014:

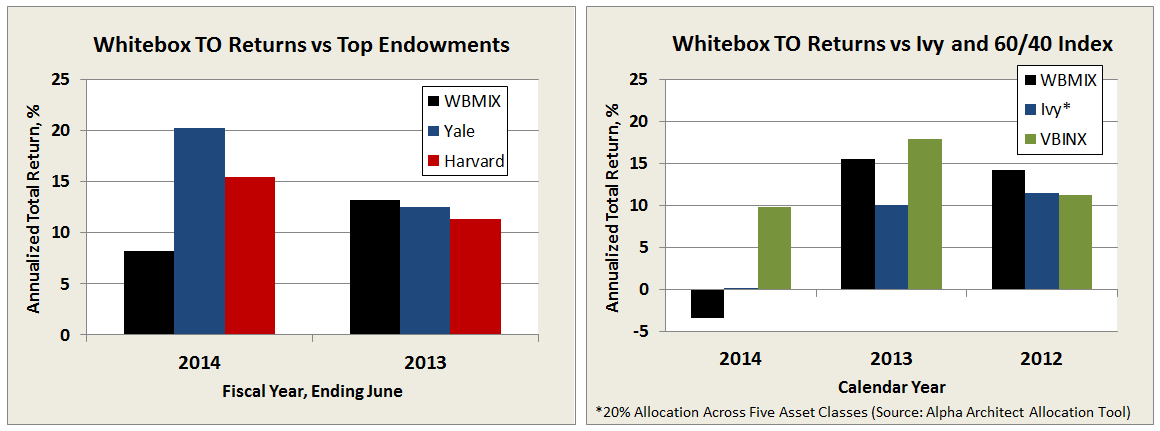

From the beginning, Mr. Redleaf has hoped TO would be judged in comparison to top endowments. Below are a couple comparisons, first against Yale and Harvard, which report on fiscal basis, and second against a simple Ivy asset allocation (computed using Alpha Architect’s Allocation Tool) and Vanguard’s 60/40 Balanced Index. Again, a strong showing in 2012/13, but 2014 was a tough year for TO (and Ivy).

Beyond strategy and performance, the folks at Whitebox continue to distinguish themselves as leaders in shareholder friendliness – a much welcomed and refreshing attribute, particularly with former hedge fund shops now offering the mutual funds and ETFs. Since last report:

- They maintain a “culture of transparency and integrity,” like their name suggests providing timely and thoughtful quarterly commentaries, published on their public website, not just for advisors. (In stark contrast to other firms, like AQR Funds, which in the past have stopped publishing commentaries during periods of underperformance, no longer make commentaries available without an account, and cater to Accredited Investors and Qualified Eligible Persons.)

- They now benchmark against SP500 total return, not just SPX.

- They eliminated the loaded advisor share class.

- Their expense ratio is well below peer average. Institutional shares, available at some brokerages for accounts with $100K minimum, have been running between 1.25-1.35%. They impose a voluntary cap of 1.35%, which must be approved by its board annually, but they have no intention of ever raising … just the opposite as AUM grows, says Mr. Coffey. (The cap is 1.6% for investor shares, symbol WBMAX.)

These ratios exclude the mandatory reporting of dividend and interest expense on short sales and acquired fund fees, which make all long/short funds inherently more expensive than long only equity funds. The former has been running about 1%, while the latter is minimal with selective index ETFs.

- They do not charge a short-term redemption fee.

All that said, they could do even better going forward:

- While Mr. Redleaf has over $1M invested directly with the fund, the most recent SAI dated 15 January 2015, indicates that the other three portfolio managers have zero stake. A spokesman for the fund defends “…as a smaller company, the partners’ investment is implicit rather than explicit. They have ‘Skin in the game,’ as a successful Tac Ops increases Whitebox’s profitability and on the other side of the coin, they stand to lose.”

David, of course, would argue that there is an important difference: Direct shareholders of a fund gain or lose based on fund performance, whereas firm owners gain or lose based on AUM.

Ed, author of two articles on “Skin in the Game” (Part I & Part II), would warn: “If you want to get rich, it’s easier to do so by investing the wealth of others than investing your own money.”

- Similarly, the SAI shows only one of its four trustees with any direct stake in the fund.

- They continue to impose a 12b-1 fee on their investor share class. A simpler and more equitable approach would be to maintain a single share class eliminating this fee and continue to charge lowest expenses possible.

- They continue to practice a so-called “soft money” policy, which means the fund “may pay higher commission rates than the lowest available” on broker transactions in exchange for research services. Unfortunately, this practice is widespread in the industry and investors end-up paying an expense that should be paid for by the adviser.

In conclusion, does the fund’s strategy remain interesting? Absolutely. Thoughtfulness, logic, and “arithmetic” are evident in each trade, in each hedge. Those trades can include broad asset classes, wherever Mr. Redleaf and team deem there are mispriced opportunities at acceptable risk.

Another example mentioned on the call is their longstanding large versus small theme. They believe that small caps are systematically overpriced, so they have been long on large caps while short on small caps. They have seen few opportunities in the credit markets, but given the recent fall in the energy sector, that may be changing. And, finally, first mentioned as a potential opportunity in 2013, a recent theme is their so-called “E-Trade … a three‐legged position in which we are short Italian and French sovereign debt, short the euro (currency) via put options, and long US debt.”

Does the fund’s strategy remain compelling enough to be a candidate for your one all-weather fund? If you share a macro-“market” view similar to the one articulated above by Mr. Redleaf, the answer to that may be yes, particularly if your risk temperament is aggressive and your timeline is say 7-10 years. But such contrarianism comes with a price, shorter-term at least.

During the call, Dr. Cross addressed the current drawdown, stating that “the fund would rather be down 8% than down 30% … so that it can be positioned to take advantage.” This “positioning” may turn out to be the right move, but when he said it, I could not help but think of a recent post by MFO board member Tampa Bay:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch

Mr. Redleaf is no ordinary investor, of course. His bet against mortgages in 2008 is legendary. Whitebox Advisers, LLC, which he founded in 1999 in Minneapolis, now manages more than $4B.

He concluded the call by stating the “path to victory” for the fund’s current “intelligent value” strategy is one of two ways: 1) a significant correction from current valuations, or 2) a fully recovered economy with genuine top-line growth.

Whitebox Tactical Opportunities is facing its first real test as a mutual fund. While investors may forgive not making money during an upward market, they are notoriously unforgiving losing money (eg., Fairholme 2011), perhaps unfairly and perhaps to their own detriment, but even over relatively short spans and even if done in pursuit of “efficient management of risk.”