Objective

Pinnacle Value seeks long-term capital appreciation by investing in small- and micro-cap stocks that it believes trade at a discount to underlying earnings power or asset values. It might also invest in companies undergoing unpleasant corporate events (companies beginning a turnaround, spin-offs, reorganizations, broken IPOs) as well as illiquid investments. It also buys convertible bonds and preferred stocks which provide current income plus upside potential embedded in their convertibility. The manager writes that “while our structure is a mutual fund, our attitude is partnership and we built in maximum flexibility to manage the portfolios in good markets and bad.”

Adviser

Bertolet Capital of New York. Bertolet has $83 million in assets under management, including this fund and one separate account.

Manager

John Deysher, Bertolet’s founder and president. From 1990 to 2002 Mr. Deysher was a research analyst and portfolio manager for Royce & Associates. Before that he managed equity and income portfolios at Kidder Peabody for individuals and small institutions. The fund added an equities analyst, Mike Walters, in January 2011 who is also serving as a sort of business development officer.

Strategy capacity and closure

The strategy’s maximum capacity has not been formally determined. It’s largely dependent on market conditions and the availability of reasonably priced merchandise. Mr. Deysher reports “if we ever reach the point where Fund inflows threaten to dilute the quality of investment ideas, we’ll close the Fund.” Given his steadfast and enduring commitment to his investment discipline, I have no doubt that he will.

Active share

99%. “Active share” measures the degree to which a fund’s portfolio differs from the holdings of its benchmark portfolio. High active share indicates management which is providing a portfolio that is substantially different from, and independent of, the index. An active share of zero indicates perfect overlap with the index, 100 indicates perfect independence. Pinnacle’s active share is typically between 98.5-99%, indicating an exceedingly high level of independence.

Management’s stake in the fund

Mr. Deysher has in excess of $1,000,000 in the fund, making him the fund’s largest shareholder. He also owns the fund’s advisor. Two of the fund’s three independent directors have invested over $100,000 in the fund while one has only a nominal investment, as of the May 2014 Statement of Additional Information.

Opening date

April Fool’s Day, 2003.

Minimum investment

$2500 for regular accounts and $1500 for IRAs. The fund is available through TD Ameritrade, Fidelity, Schwab, Vanguard and other platforms.

Expense ratio

1.32%, after waivers, on assets of $31.4 million, as of July 2023. There is a 1% redemption fee for shares held less than a year.

Comments

By any rational measure, for long-term investors Pinnacle Value is the best small cap value fund in existence.

There are two assumptions behind that statement:

- Returns matter.

- Risk matters more.

The first is self-evident; the second requires just a word of explanation. Part of the explanation is simple math: an investment that falls by 50% must subsequently rise by 100% just to break even. Another part of the explanation comes from behavioral psychology. Investors are psychologically ill-equipped to deal with risk: we hate huge losses and we react irrationally in the face of them but we refuse to believe that they’re going to happen to us, so we rarely act appropriately to mitigate them. In good times we delude ourselves into thinking that we’re not taking on unmanageable risks, then they blow up and we sit for years in cash. The more volatile the asset class, the greater the magnitude of our misbehavior.

If you’re thinking “uh-uh, not me,” you need to go buy Dan Kahneman’s Thinking, Fast and Slow (2013) or James Montier’s The Little Book of Behavioral Investing

(2010). Kahneman won the Nobel Prize for his work on the topic, Montier is an asset allocation strategist with GMO and used to be head of Global Strategy at Société Générale.

John Deysher does a better job of managing risks in pursuit of reasonable returns than any other small cap manager. Since inception, Pinnacle Value has returned about 9.9% annually.

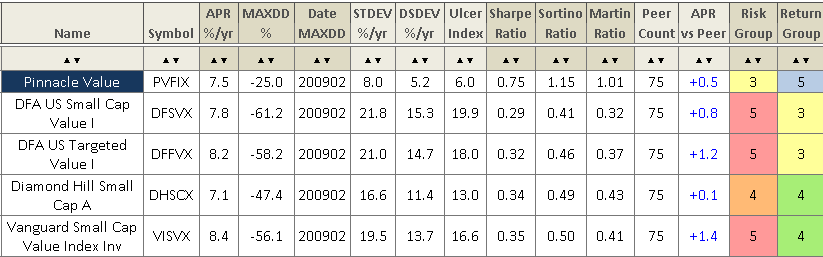

Using the Observer’s premium MultiSearch tool, we were able to assess the ten-year risk adjusted performance of every small cap value fund. Here’s what we found:

|

Pinnacle |

Coming in second |

|

|

Maximum Drawdown, i.e. greatest decline |

25%, best in class |

Heartland Value Plus, 38.9% |

|

Standard deviation |

8%, best in class |

Queens Road SCV, 15.6% |

|

Downside deviation |

5.2%, best in class |

Queens Road SCV, 10.4% |

|

Ulcer Index, which combines the magnitude of the greatest loss with the amount of time needed to recover from it |

6.0, best in class |

Perkins Small Cap Value, 9.2 |

|

Sharpe ratio, the most famous calculation which balances returns against volatility |

0.75, best in class |

0.49, AllianzGI NFJ Small-Cap Value |

|

Sortino ratio, a refinement of the Sharpe ratio that targets downside volatility |

1.15, best in class |

0.71, Perkins Small Cap Value |

|

Martin ratio, a refinement that targets returns against the size of a fund’s drawdowns |

1.01, best in class |

0.81, Perkins Small Cap Value |

Those rankings are essentially unchanged even if we look only at results for the powerful Upmarket cycle that began in March 2009: Pinnacle returned an average of 11.4% annually during the cycle, with the group’s best performance in six of the seven measures above. It’s fourth of 94 on the Martin ratio.

We reach the same conclusion when we compare Pinnacle just against Morningstar’s “Gold” rated small cap value funds and Vanguard’s SCV index. Again, these are the 10-year numbers:

So what does he actually do?

The short version: he buys very good, very small companies when their stocks are selling at historic lows. Pinnacle looks for firms with strong balance sheets since small firms have fewer buffers in a downturn than large ones do, management teams that do an outstanding job of allocating capital including their own, and understandable businesses which tends to keep him out of tech, bio-tech and other high obsolescence industries.

For each of the firms they track, they know what qualifies as the “fire sale” price of the stock, typically the lowest p/e or lowest price/book ratios at which the stock has sold. When impatient investors offer quality companies at fire sale prices, Mr. Deysher buys. When they demand higher prices, he waits.

There’s an old saying, Wall Street is the place where the patient take from the impatient. Impatient investors tend to make mistakes. We are there to exploit those mistakes. We are very patient. When we find a compelling value, we step up quickly. That reflects the fact that we’re very risk adverse, not action adverse. John Deysher

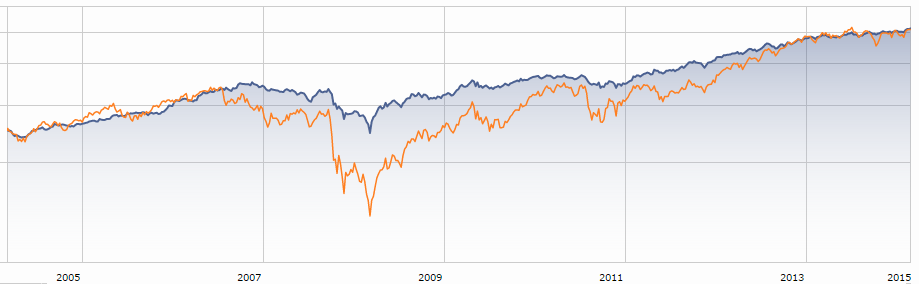

His aspiration is to be competitive in rising markets and to substantially outperform in falling ones. That’s pretty much was his ten-year performance chart shows. Pinnacle is the blue line levitating over the 2008 crash; his peer group is in orange.

Pinnacle’s portfolio is compact, at 37 names. Since fire sales are relatively rare, the fund generally sits between 40-60% in cash though he’s been willing to invest substantial amounts of that cash in a relatively short period. Many of his holdings are incredibly small; of 202 small cap value funds, only five have smaller average market caps. And many of the holdings are unusual, even by the standard of microcap value funds. Some trade over-the-counter and for some he’s virtually the only mutual fund holding them. He also owns seven closed-end funds as arbitrage plays: he bought them at vast discounts to their NAVs, those discounts will eventually revert to normal and provide Pinnacle with a source of market-neutral gain.

Bottom line

The small cap Russell 2000 index closed February 2015 at an all-time high. An investment made six years ago – March 2009 – in Vanguard’s small cap index has almost quadrupled in value. GMO calculates that U.S. small caps are the most overvalued equity class they track. If investors are incredibly lucky, prices might drift up or stage a slow, orderly decline. If they’re less lucky, small cap prices might reset themselves 40% below their current level. No one knows what path they’ll take. So Dirty Harry brings us to the nub of the matter:

You’ve gotta ask yourself one question: “Do you feel lucky?” Well, do ya, punk?

Mr. Deysher would prefer to give his investors the opportunity to earn prudent returns, sleep well at night and, eventually, profit richly from the irrational behavior of the mass of investors. Over the past decade, he’s pulled that off better than any of his peers.

Fund website

Pinnacle Value Fund. Yuh … really, John’s not much into marketing, so the amount of information available on the site is pretty limited. Jeez, we’ve profiled the fund twice before and never even made it to his “In the News” list. And while I’m pretty sure that the factsheet was done on a typewriter…. After two or three hours’ worth of conversations over the years, it’s clear that he’s a very smart and approachable guy. He provides his direct phone number on the factsheet. If I were an advisor worried about how long the good times will last and how to get ahead of events, I’d likely call him.

© Mutual Fund Observer, 2015. All rights reserved. The information here reflects publicly available information current at the time of publication. For reprint/e-rights contact us.