Dear friends,

Investing by aphorism is a tricky business.

“Buy on the sound of cannons, sell on the sound of trumpets.” It’s widely attributed to “Baron Nathan Rothschild (1810).” Of course, he wasn’t a baron in 1810. There’s no evidence he ever said it. 1810 wouldn’t have been a sensible year for the statement even if he had said it. And the earliest attributions are in anti-Semitic French newspapers advancing the claim that some Rothschild or another triggered a financial panic for family gain.

And then there’s weiji. It’s one of the few things that Condoleeza Rice and Al Gore agree upon. Here’s Rice after a trip to the Middle East:

I don’t read Chinese but I’m told that the Chinese character for crisis is “weiji”, which means both danger and opportunity. And I think that states it very well.

And Gore, accepting the Nobel Prize:

In the Kanji characters used in both Chinese and Japanese, “crisis” is written with two symbols, the first meaning “danger,” the second “opportunity.”

John Kennedy, Richard Nixon, business school deans, the authors of The Encyclopedia of Public Relations, Flood Planning: The Politics of Water Security, On Philosophy: Notes on A Crisis, Foundations of Interpersonal Practice in Social Work, Strategy: A Step by Step Approach to the Development and Presentation of World Class Business Strategy (apparently one unencumbered by careful fact-checking), Leading at the Edge (the author even asked “a Chinese student” about it, the student smiled and nodded so he knows it’s true). One sage went so far as to opine “the danger in crisis situations is that we’ll lose the opportunity in it.”

John Kennedy, Richard Nixon, business school deans, the authors of The Encyclopedia of Public Relations, Flood Planning: The Politics of Water Security, On Philosophy: Notes on A Crisis, Foundations of Interpersonal Practice in Social Work, Strategy: A Step by Step Approach to the Development and Presentation of World Class Business Strategy (apparently one unencumbered by careful fact-checking), Leading at the Edge (the author even asked “a Chinese student” about it, the student smiled and nodded so he knows it’s true). One sage went so far as to opine “the danger in crisis situations is that we’ll lose the opportunity in it.”

Weiji, Will Robinson! Weiji!

Except, of course, that it’s not true. Chinese philologists keep pointing out that “ji” is being misinterpreted. At base, “ji” can mean a lot of things. Since at least the third century CE, “weiji” meant something like “latent danger.” In the early 20th century it was applied to economic crises but without the optimistic “hey, let’s buy the dips!” sense now given it. As Victor Mair, a professor of Chinese language and literature at the University of Pennsylvania put it:

Those who purvey the doctrine that the Chinese word for “crisis” is composed of elements meaning “danger” and “opportunity” are engaging in a type of muddled thinking that is a danger to society, for it lulls people into welcoming crises as unstable situations from which they can benefit. Adopting a feel-good attitude toward adversity may not be the most rational, realistic approach to its solution.

Maybe in our March issue, I’ll expound on the origin of the phrase “furniture polish.” Did you know that it’s an Olde English term that comes from the French. It reflects the fact that the best furniture in the world was made around the city of Krakow, Poland so if you had furniture Polish, you had the most beautiful anywhere.

The good folks at Leuthold foresee a market decline of 30%, likely some time in 2015 or 2016 and likely sooner rather than later. Professor Studzinski suspects that they’re starry-eyed optimists. Yale’s Crash Confidence Index is drifting down, suggesting that investors think there will be a crash, a perception that moves contrary to the actual likelihood of a crash, except when it doesn’t. AAII’s Investor Confidence Index rose right along with market volatility. American and Chinese investors became more confident, Europeans became less confident and US portfolios became more risk-averse.

Meanwhile oil prices are falling, Russia is invading, countries are unraveling, storms are raging, Mitt’s withdrawing … egad! What, you might ask, am I doing about it? Glad you asked.

Snowball and the power of positive stupidity

My portfolio is designed to allow me to be stupid. It’s not that I try to be stupid but, being human, the temptation is almost irresistible at times. If you’re really smart, you can achieve your goals by taking a modest amount and investing it brilliantly. My family suggested that I ought not be banking on that route, so I took the road less traveled. Twenty years ago, I used free software available from Fidelity, Price and Vanguard, my college’s retirement plan providers, to determine how much I needed to invest in order to fund my retirement. I used conservative assumptions (long-term inflation near 4% and expected portfolio returns below 8% nominal), averaged the three recommendations and ended up socking away a lot each month.

Downside (?): I needed to be careful with our money – my car tends to be a fuel-efficient used Honda or Toyota that I drive for a quarter million miles or so, I tend to spend less on new clothes each year than on good coffee (if you’re from Pittsburgh, you know Mr. Prestogeorge’s coffee; if you’re not, the Steeler Nation is sad on your behalf), our home is solid and well-insulated but modest and our vacations often involve driving to see family or other natural wonders.

Upside: well, I’ve never become obsessed about the importance of owning stuff. And the more sophisticated software now available suggests that, given my current rate of investment, I only need to earn portfolio returns well under 6% (nominal) in order to reach my long-term goals.

And I’m fairly confident that I’ll be able to maintain that pace, even if I am repeatedly stupid along the way.

It’s a nice feeling.

A quick review of my fund portfolio’s 2015 performance would lead you to believe that I managed to be extra stupid last year with a portfolio return of just over 3%. If my portfolio’s goal was to maximize one-year returns, you’d be exactly right. But it isn’t, so you aren’t. Here’s a quick review of what I was thinking when I constructed my portfolio, what’s in it and what might be next.

The Plan: Follow the evidence. My non-retirement portfolio is about half equity and half income because the research says that more equity simply doesn’t pay off in a portfolio with an intermediate time horizon. The equity portion is about half US and half international and is overweighted toward small, value, dividend and quality. The income portion combines some low-cost “normal” stuff with an awful lot of abnormal investments in emerging markets, convertibles, and called high-yield bonds. On whole the funds have high active share, long-tenured managers, are risk conscious, lower turnover and relatively low expense. In most instances, I’ve chosen funds that give the managers some freedom to move assets around.

Pure equity:

Artisan Small Cap Value (ARTVX, closed). This is, by far, my oldest holding. I originally bought Artisan Small Cap (ARTSX) in late 1995 and, being a value kinda guy, traded those shares in 1997 for shares in the newly-launched ARTVX. It made a lot of money for me in the succeeding decade but over the past five years, its performance has sucked. Lipper has it ranked as 203 out of 203 small value funds over the past five years, though it has returned about 7% annually in the period. Not entirely sure what’s up. A focus on steady-eddy companies hasn’t helped, especially since it led them into a bunch of energy stocks. A couple positions, held too long, have blown up. The fact that they’re in a leadership transition, with Scott Satterwhite retiring in October 2016, adds to the noise. I’ll continue to watch and try to learn more, but this is getting a bit troubling.

Artisan International Value (ARTKX, closed). I acquired this the same way I acquired ARTVX, in trade. I bought Artisan International (ARTIX) shortly after its launch, then moved my investment here because of its value focus. Good move, by the way. It’s performed brilliantly with a compact, benchmark-free portfolio of high quality stocks. I’m a bit concerned about the fund’s size, north of $11 billion, and the fact that it’s now dominated by large cap names. That said, no one has been doing a better job.

Grandeur Peak Global Reach (GPROX, closed). When it comes to global small and microcap investing, I’m not sure that there’s anyone better or more disciplined than Grandeur Peak. This is intended to be their flagship fund, with all of the other Grandeur Peak funds representing just specific slices of its portfolio. Performance across the group, extending back to the days when the managers ran Wasatch’s international funds, has been spectacular. All of the existing funds are closed though three more are in the pipeline: US Opportunities, Global Value, and Global Microcap.

Pure income

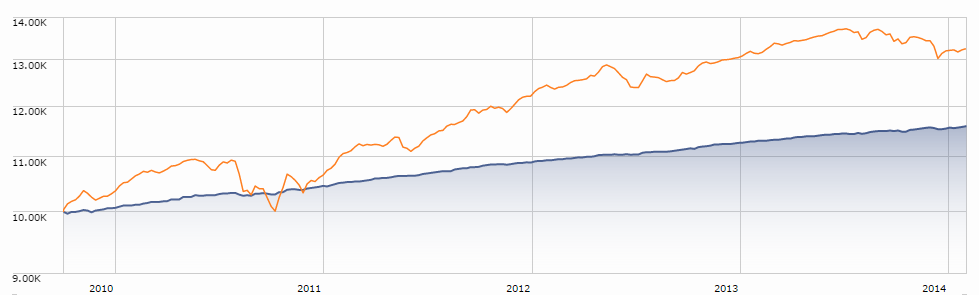

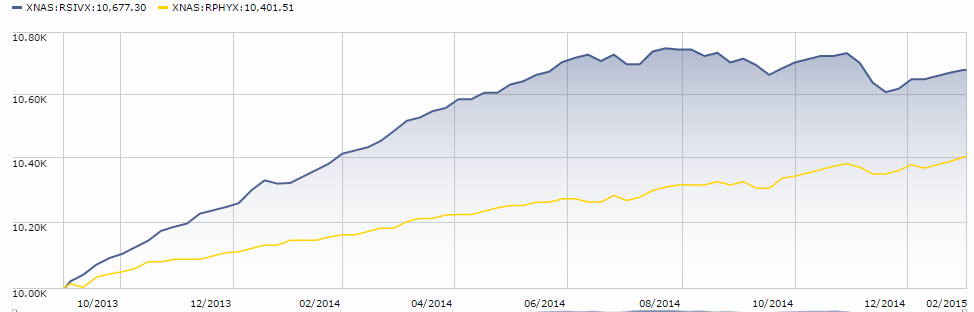

RiverPark Short Term High Yield (RPHYX, closed). The best and most misunderstood fund in the Morningstar universe. Merely noting that it has the highest Sharpe ratio of any fund doesn’t go far enough. Its Sharpe ratio, a measure of risk-adjusted returns where higher is better, since inception is 6.81. The second-best fund is 2.4. Morningstar insists on comparing it to its high yield bond group, with which it shares neither strategy nor portfolio. It’s a conservative cash management account that has performed brilliantly. The chart is RPHYX against the HY bond peer group.

RiverPark Strategic Income (RSIVX). At base, this is the next step out from RPHYX on the risk-return spectrum. Manager David Sherman thinks he can about double the returns posted by RPHYX without a significant risk of permanent loss of capital. He was well ahead of that pace until mid-2014 when he encountered a sort of rocky plateau. In the second half of 2014, the fund dropped 0.45% which is far less than any plausible peer group. Mr. Sherman loathes the prospect of “permanent impairment of capital” but “as long as the business model remains acceptable and is being pursued consistently and successfully, we will tolerate mark-to-market losses.” He’s quite willing to hold bonds to maturity or to call, which reduces market volatility to annoying noise in the background. Here’s the chart of Strategic Income (blue) against its older sibling.

Matthews Strategic Income (MAINX). I think this is a really good fund. Can’t quite be sure since it’s essentially the only Asian income fund on the market. There’s one Asian bond fund and a couple ETFs, but they’re not quite comparable and don’t perform nearly as well. The manager’s argument struck me as persuasive: Asian fixed-income offers some interesting attributes, it’s systematically underrepresented in indexes and underfollowed by investors (the fund has only $67 million in assets despite a strong record). Matthews has the industry’s deepest core of Asia analysts, Ms. Kong struck me as exceptionally bright and talented, and the opportunity set seemed worth pursuing.

Impure funds

FPA Crescent (FPACX). I worry, sometimes, that the investing world’s largest “free-range chicken” (his term) might be getting fat. Steve Romick has one of the longest and most successful records of any manager but he’s currently toting a $20 billion portfolio which is 40% cash. The cash stash is consistent with FPA’s “absolute value” orientation and reflects their ongoing concerns about market valuations which have grown detached from fundamentals. It’s my largest fund holding and is likely to remain so.

T. Rowe Price Spectrum Income (RPSIX). This is a fund of TRP funds, including one equity fund. It’s been my core fixed income holding since it’s broadly diversified, low cost and sensible. Over time, it tends to make about 6% a year with noticeably less volatility than its peers. It’s had two down years in a quarter century, losing about 2% in 1994 and 9% in 2008. I’m happy.

Seafarer Overseas Growth & Income (SFGIX). I believe that Andrew Foster is an exceptional manager and I was excited when he moved from a large fund with a narrow focus to launch a new fund with a broader one. Seafarer is a risk-conscious emerging markets fund with a strong presence in Asia. It’s my second largest holding and I’ve resolved to move my account from Scottrade to invest directly with Seafarer, to take advantage of their offer of allowing $100 purchase minimums on accounts with an automatic investing plan. Given the volatility of the emerging markets, the discipline to invest automatically rather than when I’m feeling brave seems especially important.

Matthews Asian Growth & Income (MACSX). I first purchased MACSX when Andrew Foster was managing this fund to the best risk-adjusted returns in its universe. It mixes common stock with preferred shares and convertibles. It had strong absolute returns, though poor relative ones, in rising markets and was the best in class in falling markets. It’s done well in the years since Andrew’s departure and is about the most sensible option around for broad Asia exposure.

Northern Global Tactical Asset Allocation (BBALX). Formerly a simple 60/40 balanced fund, BBALX uses low-cost ETFs and Northern funds to execute their investment planning committee’s firm-wide recommendations. On whole, Northern’s mission is to help very rich people stay very rich so their strategies tend to be fairly conservative and tilted toward quality, dividends, value and so on. They’ve got a lot less in the US and a lot more emerging markets exposure than their peers, a lot smaller market cap, higher dividends, lower p/e. It all makes sense. Should I be worried that they underperform a peer group that’s substantially overweighted in US, large cap and growth? Not yet.

Aston River Road Long/Short (ARLSX). Probably my most controversial holding since its performance in the past year has sucked. That being said, I’m not all that anxious about it. By the managers’ report, their short positions – about a third of the portfolio – are working. It’s their long book that’s tripping them up. Their long portfolio is quite different from their peers: they’ve got much larger small- and mid-cap positions, their median market cap is less than half of their peers’ and they’ve got rather more direct international exposure (10%, mostly Europe, versus 4%). In 2014, none of those were richly rewarding places to be. Small caps made about 3% and Europe lost nearly 8%. Here’s Mr. Moran’s take on the former:

Small-cap stocks significantly under-performed this quarter and have year-to-date as well. If the market is headed for a correction or something worse, these stocks will likely continue to lead the way. We, however, added substantially to the portfolio’s small-cap long positions during the quarter, more than doubling their weight as we are comfortable taking this risk, looking different, and are prepared to acknowledge when we are wrong. We have historically had success in this segment of the market, and we think small-cap valuations in the Fund’s investable universe are as attractive as they have been in more than two years.

It’s certainly possible that the fund is a good idea gone bad. I don’t really know yet.

Since my average holding period is something like “forever” – I first invested in eight of my 12 funds shortly after their launch – it’s unlikely that I’ll be selling anyone unless I need cash. I might eventually move the Northern GTAA money, though I have no target in mind. I suspect Charles would push for me to consider making my first ETF investment into ValueShares US Quantitative Value (QVAL). And if I conclude that there’s been some structural impairment to Artisan Small Cap Value, I might exit around the time that Mr. Satterwhite does. Finally, if the markets continue to become unhinged, I might consider a position in RiverPark Structural Alpha (RSAFX), a tiny fund with a strong pedigree that’s designed to eat volatility.

My retirement portfolio, in contrast, is a bit of a mess. I helped redesign my college’s retirement plan to simplify and automate it. That’s been a major boost for most employees (participation has grown from 23% to 93%) but it’s played hob with my own portfolio since we eliminated the Fidelity and T. Rowe funds in favor of a greater emphasis on index funds, funds of index funds and a select few active ones. My allocation there is more aggressive (80/20 stocks) but has the same tilt toward small, value, and international. I need to find time to figure out how best to manage the two frozen allocations in light of the more limited options in the new plan. Nuts.

For now: continue to do the automatic investment thing, undertake a modest bit of rebalancing out of international equities, and renew my focus on really big questions like whether to paint the ugly “I’m so ‘70s” brick fireplace in my living room.

Strange doings, currency wars, and unintended consequences

Strange doings, currency wars, and unintended consequences

By Edward A. Studzinski

Imagine the Creator as a low comedian, and at once the world becomes explicable. H.L. Mencken

January 2015 has perhaps not begun in the fashion for which most investors would have hoped. Instead of continuing on from last year where things seemed to be in their proper order, we have started with recurrent volatility, political incompetence, an increase in terrorist incidents around the world, currency instability in both the developed and developing markets, and more than a faint scent of deflation creeping into the nostrils and minds of central bankers. Through the end of January, the Dow, the S&P 500, and the NASDAQ are all in negative territory. Consumers, rather than following the lead of the mass market media who were telling them that the fall in energy prices presented a tax cut for them to spend, have elected to save for a rainy day. Perhaps the most unappreciated or underappreciated set of changed circumstances for most investors to deal with is the rising specter of currency wars.

So, what is a currency war? With thanks to author Adam Chan, who has written thoughtfully on this subject in the January 29, 2015 issue of The Institutional Strategist, a currency war is usually thought of as an effort by a country’s central bank to deliberately devalue their currency in an effort to stimulate exports. The most recent example of this is the announcement a few weeks ago by the European Central Bank that they would be undertaking another quantitative easing or QE in shorthand. More than a trillion Euros will be spent over the next eighteen months repurchasing government bonds. This has had the immediate effect of producing negative yields on the market prices of most European government bonds in the stronger economies there such as Germany. Add to this the compound effect of another sixty billion Yen a month of QE by the Bank of Japan going forward. Against the U.S. dollar, those two currencies have depreciated respectively 20% and 15% over the last year.

We have started to see the effects of this in earnings season this quarter, where multinational U.S. companies that report in dollars but earn various streams of revenues overseas, have started to miss estimates and guide towards lower numbers going forward. The strong dollar makes their goods and services less competitive around the world. But it ignores another dynamic going on, seen in the collapse of energy and other commodity prices, as well as loss of competitiveness in manufacturing.

Countries such as the BRIC emerging market countries (Brazil, Russia, India, China) but especially China and Russia, resent a situation where the developed countries of the world print money to sustain their economies (and keep the politicians in office) by purchasing hard assets such as oil, minerals, and manufactured goods for essentially nothing. For them, it makes no sense to allow this to continue.

The end result is the presence in the room of another six hundred pound gorilla, gold. I am not talking about gold as a commodity, but rather gold as a currency. Note that over the last year, the price of gold has stayed fairly flat while a well-known commodity index, the CRB, is down more than 25% in value. Reportedly, former Federal Reserve Chairman Alan Greenspan supported this view last November when he said, “Gold is still a currency.” He went on to refer to it as the “premier currency.” In that vein, for a multitude of reasons, we are seeing some rather interesting actions taking place around the world recently by central banks, most of which have not attracted a great deal of notice in this country.

In January of this year, the Bundesbank announced that in 2014 it repatriated 120 tons of its gold reserves back to Germany, 85 tons from New York and the balance from Paris. Of more interest, IN TOTAL SECRECY, the central bank of the Netherlands repatriated 122 tons of its gold from the New York Federal Reserve, which it announced in November of 2014. The Dutch rationale was explained as part of a currency “Plan B” in the event the Netherlands left the Euro. But it still begs the question as to why two of the strongest economies in Europe would no longer want to leave some of their gold reserves on deposit/storage in New York. And why are Austria and Belgium now considering a similar repatriation of their gold assets from New York?

At the same time, we have seen Russia, with its currency under attack and not by its own doing or desire as a result of economic sanctions. Putin apparently believes this is a deliberate effort to stimulate unrest in Russia and force him from power (just because you are paranoid, it doesn’t mean you are wrong). As a counter to that, you see the Russian central bank being the largest central bank purchaser of gold, 55 tons, in Q314. Why? He is interested in breaking the petrodollar standard in which the U.S. currency is used as the currency to denominate energy purchases and trade. Russia converts its proceeds from the sale of oil into gold. They end up holding gold rather than U.S. Treasuries. If he is successful, there will be considerably less incentive for countries to own U.S. government securities and for the dollar to be the currency of global trade. Note that Russia has a positive balance of trade with most of its neighbors and trading partners.

Now, my point in writing about this is not to engender a discussion about the wisdom or lack thereof in investing in gold, in one fashion or another. The students of history among you will remember that at various points in time it has been illegal for U.S. citizens to own gold, and that on occasion a fixed price has been set when the U.S. government has called it in. My purpose is to point out that there have been some very strange doings in asset class prices this year and last. For most readers of this publication, since their liabilities are denominated in U.S. dollars, they should focus on trying to pay those liabilities without exposing themselves to the vagaries of currency fluctuations, which even professionals have trouble getting right. This is the announced reason, and a good one, as to why the Tweedy, Browne Value Fund and Global Value Fund hedge their investments in foreign securities back into U.S. dollars. It is also why the Wisdom Tree ETF’s which are hedged products have been so successful in attracting assets. What it means is you are going to have to pay considerably more attention this year to a fund’s prospectus and its discussion of hedging policies, especially if you invest in international and/or emerging market mutual funds, both equity and fixed income.

My final thoughts have to do with unintended consequences, diversification, and investment goals and objectives. The last one is most important, but especially this year. Know yourself as an investor! Look at the maximum drawdown numbers my colleague Charles puts out in his quantitative work on fund performance. Know what you can tolerate emotionally in terms of seeing a market value decline in the value of your investment, and what your time horizon is for needing to sell those assets. Warren Buffett used to speak about evaluating investments with the thought as to whether you would still be comfortable with the investment, reflecting ownership in a business, if the stock market were to close for a couple of years. I would argue that fund investments should be evaluated in similar fashion. Christopher Browne of Tweedy, Browne suggested that you should pay attention to the portfolio manager’s investment style and his or her record in the context of that style. Focus on whose record it is that you are looking at in a fund. Looking at Fidelity Magellan’s record after Peter Lynch left the fund was irrelevant, as the successor manager (or managers as is often the case) had a different investment management style. THERE IS A REASON WHY MORNINGSTAR HAS CHANGED THEIR METHODOLOGY FROM FOLLOWING AND EVALUATING FUNDS TO FOLLOWING AND EVALUATING MANAGERS.

Diversification is another key issue to consider. Outstanding Investor Digest, in Volume XV, Number 7, published a lecture and Q&A with Philip Fisher that he gave at Stanford Business School. If you don’t know who Philip Fisher was, you owe it to yourself to read some of his work. Fisher believed strongly that you had achieved most of the benefits of risk reduction from diversification with a portfolio of from seven to ten stocks. After that, the benefits became marginal. The quote worth remembering, “The last thing I want is a lot of good stocks. I want a very few outstanding ones.” I think the same discipline should apply to mutual fund portfolios. You are not building an investment ark, where you need two of everything.

Finally, I do expect this to be a year of unintended consequences, both for institutional and individual investors. It is a year (but the same applies every year) when predominant in your mind should not be, “How much money can I make with this investment?” which is often tied to bragging rights at having done better than your brother-in-law. The focus should be, “How much money could I lose?” And my friend Bruce would ask if you could stand the real loss, and what impact it might have on your standard of living? In 2007 and 2008, many people found that they had to change their standard of living and not for the better because their investments were too “risky” for them and they had inadequate cash reserves to carry them through several years rather than liquidate things in a depressed market.

Finally, I make two suggestions. One, the 2010 documentary on the financial crisis by Charles Ferguson entitled “Inside Job” is worth seeing and if you can’t find it, the interview of Mr. Ferguson by Charlie Rose, which is to be found on line, is quite good. As an aside, there are those who think many of the most important and least watched interviews in our society today are conducted by Mr. Rose, which I agree with and think says something about the state of our society. And for those who think history does not repeat itself, I would suggest reading volume I, With Fire and Sword of the great trilogy of Henryk Sienkiewicz about the Cossack wars of the Sixteenth Century set in present day Ukraine. I think of Sienkiewicz as the Walter Scott of Poland, and you have it all in these novels – revolution and uprising in Ukraine, conflict between the Polish-Lithuanian Commonwealth and Moscow – it’s all there, but many, many years ago. And much of what is happening today, has happened before.

I will leave you with a few sentences from the beginning pages of that novel.

It took an experienced ear to tell the difference between the ordinary baying of the wolves and the howl of vampires. Sometimes entire regiments of tormented souls were seen to drift across the moonlit Steppe so that sentries sounded the alarm and garrisons stood to arms. But such ghostly armies were seen only before a great war.

Genius, succession and transition at Third Avenue

The mutual fund industry is in the midst of a painful transition. As long ago as the 1970s, Charles Ellis recognized that the traditional formula could no longer work. That formula was simple:

- Read Dodd and Graham

- Apply Dodd and Graham

- Crush the competition

- Watch the billions flow in.

Ellis’s argument is that Step 3 worked only if you were talented and your competitors were not. While that might have described the investing world in the 1930s or even the 1950s, by the 1970s the investment industry was populated by smart, well-trained, highly motivated investors and the prospect of beating them consistently became as illusory as the prospect of winning four Super Bowls in six years now is. (With all due respect to the wannabees in Dallas and New England, each of which registered three wins in a four year period.)

The day of reckoning was delayed by two decades of a roaring stock market. From 1980 – 1999, the S&P 500 posted exactly two losing years and each down year was followed by eight or nine winning ones. Investors, giddy at the prospect of 100% and 150% and 250% annual reports, catapulted money in the direction of folks like Alberto Vilar and Garrett Van Wagoner. As the acerbic hedge fund manager Jim Rogers said, “It is remarkable how many people mistake a bull market for brains.”

That doesn’t deny the existence of folks with brains. They exist in droves. And a handful – Charles Royce and Marty Whitman among them – had “brains” to the point of “brilliance” and had staying power.

For better and worse, Step 4 became difficult 15 years ago and almost a joke in the past decade. While a handful of funds – from Michael C. Aronstein’s Mainstay Marketfield (MFLDX) and The Jeffrey’s DoubleLine complex – managed to sop up tens of billions, flows into actively-managed fund have slowed to a trickle. In 2014, for example, Morningstar reports that actively-managed funds saw $90 billion in outflows and passive funds had $156 billion in inflows.

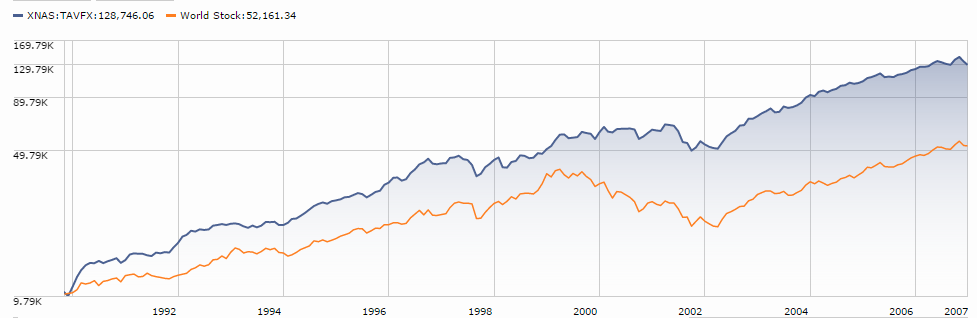

The past five years have not been easy ones for the folks at Third Avenue funds. It’s a firm with that earned an almost-legendary reputation for independence and success. Our image of them and their image of themselves might be summarized by the performance of the flagship Third Avenue Value Fund (TAVFX) through 2007.

The Value Fund (blue) not only returned more than twice what their global equity peers made, but also essential brushed aside the market collapse at the end of the 1990s bubble and the stagnation of “the lost decade.” Investors rewarded the fund by entrusting it with billions of dollars in assets; the fund held over $11 billion at its peak.

But it’s also a firm that struggled since the onset of the market crisis in late 2007. Four of the firm’s funds have posted mediocre returns – not awful, but generally below-average – during the market cycle that began in early October 2007 and continues to play out. The funds’ five- and ten-year records, which capture parts of two distinct market cycles but the full span of neither, make them look distinctly worse. That’s been accompanied by the departure of both investment professionals and investor assets:

Third Avenue Value (TAVFX) saw the departure of Marty Whitman as the fund’s manager (2012) and of his heir presumptive Ian Lapey (2014), along with 80% of its assets. The fund trails about 80% of its global equity peers over the past five and ten years, which helps explain the decline. Performance has rallied in the past three years with the fund modestly outperforming the MSCI World index through the end of 2014, though investors have been slow to return.

Third Avenue Small Cap Value (TASCX) bid adieu to manager Curtis Jensen (2014) and analyst Charles Page, along with 80% of its assets. The fund trails 85% of its peers over the past five years and ten years.

Third Avenue International Value (TAVIX) lost founding manager Amit Wadhwaney (2014), his co-manager and two analysts. Trailing 96% of its peers for the past five and ten years, the fund’s AUM declined by 86% from its peak assets.

Third Avenue Focused Credit (TFCIX) saw its founding manager, Jeffrey Gary, depart (2010) to found a competing fund, Avenue Credit Strategies (ACSAX) though assets tripled from around the time of his departure to now. The fund’s returns over the past five years are almost dead-center in the high yield bond pack.

Only Third Avenue Real Estate Value (TAREX) has provided an island of stability. Lead manager Michael Winer has been with the fund since its founding, he’s got his co-managers Jason Wolfe (2004) and Ryan Dobratz (2006), a growing team, and a great (top 5% for the past 3, 5, 10 and 15 year periods) long-term record. Sadly, that wasn’t enough to shield the fund from a 67% drop in assets from 2006 to 2008. Happily, assets have tripled since then to about $3 billion.

In sum, the firm’s five mutual funds are down by $11 billion from their peak asset levels and nearly 50% of the investment professionals on staff five years ago, including the managers of four funds, are gone. At the same time, only one of the five funds has had performance that meets the firm’s long-held standards of excellence.

Many outsiders noted not just the departure of long-tenured members of the Third Avenue community, but also the tendency to replace some those folks with outsiders, including Robert Rewey, Tim Bui and Victor Cunningham. The most prominent change was the arrival, in 2014, of Robert Rewey, the new head of the “value equity team.” Mr. Rewey formerly was a portfolio manager at Cramer Rosenthal McGlynn, LLC, where his funds’ performance trailed their benchmark (CRM Mid Cap Value CRMMX, CRM All Cap Value CRMEX and CRM Large Cap Opportunity CRMGX) or exceeded it modestly (CRM Small/Mid Cap Value CRMAX). Industry professionals we talked with spoke of “a rolling coup,” the intentional marginalization of Mr. Whitman within the firm he created and the influx of outsiders. Understandably, the folks at Third Avenue reject that characterization, noting that Mr. Whitman is still at TAM, that he attends every research meeting and was involved in every hiring decision.

Change in the industry is constant; the Observer reports on 500 or 600 management changes – some occasioned by a manager’s voluntary change of direction, others not – each year. The question for investors isn’t “had Third Avenue changed?” (It has, duh). The questions are “how has that change been handled and what might it mean for the future?” For answers, we turned to David Barse. Mr. Barse has served with Mr. Whitman for about a quarter century. He’s been president of Third Avenue, of MJ Whitman LLC and of its predecessor firm. He’s been with the operation continuously since the days that Mr. Whitman managed the Equity Strategies Fund in the 1980s.

From that talk and from the external record, I’ve reached three tentative conclusions:

- Third Avenue Value Fund’s portfolio went beyond independent to become deeply, perhaps troublingly, idiosyncratic during the current cycle. Mr. Whitman saw Asia’s growth as a powerful driver to real estate values there and the onset of the SARS/avian flu panics as a driver of incredible discounts in the stocks’ prices. As a result, he bought a lot of exposure to Asian real estate and, as the markets there declined, bought more. At its peak, 65% of the fund’s portfolio was exposed to the Asian real estate market. Judging by their portfolios, neither the very successful Real Estate Value Fund nor the International Value Fund, the logical home of such investments, believed that it was prudent to maintain such exposure. Mr. Winer got his fund entirely out of the Asia real estate market and Mr. Wadhwaney’s portfolio contained none of the stocks held in TAVFX. Reportedly members of Mr. Whitman’s own team had substantial reservations about the extent of their investment and many shareholders, including large institutional investors, concluded that this was not at all what they’d signed up for. Third Avenue has now largely unwound those positions, and the Value Fund had 8.5% of its 2014 year-end portfolio in Hong Kong.

- “Succession planning” always works better on paper than in the messy precinct of real life. Mr. Whitman and Mr. Barse knew, on the day that TAVFX launched, that they needed to think about life after Marty. Mr. Whitman was 67 when the fund launched and was setting out for a new adventure around the time that most professionals begin winding down. In consequence, Mr. Barse reports, “Succession planning was intrinsic to our business plans from the very beginning. This was a fantastic business to be in during the ‘90s and early ‘00s. We pursued a thoughtful expansion around our core discipline and Marty looked for talented people who shared his discipline and passion.” Mr. Whitman seems to have been more talented in investment management than in business management and none of this protégés, save Mr. Winer, showed evidence of the sort of genius that drove Mr. Whitman’s success. Finally, in his 89th year of life, Mr. Whitman agreed to relinquish management of TAVFX with the understanding that Ian Lapey be given a fair chance as his successor. Mr. Lapey’s tenure as manager, both the five years which included time as co-manager with Mr. Whitman and the 18 months as lead manager, was not notably successful.

- Third Avenue is trying to reorient its process from “the mercurial genius” model to “the healthy team” one. When Third Avenue was acquired in 2002 by the Affiliated Managed Group (AMG), the key investment professionals signed a ten year commitment to stay with the firm – symbolically important if legally non-binding – with a limited non-compete period thereafter. 2012 saw the expiration of those commitments and the conclusion, possibly mutual, that it was time for long-time managers like Curtis Jensen and Amit Wadhwaney to move on. The firm promoted co-managers with the expectation that they’d become eventual successors. Eventually they began a search for Mr. Whitman’s successor. After interviewing more than 50 candidates, they selected Mr. Rewey based on three factors: he understood the nature of a small, independent, performance-driven firm, he understood the importance of healthy management teams and he shared Mr. Whitman’s passion for value investing. “We did not,” Mr. Barse notes, “make this decision lightly.” The firm gave him a “team leader” designation with the expectation that he’d consciously pursue a more affirmative approach to cultivating and empowering his research and management associates.

It’s way too early to draw any conclusions about the effects of their changes on fund performance. Mr. Barse notes that they’ve been unwinding some of the Value Fund’s extreme concentration and have been working to reduce the exposure of illiquid positions in the International Value Fund. In the third quarter, Small Cap Value eliminated 16 positions while starting only three. At the same time, Mr. Barse reports growing internal optimism and comity. As with PIMCO, the folks at Third Avenue feel they’re emerging from a necessary but painful transition. I get a sense that folks at both institutions are looking forward to going to work and to the working together on the challenges they, along with all active managers and especially active boutique managers, face.

The questions remain: why should you care? What should you do? The process they’re pursuing makes sense; that is, team-managed funds have distinct advantages over star-managed ones. Academic research shows that returns are modestly lower (50 bps or so) but risk is significantly lower, turnover is lower and performance is more persistent. And Third Avenue remains fiercely independent: the active share for the Value Fund is 98.2% against the MSCI World index, Small Cap Value is 95% against the Russell 2000 Value index, and International Value is 97.6% against MSCI World ex US. Their portfolios are compact (38, 64 and 32 names, respectively) and turnover is low (20-40%).

For now, we’d counsel patience. Not all teams (half of all funds claim them) thrive. Not all good plans pan out. But Third Avenue has a lot to draw on and a lot to prove, we wish them well and will keep a hopeful eye on their evolution.

Where are they now?

We were curious about the current activities of Third Avenue’s former managers. We found them at the library, mostly. Ian Lapey’s LinkedIn profile now lists him as a “director, Stanley Furniture Company” but we were struck by the current activities of a number of his former co-workers:

Apparently time at Third Avenue instills a love of books, but might leave folks short of time to pursue them.

Would you give somebody $5.8 million a year to manage your money?

And would you be steamed if he lost $6.9 million for you in your first three months with him?

If so, you can sympathize with Bill Gross of Janus Funds. Mr. Gross has reportedly invested $700 million in Janus Global Unconstrained Bond (JUCIX), whose institutional shares carry a 0.83% expense ratio. So … (mumble, mumble, scribble) 0.0083 x 700,000,000 is … ummmm … he’s charging himself $5,810,000 for managing his personal fortune.

Oh, wait! That overstates the expenses a bit. The fund is down rather more than a percent (1.06% over three months, to be exact) so that means he’s no longer paying expenses on the $7,420,000 that’s no longer there. That’d be a $61,000 savings over the course of a year.

It calls to mind a universally misquoted passage from F. Scott Fitzgerald’s short story, “The Rich Boy” (1926)

Let me tell you about the very rich. They are different from you and me. They possess and enjoy early, and it does something to them, makes them soft, where we are hard, cynical where we are trustful, in a way that, unless you were born rich, it is very difficult to understand.

Hemingway started the butchery by inventing a conversation between himself and Fitzgerald, in which Fitzgerald opines “the rich are different from you and me” and Hemingway sharply quips, “yes, they have more money.” It appears that Mary Collum, an Irish literary critic, in a different context, made the comment and Hemingway pasted it seamlessly into a version that made him seem the master.

P.S. please don’t tell the chairman of Janus. He’s the guy who didn’t know that all those millions flowing from a single brokerage office near Gross’s home into Gross’s fund was Gross’s money. I suspect it’s just better if we don’t burden him with unnecessary details.

P.S. please don’t tell the chairman of Janus. He’s the guy who didn’t know that all those millions flowing from a single brokerage office near Gross’s home into Gross’s fund was Gross’s money. I suspect it’s just better if we don’t burden him with unnecessary details.

Top developments in fund industry litigation

![]() Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized and filtered as never before. For a complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Fundfox, launched in 2012, is the mutual fund industry’s only litigation intelligence service, delivering exclusive litigation information and real-time case documents neatly organized and filtered as never before. For a complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Decision

- The court granted Vanguard‘s motion to dismiss shareholder litigation regarding two international funds’ holdings of gambling-related securities: “the court concludes that plaintiffs’ claims are time barred and alternatively that plaintiff has not established that the Board’s refusal to pursue plaintiffs’ demand for litigation violated Delaware’s business judgment rule.” Defendants included independent directors. (Hartsel v. Vanguard Group Inc.)

Settlement

- Morgan Keegan defendants settled long-running securities litigation, regarding bond funds’ investments in collateralized debt obligations, for $125 million. Defendants included independent directors. (In re Regions Morgan Keegan Open-End Mut. Fund Litig.; Landers v. Morgan Asset Mgmt., Inc.)

Briefs

- AXA Equitable filed a motion for summary judgment in fee litigation regarding twelve subadvised funds: “The combined investment management and administrative fees . . . for the funds were in all cases less than 1% of fund assets, and in some cases less than one half of 1%. These fees are in line with industry medians.” (Sanford v. AXA Equitable Funds Mgmt. Group, LLC; Sivolella v. AXA Equitable Life Ins. Co.)

- Plaintiffs filed their opposition to Genworth‘s motion for summary judgment in a fraud case regarding an investment expert’s purported role in the management of the BJ Group Services portfolios. (Goodman v. Genworth Fin. Wealth Mgmt., Inc.)

- Plaintiffs filed their opposition to SEI defendants’ motion to dismiss fee litigation regarding five subadvised funds: By delegating “nearly all of its investment management responsibilities to its army of sub-advisers” and “retaining substantial portions of the proceeds for itself,” SEI charges “excessive fees that violate section 36(b) of the Investment Company Act.” (Curd v. SEI Invs. Mgmt. Corp.)

Answer

- Having previously lost its motion to dismiss, Harbor filed an answer to excessive-fee litigation regarding its subadvised International and High-Yield Bond Funds. (Zehrer v. Harbor Capital Advisors, Inc.)

The Alt Perspective: Commentary and news from DailyAlts.

By Brian Haskin, editor of DailyAlts.com

By Brian Haskin, editor of DailyAlts.com

Last month, I took a look at a few of the trends that took shape over the course of 2014 and noted how those trends might unfold in 2015. Now that the full year numbers are in, I thought I would do a 2014 recap of those numbers and see what they tell us.

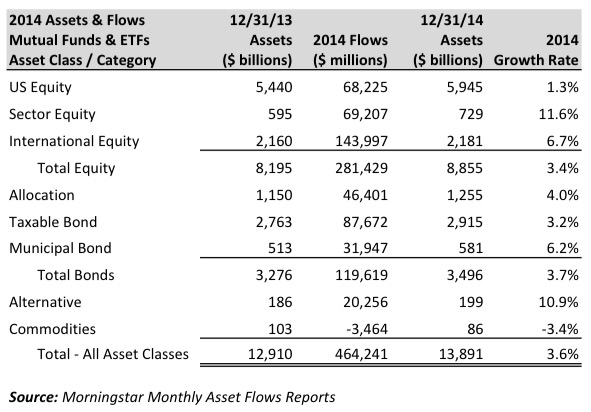

Overall, assets in the Liquid Alternatives category, including both mutual funds and ETFs, were up 10.9% based on Morningstar’s classification, and 9.8% by DailyAlts classification. For ease of use, let’s call it 10%. Not too bad, but quite a bit short of the growth rates seen earlier in the year that hovered around 40%. But, compared to other major asset classes, alternative funds actually grew about 3 times faster. That’s quite good. The table below summarizes Morningstar’s asset flow data for mutual funds and ETFs combined:

The macro shifts in investor’s allocations were quite subtle, but nonetheless, distinct. Assets growth increased at about an equal rate for both stocks and bonds at a 3.4% and 3.7%, respectively, while commodities fell out of favor and lost 3.4% of their assets. However, with most investors underinvested in alternatives, the category grew at 10.9% and ended the year with $199 billion in assets, or 1.4% of the total pie. This is a far cry from institutional allocations of 15-20%, but many experts expect to see that 1.4% number increase to the likes of 10-15% over the coming decade.

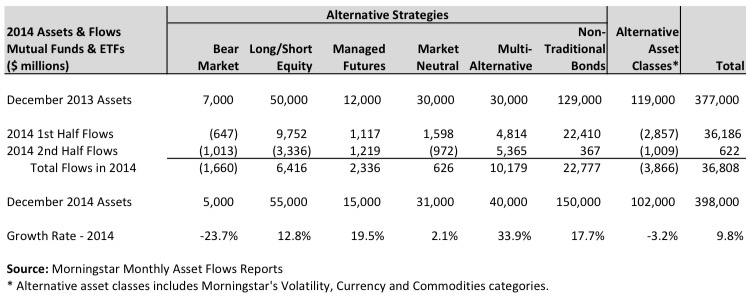

Now, let’s take a look a more detailed look at the winning and loosing categories within the alternatives bucket. Here is a recap of 2014 flows, beginning assets, ending assets and growth rates for the various alternative strategies and alternative asset classes that we review:

The dominant category over the year was what Morningstar calls non-traditional bonds, which took in $22.8 billion. Going into 2014, investors held the view that interest rates would rise and, thus, they looked to reduce interest rate risk with the more flexible non-traditional bond funds. This all came to a halt as interest rates actually declined and flows to the category nearly dried up in the second half.

On a growth rate perspective, multi-alternative funds grew at a nearly 34% rate in 2014. These funds allocate to a wide range of alternative investment strategies, all in one fund. As a result, they serve as a one-stop shop for allocations to alternative investments. In fact, they serve the same purpose as fund-of-hedge funds serve for institutional investors but for a much lower cost! That’s great news for retail investors.

Finally, what is most striking is that the asset flows to alternatives all came in the first half of the year – $36.2 billion in the first half and only $622 million in the second half. Much of the second half slowdown can be attributed to two factors: A complete halt in flows to non-traditional bonds in reaction to falling rates, and billions in outflows from the MainStay Marketfield Fund (MFLDX), which had an abysmal 2014. The good news is that multi-alternative funds held steady from the first half to the second – a good sign that advisors and investors are maintaining a steady allocation to broad based alternative funds.

For 2015, expect to see multi-alternative funds continue to gather assets at a steady clip. The managed futures category, which grew at a healthy 19.5% in 2014 on the back of multiple difficult years, should see continued action as global markets and economies continue to diverge, thus creating a more favorable environment for these funds. Market neutral funds should also see more interest as they are designed to be immune to most of the market’s ups and downs.

Next month we will get back to looking at a few of the intriguing fund launches for early 2015. Until then, hold on for the ride and stay diversified!

Observer Fund Profiles

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past two or three years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

Osterweis Strategic Investment (OSTVX). I’m always intrigued by funds that Morningstar disapproves of. When you combine disapproval with misunderstanding, then add brilliant investment performance, it becomes irresistible for us to address the question “what’s going on here?” Short answer: good stuff.

Pear Tree Polaris Foreign Value Small Cap (QUSOX). There are three, and only three, great international small cap funds: Wasatch International Opportunities (WAIOX), Grandeur Peak International Opportunities (GPIOX) and Pear Tree Polaris Foreign Value Small Cap. Why have you only heard of the first two?

TrimTabs Float Shrink ETF (TTFS). This young ETF is off to an impressive start by following what it believes are the “best informed market participants.” This is a profile by our colleague Charles Boccadoro, which means it will be data-rich!

Touchstone Sands Capital Emerging Markets Growth (TSEMX). Sands Capital has a long, strong record in tracking down exceptional businesses and holding them close. TSEMX represents the latest extension of the strategy from domestic core to global and now to the emerging markets.

Conference Call Highlights: Bernie Horn, Polaris Global Value

About 40 of us gathered in mid-January to talk with Bernie Horn. It was an interesting talk, one which covered some of the same ground that he went over in private with Mr. Studzinski and me but one which also highlighted a couple new points.

About 40 of us gathered in mid-January to talk with Bernie Horn. It was an interesting talk, one which covered some of the same ground that he went over in private with Mr. Studzinski and me but one which also highlighted a couple new points.

Highlights:

- The genesis of the fund was in his days as a student at the Sloan School of Management at MIT at the end of the 1970s. It was a terrible decade for stocks in the US but he was struck by the number of foreign markets that had done just fine. One of his professors, Fischer Black, an economist whose work with Myron Scholes on options led to a Nobel Prize, generally preached the virtues of the efficient market theory but carries “a handy list of exceptions to EMT.” The most prominent exception was value investing. The emerging research on the investment effects of international diversification and on value as a loophole to EMT led him to launch his first global portfolios.

- His goal is, over the long-term, to generate 2% greater returns than the market with lower volatility.

- He began running separately-managed accounts but those became an administrative headache and so he talked his investors into joining a limited partnership which later morphed into Polaris Global Value Fund (PGVFX).

- The central discipline is calculating the “Polaris global cost of equity” (which he thinks separates him from most of his peers) and the desire to add stocks which have low correlations to his existing portfolio.

- The Polaris global cost of capital starts with the market’s likely rate of return, about 6% real. He believes that the top tier of managers can add about 2% or 200 bps of alpha. So far that implies an 8% cost of capital. He argues that fixed income markets are really pretty good at arbitraging currency risks, so he looks at the difference between the interest rates on a country’s bonds and its inflation rate to find the last component of his cost of capital. The example was Argentina: 24% interest rate minus a 10% inflation rate means that bond investors are demanding a 14% real return on their investments. The 14% reflects the bond market’s judgment of the cost of currency; that is, the bond market is pricing-in a really high risk of a peso devaluation. In order for an Argentine company to be attractive to him, he has to believe that it can overcome a 22% cost of capital (6 + 2 + 14). The hurdle rate for the same company domiciled elsewhere might be substantially lower.

- He does not hedge his currency exposure because the value calculation above implicitly accounts for currency risk. Currency fluctuations accounted for most of the fund’s negative returns last year, about 2/3s as of the third quarter. To be clear: the fund made money in 2014 and finished in the top third of its peer group. Two-thirds of the drag on the portfolio came from currency and one-third from stock selections.

- He tries to target new investments which are not correlated with his existing ones; that is, ones that do not all expose his investors to a single, potentially catastrophic risk factor. It might well be that the 100 more attractively priced stocks in the world are all financials but he would not overload the portfolio with them because that overexposes his investors to interest rate risks. Heightened vigilance here is one of the lessons of the 2007-08 crash.

- An interesting analogy on the correlation and portfolio construction piece: he tries to imagine what would happen if all of the companies in his portfolio merged to form a single conglomerate. In the conglomerate, he’d want different divisions whose cash generation was complementary: if interest rates rose, some divisions would generate less cash but some divisions would generate more and the net result would be that rising interest rates would not impair the conglomerates overall free cash flow. By way of example, he owns energy exploration and production companies whose earnings are down because of low oil prices but also refineries whose earnings are up.

- He instituted more vigorous stress tests for portfolio companies in the wake of the 2007-09 debacle. Twenty-five of 70 companies were “cyclically exposed”. Some of those firms had high fixed costs of operations which would not allow them to reduce costs as revenues fell. Five companies got “bumped off” as a result of that stress-testing.

A couple caller questions struck me as particularly helpful:

Ken Norman: are you the lead manager on both the foreign funds? BH: Yes, but … Here Bernie made a particularly interesting point, that he gives his associates a lot of leeway on the foreign funds both in stock selection and portfolio construction. That has two effects. (1) It represents a form of transition planning. His younger associates are learning how to operate the Polaris system using real money and making decisions that carry real consequences. He thinks that will make them much better stewards of Polaris Global Value when it becomes their turn to lead the fund. (2) It represents a recruitment and retention strategy. It lets bright young analysts know that they have a real role to play and a real future with the firm.

Shostakovich, a member of the Observer’s discussion board community and investor in PGVFX: you’ve used options to manage volatility. Is that still part of the plan? BH: Yes, but rarely now. Three reasons. (1) There are no options on many of the portfolio firms. (2) Post-08, options positions are becoming much more expensive, hence less rewarding. (3) Options trade away “excess” upside in exchange for limiting downside; he’s reluctant to surrender much alpha since some of the firms in the portfolio have really substantial potential.

Bottom line: You need to listen to the discussion of ways in which Polaris modified their risk management in the wake of 2008. Their performance in the market crash was bad. They know it. They were surprised by it. And they reacted thoughtfully and vigorously to it. In the absence of that one period, PGVFX has been about as good as it gets. If you believe that their responses were appropriate and sufficient, as I suspect they were, then this strikes me as a really strong offering.

We’ve gathered all of the information available on Polaris Global Value Fund, including an .mp3 of the conference call, into its new Featured Fund page. Feel free to visit!

Conference Call Upcoming: Matthew Page and Ian Mortimer, Guinness Atkinson Funds

We’d be delighted if you’d join us on Monday, February 9th, from noon to 1:00 p.m. Eastern, for a conversation with Matthew Page and Ian Mortimer, managers of Guinness Atkinson Global Innovators (IWIRX) and Guinness Atkinson Dividend Builder (GAINX). These are both small, concentrated, distinctive, disciplined funds with top-tier performance. IWIRX, with three distinctive strategies (starting as an index fund and transitioning to an active one), is particularly interesting. Most folks, upon hearing “global innovators” immediately think “high tech, info tech, biotech.” As it turns out, that’s not what the fund’s about. They’ve found a far steadier, broader and more successful understanding of the nature and role of innovation. Guinness reports:

We’d be delighted if you’d join us on Monday, February 9th, from noon to 1:00 p.m. Eastern, for a conversation with Matthew Page and Ian Mortimer, managers of Guinness Atkinson Global Innovators (IWIRX) and Guinness Atkinson Dividend Builder (GAINX). These are both small, concentrated, distinctive, disciplined funds with top-tier performance. IWIRX, with three distinctive strategies (starting as an index fund and transitioning to an active one), is particularly interesting. Most folks, upon hearing “global innovators” immediately think “high tech, info tech, biotech.” As it turns out, that’s not what the fund’s about. They’ve found a far steadier, broader and more successful understanding of the nature and role of innovation. Guinness reports:

Guinness Atkinson Global Innovators is the #1 Global Multi-Cap Growth Fund across all time periods (1,3,5,& 10 years) this quarter ending 12/31/14 based on Fund total returns.

They are ranked 1 of 500 for 1 year, 1 of 466 for 3 years, 1 of 399 for 5 years and 1 of 278 for 10 years in the Lipper category Global Multi-Cap Growth.

Goodness. And it still has under $200 million in assets.

Matt volunteered the following plan for their slice of the call:

I think we would like to address some of the following points in our soliloquy.

- Why are innovative companies an interesting investment opportunity?

- How do we define an innovative company?

- Aren’t innovative companies just expensive?

- Are the most innovative companies the best investments?

I suppose you could sum all this up in the phrase: Why Innovation Matters.

In deference to the fact that Matt and Ian are based in London, we have moved our call to noon Eastern. While they were willing to hang around the office until midnight, asking them to do it struck me as both rude and unproductive (how much would you really get from talking to two severely sleep-deprived Brits?).

Over the past several years, the Observer has hosted a series of hour-long conference calls between remarkable investors and, well, you. The format’s always the same: you register to join the call. We share an 800-number with you and send you an emailed reminder on the day of the call. We divide our hour together roughly in thirds: in the first third, our guest talks with us, generally about his or her fund’s genesis and strategy. In the middle third I pose a series of questions, often those raised by readers. Here’s the cool part, in the final third you get to ask questions directly to our guest; none of this wimpy-wompy “you submit a written question in advance, which a fund rep rewords and reads blankly.” Nay nay. It’s your question, you ask it. The reception has been uniformly positive.

HOW CAN YOU JOIN IN?

If you’d like to join in, just click on register and you’ll be taken to the Chorus Call site. In exchange for your name and email, you’ll receive a toll-free number, a PIN and instructions on joining the call. If you register, I’ll send you a reminder email on the morning of the call.

If you’d like to join in, just click on register and you’ll be taken to the Chorus Call site. In exchange for your name and email, you’ll receive a toll-free number, a PIN and instructions on joining the call. If you register, I’ll send you a reminder email on the morning of the call.

Remember: registering for one call does not automatically register you for another. You need to click each separately. Likewise, registering for the conference call mailing list doesn’t register you for a call; it just lets you know when an opportunity comes up.

WOULD AN ADDITIONAL HEADS UP HELP?

Over two hundred readers have signed up for a conference call mailing list. About a week ahead of each call, I write to everyone on the list to remind them of what might make the call special and how to register. If you’d like to be added to the conference call list, just drop me a line.

Funds in Registration

There continued to be remarkably few funds in registration with the SEC this month and I’m beginning to wonder if there’s been a fundamental change in the entrepreneurial dynamic in the industry. There are nine new no-load retail funds in the pipeline, and they’ll launch by the end of April. The most interesting development might be DoubleLine’s move into commodities. (It’s certainly not Vanguard’s decision to launch a muni-bond index.) They’re all detailed on the Funds in Registration page.

Manager Changes

About 50 funds changed part or all of their management teams in the past month. An exceptional number of them were part of the continuing realignment at PIMCO. A curious and disappointing development was the departure of founding manager Michael Carne from the helm of Nuveen NWQ Flexible Income Fund (NWQAX). He built a very good, conservative allocation fund that holds stocks, bonds and convertibles. We wrote about the fund a while ago: three years after launch it received a five-star rating from Morningstar, celebration followed until a couple weeks later Morningstar reclassified it as a “convertibles” fund (it ain’t) and it plunged to one-star, appealed the ruling, was reclassified and regained its stars. It has been solid, disciplined and distinctive, which makes it odd that Nuveen chose to switch managers.

You can see all of the comings and goings on our Manager Changes page.

Briefly Noted . . .

On December 1, 2014, Janus Capital Group announced the acquisition of VS Holdings, parent of VelocityShares, LLC. VelocityShares provides both index calculation and a suite of (creepy) leveraged, reverse leveraged, double leveraged and triple leveraged ETNs.

Fidelity Strategic Income (FSICX) is changing the shape of the barbell. They’ve long described their portfolio as a barbell with high yield and EM bonds on the one end and high quality US Treasuries and corporates on the other. They’re now shifting their “neutral allocation” to inch up high yield exposure (from 40 to 45%) and drop investment grade (from 30 to 25%).

GaveKal Knowledge Leaders Fund (GAVAX/GAVIX) is changing its name to GaveKal Knowledge Leaders Allocation Fund. The fund has always had an absolute value discipline which leads to it high cash allocations (currently 25%), exceedingly low risk … and Morningstar’s open disdain (it’s currently a one-star large growth fund). The changes will recognize the fact that it’s not designed to be a fully-invested equity fund. Their objective changes from “long-term capital appreciation” to “long-term capital appreciation with an emphasis on capital preservation” and “fixed income” gets added as a principal investment strategy.

SMALL WINS FOR INVESTORS

Palmer Square Absolute Return Fund (PSQAX/PSQIX) has agreed to a lower management fee and has reduced the cap on operating expenses by 46 basis points to 1.39% and 1.64% on its institutional and “A” shares.

Likewise, State Street/Ramius Managed Futures Strategy Fund (RTSRX) dropped its expense cap by 20 basis points, to 1.90% and 1.65% on its “A” and institutional shares.

CLOSINGS (and related inconveniences)

Effective as of the close of business on February 27, 2015, BNY Mellon Municipal Opportunities Fund (MOTIX) will be closed to new and existing investors. It’s a five-star fund with $1.1 billion in assets and five-year returns in the top 1% of its peer group.

Franklin Small Cap Growth Fund (FSGRX) closes to new investors on February 12, 2015. It’s a very solid fund that had a very ugly 2014, when it captured 240% of the market’s downside.

OLD WINE, NEW BOTTLES

Stand back! AllianceBernstein is making its move: all AllianceBernstein funds are being rebranded as AB funds.

OFF TO THE DUSTBIN OF HISTORY

Ascendant Natural Resources Fund (NRGAX) becomes only a fond memory as of February 27, 2015.

AdvisorShares International Gold and AdvisorShares Gartman Gold/British Pound ETFs liquidated at the end of January.

Cloumbia is cleaning out a bunch of funds at the beginning of March: Columbia Masters International Equity Portfolio, Absolute Return Emerging Markets Macro Fund,Absolute Return Enhanced Multi-Strategy Fund and Absolute Return Multi-Strategy Fund. Apparently having 10-11 share classes each wasn’t enough to save them. The Absolute Return funds shared the same management team and were generally mild-mannered under-performers with few investors.

Direxion/Wilshire Dynamic Fund (DXDWX) will be dynamically spinning in its grave come February 20th.

Dynamic Total Return Fund (DYNAX/DYNIX) will totally return to the dust whence it came, effective February 20th. Uhhh … if I’m reading the record correctly, the “A” shares never launched, the “I” shares launched in September 2014 and management pulled the plug after three months.

Loeb King Alternative Strategies (LKASX) and Loeb King Asia Fund (LKPAX) are being liquidated at the end of February because, well, Loeb King doesn’t want to run mutual funds anymore and they’re getting entirely out of the business. Both were pricey long/short funds with minimal assets and similar success.

New Path Tactical Allocation Fund became liquid on January 13, 2015.

In “consideration of the Fund’s asset size, strategic importance, current expenses and historical performance,” Turner’s board of directors has pulled the plug on Turner Titan Fund (TTLFX). It wasn’t a particularly bad fund, it’s just that Turner couldn’t get anyone (including one of the two managers and three of the four trustees) to invest in it. Graveside ceremonies will take place on March 13, 2015 in the family burial plot.

In Closing . . .

I try, each month, to conclude this essay with thanks to the folks who’ve supported us, by reading, by shopping through our Amazon link and by making direct, voluntary contributions. Part of the discipline of thanking folks is, oh, getting their names right. It’s not a long list, so you’d think I could manage it.

I try, each month, to conclude this essay with thanks to the folks who’ve supported us, by reading, by shopping through our Amazon link and by making direct, voluntary contributions. Part of the discipline of thanking folks is, oh, getting their names right. It’s not a long list, so you’d think I could manage it.

Not so much. So let me take a special moment to thank the good folks at Evergreen Asset Management in Washington for their ongoing support over the years. I misidentified them last month. And I’d also like to express intense jealousy over what appears to be the view out their front window since the current view out my front window is

With extra careful spelling, thanks go out to the guys at Gardey Financial of Saginaw (MI), who’ve been supporting us for quite a while but who don’t seem to have a particularly good view from their office, Callahan Capital Management out of Steamboat Springs (hi, Dan!), Mary Rose, our friends Dan S. and Andrew K. (I know it’s odd, but just knowing that there are folks who’ve stuck with us for years makes me feel good), Rick Forno (who wrote an embarrassingly nice letter to which we reply, “gee, oh garsh”), Ned L. (who, like me, has professed for a living), David F., the surprising and formidable Dan Wiener and the Hastingses. And, as always, to our two stalwart subscribers, Greg and Deb. If we had MFO coffee mugs, I’d sent them to you all!

Do consider joining us for the talk with Matt and Ian. We’ve got a raft of new fund profiles in the works, a recommendation to Morningstar to euthanize one of their long-running features, and some original research on fund trustees to share. In celebration of our fourth birthday this spring, we’ve got surprises a-brewin’ for you.

Until then, be safe!