Dear friends,

I’ve been reading two strands of research lately. One shows that simple expressions of gratitude and acts of kindness have an incredibly powerful effect on your mental and physical health. Being consciously grateful of the goodness in your life, for example, carries most of the same benefits of meditation without the need for … well, sitting on the floor and staring at candle flames. The other shows that people tend to panic when you express gratitude to them  or try to do kind things for them. Apparently giving money away to strangers is a lot harder than you’d imagine.

or try to do kind things for them. Apparently giving money away to strangers is a lot harder than you’d imagine.

The midwinter holidays ahead – not just Christmas but a dozen other celebrations rooted in other cultures and other traditions – are, at base, expressions of gratitude. They occur in the darkest, coldest, most threatening time of year. They occur at the moment when we most need others, and they most need us. No one thrives when they’re alone and each day brings 14 to 18 hours of darkness. And so we’ve chosen, from time immemorial, to open our hearts and our homes, our arms and our pantries, to friends and strangers alike.

Don’t talk yourself out of that impulse. Don’t worry about whether your gift is glittery (if people actually care about that, you’re sharing gifts with the wrong people) or your meal is perfect (Martha Stewart’s were and she ended up in the Big House). People most appreciate gifts that make them think of you; give a part of yourself. Follow the Grinch. Take advice from Scrooged. Tell someone they make you smile, hug them if you dare, smile and go.

Oh, by the way, you make me smile. I’m endlessly humbled (and pleased) at the realization that you’re dropping by to see what we’ve been thinking. Thanks for that!

Built on failure

Success is not built on success. It’s built on failure. It’s built on frustration. Sometimes it’s built on catastrophe. Sumner Redstone (2007)

My dad never had much tolerance of failure. Perhaps because he’d experienced more than his share. Perhaps because he judged people so harshly and assumes that others did the same to him. No matter. For him, a failed project was the sign of a failed person. And so we learned to keep our heads down, volunteer nothing, risk nothing, and never fail.

And, at the same time, we never succeeded. “In order to succeed, you have to live dangerously,” Mr. Redstone advised. The notion of taking risks came late and hesitantly.

I wish I’d risked more and failed more, perhaps even failed more joyfully. But I’m working on it. You should, too. Being comfortable with failure is good; it means that you’re less likely to sabotage yourself through timidity. It’s a human resources truism that a guy with 10% of the necessary qualifications for a job will apply for it. A woman with 90% of the qualifications will not. Both ask themselves the same question, “what’s the worst that could happen?” but give themselves strikingly different answers. Talking comfortably about failure is better; it means that you’re removing the terror from other’s minds, enabling them to take the risks that might lead to failure but that are also essential for success. You should practice both. There’s also some interesting research that suggests that people who think of themselves as “experts” get all puffed up, then become rigid and dogmatic. That’s hardly a recipe for success.

The Wall Street Journal recently published “How not to flunk at failure,” (10/25/2015) by John Danner and Mark Coopersmith. Both are faculty at UC-Berkeley’s Haas School of Business. They’ve co-authored The Other “F” Word: How Smart Leaders, Teams, and Entrepreneurs Put Failure to Work (2015). They argue that it’s more common to fail poorly than to fail well because we so horrified at the notion that we failed at all. As a result, we feel sick and learn nothing.

They offer four recommendations for failing well.

- The first step: admit you’ve had failures yourself. The guys who growl that “failure is not an option” end up, they say, creating a culture of “trial and terror” rather than a healthy culture of “trial and error.”

- Ask the right questions when the inevitable failure occurs. Abandon the witch hunt that begins with the question “who was responsible?” Instead, think “hmmm, that was the damnedest thing” and begin exploring it with the sorts of who, what, why, where, when questions familiar to journalists.

- Borrow a page, or at least a term, from the lab. Stop talking in excited terms about mission-critical strategic imperatives and start talking about experiments. Experiments are just a tool, a means to learn something. Sometimes we learn the most when an experiment does something utterly freakish. “We’ll try this as an experiment, see what comes of it and plan from there” involves less psychological commitment and more distance.

- Make the ending count. Your staff needs your support much less when things go right than when they go wrong. You need to celebrate the end of an experiment that went poorly with at least as much ceremony as you do when one went well. “Well, that Why don’t I take you out for a nice dinner and we’ll figure out what we’ve learned and where we go from here,” would be a spectacularly good use of your time and the corporate credit card.

Nice article. I can’t link directly to it but if you Google the title, the first result will be the article and you’ll be able to get it. (Alternately, you might, like me, subscribe to the newspaper and simply open it in your browser.)

We’ve tried a bunch of things that have failed and have learned a lot from them. Three stand out.

-

I suck as a stock investor. Suck, suck, suck. I tried it for a few years. Subscribed to Morningstar Stock Investor. Read Value Line reports. Looked carefully through three years of annual reports. Bought only deeply discounted stocks with viable business models and good managers. I still ended up owning WorldCom (which went to zero) and a bunch of stocks that inexplicably refused to go up. Ended up selling the lot of them, booking a useful tax loss and shifting the money to a diversified fund.

What I learned was that I’m temperamentally unsuited to stock investing. Having spent months researching an investment, I expect it to do something. As in good! And now! When they staggered about like drunken sailors, I kept feeling the pressure to do something myself. That’s always a losing proposition. And I learned that a few thousand dollars in a fund bought you much better diversification than a few thousand dollars in individual securities.

-

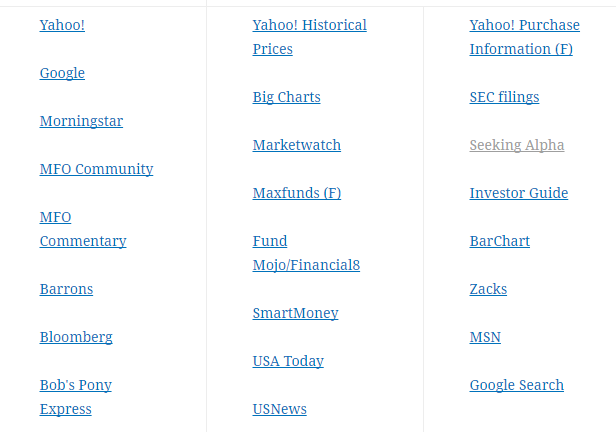

The Best of the Web isn’t very good. You’ll find it, covered with cobwebs, under “The Best” tab up there at the top right of the screen. Our plan was to sort through a bunch of web-based resources – from fund screeners to news sources – so that you didn’t have to. It’s a worthy project give or take the cobwebs and the occasional references you might find there to President Grover Cleveland’s recent initiatives.

What I learned was that there are limits to what we can do well. The number of hours it took to review 30 or 40 news sites or to assess the research behind various firms fund ratings, even with a former colleague doing a lot of the legwork, was enormous. The additional time to review and edit drafts was substantial. The gain to our readers was not. We’ve become much more canny about asking the hard “but then what will we stop doing?” question as we consider innovations that add to the 100 hour a month workload that many of us already accept.

-

The Utopia Funds profile was a disaster. This dates back eight years to our FundAlarm days and it still makes me wince whenever I think of it. Utopia Funds were launched by a small firm out of Michigan and I ridiculed them for the presumptuousness of the name. Imagine my surprise to be having a wonderfully pleasant conversation, a week later, to the firm’s CEO and CIO. The funds, arrayed on a risk scale from Growth to Very Conservative, invested in orphan securities: little bits and pieces that were too small to interest large investment houses and that were often underpriced. Bonds in Malaysia, apartments in Milan, microcap stocks in Austin. The CIO had been managing the strategy in separate accounts, was charming and they appealed to many of my biases (small firm, interesting portfolio, reasonable expenses, ultra-low minimum investments). I got enthused, ran two positively fawning pieces about the funds and Zach the lead manager (He’s Zachtastic!) and invested in them for myself and for family. They absolutely imploded in 2008 – Very Conservative was down about 35% by November – and were liquidated with no explanation and very short notice. I felt betrayed by the adviser and like I had betrayed my readers.

What I learned was caution. My skeptical first reaction was correct but I let it get washed away by the CIO’s passion, attention and well-told tale. I also overlooked the fact that the strategy’s record was generated in separately-managed accounts and that the CIO was delegating day-to-day responsibility to two talented but less-experienced colleagues. Since then, I’ve changed the way I deal with managers. I now write the profile first, based on the data and the public statements on file. I identify things that cannot be ascertained from those sources and then approach the managers with a limited, targeted set of questions. That helps keep me from substituting their narrative for mine. In addition, I’ve become a lot more skeptical of track records generated in vehicles (separate accounts, SICAVs, hedge funds) other than mutual funds; the structural differences between them really matter. In each draft, I try to flag areas of concern and then share them with you. Forcing myself to ask the question “what are the soft spots here” helps maintain a sort of analytic discipline.

Utopia’s advisers, by the way, are doing well: still in Traverse City at what appears to be a thriving firm that, true to their owner’s vision, uses part of the firm’s profits to fund a charitable foundation. Me, too: I took the proceeds from the redemption and used it to open positions in FPA Crescent (FPACX) and Matthews Asian Growth & Income (MACSX).

It’s okay to fail, if you fail well. I think that the Observer has been strengthened by my many failures and I hope it will continue to be.

For your part, you need to go find your manager’s discussion of his or her failures. Good managers take ownership of them in no uncertain terms; folks from Bridgeway, Oberweis, Polaris and Seafarer have all earned my respect for the careful, thoughtful discussions they’ve offered of their screw-ups and their responses. If you can’t find any discussion of failures, I’d worry. And if your manager is ducking responsibility (mumbly crap about “contingencies not fully anticipated”), dump him.

Speaking of the opportunity to take a risk and succeed (or fail) spectacularly, it’s time to introduce …

MFO Premium, just because “MFO Extra” sounded silly

We are pleased to announce the launch of MFO Premium. We’re offering it as a gesture of thanks to folks who have supported MFO in the past and an incentive for those who have been promising themselves to support us but haven’t quite gotten there. You can gain a year’s access for a contribution of at least $100; if there are firms that would like multiple log-ins, we’d happily talk through a package.

MFO Premium has been in development for more than a year. Its genesis lays in the tools that Charles, Ed and I rely on as we’re trying to make sense of a fund’s track record. We realized early on that the traditional reporting time frames (YTD, 1-, 3-, 5- and 10-year periods) were meaningless at best and seriously misleading at worst since they capture arbitrary periods unrelated to the rhythms of the market. As a result, we made a screener that allowed us to look at performance in up cycles, down cycles and across full cycles. We also concluded that most services have simple-minded risk measurements; while reporting standard deviation and beta are nice, they represent a small and troubled toolkit since they simplify risk down to short-term volatility. As a result, we made a screener that provides six or eight different lens (from maximum drawdown in each measurement period to recovery times, Ulcer indexes and a simple “risk group” snapshot) through which to judge what you’re getting into.

Along the way we added a tool for side-by-side comparisons of individual funds, side-by-side comparisons with ETFs, previews of our works in progress, a slowly-evolving piece on demographic change and the future of the fund world, sample screener runs (mostly recently, resilient small caps and tech funds that might best hold value in an extended bear) and a small discussion area you can use if something is goofed up.

We think it has three special characteristics:

- It’s interesting: so far as we can tell, most of this content is not available in the tools available to “normal” folks and it’s stuff we’ve found useful.

- It’s evolving: our current suite of tools is slated to expand as we add more functions that we, personally, have needed or wanted. Sam Lee has been meditating upon the subject since his Morningstar days and has ideas about what we might be able to offer, and I suspect you folks do, too.

- It’s responsive: we’re trying to make our tools as useful as possible. If you can show us something that would make the site better and if it’s within our capabilities, we’ll likely do it.

To be clear: we are taking nothing away from MFO’s regular site. Not now, not ever. Nothing’s moving behind a paywall. We’re a non-profit and, more particularly, a non-profit that has a long-standing, principled dedication to helping people make sense of their options. If anything, the success of MFO Premium will allow us to expand and strengthen the offerings on MFO itself.

We operate MFO on revenues of a little more than $1,000/month, mostly from our Amazon affiliation. At 25,000 readers, that comes to income of about $0.04 per reader per month. We got two immediate and two longer-term goals for any additional contributions that the premium site engenders:

- Pay for the data. Our Lipper data feed, which powers the premium screener and supports our other analyses, costs $1,000/month. That cost goes up if we have more than a couple thousand people using the premium screener, a problem we’re unlikely to face for a while. For the nonce, our first-year contract costs us $12,000.

- Pay for design and programming support. As folks point out monthly, our current format – one long scrolling essay – is exceedingly cumbersome. It arose from the days of FundAlarm, where my first monthly “comments and highlights” column was about as long as your annual Christmas letter. Our plan is to switch to a template which makes MFO looks distinctly magazine-like with a table of contents and a series of separate stories and features. At the same time, we’ll continue to look like MFO. We’ve got outside professionals available to customize the template we’ve chosen and to do the design work. We’ve budgeted about $1,500 for that work.

If we end up with 140 contributions, and we’re already half way there, we can cover those expenses and contemplate the two longer-term plans:

- Offer some compensation for the folks who write for, do programming for or manage the Observer. Currently our compensation budget in most months is zero.

- Expand our efforts to help guide and support independent managers and boutique firms. There are an awful lot of smart, talented people out there who are working in splendid isolation from one another. We suspect that helping small fund advisers find ways to exchange thoughts and share angst might well make a difference in the breadth and quality of services that other folks receive.

Three final questions that have come up: (1) What if I’ve already contributed this year? In response to a frequently asked question, we’ve kept track of all of the folks who’ve already contributed to the Observer this year. You’re not getting left behind but it may take a couple weeks for us to catch up with you. (2) Is my contribution tax-deductible? Melissa, our attorney, has been very stern with me about how I’m allowed to answer this question so I’ll let her answer it.

Contributions are tax-deductible to the extent allowable under law. In accordance with IRS regulations, the fair market value of the online premium access of $15 is not tax-deductible. MFO is not confirming or guaranteeing that any donor can take charitable deductions; no nonprofit can do that since it depends on the individual donor’s tax situation. For example, donors can only take the deduction if they itemize and donors are subject to certain AGI limits. The nonprofit can only state that it is a 501(c)(3) organization and contributions may be tax-deductible under the law.

(3) Is there an alternative to using PayPal? Well, yes. PayPal is the default. But you do not need a PayPal account. We just use the secure PayPal portal, which allows credit or debit card payment methods. Alternately, writing a check works: Mutual Fund Observer, Inc., 5456 Marquette Street, Davenport, IA 52806. (Drop us an email when the check is in the mail and we will access you pronto.) We’re also working to activate an Amazon Pay option.

That’s about it. We think that the site is useful, the contribution target is modest and the benefits are substantial. We hope you agree and agree chip in. Too, clicking on and bookmarking our Amazon link helps us a lot, costs you nothing and minimizes your time at the mall.

Now, back to our story!

Charge of the Short-Pants Brigade

“What is youth except a man or a woman before it is ready or fit to be seen.”

Evelyn Waugh

We are now in that time of the year, December, which I will categorize as the silly season for investors, both institutional and individual. Generally things should be settling down into the holiday whirl of Christmas parties and distribution of bonus checks, at least in the world of money management. Unfortunately, things have not gone according to plan. Once again that pesky passive index, the S&P 500, is outperforming many active managers. And in some instances, it is not just outperforming, but in positive total-return territory while many active managers are in negative territory. So for the month of December, there is an unusual degree of pressure to catch-up the underperformance by year-end.

We are now in that time of the year, December, which I will categorize as the silly season for investors, both institutional and individual. Generally things should be settling down into the holiday whirl of Christmas parties and distribution of bonus checks, at least in the world of money management. Unfortunately, things have not gone according to plan. Once again that pesky passive index, the S&P 500, is outperforming many active managers. And in some instances, it is not just outperforming, but in positive total-return territory while many active managers are in negative territory. So for the month of December, there is an unusual degree of pressure to catch-up the underperformance by year-end.

We have seen this play out in the commodities, especially the energy sector. As the price of oil has drifted downwards, bouncing but now hovering around $40 a barrel, it has been dangerous to assume that all energy stocks were alike, that leverage did not matter, and that lifting costs and the ability to get product to market did not matter. It did, which is why we see some companies on the verge of being acquired at a very low price relative to barrels of energy in the ground and others faced with potential bankruptcy. It did matter whether your reserves were shale, tar sands, deep water, or something else.

Some of you wonder why, with a career of approaching thirty years as an active value investor, I am so apparently negative on active management. I’m not – I still firmly believe that over time, value outperforms, and active management should add positive alpha. But as I have also said in past commentaries, we are in the midst of a generational shift of analysts and money managers. And it is often a shift where there is not a mentoring overlap or transition (hard to have an overlap when someone is spending much of his or her time a thousand miles away). Most of them have never seen, let alone been through, a protracted bear market. So I don’t really know how they will react. Will they panic or will they freeze? It is very hard to predict, especially from the outside looking in. But in a world of email, social media, and other forms of instantaneous communication, it is also very hard to shut out the outside noise and intrusions. I have talked to and seen managers and analysts who retreated into their offices, shut the door, and melted under the pressure.

For many of you, I think the safer and better course of action is to allocate certain assets, particularly retirement, to passively-managed products which will track the long-term returns of the asset classes in which they are invested. They too will have maximum draw-down and other bear market issues, but you will eliminate a human element that may negatively impact you at the wrong time.

The other issue of course is benchmarking and time horizons, which is difficult for non-value investors to appreciate. Value can be out of favor for a long, long period of time. Indeed it can be out of favor so long that you throw in the towel. And then, you wish you had not. The tendency towards short-termism in money management is the enemy of value investing. And many in money management who call themselves value managers view the financial consultant or intermediary as the client rather than Mr. and Mrs. Six-Pack whose money it is in the fund. They play the game of relative value, by using strategies such as regression to the mean. “See, we really are value investors. We lost less money than the other guys.”

The Real Thing

One of the high points for me over the last month was the opportunity to attend a dinner hosted by David Marcus, of Evermore Global Value, in Boston, at the time of the Schwab Conference. I would like to say that David Snowball and I attended the Schwab Conference, but Schwab does not consider MFO to be a real financial publication. They did not consider David Snowball to be a financial journalist.

I have known of David Marcus for some years, as one of the original apostles under Max Heine and Michael Price at Mutual Shares. I am unfortunately old enough to remember that the old Mutual Shares organization was something special, perhaps akin to the Brooklyn Dodgers team of 1955 that beat the Yankees in the World Series (yes, children, the Dodgers were once in Brooklyn). Mutual Shares nurtured a lot of value investing talent, many of whom you know and others, like Seth Klarman of Baupost and my friend Bruce Crystal, whom you may not.

David Snowball and I subsequently interviewed David Marcus for a profile of his fund. I remember being struck by his advice to managers thinking of starting another 1940 Act mutual fund – “Don’t start another large cap value fund just like every other large cap value fund.” And Evermore Global is not like any other fund out there that I can see. How do I know? Well, I have now listened to David Marcus at length in person, explaining what he and his analysts do in his special situation fund. And I have done what I always do to see whether what I am hearing is a marketing spiel or not. I have looked at the portfolio. And it is unlike any other fund out there that I can see in terms of holdings. Its composition tells me that they are doing what they say they are doing. And, David can articulate clearly, at length, about why he owns each holding.

What makes me comfortable? Because I don’t think David is going to morph into something different than what he is and has been. Apparently Michael Price, not known for suffering fools gladly, said that if the rationale for making an investment changed or was not what you thought it was, get rid of the investment. Don’t try and come up with a new rationale. I will not ruin your day by telling you that in many firms today the analysts and portfolio managers regularly reinvent a new rational, especially when compensation is tied to invested assets under management. I also believe Marcus when he says the number of stocks will stay at a certain level, to make sure they are the best ideas. You will not have to look back at prior semi-annual reports to wonder why the relatively concentrated fund of forty stocks became the concentrated fund of eighty stocks (well it’s active share because there are not as many as Fidelity has in their similar fund). So, I think this is a fund worth looking at, for those who have long time horizons. By way of disclosure, I am an investor in the fund.

Final Thoughts

For those of you who like history, and who want to understand what I am talking about in terms of the need for appreciating generational shifts in management when they happen, I commend to you Rick Atkinson’s first book in his WWII trilogy, An Army at Dawn.

My friend Robin Angus, at the very long-term driven UK Investment Trust Personal Assets, in his November 2015 Quarterly Report quoted Brian Spector of Baupost Partners in Boston, whose words I think are worth quoting again. “One of the most common misconceptions regarding Baupost is that most outsiders think we have generated good risk-adjusted returns despite holding cash. Most insiders, on the other hand, believe we have generated those returns BECAUSE of that cash. Without that cash, it would be impossible to deploy capital when … great opportunities became widespread.”

Finally, to put you in the holiday mood, another friend, Larry Jeddeloh of The Institutional Strategist, recently came back from a European trip visiting clients there. A client in Geneva said to Larry, “If you forget for a moment analysis, logic, reasoning and just sniff the air, one smells gunpowder.”

Not my hope for the New Year, but ….

Edward A. Studzinski

When Good Managers Go Bad

By Leigh Walzer, founder and principal of Trapezoid, LLC. Leigh’s had a distinguished career working in investment management, in part in the tricky field of distressed securities analysis. He plied that trade for seven years with Michael Price and the Mutual Series folks. He followed that with a long stint as a director at Angelo, Gordon & Co., a well-respected alternatives manager and a couple private partnerships. Through it all, Leigh has been insatiably curious about not just “what works?” but, more importantly, “why does it work?” That’s the work now of Trapezoid LLC.

By Leigh Walzer, founder and principal of Trapezoid, LLC. Leigh’s had a distinguished career working in investment management, in part in the tricky field of distressed securities analysis. He plied that trade for seven years with Michael Price and the Mutual Series folks. He followed that with a long stint as a director at Angelo, Gordon & Co., a well-respected alternatives manager and a couple private partnerships. Through it all, Leigh has been insatiably curious about not just “what works?” but, more importantly, “why does it work?” That’s the work now of Trapezoid LLC.

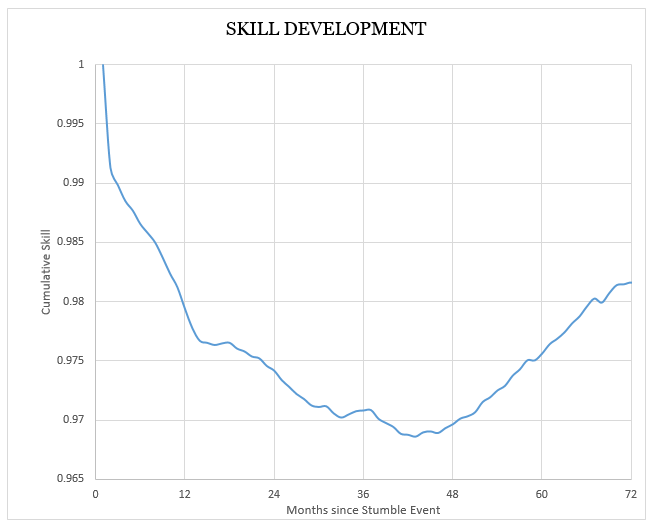

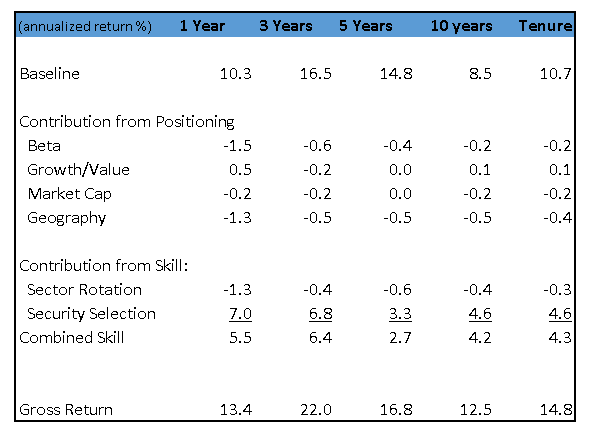

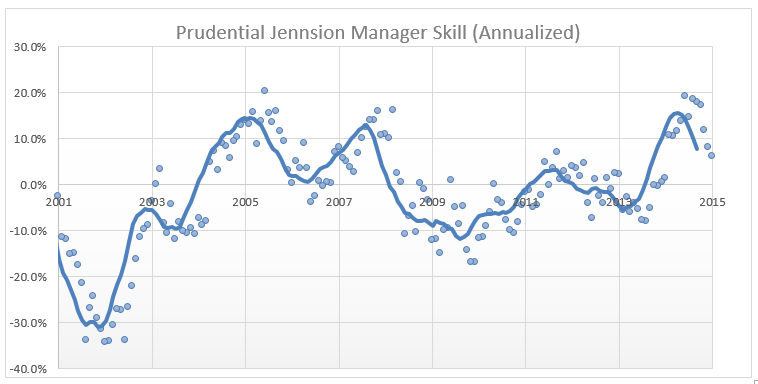

Continuing the theme of learning from failure… One of the toughest decisions for investors is what to do when a portfolio manager who had been performing well turns in a bad year? We can draw on our extensive database of manager skill for insight and precedents.

The Trapezoid system parses out manager skill over time. Our firm strives to understand whether past success was the result of luck or skill and determine which managers are likely to earn their fees going forward. Readers can demo the system for free at www.fundattribution.com where most of the active US equity mutual funds are modelled. The demo presents free access to certain categories with limited functionality.

To answer the question we look back in time for portfolio managers who experienced what we call a “Stumble.” Specifically, we looked for instances where a manager who had negative skill over the latest twelve months and positive skill in the preceding three years. The skill differential had to be at least 5 points. Skill in this case is a combination of Security Selection and Sector Selection. We evaluated data over the past 20 years, ignoring funds with a manager change or insufficient history.

Our goal was to see how these managers did following the Stumble. To make the comparison as fair and unbiased as possible, we compared the Stumble managers to a control group who had the same historical skill with no Stumble.

Exhibit I illustrates with two hypothetical funds. Coyote Fund had the same cumulative skill over a four year period – but investors in Roadrunner followed a much rougher path, and saw their value plummet in Year 4.

EXHIBIT I

Returns from Two Hypothetical Funds

| Year 1 | Year 2 | Year 3 | Year 4 | |

| Roadrunner | 5 | 3 | 4 | -8 |

| Coyote | -3 | 1 | 5 | 0.5 |

Should holders of Roadrunner switch? Does the most recent performance suggest Roadrunner might have lost its Mojo? Does Roadrunner deserve a mulligan for an uncharacteristic year? Or should investors stick to their conviction that over the long haul Roadrunner and Coyote are equally skilled and stay the course? Or that Roadrunner is due for a bounce back?

Our database indicates that managers who stumble take approximately 30 months to regain their footing. During that thirty month period, these funds underperform by an incremental 3%. (See Exhibit II) This suggests investors would do well to switch from Roadrunner to Coyote. Note that a lot of the performance disparity occurs in the first few months after a Stumble, so close monitoring might allow investors to contain the damage. But if you don’t react quickly, there is a stronger case to stay put.

Why are managers slow to recover after a stumble? For many funds skill is partly cyclical. Cyclicality can occur because funds participate in market themes and seams of opportunity which play out over time. Strong or poor performance may affect funds flow which may further impact returns. So a Stumble may not tell investors much about the long term prognosis, but it is helpful in predicting over the short term. Our algorithms try to distinguish secular from cyclical trends and, equally important, how confident we can be in making predictions.

EXHIBIT II

Typical Skill Trend after Stumble Event

On a related note, we are sometimes asked whether managers learn from their experience and become better over time. We are sympathetic to the view that managers with a few gray hairs might do better than their younger peers, but the data doesn’t support this. In general managers with more experience don’t outperform the greenhorns, but they don’t seem to lose their fastball either.

But there is something interesting in this chart. Managers who survive a crisis do a little better than their peers in later years. One explanation is that with the battle scars come some valuable lessons which helps managers navigate the market better.

We looked for specific funds which stumbled recently. They are listed in Exhibit III. Some of these funds actually have good 3-5 year track records and have fund classes on the Trapezoid Honor Roll, which is separate from the Observer’s. Think of the Stumble Event as an early warning indicator: we are looking for funds that have lost altitude or veered off their trajectory.

EXHIBIT III

Funds with Stumble Event in the 12 Months Ending June 2015

| AUM $bn | Category | Stumble Magnitude | |

| ClearBridge Aggressive Growth Fund | 13.2 | Large Opport. | -5% |

| MFS Growth Fund | 11.1 | All-Cap Growth | -6% |

| Federated Strategic Value Dividend Fund | 9.2 | Large Value | -6% |

| Putnam Capital Spectrum Fund | 9.2 | Dynamic Alloc. | -7% |

| American Century Ultra Fund | 7.9 | Large Blend | -5% |

| Artisan Mid-Cap Value Fund | 7.2 | Mid-Cap Blend | -6% |

| Baron Growth Fund | 7.0 | Small Blend | -8% |

| Columbia Acorn International Fund | 6.9 | Foreign SMID Growth | -9% |

| BBH Core Select Fund | 4.9 | Large Blend | -6% |

| Fairholme Fund | 4.9 | Large Value | -19% |

| Touchstone Sands Capital Select Growth Fund | 4.9 | Large Growth | -9% |

| MFS International New Discovery Fund | 4.8 | Foreign All-Cap Growth | -9% |

| Fidelity Fund | 4.7 | Large Blend | -5% |

| Baron Small-Cap Fund | 4.5 | Small Growth | -7% |

| Invesco Charter Fund | 4.4 | Large Blend | -12% |

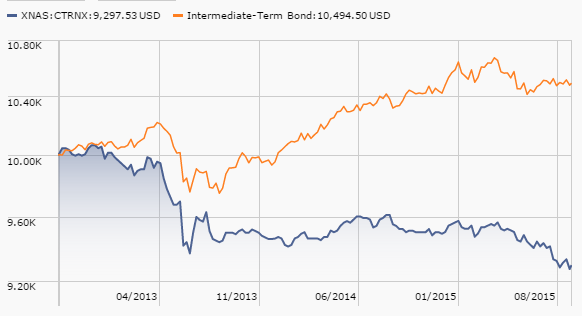

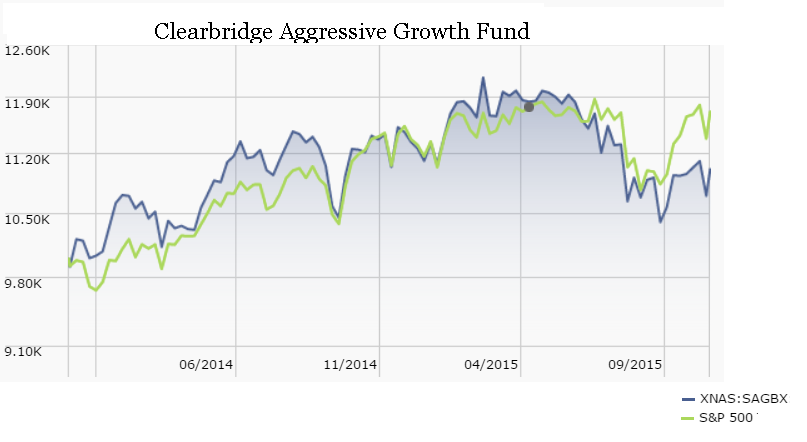

We took a harder look at the largest fund on the list, ClearBridge Aggressive Growth (SAGYX).

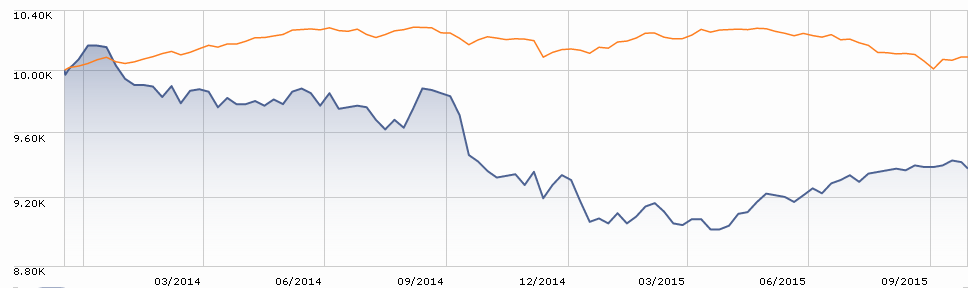

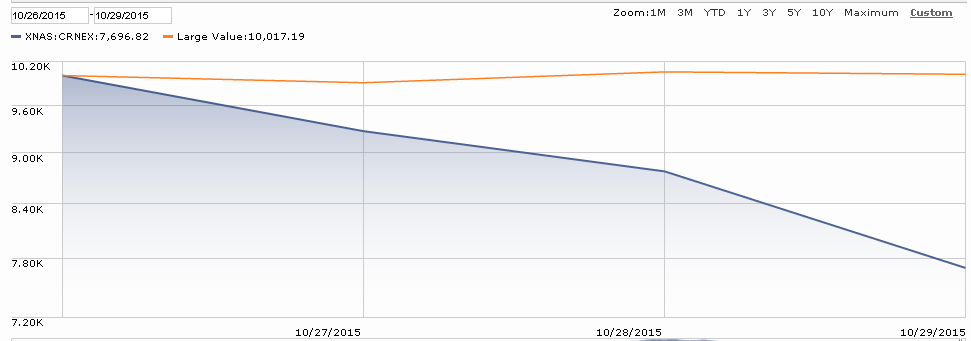

EXHIBIT IV

ClearBridge Aggressive Growth Fund: Recent Performance

This $14bn fund has a 32 year history with the same lead manager in place throughout. At various times in the past it was known as Shearson, Smith Barney, or Legg Mason Aggressive Growth Fund.

We don’t have data back to inception, but over the past 20 years, the manager (Richard Freeman) has demonstrated sector selection skill of approximately 1% per year. Exhibit IV shows the recent net returns (courtesy of Morningstar). We see little or no stock picking skill. The fund is very concentrated and differentiated; the Active Index (or OAI) is 23; in general when we see scores over 18, we read it as evidence of a truly active manager). Over the past 5 years, sector selection has contributed approximately 3%/year. Based on this showing, our Orthogonal Attribution Engine (or OAE, the tool we use to parse out the effects of each of the six sources of a fund’s over- or under-performance) has enough confidence to incur expenses of roughly 1%/year. As a result, several fund classes are on our Trapezoid Honor Roll – i.e., we have 60% confidence skill justifies expenses. The fund has tripled in size in three years which is a bit of a concern. We can replicate the fund with 87% R-squared. Our “secret sauce” to replicate the fund is a blend of S&P500, small-cap, a very large dollop of biotech, and small twists of media, energy, and healthcare. The recipe doesn’t seem to have changed much over time.

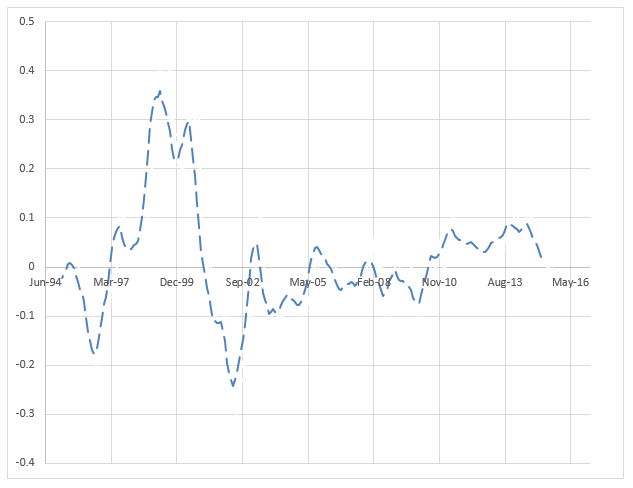

Exhibit V gives a sense of the cyclicality of combined skill over time, the manager has had some periods of exceptional performance but also some slumps. The first half of 2002 was a rough period for the fund; the negative skill reflects mainly that the fund had (as always) a heavy overweight on biotech which badly underperformed the market during that timeframe.

EXHIBIT V

ClearBridge Aggressive Growth: Combined Skill from Security Selection and Sector Rotation (1995-2015)

Coming into the second half of 2014, the fund had its characteristic strong overweight on biotech. This weighting should have served the fund well. However, security selection was negative in the twelve months ended July 2014. (NB: The fund’s Fiscal Year ends August) Some of the stocks the fund had held for several years and ridden up like Biogen, SanDisk, Cree, and Weatherford did not work in this environment. We view this as negative skill, since the manager could have sold high and redeployed to other stocks in the same sector. Our math suggests the fund also incurred above average trading costs over the past year, which shows up in our model as negative skill. We asked ClearBridge to review our findings but they did not respond as of this writing.

ClearBridge Aggressive Growth re-entered Stumble territory in June. We noted earlier that funds with a Stumble event tend to lose another 2.5% before regaining their footing. In their case, that prediction has held true. We have not refreshed their skill but they have lagged the S&P500 badly. Most recently, another big biotech position they rode up, Valeant Pharmaceuticals, has come undone.

Bottom Line: Investors should consider heading to the sidelines when a fund stumbles and wait until the dust clears. We usually pay more heed to long term track record than short term blips and momentum. But a sudden drop-off in skill usually portends more pain to come. So for marginally attractive funds a Stumble Event may be a sell signal.

ClearBridge has had the conviction to remain overweight biotech for many years which has served them well. That sector now has negative momentum. We expect the poor security selection will even out over time. Investors who are neutral or positive on the sector should give the fund the benefit of the doubt.

To see additional details, please register at www.fundattribution.com and click on the Stumbles link from the Dashboard. As always, we welcome your comments at [email protected]

Quick hits: Resilient small caps and tech funds

Partly as a teaching tool, I’ve been walking folks through how to use our fund screener. Two outputs that you might find interesting:

Resilient small cap winners: which small cap funds came closest to letting you have your cake and eat it, too? That is, which were cautious enough to post both relatively limited losses in the 2007-09 bear market and to manage top tier returns across the entire market cycle (2007 – present)? Three stand out:

Intrepid Endurance (ICMAX), a cash-heavy absolute value fund once skippered by Eric Cinnamond, now of Aston River Road Independent Value (ARIVX).

Dreyfus Opportunistic Small Cap (DSCVX), a much more volatile fund whose upside has outpaced its downside. It’s closed to new investors.

Diamond Hill Small Cap (DHSCX), a star that’s set to close to new investors at the end of December.

Resilient tech: did any tech funds manage both of the past two bears, 2000-02 and 2007-09? I screened for the funds that had the lowest maximum drawdowns and Ulcer Indexes in both crashes. Turns out that risk-sensitivity persisted: four of the five most stable funds in 2002 were on the list again in 2007. The best prospect is Zachary Shafran’s Ivy Science & Tech (WSTAX). It’s more of a “great companies that use tech brilliantly” firm than a pure tech play. Paul Wick’s Columbia Seligman Communication & Information (SLMCX) was almost as good but there’s been a fair turnover in the management team lately. Two Fidelity Select sector funds, IT Services (FBSOX) and the soon-to-be-renamed Software & Computer Services (FSCSX), also repeated despite 17 manager changes between them. Chip, our IT services guru, mumbles “told you so.”

Category Averages

Category Averages

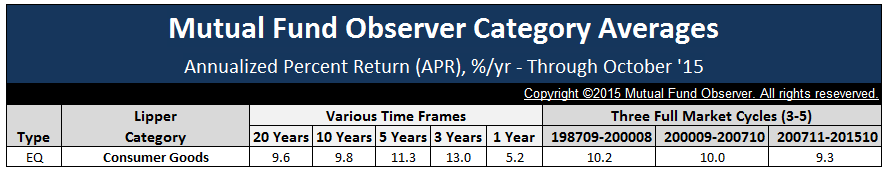

As promised, we’ve added a Category Averages tool on the MFO Premium page. Averages are presented for 144 categories across 10 time frames, including the five full market cycles period dating back to 1968. The display metrics include averages for Total Return, Annualized Percent Return (APR), Maximum Drawdown (MAXDD), MAXDD Recovery Time, Standard Deviation (STDEV, aka volatility), and MFO Risk Group ranking.

Which equity category has delivered the most consistently good return during the past three full market cycles? Consumer Goods. Nominally 10% per year. It’s also done so with considerably less volatility and drawdown than most equity categories.

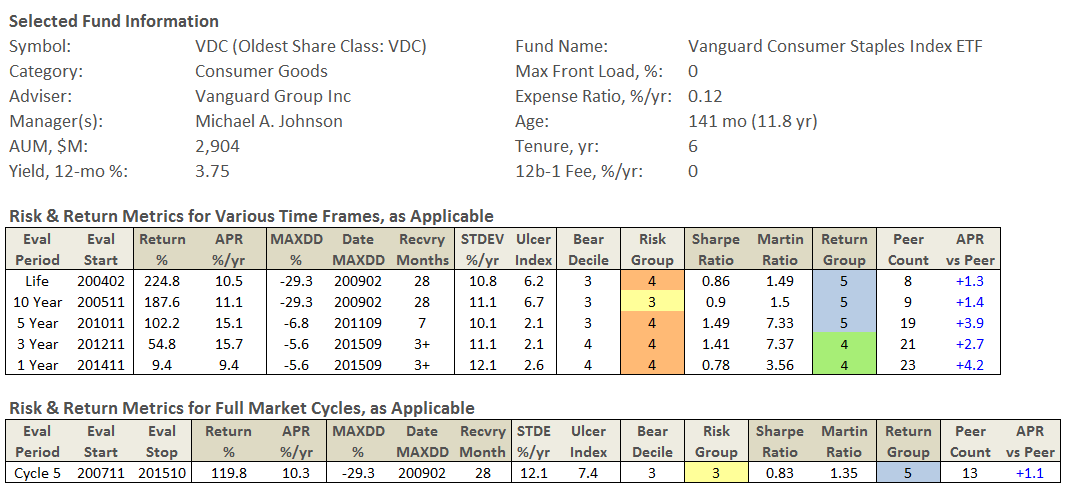

One of the lower risk established funds in this category is Vanguard Consumer Staples Index ETF VDC. (It is also available in Admiral Shares VCSAX.) Here are its risk and return metrics for various time frames:

The new tool also enables you to examine Number of Funds used to compute the averages, as well as Fund-To-Fund Variation in APR within each category.

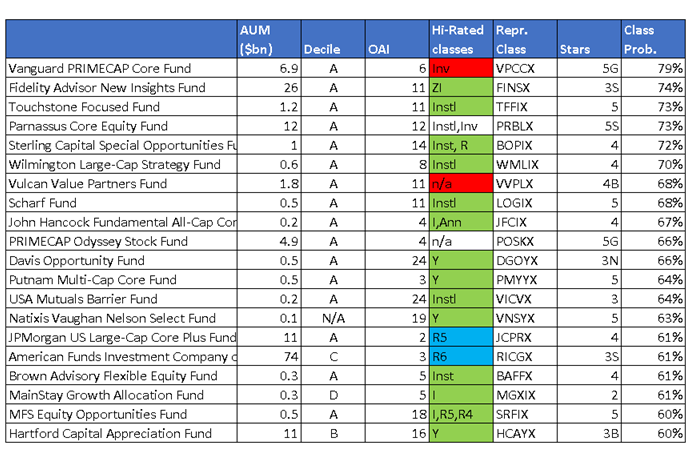

Morningstar anoints the “emerging, unknown, and up-and-coming”

In mid-November, Dan Culloton shared the roster of Morningstar Prospects with readers. These are funds that “emerging, unknown and up-and-coming.” They’re listed below, while the link above will take you to the Morningstar video center where a commercial and a video interview will auto-launch.

One measure of the difference between Morningstar’s universe and ours: they can see 23 year old funds as “emerging” and $10 billion ones as “unknown.” We don’t.

| AUM | Inception | ||

| BBH Global Core Select BBGRX | 138 million | 3/2013 | Limited overlap with the management team for BBH Core Select. So far a tepid performer. It has a bit lower returns than its Lipper peers and a bit lower volatility. In the end, the lifetime Sharpe ratio is identical. |

| Bridge Builder Core Bond BBTBX | 10.0 billion | 10/2013 | Splendid fund except “Fund shares are currently available exclusively to investors participating in Advisory Solutions, an investment advisory program or asset-based fee program sponsored by Edward Jones.” Charles is not a fan of EJ’s fees. |

| Fidelity Conservative Income FCONX | 3.7 billion | 03/2011 | A very low volatility ultra-short bond fund. It gives up about 100 bps a year in returns to its peers. Still its volatility is so low that its measures of risk-adjusted returns (Sharpe, Martin and Sortino ratios) shine. |

| JOHCM International Select II JOHAX | 3.1 billion | 7/2009 | Great fund. Returns about twice its peer average with no greater volatility. We profiled it shortly before it closed to new investors to give folks a think about whether they wanted to get in. |

| Polen Growth POLRX | 732 million | 12/2010 | A low turnover, large-growth fund that, in the long term, has beaten its peers by about 2% a year with noticeably lower volatility. Just passed the five-year mark with the same managers since inception. |

| Smead Value SMVLX | 1.3 billion | 1/2008 | One major change since we profiled Smead two years ago: Cole, the manager’s son, has been added as co-manager and seems more and more to be driving the train. So far, the fund’s splendid record has continued. |

| SSgA Dynamic Small Cap SVSCX | 77 million | 7/1992 | This is the most intriguing one of the bunch. Risk-sensitive small cap quant fund. New manager in 2010 and co-manager in 2015. Top 1% performer over those five years. Lewis Braham mentioned it as one of “five great overlooked little funds” in October. One flag: assets have tripled in the past three months. |

Farewell to FundFox

We’re saddened to report the closure of FundFox, the only service devoted exclusively to target federal litigation involving the fund industry. It was started in 2012 by David Smith, who used to work for the largest liability insurance provider to the fund industry, as a simpler, cleaner, more specialized alternative to services such as WestLaw or Lexis. David drew an exceedingly loyal (think: 100% resubscription rate) readership that never grew enough for the service to become financially self-sustaining. David closed on Friday the 13th of last month. David’s monthly column has run in the Observer for the past 17 months. We’ll miss him.

David’s going to take a deep breath now, enjoy the holidays and think about his next steps. One possibility would be to work in a fund compliance group; another would be to join his family’s century-old citrus business.

“Two roads diverged in a yellow wood, And sorry I could not travel both.” Diverged indeed.

Cap gains 2015: Not as bad as last year, except for those that are much worse

CapGainsValet.com is up and running again (and still free). CGV is designed to be the place for you to easily find mutual fund capital gains distribution information. If this concept is new to you, have a look at the Articles section of the CGV website where you’ll find educational pieces ranging from beginner concepts to more advanced tax saving strategies.

is up and running again (and still free). CGV is designed to be the place for you to easily find mutual fund capital gains distribution information. If this concept is new to you, have a look at the Articles section of the CGV website where you’ll find educational pieces ranging from beginner concepts to more advanced tax saving strategies.

I’ve been gathering and posting 2015 capital gain distribution estimates for CapGainsValet.com for the last two months. My database currently has distribution estimates for almost 190 fund firms. This represents 90% of the firms I’m hoping to eventually add, which means the 2015 database is nearly complete. (Hurray for me!)

I recently had a look through last year’s database to see how it compares to this year’s numbers. Here’s what I found:

- Fewer funds are distributing more than 10%. Last year I found 517 mutual funds that distributed more than 10% of their NAV. From all indications, 2014 was one of the biggest distribution years on record. For 2015, I’ve found 367 funds that are going to distribute more than 10%. My guess is that we’ll end the year in the 375-380 range.

- More BIG distributions. In 2014, I was able to find 12 funds that distributed more than 30% of their NAV. This year that number has already jumped to 19. Even though the number of 30% distributors has increased, the number of funds that are distributing between 20% and 30% of NAV is about half of what it was last season.

- Several big names in the doghouse. If you take a look at my “In the Doghouse” list, you will find that there are some of the bigger names in the actively managed funds universe. Montag & Caldwell Growth, Columbia Acorn and Fairholme will be distributing billions. Successful funds with large fund outflows are likely going to have trouble controlling future capital gains distributions.

- ETFs are still looking very tax efficient. Although CGV does not track ETF distributions, I am seeing very low capital gain numbers from ETF providers. Market-cap weighted index funds and ETFs continue to be tax efficient.

- More tax swapping opportunities. Last year’s distributions corresponded to a fairly solid year of gains – it is not looking like that will be the case this year. Last year, selling a fund

before its large capital gain distribution meant little difference because the fund’s embedded gains were similar or larger. If you bought a fund this year, receiving a large distribution will likely result in a higher tax bill than if you sell the fund before its record date. At Tarbox (my day job) we have already executed a number of tax-swap trades that will save our clients hundreds to thousands of dollars on their 2015 tax return. Have a look through your holdings for these types of opportunities.

before its large capital gain distribution meant little difference because the fund’s embedded gains were similar or larger. If you bought a fund this year, receiving a large distribution will likely result in a higher tax bill than if you sell the fund before its record date. At Tarbox (my day job) we have already executed a number of tax-swap trades that will save our clients hundreds to thousands of dollars on their 2015 tax return. Have a look through your holdings for these types of opportunities.

Of course, CGV is not the only site providing shortcuts to capital gain distribution estimates. MFO’s discussion board has an excellent list of capital gain distribution estimates with a number of fund firms too small for the CGV database. Check it out and provide some assistance if you can.

Mark Wilson, APA, CFP®

Chief Investment Officer, The Tarbox Group, Inc.

Chief Valet, CapGainsValet

The Alt Perspective: Commentary and news from DailyAlts.

Give Up The Funk

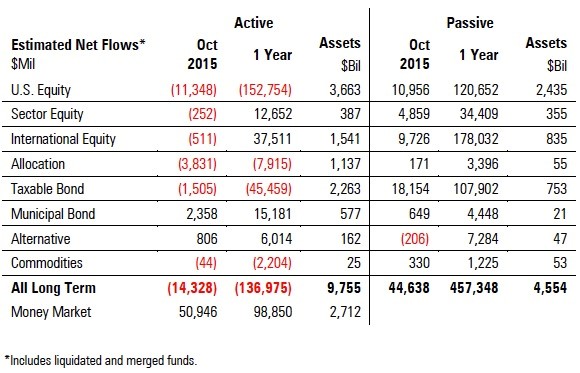

Every once in a while an asset category gets into a funk. Value investing was in a funk leading up to the dotcom bubble, growth stocks were in a funk following the dotcom bubble, etc. You probably know what I mean. Interestingly, active management is in a funk right now – just take a look at the below chart from Morningstar’s most recent U.S. Asset Flows report (includes both mutual funds and ETFs):

Actively managed funds have lost $136 billion in assets over the past year! Are investors taking their dollars out of funds? No. Passive funds have pulled in $457 billion over that same time period. That’s a gap of nearly $600 billion! On a net basis, investors have poured $320 billion of new dollars into mutual funds and ETFs in the past 12 months, nearly $27 billion per month on average. That’s some serious coin.

Is Active Management Dead?

So what is the story, is active management dead? No, active management is not dead, and it never will be. Part of the problem is that most actively managed funds are mutual funds, while most passive funds are ETFs. ETFs have a lower cost structure and a lower barrier to entry. Advantage passive ETFs. This will shift over time with new product development, and the pendulum will swing back, at least part way. Other factors are also at play, and just like other funks, things will change.

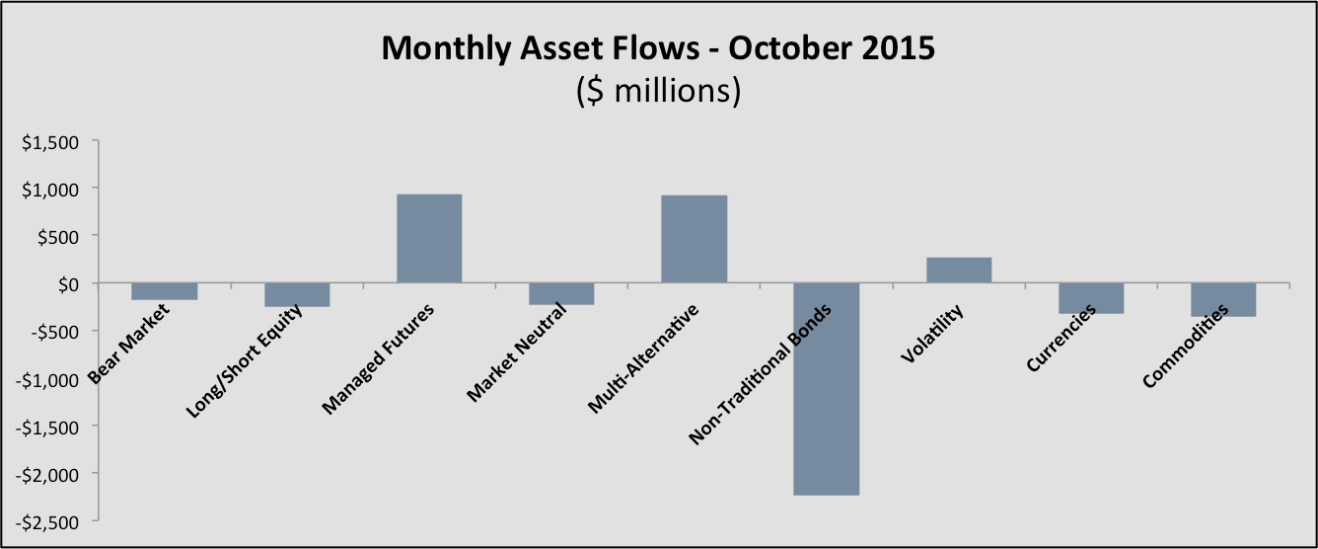

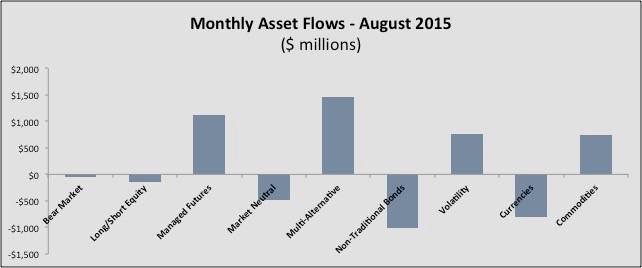

But in the meantime, one of the four categories of actively managed funds to garner assets over the past year, and only one of two in October, was that of Alternatives. Why? Because alternative funds offer diversification beyond traditional stock and bond portfolios. They offer investors exposure to more unconstrained forms of investing that can generate lower risk and/or provide improved portfolio diversification due to their low correlation with long-only stocks and bonds.

A recent paper by the Alternative Investment Management Association (AIMA) and the Chartered Alternative Investment Analyst Association (CAIA Association) appropriately breaks hedge funds down into two categories: Substitutes and Diversifiers. This is an important distinction since each grouping has a different role in a portfolio, and can have a different impact on overall results. Substituted replace assets that are already existing in most portfolios, such as stocks and bonds, while diversifiers are investment strategies that have a low to zero correlation with traditional asset classes. If you are considering, or even currently using alternatives, I would encourage you to read the paper.

Liquid Alts Asset Flows

So let’s take a quick look at the asset flows into, or out of, liquid alternatives for October. The picture hasn’t changed much in the past few months. Flows are going into multi-alternative funds, managed futures funds and volatility funds, while assets are flowing out of non-traditional bonds funds and bit out of other categories.

Leading up to 2015, non-traditional bond fund had significant inflows as everyone expected rates to rise. Many of these funds are designed to protect against rising rates. Here we are in late November 2015 and still no rate rise. Mediocre performance and not significant rate rise in sight, and out go investors who need income and returns more than protection.

Quick Wrap

A couple final notes of interest from the news and research categories this past month:

- Putnam published a thoughtful paper on how alternatives perform in different economic environments: Evaluating Alternatives In Four Growth and Inflation Scenarios.

- John Dolfin and Chris Maxey of Steben & Company review the Importance of Manager Selection as it relates to alternative investments.

- A new liquid form of venture capital investing is available to retail investors via a mutual fund as outlined in New Mutual Fund Aims to Democratize Access to Venture Capital.

- DailyAlts has a new column called Best and Worst where we publish a series of stories each month highlighting the best and worst performing funds in each main category of liquid alternatives.

Be sure to check out DailyAlts.com for more updates on the liquid alternatives market, and feel free to sign up for our free daily or weekly newsletter.

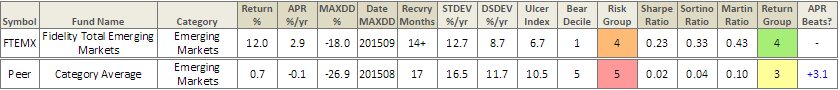

Observer Fund Profiles: Fidelity Total Emerging Markets

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

Fidelity Total Emerging Markets (FTEMX): we’ve long argued that EM investors need to find a strategy for managing volatility and that a balanced fund is the best strategy they’ve got. There’s a good argument that John Carlson’s fund is the best option for pursuing that best strategy.

Elevator Talk: Bryn Torkelson, Matisse Discounted Closed-End Fund Strategy (MDCAX/MDCEX)

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we have decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we have decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

Bryn Torkelson

Bryn Torkelson manages MDCAX, which launched at the end of October 2012. He also co-founded and owns the advisor (launched in 2010) and the sub-adviser, Deschutes Portfolio Strategies (launched in 1997). Bryn started in the investment industry in 1981 as a broker with Smith Barney and later worked with Dain Bosworth. He has a B.S. in Finance from the University of Oregon, which is helpful since some of the research underlying the strategy was conducted at the university’s Lundquist College of Business. He manages one hedge fund, Matisse Absolute Return Fund, a 5 star rated fund by Morningstar, and about 700 separate accounts, mostly for high net-worth individuals. In all, the firm manages about $900 million.

He’s headquartered in Lake Oswego, Oregon, a curiously hot spot for investment firms. It’s also home for the advisers of the Jensen and Auxier funds.

The story here’s pretty simple. Taken as a group, closed-end fund (CEF) portfolios return about what the overall market does. So if you simply invested in all the existing CEFs, you’d own an expensive index fund. CEFs, much more than other investment vehicles, are owned mostly by individual investors. Those folks are given to panic and regularly offer to sell $100 in stocks for $80; on a really bad day, they’ll trade $100 in stocks for $60 in cash. That’s irrational. Buyers move in, snap up assets at lunatic discounts and the discounts largely evaporate.

Here’s the Matisse plan: research and construct a portfolio from the 20% most discounted funds in the overall universe of income-producing CEFs, wait for the discounts to evaporate, then rebalance typically monthly to restock the portfolio with the most-discounted quintile. Research from the Securities Analysis Center at Oregon, looking back as far as they could get monthly price and discount data (1988), suggests that strategy produced 20% a year with a beta of .75. In their separate accounts which started in 2006, the strategy has produced approximately 9% net annually mostly from income and 2-3% capital gains from the contraction of the CEF discounts. Those gains are useful because they’re market neutral; that is, the discounts tend to contract over time whether the overall market is rising or falling.

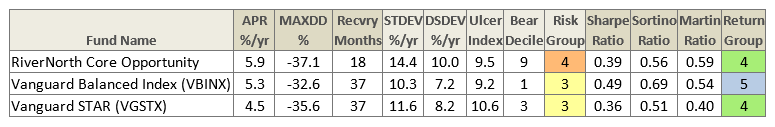

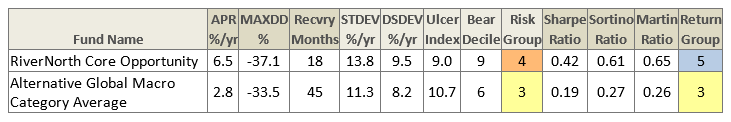

Sadly, in the three years since launch, the mutual fund has returned just 3.3% a year (through late November 2015) which is better than the average tactical allocation fund but far lower than a generic balanced fund. Mr. Torkelson argues that CEF discounts reached, and have stayed at near-record levels this year which accounts for the modest gains. The folks at RiverNorth, who use a different CEF arbitrage strategy in RiverNorth Core Opportunities (RNCOX), agree with that observation. Despite “tough sledding,” Mr. T. believes the CEF market likely bottomed-out in October, which leaves him “very optimistic going forward.” He notes that, since 1988, discounts have only been wider 3% of the time – during a few months in 2008-2009, the tech bubble in 2000 and during the recession of 1990. Today his portfolios have an average discount of 17.5% and a distribution yield of 8.2%.

Here are Mr. Torkelson’s 281 words on why you should add MDCAX to your due-diligence list:

I started our fund/strategy to help investors gain access to higher income opportunities than available in ETF’s or open ended mutual funds. Today the funds distribution income is approximately 8.2%. The misunderstood market of “closed end mutual funds” (CEF’s) presents investors opportunities to buy quality income funds at 15-20% discounts to published market values. When we buy discounts our clients’ portfolios will generates substantially higher income than similar ETF’s or open ended mutual funds.

The entire CEF universe is approximately 500+ funds representing $230 billion in assets. Most of these funds are designed to pay income, often distributed monthly or quarterly. The source of the income varies on each funds objective. However, income is generated from taxable or municipal bonds, preferred stock, convertible bonds, bank loans, MLP’s, REIT’s, return of capital (ROC) or even income from “covered call writing” strategies on the portfolio.

The exciting aspect of the strategy is these CEFs trade on stock exchanges and they often trade at market values well below their published daily Net Asset Values (NAV). Our studies indicate there is a high probability for the discounts to be “mean reverting”. When this happens our clients receive both capital gains in addition to income. For example, firms like Blackrock or PIMCO manage both open ended mutual funds and closed end funds often with the same manager and or objectives. If you purchase the highly discounted vehicle of CEF’s instead of the opened ended equivalent vehicle, you’ll typically get much better returns. The other great part of our strategy is our investors get a highly diversified portfolio without any concentration worries. On a look-through basis our investors get a highly discounted income oriented global balanced portfolio.

Matisse Discounted Closed-End Fund Strategy has a $1000 minimum initial investment on its “A” shares, which bear a sales load, and $25,000 on its Institutional shares, which do not. Matisse has limited the funds expense ratio to 1.25% on the “I” shares. The pass-through costs of CEF funds in which they invest are included and a central and unavoidable contributor to the overall fees. Those pass-throughs accounted for 1.37% last year. With those fees included the expenses on the “I” shares run a stiff 2.62% while the “A” shares are 25 basis points higher. The fund has gathered about $120 million in assets since its October 2012 launch. They have $200 million the overall strategy. It just earned its initial Morningstar rating of three stars within the “tactical allocation” universe for the “I” shares and two stars for the “A” shares for investors who pay the full load.

You’ve got a sort of embarrassment of riches as far as web contacts go. In addition to the sub-adviser’s site, there are separate sites for the Matisse strategy and for the Matisse mutual fund. The former is a bit more informative about what they’re up to; the latter is better for details on the fund. Bryn’s strategy predates his mutual fund. The first six slides on this presentation gives a view of the strategy’s longer-term performance.

Launch Alert: DoubleLine Global Bond Funds

For those who can’t get enough of bondfant terrible Jeffrey Gundlach, DoubleLine Global Bond Fund (DLGBX) is arriving just in time. The fund launched on November 30, 2015 with Mr. Gundlach at the helm. This will be the 17th fund on Mr. Gundlach’s daily to-do list which also includes nine funds on which DoubleLine is a sub-adviser and seven in-house ones. On whole he’s responsible for 50 accounts and about $70 billion in assets.

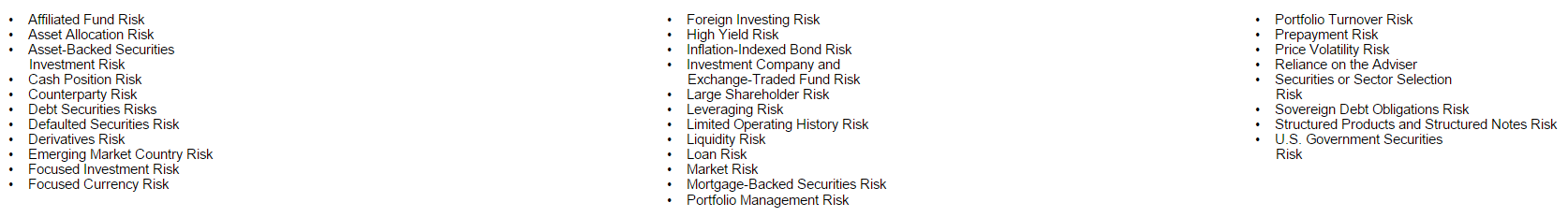

The fund’s investment objective is to seek long-term total return. The plan is to invest, mostly, in investment-grade debt issued, mostly, by G-20 countries. Once we’re past the “mostly,” things open up to include high-yield debt, swaptions, shorting, currency hedges, bank loans, corporate bonds and other creatures. They expect an average duration of 1-10 years.

In case you’re wondering if there are any particular risks to be aware of, DoubleLine offers this list:

The minimum initial investment for the retail shares is $2000 and the opening expense ratio is 0.96%.

Folks on our discussion board would urge you to consider T. Rowe Price Global Multi-Sector Bond (PRSNX) and PIMCO Total Return Active ETF (BOND) as worthy, tested, less-expensive alternatives.

Funds in Registration

We’ve reached the slow time of the year. Funds in registration now won’t be able to claim full-year returns for 2016, so there tends to be a lull in new fund releases. This month we found just five retail, no-load funds in SEC registration. Two are hedge funds undergoing conversion (LDR Preferred Income and Livian Equity Opportunity), two are edgy internationals (Frontier Silk Invest New Horizons and Harbor International Small Cap, managed by Barings) and one an ESG-oriented blue chip fund, TCW New America Premier Equities. All are them are here.

Manager Changes

Chip tracked down 69 full or partial management changes this month, substantial but not a record. The retirement of Jason Cross, one of the founding managers and lead on their long/short trading strategy, from the Whitebox Funds is pretty consequential. Clifton Hoover is stepping away from Dreman Contrarian SCV (DRSAX) to become Dreman’s CIO. Otherwise, it’s mostly not front-page news.

Rekenthaler: “Great” funds aren’t worth the price of admission

John Rekenthaler, a guy who regularly thinks interesting thoughts, collaborated with colleague Jeff Ptak to test the truism that the best long-term strategy is to invest in “singles hitters.” That is, to invest in funds that are consistently a bit above average rather than alternately brilliant and disastrous. By at least one measure, that’s an … um, untruism. Rekenthaler and Ptak concluded that the funds with the best long-term records are ones that frequently land in their peer group’s top tier. They were home run hitters; singles hitters fell well behind.

Sadly, they also concluded that such funds (think Fairholme FAIRX or CGM Focus CGMFX) are often impossible to own. Mr. Ptak writes:

Great funds probably aren’t good. Rather, they’re intermittently amazing and horrendous. Streaky. Hard to stick with. Demanding. That would seem to match findings that the long-term standouts have often plumbed their category’s depths, owning securities that others neglect. Bad stuff routinely happens to great funds. Being merely good isn’t enough. You have to be bad … awful at times … and stick with it … and then maybe you’ll be great.

It’s an interesting, though incomplete, argument. We should think about it.

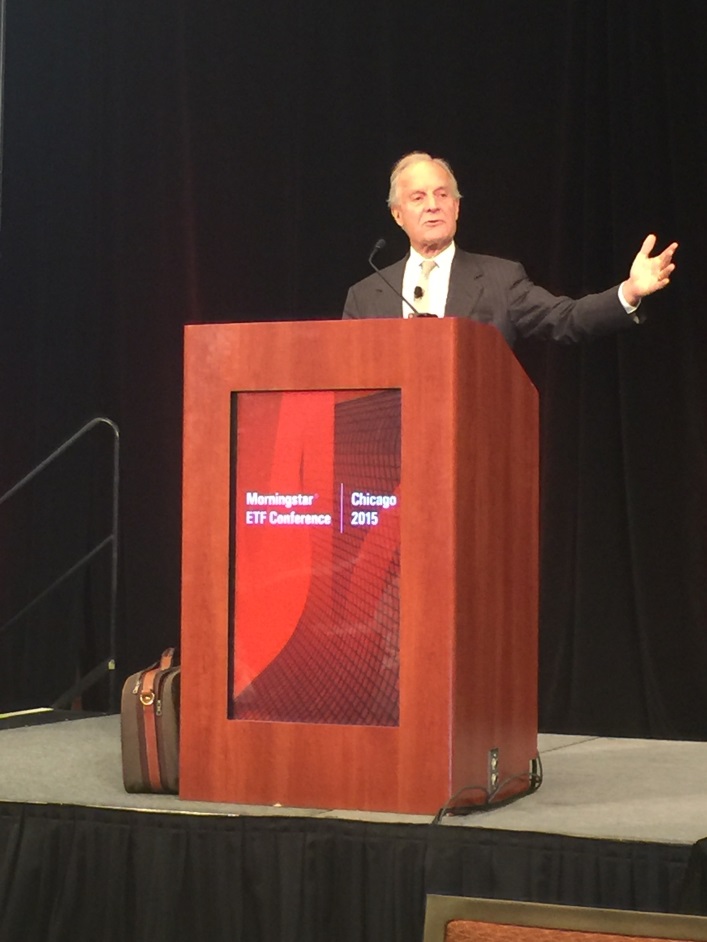

Updates: Gross, Black, Sequoia

In July 2014, after listening to Bill Gross’s disjointed maundering as a Morningstar keynote speaker, we suggested that he’d lost his marbles and that it was time either for him to go or for you to. In September 2014 he stomped off. In October 2015 he decided to sue PIMCO for succumbing to “a lust for power” in their efforts to oust him. A quarter billion or so would make him feel better. Now PIMCO has filed a motion to dismiss the suit, claiming that

The complaint, parts of which read more like a screenplay than a court pleading, uses irrelevant and false personal attacks on Mr. Gross’s former colleagues in an apparent effort to distract attention from the fundamental failings of these ‘contract’ claims.

They’ve urged him to get on with his life. Stay tuned, since I don’t see that happening.

We reported in October, in an admirably dispassionate voice, on the sudden departure of Gary Black from Calamos Investments. In September, Calamos noted that Mr. Black was gone from the firm “effective immediately.” The company positioned it as “an evolution of the management.” He left after three years, a Calamos rep explained, because he “completed the work he was hired to do.” They had no idea of what he was going to be doing next.

Randy Diamond, writing for Pensions & Investments (11/30/2015) hints at a rather more colorful tale in his essay “Calamos continues fighting after another change at the top.”

Mr. Black lasted a little more than three years at Calamos. He joined the firm in August 2012 to replace Mr. Calamos’ nephew, Nick Calamos. Although a news release at the time said Nick Calamos “decided to step back from the day-to-day business of the firm to pursue personal interests,” sources interviewed said he left after frequent clashes with his uncle over how to fix poor investment performance in the firm’s strategies.

Sources said one reason Mr. Black left involved the team from his New York-based long-short investment business, which he sold to Calamos Investments when he joined the firm. Sources said five of the team’s seven investment professionals left this year in a dispute with John Calamos over compensation.

After the dissolution of Mr. Black’s long-short unit, the firm acquired a new long-short team, Phineus Partners LP of San Francisco.

In November 2015, we argued that the Sequoia Fund “seems in the midst of the worst screw-up in its history.” The fund, against the warnings of its board, sunk a third of its portfolio in Valeant Pharmaceuticals (VRX). The managers’ defense of Valeant’s business practices sound a lot like they were written by Valeant or by folks pressured into being cheerleaders. James Stewart, writing in the New York Times, did a really nice follow-up piece, “Huge Valeant Stake Exposes Rift at Sequoia Fund” (11/12/2015). In addition to dripping acid on Sequoia’s desperate argument that betting the farm on Valeant CEO Michael Pearson was no different than when they bet the farm on Berkshire-Hathaway CEO Warren Buffett, Stewart also managed to get some information on the arguments made by the two board members who resigned. It’s very much worth reading.

The fund lost another 1.26% in November, which places it in the bottom 1% of its peer group. Valeant dropped 22% in the same period which suggests its impact on the portfolio is dwindling. Over the past three years, it trails 98% of its peers. (Leigh Walzer might say this qualifies as “a stumble.”)

After talking with Sequoia management (“they were very cooperative”) but not with the trustees who resigned in protest, Morningstar reaffirmed Sequoia’s Gold rating.

Several of us have taken the position that we’re likely in the early stages of a bear market. The Wall Street Journal (12/01/2015) reports two troubling bits of economic data that might feed that concern: US corporate capital expenditures (capex) continue dropping and emerging market corporate debt defaults continue rising. For the first time in recent years, e.m. default rates exceed U.S. rates.

Briefly Noted . . .

One of the odder SEC filings this month: “Effective November 30, 2015, the Adaptive Allocation Fund (AAXAX) will no longer operate a website, and any references within the Prospectus and SAI to www.unusualfund.com are hereby deleted.” No idea.

BofA Global Capital Management is selling their cash asset management business to BlackRock, sometime in the first half of 2016.

Templeton Foreign Smaller Companies Fund (FINEX), Templeton Global Balanced Fund (TAGBX) and Templeton Global Opportunities Trust (TEGOX) have each added the ability to “sell (write) exchange traded and over-the-counter equity put and call options on individual securities held in its portfolio in an amount up to 10% of its net assets to generate additional income for the Fund.”

SMALL WINS FOR INVESTORS

The Fairholme Allocation Fund (FAAFX) reopened to new investors on November 18. The fund has had one great year (2013) since inception and has trailed 97% over the past three years. Assets have dropped from $379 million at the end of November 2014 to $298 million a year later.

JPMorgan Small Cap Equity Fund (VSEAX) reopened to new investors on November 16, 2015. It’s an exceptionally solid fund with a large asset base; I assume the reopening came because inflows stabilized rather than in response to outflows.

Effective January 1, 2016, Royce is dropping the management fee on Royce European Small-Cap Fund (RISCX), Global Value Fund (RIVFX), International Small-Cap Fund (RYGSX), and International Premier Fund (RYIPX) by 25 bps.

Effective November 17, 2015, the management fees of Schwab U.S. Broad Market, U.S. Large-Cap, U.S. Large-Cap Growth, and U.S. Large-Cap Value ETFs have been reduced by one basis point each. The resulting expense ratios range from 3-6 bps.

CLOSINGS (and related inconveniences)

Effective January 29, 2016, the AQR Style Premia Alternative Fund (QSPNX) and AQR Style Premia Alternative LV Fund (QSLNX) will be closed to new investors. They’re two year old institutional funds. Both have posted exceedingly strong returns with the Alternative Fund drawing $1.6 billion and Alternative LV accumulating $170 million in assets.

Effective December 31, 2015, the Diamond Hill Small Cap Fund (DHSCX) will close to most new investors. Told you so.

On December 31, 2015, the Undiscovered Managers Behavioral Value Fund (UBVAX) will institute a soft close. Shhh! Don’t tell anyone but the undiscovered managers are Russell Fuller and David Potter! And don’t tell David, but Russell is running an even-more undiscovered fund without him: Fuller & Thaler Behavioral Core Equity (FTHAX). The former is a large small cap fund, the latter is small large cap one.

OLD WINE, NEW BOTTLES

Effective October 31, 2015, Aberdeen U.S. Equity Fund became Aberdeen U.S. Multi-Cap Equity Fund.

Effective on or about January 4, 2016, Clearbridge Mid Cap Core will be renamed ClearBridge Mid Cap Fund.

Effective January 1, 2016, Fidelity Medical Delivery Portfolio will be renamed Health Care Services Portfolio and Fidelity Software and Computer Services Portfolio will be renamed Software and IT Services Portfolio.

Effective January 25, 2016, Merk Asian Currency Fund (MEAFX) becomes Merk Chinese Yuan Currency and Income Fund. The fund already reports having 98% of its portfolio in the Chinese currency (and 20.2% in Hong Kong?), so it’s largely symbolic.

On February 24, 2016, the word “Retirement” will be removed from the names of all of the T. Rowe Price Target Retirement Funds (Funds).

OFF TO THE DUSTBIN OF HISTORY

AlphaCentric Smart Money Fund (SMRTX) smartly lost 19% in 15 months of existence, which might explain why its board decided that it’s in “the best interests of the Fund and its shareholders that the Fund cease operations.” Those interests will be expressed in the fund’s liquidation, just before Christmas.

On October 27, Andrew Kerai stepped aside as manager of BDC Income Fund (ABCDX) less than a year after the fund’s launch. Six days later, the fund’s board of trustees voters to close and liquidate it. It disappeared on November 30, 2015, still short of its one-year mark.

Carne Hedged Equity Fund (CRNEX) is liquidating on December 7, 2015. The board forthrightly attributed the closure to “recent Fund performance, the inability of the Fund to garner additional assets, the relatively small asset size of the Fund, recent significant shareholder redemptions, and other factors.” The fund buys mostly household names (Gilead, PayPal, Apple, Michael Kors, IBM) and was doing well until early 2014. Since then it’s dropped 24% in a steadily rising market. Neither the fund’s shareholders nor I know what happened. The 2014 annual report contains one cryptic passage from the manager, “I looked to optimize the hedging without diverting from the core portfolio. This strategy was a poor choice.” The subsequent semi-annual report contains no text and the website offers neither commentary nor shareholder letters.

Catalyst Activist Investor Fund (AIXAX) will liquidate on December 21, 2015. The fund looked to invest in companies where the public filings, typically Form 13D, showed activity by activist investors. The idea is to follow the smart money in, and out. The strategy lost about 25% since its summer 2014 launch. If you’re intrigued by the strategy, there’s still the 13D Activist Fund (DDDAX) which has also lost money on that period but a lot less money.

CRM Global Opportunity Fund (CRMWX) has closed in advance of a December 16, 2015 liquidation.

Curian/PIMCO Income Fund has closed and will cease operations on the as-yet unannounced cessation date.

Dreyfus International Value Fund (DVLAX) merges into Dreyfus International Equity Fund (DIEAX) on January 22, 2016. DIEAX isn’t particularly good but it does have better performance and significantly lower expenses than the liquidating fund.

On December 23, 2015, Forward Tactical Enhanced Fund (FTEEX) becomes the latest attraction at Forward’s LiquidationFest. It takes a 9,956% turnover ratio with it.

Speaking of firm-wide festivities, Franklin is unleashing a bundle of liquidations. For the sake of space, I’ve stuck them in a table.

| Fund | Fate | As of |

| All Cap Value | Merges into Small Cap Value | April 1, 2016 |

| Double Tax-Free Income | Merges into High Yield Tax-Free Income | April 29, 2016 |

| Large Cap Equity | Merges with Growth | March 11, 2016 |

| World Perspectives | Will liquidate | February 24, 2016 |

| Multi-Asset Real Return | Will liquidate | March 1, 2016 |

Here’s a filing written by a former philosophy major: “On November 12, 2015, Gateway International Fund was liquidated. The Fund no longer exists, and as a result, shares of the Fund are no longer available for purchase or exchange.”

JPMorgan Global Natural Resources Fund (JGNAX) will liquidate on or about December 16, 2015. Over five years, the fund turned a $10,000 initial investment into a $3,500 portfolio.

In January 2016, shareholders will vote on a proposed merger of Keeley Mid Cap Value Fund (KMCVX) into the Keeley Mid Cap Dividend Value Fund (KMDVX). They should approve.

MAI Energy Infrastructure and MLP Fund (VMLPX) will liquidate on December 23, 2015.

MFS Global Leaders Fund was terminated as of November 18, 2015.

RBC Prime Money Market Fund is closing on September 30, 2016 and liquidating shortly thereafter. The combination of zero interest and new liquidity regs are making such filings a lot more common.

SMH Representation Trust (SMHRX) liquidates on December 21, 2015. There’s been a bit of a performance slump of late.

I wonder if Morningstar ever looks at these things and thinks “perhaps labeling this chart as growth of $10,000 is a misnomer”?

Sometime in the first quarter of 2016, Templeton BRIC Fund (TABRX) will merge into Templeton Developing Markets Trust (TEDMX).

Thomas Crown Global Long/Short Equity Fund (TCLSX) liquidated on November 13, 2015 following the painful realization that “there are no meaningful prospects for growth in assets.”

Visium Event Driven Fund became driverless on November 27, 2015.

In Closing . . .

We’d like to thank all those who have contributed to MFO. That certainly includes the folks who contributed for premium access, but we’re equally grateful to the folks who made other levels of contribution. To Mitchell, Frank, John, Edward, and Charles, you’re golden!. Thank you, too, to all those who loyally use our Amazon link. It was a good month.

We wish you all a joyous holiday season. We know your families are crazy; hug them all the tighter for it. In the end they matter more than all the trinkets and all the bling and all the toys and all the square footage you’ll ever buy.

We’ll look for you in the New Year.

I’m grateful for gravy, for the sweet warmth of a friend hugged close, for my son’s stunning ability to sing and for all the time my phone is turned off.

I’m grateful for gravy, for the sweet warmth of a friend hugged close, for my son’s stunning ability to sing and for all the time my phone is turned off. Bottom line: Leuthold – bear’s at the door. GMO – pretty much zero, real, with the prospect of real ugliness after the US election. Bogle – maybe 2% real. Blodget – “crap.” Research Affiliates – 1%.

Bottom line: Leuthold – bear’s at the door. GMO – pretty much zero, real, with the prospect of real ugliness after the US election. Bogle – maybe 2% real. Blodget – “crap.” Research Affiliates – 1%.

By Leigh Walzer

By Leigh Walzer

Lewis is also the author of The House that Bogle Built: How John Bogle and Vanguard Reinvented the Mutual Fund Industry(2011), which has earned a slew of positive, detailed reviews on Amazon. He is a graceful writer and lives in Pittsburgh; I’m jealous of both. Then, too, when I Googled his name in search of a small photo for the story I came up with

Lewis is also the author of The House that Bogle Built: How John Bogle and Vanguard Reinvented the Mutual Fund Industry(2011), which has earned a slew of positive, detailed reviews on Amazon. He is a graceful writer and lives in Pittsburgh; I’m jealous of both. Then, too, when I Googled his name in search of a small photo for the story I came up with

In my endless poking around, I came upon a clear, thoughtful, entertaining explanation of global warming that even those who aren’t big into science or the news could read, enjoy and learn from. The site is Wait But Why and it attempts to actually explain things (including sad millennials and procrastination) using, well, facts and humor.

In my endless poking around, I came upon a clear, thoughtful, entertaining explanation of global warming that even those who aren’t big into science or the news could read, enjoy and learn from. The site is Wait But Why and it attempts to actually explain things (including sad millennials and procrastination) using, well, facts and humor.

Jack Bogle

Jack Bogle  y being green

y being green about what that means. An appendix defines about 10 terms, no one of which is related to their data reports.