Dear friends,

They’re baaaaack!

The summer silence has been shattered. My students have returned in endlessly boisterous, hormonally-imbalanced, self-absorbed droves. They’re glued to their phones and to their preconceptions, one about as maddening as the other.

The steady rhythm of the off-season (deal with something else falling off the house, talk to a manager, mow, think, read, write, kvetch) has been replaced by getting up at 5:30 and bolting through days, leaving a blur behind.

Somewhere in the background, Putin threatens war, the market threatens a swoon, horrible diseases spread, politicians debate who among them is the most dysfunctional and someone finds time to think Deep Thoughts about the leaked nekkid pitchers of semi-celebrities.

On whole, it’s good to be back.

Seven things that matter, two that don’t … and one that might

I spoke on August 20th to about 200 folks at the Cohen Fund client conference in Milwaukee. Interesting gathering, surprisingly attractive city, consistently good food (thanks guys!) and decent coffee. My argument was straightforward and, I hope, worth repeating here: if you don’t start thinking and acting differently, you’re doomed. A version of that text follows.

Your apparent options: dead, dying or living dead

From the perspective of most journalists, many advisors and a clear majority of investors, this gathering of mutual fund managers and of the professionals who make their work possible looks to be little more than a casting call for the Zombie Apocalypse. You are seen, dear friends, as “the walking dead,” a group whose success is predicated upon their ability to do … what? Eat their neighbors’ brains which are, of course, tasty but, and this is more important, once freed of their brains these folks are more likely to invest in your funds.

From the perspective of most journalists, many advisors and a clear majority of investors, this gathering of mutual fund managers and of the professionals who make their work possible looks to be little more than a casting call for the Zombie Apocalypse. You are seen, dear friends, as “the walking dead,” a group whose success is predicated upon their ability to do … what? Eat their neighbors’ brains which are, of course, tasty but, and this is more important, once freed of their brains these folks are more likely to invest in your funds.

CBS News declared you “a losing bet.” TheStreet.com declared that you’re dead. Joseph Duran asked, curiously, “are you a dinosaur?” Schwab declared that “a great question!” Ric Edelman, a major financial advisor, both widely quoted and widely respected, declares, “The retail mutual fund industry is a dinosaur and won’t exist in 10 or 15 more years, as investors are realizing the incredible opportunity to lower their cost, lower their risks and improve their disclosure through low-cost passive products.” When asked what their parents do for a living, your kids desperately wish they could say “my dad writes apps and mom’s a paid assassin.” Instead they mumble “stuff.” In short, you are no longer welcome at the cool kids’ table.

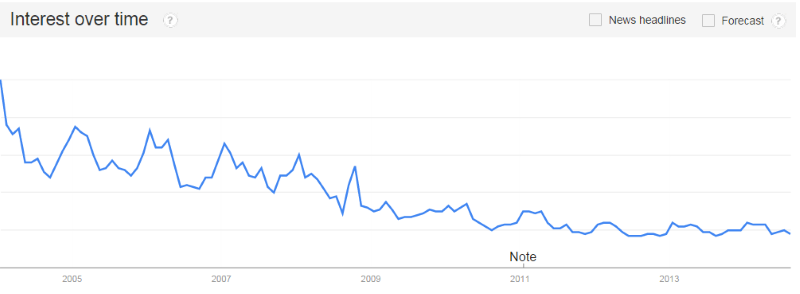

Serious data underlies those declarations. The estimable John Rekenthaler reports that only one-third of new investment money flows to active funds, one third to ETFs and one third to index funds. Drop target-date funds out of the equation and the amount of net inflows to funds is reduced by a quarter. The number of Google searches for the term “mutual funds” is down 80% over the past decade.

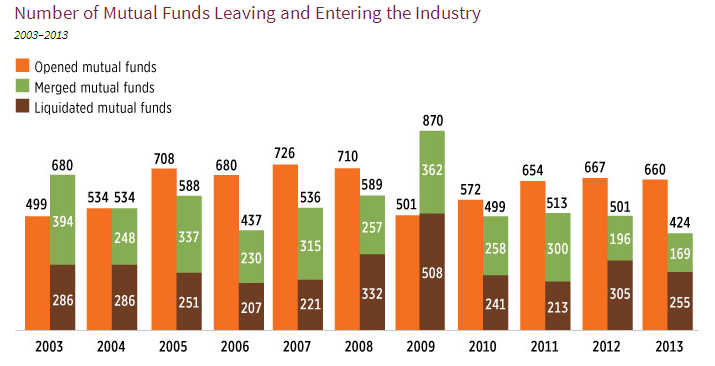

Funds liquidate or merge at the rate of 400-500 per year. Of the funds that existed 15 years ago, Vanguard found that 46% have been liquidated or merged. The most painful stroke might have been delivered by Morningstar, a firm whose fortunes were built on covering the mutual fund industry. Two weeks ago John Rekenthaler, vice president and resident curmudgeon, asked the question “do have funds have a future?” He answered his own question with “to cut to the chase: apparently not much.”

Friends, I feel your pain. Not that zombies actually feel pain. You know if Mr. Cook accidentally rips Mr. Bynum’s arm off and bludgeons him with it, “it’s all good.” But if you did feel pain, I’d be right there with you since in a Zombies Anonymous sort of way I’m obliged to say “Hello. My name is Dave and I’m a liberal arts professor.”

The parallel experience of the liberal arts college

I teach at Augustana College – as school known only to those of you blessed with a Scandinavian Lutheran heritage or to fans of the history of college football.

We operate in an industry much like yours – higher education is in crisis, buffeted by changing demographics – a relentless decline in the number of 17 year old high school graduates everywhere except in a band of increasingly sunbaked states – changing societal demands and bizarre new competitors whose low cost models have caught the attention of regulators, journalists and parents.

You might think, “yeah, but if you’re good – if you’re individually excellent – you’ll do fine.” “Emerson was wrong, wrong, wrong: being excellent does not imply you’ll be noticed, much less be successful.”

Remember that “build a better mousetrap and people will beat a path to your door” promise. Nope. Not true, even for mousetraps. There have been over 4400 patents for mousetraps (including a bunch labeled “better mousetrap”) issued since 1839. There are dozens of different subclasses, including “Electrocuting and Explosive,” “Swinging Striker,” “Choking or Squeezing,” and 36 others. One device, patented in 1897, controls 60% of the market and a modification of it patented in 1903 controls another 15-20%. About 0.6% of patented mousetraps were able to attract a manufacturer.

Remember that “build a better mousetrap and people will beat a path to your door” promise. Nope. Not true, even for mousetraps. There have been over 4400 patents for mousetraps (including a bunch labeled “better mousetrap”) issued since 1839. There are dozens of different subclasses, including “Electrocuting and Explosive,” “Swinging Striker,” “Choking or Squeezing,” and 36 others. One device, patented in 1897, controls 60% of the market and a modification of it patented in 1903 controls another 15-20%. About 0.6% of patented mousetraps were able to attract a manufacturer.

The whole “succeed in the market because you’re demonstrably better” thing is certainly not true for small colleges. Let me try an argument out with you: Augustana is the best college you’ve never heard of. The best. What’s the evidence?

- We’re #6 among all colleges in the number of Academic All-Americans we’ve produced, #2 behind only MIT as a Division 3 school.

- We were in the top 50 schools in the 20th century for the number of our graduates who went on to earn doctorates.

- National Survey of Student Engagement (NSSE) and the Wabash National Study both singled us out for the magnitude of gains that our students made over their four years.

- The Teagle Foundation identified use as one of the 12 colleges that define the “Gold Standard” in American higher education based on our ability to vastly outperform given the assets available to us.

And yet, we’re not confident of our future. We’re competing brilliantly, but we’re competing to maintain our share of a steadily shrinking pie. Fewer students each year are willing to even consider a small school as families focus more on price rather than value or on “name” rather than education. Most workers expect to enjoy their peak earnings in their late 40s and 50s. For college professors entering the profession today, peak lifetimes earnings might well occur in Year One. After that, they face a long series of pay freezes or raises that come in just below the CPI. Bain & Company estimate that one third of all US colleges and universities are financially unsustainable; they spend more than the take in and collect debt faster than they build equity. While some colleges will surely fold, the threat for most is less closure than permanent stagnation and increasing irrelevance.

Curious problem: by all but one measures (name recognition), we’re better for students than the household names but no one believes us and few will even consider attending. We’re losing to upstart competitors with inferior products and lumbering behemoths.

And you are too.

“The fault, dear Brutus, is not in our stars, But in ourselves, that we are underlings.”

Half of that is our own fault. We tend to be generic and focused on ourselves, without material understanding of the bigger picture. And half of your problem is your fault: 80% of mutual funds could disappear without any noticeable loss of investors. They don’t matter. There are 500 domestic large core funds. I’d be amazed if anyone could make a compelling case for keeping 90% of them open. More correctly, those don’t matter to anyone but the advisor who needs them for business development purposes.

Here’s the test: would anyone pay good money to buy the fund from you? Get serious: half of all funds can’t draw even a penny’s investment from their own managers (Sarah Max, Fund managers who invest elsewhere). The level of fund trustee investment in the funds they oversee on behalf of the rest of us is so low, especially in the series trusts common among smaller funds, as to represent an embarrassment.

The question is: can you do anything? Will anything you do matter? In order to answer that question, it would help to understand what matters, what doesn’t … and what might.

Herewith: seven things that matter, two that don’t … and one that might.

Seven things that matter.

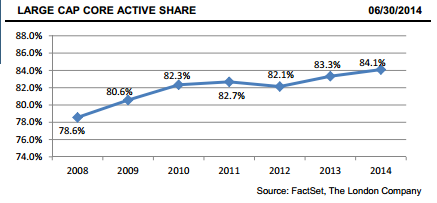

- Independence matters. Whether measured by r-squared, tracking error or active share, researchers have generated a huge body of evidence that independent thinking is a prerequisite to outstanding performance. Surprisingly, that’s true on the downside as much as the upside: higher active managers perform better in falling markets than herd-huggers do. But herding behavior is increasing. Where two-thirds of the industry’s assets were once housed in “highly active” funds, that number is now 25% and falling.

- Size matters. There is no evidence to suggest that “bigger is better” in the mutual fund world, at least once a fund passes the threshold of economic viability. Large funds face two serious constraints. First, their investable universes collapse; that is, if you have $10 billion to invest, there are literally thousands of small companies whose stocks become utterly meaningless to you and your forced to seek a competitive advantage against a few hundred competitors all looking at the same few hundred larger names. Second, larger funds become cash cows generating revenue essential to the adviser’s business. The livelihoods of dozens or hundreds of coworkers depend on having the manager not lose assets, much more than they depend on investment excellence. But money flows to “safe” bloated funds.

- Alignment of interest matters. Almost all of us know that there’s a lot of research showing that good things happen when fund managers stake their personal fortunes on the success of their funds; in particular, risk-adjusted returns rise. Fewer people know that there appears to be an even stronger effect from substantial ownership by a fund’s trustees: high trustee ownership is linked to lower risk, higher active share and less tolerance of inept management. But, Morningstar reports, something like 500 firms have funds with negligible insider ownership.

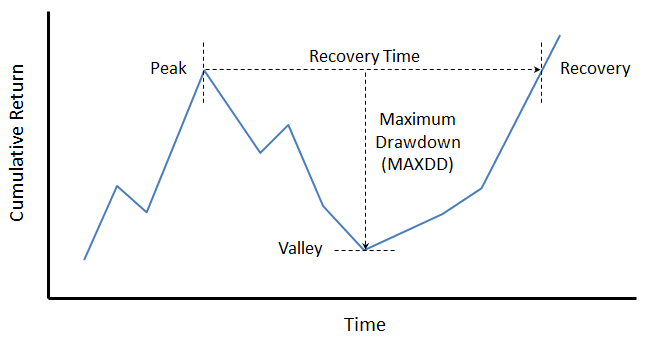

- Risk matters. Investors are far more risk-averse than they know. That’s one of the most frequently observed findings in the behavioral finance literature. No amount of upside offsets a tendency to crash. The sad consequence of misjudged risk is reflected in the Dalbar’s widely quoted calculations showing that investors might pocket as little as one-quarter of their funds’ returns largely because of excess confidence, excess trading and a tendency to run away as the worst possible time.

- Focus matters. If the goal is to provide better (not necessarily higher, but perhaps steadier, more explicable, less volatile) returns than a broad market index, then you need to look as little like the index as possible. Too many folks become “fund collectors” with sprawling portfolios, just as too many fund managers to commit to marginal ideas.

- Communication matters. I need to mention this because I’m, well, a professor of communication studies and we know it to be true. In general, communication from mutual funds to their investors (how to put this politely?) sucks. Websites get built for the sake of having a pretty side. Semi-annual reports get written because the SEC says to (but doesn’t say that you actually need to write anything to your investors, and many don’t). Shareholder letters get written to a template and conference calls are managed to assure that there’s no risk of anything interesting or informative breaking out. (If I hear the term “slide deck,” as in “on page 157 of your slide deck,” I’ll scream.) We know that most investors don’t understand why they’re invested or what their funds do. We know that when investors “get it,” they stay (look at Jared Peifer’s “Fund loyalty among socially responsible investors” for a study of folks who really think about their investments before making them).

- Relationships matter. Managers mumbling the mousetrap mantra believe that great performance will have the world beating a path to their door. It won’t. A fascinating study by the folks at Gerstein Fisher (“Mutual fund outperformance and growth,” Journal of Investment Management, 2014) offered an entirely maddening conclusion: good performance draws assets if you’re large, but has no effect on assets if you have under a quarter billion in assets. So how do smaller funds prosper? At least from our experience, it is by having a story that makes sense to investors and a nearly evangelical advocate to tell that story, face to face, over and over. Please flag this thought: it’s not whether you’re impressed with your story. It’s not whether it makes sense to you. It’s whether it makes enough sense to investors that, once you’re gone, they can explain it with conviction to other people.

Two things that don’t.

- Great returns don’t matter. Beating the market doesn’t matter. Beating your peers doesn’t matter. It’s impossible to do consistently (“peer beating” is, by definition, zero sum), it doesn’t draw assets and it doesn’t necessarily serve your investors’ needs. Consistent returns, consistently explained, might matter.

- Morningstar doesn’t matter. A few of you might yet win the lottery and get analyst coverage from Morningstar, but you should depend on that about the way you depend on winning the Powerball. Recent feature on “Under the Radar” funds gives you a view of Morningstar’s basement: these seven funds were consistently excellent, averaged $400 million in assets and 12 years of manager tenure – and they were still “under the radar.” In reality, Morningstar doesn’t even know that you exist. More to the point: the genius of independent funds is that they’re not cookie-cutters, but Morningstar is constrained to use a cookie-cutter. The more independent you are, the more likely that Morningstar will give you a silly peer group.

This is not, by the way, a criticism of Morningstar. I like a lot of the folks there and I know they often work like dogs to get it right. It’s simply a reflection on their business model and the complexity of the task before them. In attempting to do the greatest good for the greatest number (and to serve their shareholders), they’re inevitably drawn to the largest, most popular funds.

The one thing that might matter?

I might say “the Observer” does. We’ve got 26,000 readers and we’ve had the opportunity to work with dozens of journalists. We’ve profiled over 125 smaller funds, exceeding the number of Morningstar’s small fund profiles by, well, 120. We know you’re there and know your travails. We’re working really hard to help folks think more clearly about small, independent funds in general and by a hundred of so really distinguished smaller funds in particular.

But a better answer is: you might matter.

But do you want to?

It is clear that we can all do our jobs without mattering. We can attend quarterly meetings, read thick packets, listen thoughtfully to what we’ve been told, ask a trenchant question (just to prove that we’ve been listening) … and still never make six cents worth of difference to anyone.

There may have been a time, perhaps in the days of “a rising tide,” when firms could afford to have folks more interested in getting along than in making a difference. Those days are passed. If you aren’t intent on being A Person Who Matters, you need to go.

How might you matter?

- Figure out whether you have a reason to exist. Ask “what’s the story supposed to be?” Look at the prospect that “your” story is so painfully generic or agonizingly technical than it means nothing to anyone. And if you’ve got a good story, tell it passionately and well.

- Align your walking and your talking. First, pin your personal fortune on the success of your funds. Second, get in place a corporate policy that ensures everyone does likewise. There are several fine examples of such policies that you might borrow from your peers. Third, let people know what your policy is and why it matters to them.

- Help people succeed. Very few of the journalists who might share your message actually know enough to do it well. And they often know it and they’d like to do better. Great! Find the time to help them succeed. Become a valuable source of honest assessment, suggest story possibilities, notice when they do well. That ethos is not limited to aiding journalists. Help other independent funds succeed, too. Tell people about the best of them. Tell them what’s worked for you. They’re not your enemies and they’re not your competitors. They might, however, become part of a community that can help you survive.

- Climb out of your silo. Learn stuff you don’t need to know. I know compliance is tough. I know those board packets are thick. But that’s not an excuse. Bill Bernstein earned a PhD in chemistry, then MD in neurology, pursued the active practice of medicine, started writing about asset allocation and the efficient frontier, then advising, then writing books on topics well afield of his specialties. Bill writes: “As Warren Buffett famously observed, investing is not a game in which the person with an IQ of 160 beats the persons with an IQ of 130. Rather, it’s a game best played by those with a broad set of skills that are rich not only in quantitative ability but also in deep historical knowledge, all deployed with an Asperger’s-like emotional detachment.” Those of us in the liberal arts love this stuff.

- Build relationships, perhaps in odd ways. Trustees: you were elected to represent the fund’s shareholders so why are you hiding from them? Put your name and address on the website and let them know that if they have a concern, you’ll listen. Send a handwritten card to every new investor, at least those who invest directly with the fund. Tell them they matter to you. Heck, send them an anniversary card a year after they first invest, signed by you all. When they go, ask “why?” This is the only industry I’ve ever worked with that has precisely zero interest in customer loyalty.

- Be prepared to annoy people. Frankly, you’re going to be richly rewarded, financially and interpersonally, for your willingness to go away. If you try to change things, you’re going to upset at least some of the people in every room. You’re going to hear the same refrain, over and over: “But no one does that.”

- Stop hiring pretty good people. Hire great ones, or no one. The hallmark of dynamic, rising institutions is their insistence on bringing in people who are so good it kind of scares the folks who are already there. That’s been the ethos of my academic department for 20 years. It is reflected in the Artisan Fund’s insistence that they will hire in only “category killers.” They might, they report, interview several dozen management teams a year and still make only one hire every two or three years. Check their record of performance and market success and draw your own conclusion. Achieving this means that you have to be a great place to work. You have to know why it’s a great place, and you have to have a strategy for making outsiders realize it, too.

Which is precisely the point. Independence is not merely a matter of portfolio construction. It’s a matter of innovation, responsibility and stewardship. It requires that you look beyond safety, look beyond asset gathering and short-term profit maximization to answer the larger question: is there any reason for us to exist?

It’s your decision. It is clear to me that business as usual will not work, but neither will hunkering down and hoping that it all goes away. Do you want to matter, or do you want to hold on – hoping that you’ll make it through despite the storm? Like the faculty near retirement. Like Louis XV who declared, “Après moi, le déluge”. Mr. Rekenthaler concludes that “active funds retreat further into silence.” Do you want to prove him right or wrong?

If you want to make a difference, start today. Start here. Start today. Take the opportunity to listen, to talk, to learn and to decide. To decide to make all the difference you can. Which might be all the difference in the world.

From Charles’s Balcony: Why Am I Rebalancing?

From Charles’s Balcony: Why Am I Rebalancing?

Long-time MFO discussion board member AKAFlack emailed me recently wondering how much investors have underperformed during the current bull market due to the practice of rebalancing their portfolios.

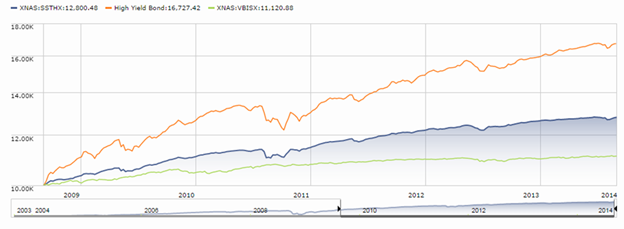

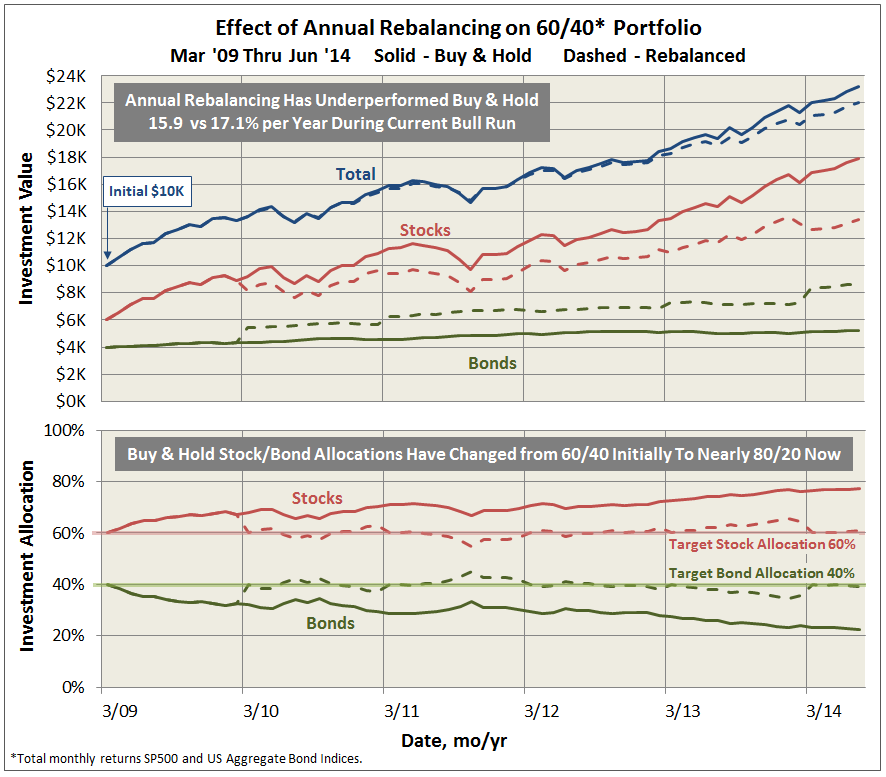

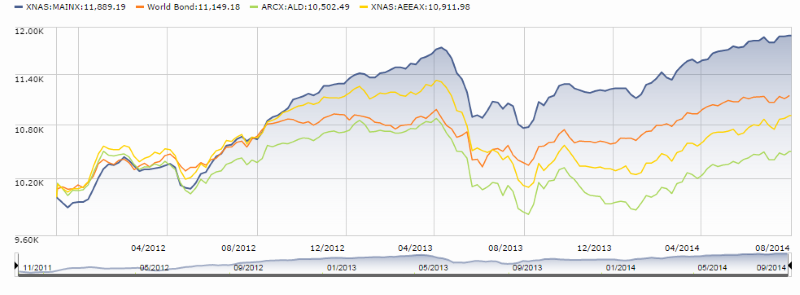

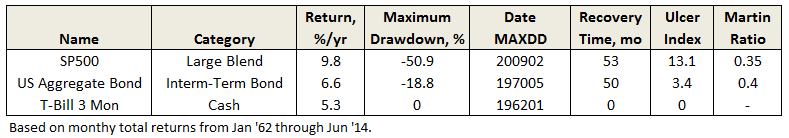

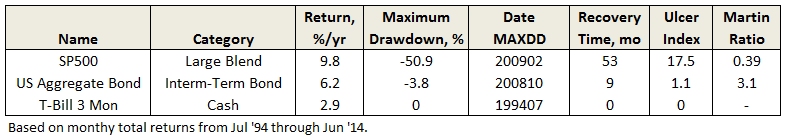

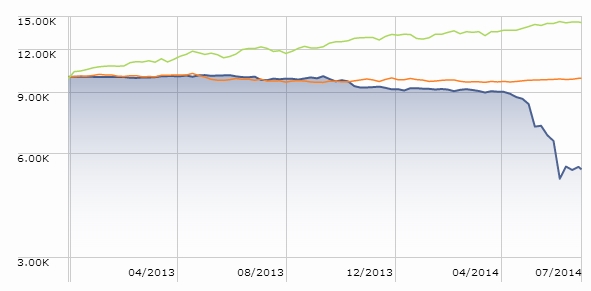

For those that rebalance annually, the answer is…almost 12% in total return from March 2009 through June 2014. Not huge given the healthy gains, but certainly noticeable. The graph below compares performance for a buy & hold and an annually rebalanced portfolio, assuming an initial investment of $10,000 allocated 60% to stocks and 40% to bonds.

So why rebalance?

According to a good study by Vanguard, entitled “Best practices for portfolio rebalancing,” the answer is not to maximize return. “If the sole objective is to maximize return regardless of risk, then the investor should select a 100% equity portfolio.”

The purpose of rebalancing, whether done periodically or by threshold deviation, is to keep a portfolio risk composition consistent with an investor’s tolerance, as defined by their target allocation. Otherwise, investors “can end up with a portfolio that is over-weighted to equities and therefore more vulnerable to equity-market corrections, putting the investors’ portfolios at risk of larger losses compared with their target portfolios.” This situation is evidenced in the allocation shown above for the buy & hold portfolio, which is now at nearly 80/20 stocks/bonds.

In this way, rebalancing is one way to keep loss aversion in check and the attendant consequences of selling and buying at all the wrong times, often chronicled in Morningstar’s notorious “Investor Return” tracking metric.

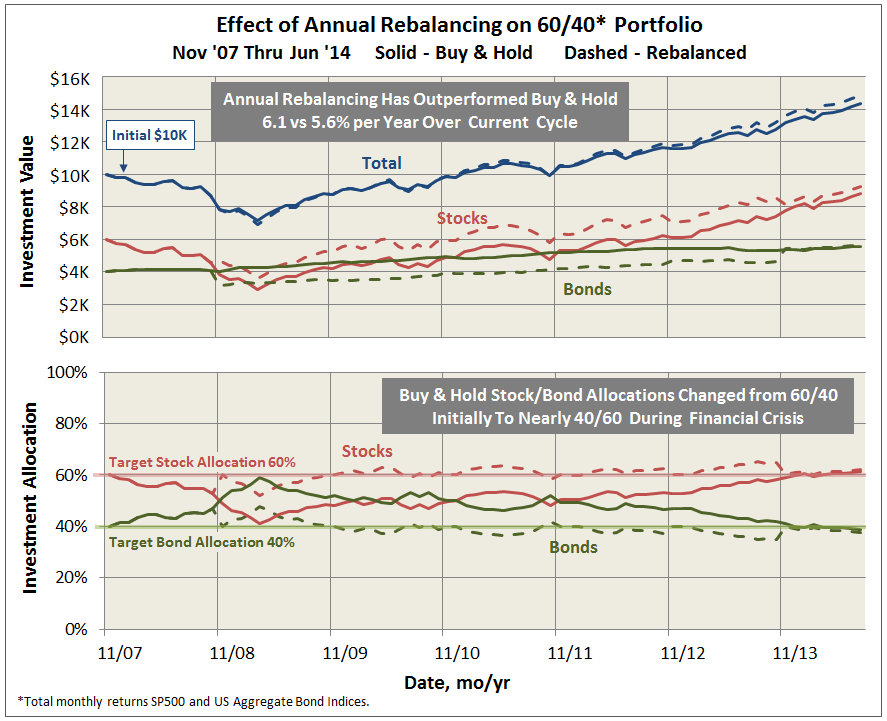

Balancing makes up ground, however, when equities are temporarily undervalued, like was the case in 2008. The same comparison as above but now across the most current full market cycle, beginning in November 2007, shows that annual balancing actually slighted outperformed the buy & hold portfolio.

In his book “The Ivy Portfolio,” Mebane Faber presents additional data to support that “there is a clear advantage to rebalancing sometime rather than letting the portfolio drift. A simple rebalance can add 0.1 to 0.2 to the Sharpe Ratio.”

If your first investment priority is risk management, occasional rebalancing to your target allocation is one way to help you sleep better at night, even if it means underperforming somewhat during bull markets.

Edward, Ex Cathedra: Money money money money money money

Edward, Ex Cathedra: Money money money money money money

“The mystery of the world is the visible, not the invisible.”

Oscar Wilde

This has been an interesting month in the world of mutual funds and fund managers. First we have Charles D. Ellis, CFA with another landmark (and land mine) article in the Financial Analysts Journal entitled “The Rise and Fall of Performance Investing.” For some years now, starting with his magnum opus for institutional investors entitled “Winning the Loser’s Game,” Ellis has been arguing that institutional (and individual) investors would be better served by using passive index funds for their investments, rather than hiring active managers who tend to underperform the index funds. By way of disclosure, Mr. Ellis founded Greenwich Associates and made his fortune selling services to those active managers that he now writes about with the zeal of a convert.

Nonetheless the numbers he presents are fairly compelling, and for that reason difficult to accept. I am reminded of one of my former banking colleagues who was always looking for the pony that he was convinced was hidden underneath the manure in the room. I can see the results of this thinking by scanning some of the discussions on the Mutual Fund Observer bulletin board. Many of those discussions seem more attuned with how smart or lucky one was to invest with a particular manager before his or her fund closed, rather than how the investment has actually performed. And I am not talking about the performance numbers put out by the fund companies, which are artificial results for artificial investors.  No, I’m talking about the real results obtained by putting the moneys invested and time periods into one’s HP12C calculator to figure out the returns. Most people really do not want to know those numbers, otherwise they become forced to think about Senator Warren’s argument that “the game is rigged.”

No, I’m talking about the real results obtained by putting the moneys invested and time periods into one’s HP12C calculator to figure out the returns. Most people really do not want to know those numbers, otherwise they become forced to think about Senator Warren’s argument that “the game is rigged.”

Ellis however makes a point that he has made before and that I have covered before. However I feel it is so important that it is worth noting again. Most mutual fund advertising or descriptions involving fees consist of one word and a number. The fee is “only” 1% (or less for most institutional investors). The problem is that that is a phrase worthy of Don Draper, as the 1% is related to the assets the investor has given to the fund company. Yet the investor already owns the assets. What is being promised then? The answer is returns. And if one accepts the Ibbotson return histories for large cap common stocks in the U.S. as running at 8 – 10% per year over a fifty-year period, we are talking about a fee running from 10 – 12.5% a year based on returns.

Taking this concept one step further Ellis suggests what you really should be looking at in assessing fees are the “incremental fee as a percentage of incremental returns after adjusting for risk.” And using those criteria, we would see something very different given that most active investment managers are underperforming their benchmark indices, namely that the incremental fees are above 100% Ellis goes on to raise a number of points in his article. I would like to focus on just one of them for the remainder of this commentary. One of Ellis’ central questions is “When will our clients decide that continuing to take all the risks and pay all the costs of striving to beat the market with so little success is no longer a good deal for them?”

My assessment is that we have finally hit the tipping point, and things are moving inexorably in that direction. Two weeks ago roughly, it was announced that Vanguard now has more than $3 trillion worth of assets, much of it in passive products. Jason Zweig recently wrote an article for The Wall Street Journal suggesting that the group of fund and portfolio managers in their 30’s and 40’s should start thinking about alternative careers, possibly as financial planners giving asset allocation advice to clients. The Financial Times suggests in an article detailing the relationship between Bill Gross at PIMCO and the analyst that covered him at Morningstar that they had become too close. The argument there was that Morningstar analysts had become co-opted by the fund industry to write soft criticism in return for continued access to managers. My own observational experience with Morningstar was that their mutual fund analysts had been top shelf when they were interviewing me and both independent and objective. I can’t speak now as to whether the hiring and retention criteria have changed.

My own anecdotal observations are limited to things I see happening in Chicago. My conclusion is that the senior managers at most of the Chicago money management firms are moving as fast as they can to suck as much money out of their businesses as quickly as possible. In some respects, it has become a variation on musical chairs and that group hears the music slowing. So you will see lots of money in bonus payments. Sustainability of the business will be talked about, especially as a sop to absentee owners, but the businesses will be under-invested in, especially with regard to personnel. What do I base that on? Well, at one firm, what I will call the boys from Winnetka and Lake Forest, I was told every client meeting now starts with questions about fees. Not performance, but fees are what is primary in the client minds. The person who said this indicated he is fighting a constant battle to see that his analyst pool is being paid commensurate with the market notwithstanding an assumption by senior management that the talent is fungible and could easily be replaced at lower prices. At another firm, it is a question of preserving the “collegiality” of the fund group’s trustees when they are adding new board members. As one executive said to me about an election, “Thank God they had two candidates and picked the less problematic one in terms of our business and causing fee issues for us.”

The investment management business, especially the mutual fund business, is a wonderful business with superb returns. But to use Mr. Ellis’ phrase, is it anything more now than a “crass commercial business?” How the industry behaves going forward will offer us a clue. Unfortunately, knowing as many of the players as well as I do leads me to conclude that greed will continue to be the primary motivator. Change will not occur until it is forced upon the industry.

I will leave you with a scene from a wonderful movie, The Freshman (with Marlon Brando and Matthew Broderick) to ponder.

“This is an ugly word, this scam. This is business, and if you want to be in business, this is what you do.”

Carmine Sabatini as played by Marlon Brandon

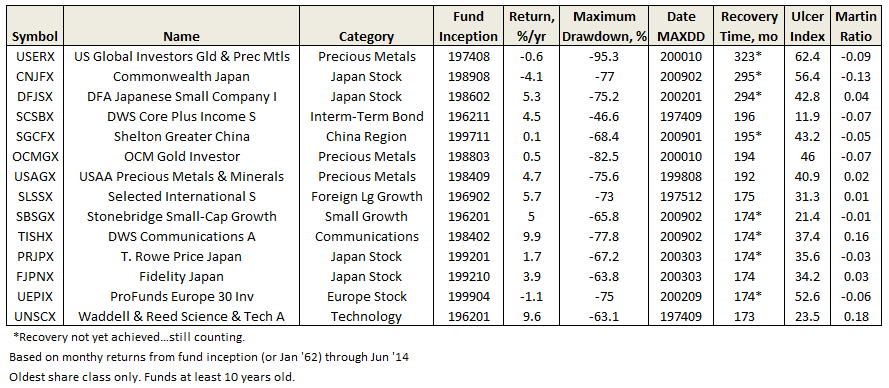

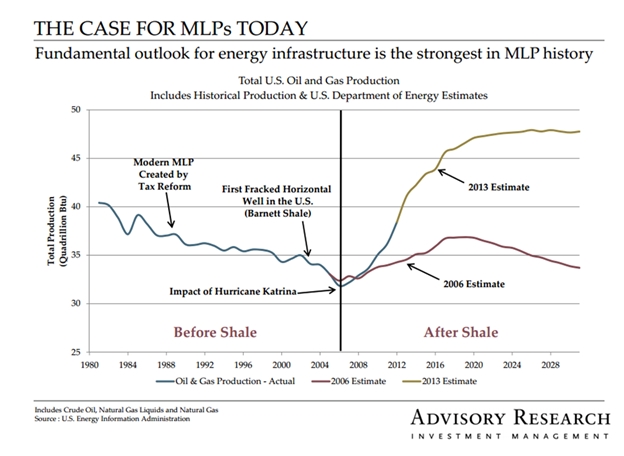

Categories Morningstar doesn’t recognize: Short-term high-yield income

There are doubtless a million ways to slice and dice the seven or eight thousand extant funds into categories. Morningstar has chosen to create 105 categories in hopes of (a) creating meaningful peer comparisons and (b) avoid mindless proliferation of categories. We’re endlessly sympathetic with their desire to maintain a disciplined, manageable system. That said, the Observer tracks some categories of funds that Morningstar doesn’t recognize, including short-term high yield, emerging markets balanced and absolute value equity.

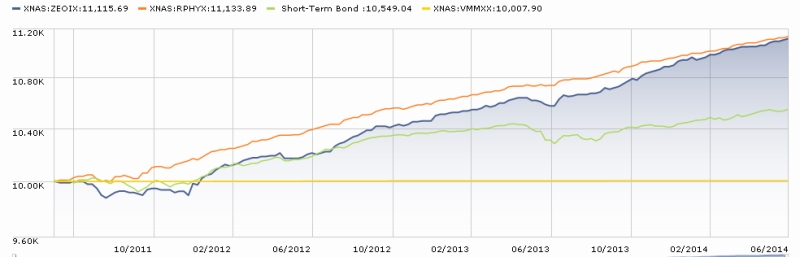

We think that these funds have two characteristics that might be obscured by Morningstar’s assignment of them to a larger category of fundamentally different funds. First, it causes funds to be misjudged if their risk profiles vary dramatically from the group’s. Short-term high yield, for example, are doomed to one- and two-star ratings. That’s not because they fail. It’s because they succeed in a way that’s fundamentally different from the majority of their peer group. In general, high yield funds have risk profiles similar to stock funds. Short-term high yield funds have dramatically lower volatility and returns closer to a short term bond fund’s than a high yield fund’s.

[High yield/orange, ST high yield blue, ST investment grade green]

Morningstar’s risk-adjusted returns calculation is far less sensitive to risk than the Observer’s is; as a risk, the lower risk is blanketed by the lower returns and the funds end up with an undeservedly wretched rating.

Bottom line: investors who need to earn more than the payout of a money market fund (0.01% ytd) or certificates of deposit (currently 1.1% annually) might take the risk of a conventional short-term bond fund (in the hopes of making 1-2%) or might be lured by the appeal of a complex market neutral derivatives strategy (paying 2% to make 3%). Another path that might reasonably consider are short-term high yield funds that take on greater risk but whose managers generally recognize that fact and have risk-management tools at hand.

The Observer has profiled three such funds: Intrepid Income, RiverPark Short-Term High Yield (now closed to new investors) and Zeo Strategic Income.

Short-term, high Income peer group, as of 9/1/14

|

|

|

YTD Returns |

3 yr |

5 yr |

Expense ratio |

|

AllianzGI Short Duration High Income A |

ASHAX |

2.41 |

— |

— |

0.85 |

|

Eaton Vance Short Duration High Income A |

ESHAX |

1.85 |

— |

— |

— |

|

Fidelity Short Duration High Income |

FSAHX |

2.88 |

— |

— |

0.8 |

|

First Trust Short Duration High Income A |

FDHAX |

2.65 |

— |

— |

1.25 |

|

Fountain Short Duration High Income A |

PFHAX |

3.01 |

— |

— |

— |

|

Intrepid Income |

ICMUX |

2.75 |

5 |

|

|

|

JPMorgan Short Duration High Yield A |

JSDHX |

2.24 |

— |

— |

0.89 |

|

MainStay Short Duration High Yield A |

MDHAX |

3.22 |

— |

— |

1.05 |

|

RiverPark Short Term High Yield (closed) |

RPHYX |

2.03 |

3.8 |

— |

1.25 |

|

Shenkman Short Duration High Income A |

SCFAX |

1.88 |

— |

— |

1 |

|

Wells Fargo Advantage S/T High Yield Bond A |

SSTHX |

1.3 |

5 |

5.07 |

0.81 |

|

Westwood Short Duration High Yield A |

WSDAX |

1.65 |

— |

— |

1.15 |

|

Zeo Strategic Income |

ZEOIX |

2.32 |

4.1 |

— |

1.38 |

|

Vanguard High Yield Corporate (benchmark 1) |

VWEHX |

5.46 |

9.9 |

10.7 |

|

|

Vanguard Short Term Corporate (benchmark 2) |

VBISX |

1.03 |

1.1 |

2.17 |

|

|

Short-term high yield composite average |

|

2.34 |

4.2 |

5.07 |

|

Over the next several months we’ll be reviewing the performance of some of these unrecognized peer groups, in hopes of having folks look beyond the stars.

To the New Castle County executives: I know your intentions were good, but …

Shortly after taking office, the new county executive for New Castle County, Delaware, made a shocking discovery: someone has nefariously invested the taxpayers’ money in two funds that (gasp!) earned one-star from Morningstar and were full of dangerous high yield investments. The executive in question, not pausing to learn anything about what the funds actually do, snapped into action. He rushed “to protect the County reserves from the potential of significant financial loss and undo risk by directing the funds to be placed in an account representing the financial security values associated with taxpayer dollars” by giving the money to UBS (a firm fined $1.5 billion two years ago in a “rogue trading” scandal). And then he, or the county staff, wrote a congratulatory press release (New Castle County Executive Acted Quickly to Protect Taxpayer Reserves).

The funds in question were RiverPark Short-Term High Yield (RPHYX) which is one of the least volatile funds in existence and which has posted the industry’s best Sharpe ratio, and FPA New Income (FPNIX), which Morningstar celebrates as an ultra-conservative choice in the face of deteriorating markets: “thanks to its super-low volatility, its five-year Sharpe ratio, a measure of risk-adjusted returns, bests all it but one of its competitors’ in both groups.”

The press release doesn’t mention how or where UBS will be investing the taxpayer’s dollars but it does sound like UBS has decided to work for free: enviable savings resulted from the fact that New Castle County “does not pay investment management fees to UBS.”

Due diligence requires going beyond a cursory reading. It turns out that The Tale of Two Cities is not a travelogue and that Animal Farm really doesn’t offer much guidance on animal husbandry, titles notwithstanding. And it turns out that the county has sold two exceptionally solid, conservative funds – funds with about the best risk-adjusted returns possible – based on a cursory reading and spurious concerns.

Observer Fund Profiles: AKREX and MAINX

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

Akre Focus (AKREX): the only question about Akre Focus is whether it can be as excellent in the future has it, and its predecessors, have been for the past quarter century.

Matthews Asia Strategic Income (MAINX): against all the noise in the markets and in the world news, Teresa Kong remains convinced that your most important sources of income in the decades ahead will increasingly be centered in Asia. She’ll doing an exceptional job of letting you tap that future today.

Elevator Talk: Brent Olsen, Scout Equity Opportunity (SEOFX)

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

Since the number of funds we can cover in-depth is smaller than the number of funds worthy of in-depth coverage, we’ve decided to offer one or two managers each month the opportunity to make a 200 word pitch to you. That’s about the number of words a slightly-manic elevator companion could share in a minute and a half. In each case, I’ve promised to offer a quick capsule of the fund and a link back to the fund’s site. Other than that, they’ve got 200 words and precisely as much of your time and attention as you’re willing to share. These aren’t endorsements; they’re opportunities to learn more.

Brent Olson is the lead portfolio manager of the Scout Equity Opportunity Fund. He joined the firm in 2013 and has more than 17 years of professional investment experience. Prior to joining Scout, Brent was director of research and a portfolio manager with Three Peaks Capital Management, LLC. From 2010-2013, Brent comanaged Aquila Three Peaks Opportunity Growth (ATGAX) and Aquila Three Peaks High Income (ATPAX) with Sandy Rufenacht. Before that, he served as an equity analyst for Invesco and both a high-yield and equity analyst for Janus.

Scout Equity Opportunity proposes to invest in leveraged companies. Leveraged companies are firms that have accumulated, or are accumulating, a noticeable level of debt on their books. These are firms that are, or were, dependent on borrowing to finance operations. Many equity investors, particularly those interested in “high quality stocks,” look askance at the practice. They’re interested in firms with low debt-to-equity ratios and the ability to finance operations internally.

Nonetheless, leveraged company stock offers the prospect for outsized gains. Tom Soviero of Fidelity Leveraged Company Stock Fund (FLVCX) captured more than 150% of the S&P 500’s upside over the course of a decade (2003-2013). The Credit Suisse Leveraged Equity Index substantially outperformed the S&P500 over the same period. Why so? Three reasons come to mind:

- Debt adds complexity, which increases the prospects for mispricing. Beyond the simple fact that most equity investors are not comfortable analyzing the other half of a firm’s capital structure, there are also several different kinds of debt, each of which adds its own complexity.

- Debt can be used wisely, which allows firms to increase their return on equity, especially when the cost of debt is low and the stock market is already rising.

- Indebtedness increases a firm’s accountability and transparency, since they gain the obligation to report to creditors, and to pay them regularly. They are, as a result, less free to make dumb decisions than managers deploying internally-generated capital.

The downside to leveraged equity investing is, well, the downside to leveraged equity investing. When the market falls, leveraged company stocks can fall harder and faster than most. By way of illustration, Fidelity Leverage Company dropped 55% in 2008. That makes it hard for many investors to hold on; indeed, by Morningstar’s calculations, Mr. Soveiro’s invested managed to pocket less than a third of his fund’s excellent returns because they tended to bail when the pain got too great.

Brent Olson knows the tale, having co-managed for three years a fund with a similar discipline. He recognizes the importance of risk control and thinks that he and the folks at Scout have found a way to manage some of the strategy’s downside.

Brent Olson knows the tale, having co-managed for three years a fund with a similar discipline. He recognizes the importance of risk control and thinks that he and the folks at Scout have found a way to manage some of the strategy’s downside.

Here are Brent’s 200 words on what a manager sensitive to high-yield fixed-income metrics brings to equity investing:

We believe superior risk-adjusted relative performance can be achieved through long-term ownership of a diversified portfolio of levered stocks. We recognize debt metrics as a leading indicator for equity performance – our adage is “credit leads, equity follows” – and so we use this as the basis for our disciplined investment process. That perspective allows us to identify companies that we believe are undervalued and thus attractive for investors.

We focus our attention on stable industries with lots of free cash flow. Within those industries, we’re looking at companies that are either using credit improvement through de-levering their balance sheet, though debt paydown or refinancing, or ones that are reapplying leverage to transform themselves, perhaps through growth or acquisitions. At the moment there are 68 names in the portfolio. There are roughly 50 other names that we’re actively monitoring with about 10 that are getting close.

We’ve thought a lot about risk management. One of the most attractive aspects of working at Scout is the deep analyst bench, and especially the strength of our fixed income team at Reams Asset Management. That gives me access to lots of data and first-rate analysis. We also can move 20% of the portfolio into fixed income in order to dampen volatility, the onset of which might be signaled by wider high-yield spreads. Finally, we can raise the ratings quality of our portfolio names.

Scout Equity Opportunity has a $1000 minimum initial investment which is reduced to a really friendly $100 for IRAs and accounts established with an automatic investing plan. Expenses are capped at 1.25% and the fund has about gathered about $7 million in assets since its March 2014 launch. Here’s the fund’s homepage. Investors intrigued by the characteristics of leveraged equity might benefit from reading Tom Soveiro’s white paper, Opportunities in Leveraged Equity Investing (2014).

Launch Alert: Touchstone Large Cap Fund (TLCYX)

On July 9, Touchstone Investments launched the Touchstone Large Cap Fund, sub-advised by The London Company. The London Company is Virginia-based RIA with over $8.7 billion in assets under management. The firm subadvises several other US-domiciled funds including:

Hennessy Equity and Income (HEIFX), since 2007. HEIFX is a $370 million, five-star LCV fund that The London Company jointly manages with FCI Advisors.

Touchstone Small Cap Core (TSFYX), since 2009. TSFYX is an $830 million, four-star SCB fund.

Touchstone Mid Cap (TMCPX), since 2011. TMCPX is a $460 million, three-star mid-cap blend fund.

American Beacon The London Company Income Equity (ABCYX), since 2012. It’s another LCV fund with about $275 million in assets.

The fund enters the most crowded part of the equity universe: large cap domestic stock. Depending on how you count, there are 466 large blend funds. The new Touchstone fund proposes to invest in 30-40 US large cap stocks. In particular they’re looking for financially stable firms that will compound returns over time. Rather than looking at earnings per share, they “pay strict attention to each company’s sustainability of return on capital and resulting free cash flow and balance sheet to derive its strategic value.” The argument is that EPS bounces, is subject to gaming and is not predictive. Return on capital tends to be a stable predictor of strong future performance. They target buying those firms at a 30-40% discount to intrinsic value and holding them for relatively long periods.

It’s a sound and attractive strategy. Still, there are hundreds of funds operating in this space and dozens that might lay plausible claim to a comparable discipline. Touchstone’s president, Steve Graziano, allows that this looks like a spectacularly silly move:

If I wasn’t looking under the hood and someone came to me to launch a large cap core fund, I’d say “you must be crazy.” It’s an overpopulated space, a stronghold of passive investing.

The reason to launch, Mr. Graziano argues, is TLC’s remarkable discipline. They’ve used this same strategy for over 15 years in its private accounts. Their large core composite has returned 9.7% annually over the last decade through June 30, 2014. During the same time, the S&P500 returned 7.8%. They’ve beaten the S&P500 over the past 3, 5, 10 and 15 year periods. The margin of victory has ranged from 130-210 bps, depending on the time period.

The firm argues that much of the strategy’s strength comes from its downside protection: “[Our] large cap core strategy focuses on investing primarily in conservative, low‐beta, large cap equities with above average downside protection.” Over the past five years, the strategy captured 62% of the market’s downside and 96% of its upside. That’s also reflected in the strategy’s low beta (0.77, which is striking for a fully-invested equity strategy) and low standard deviation (12.6, about 300 bps below the market’s).

Of the 500 or so large cap blend funds, only 23 can match the 9.7% annualized10-year returns for The London Company’s Large Core Strategy. Of those, only one (PIMCO StocksPlus Absolute Return PSPTX) can also match its five-year returns of 20.7%.

The minimum initial investment in the retail class is $2500, reduced to $1000 for IRAs. The expenses are capped at 1.49%. Here’s the fund’s homepage. While it reflects the performance of the separate accounts rather than the mutual fund’s, TLC’s Large Cap Core quarterly report contains a lot of useful information on the strategy’s historic profile.

Pre-launch Alert: PSP Multi-Manager (CEFFX)

In a particularly odd development, the legal husk of the Congressional Effect Fund is being turned to good use. As you might recall, Congressional Effect (CEFFX) was (along with the Blue Funds) another of a series of political gestures masquerading as investment vehicles. Congressional Effect went to cash whenever (evil, destructive) Congress was in session and invested in stocks otherwise. Right: out of stocks during the high-return months and in stocks over the summer and at holidays. Good.

The fund’s legal structure has been purchased by Pulteney Street Capital Management, LLC and is soon to be relaunched as the PSP Multi-Manager Fund (ticker unknown). The plan is to hire experienced managers who specialize in a set of complementary alternative strategies (long/short equity, event-driven, macro, market neutral, capital structure arbitrage and distressed) and give each of them a slice of the portfolio. The management teams represent EastBay Asset Management, Ferro Investment Management, Riverpark Advisors, S.W. Mitchell Capital, and Tiburon Capital Management. The good news is that the fund features solid managers and a low minimum initial investment ($1000). The bad news is that the expenses (north of 3%) are near the level charged by T’ree Fingers McGurk, my local loan shark sub-prime lender.

Funds in Registration

Our colleague David Welsch tracked down 17 new no-load, retail funds in registration this month. In general, these funds will be available for purchase by around Halloween. (Caveat emptor.) They include new offers from several A-tier families including BBH, Brown Advisory,and Causeway. Of special interest is the new Cambria Global Asset Allocation ETF (GAA), a passive fund tracking an active index. Charles is working to arrange an interview with the manager, Mebane Faber, during the upcoming Morningstar ETF conference.

Manager Changes

Chip reports a huge spike in the number of announced manager or management team changes this month, with 73 recorded changes, about 30 more than we’ve being seeing over the summer months. A bunch are simple games of musical chairs (Ivy and Waddell & Reed are understandably re-allocating staff) and about as many are additions of co-managers to teams, but there are a handful of senior folks who’ve announced their retirements.

Top Developments in Fund Industry Litigation – August2014

Fundfox is the only intelligence service to focus exclusively on litigation involving U.S.-registered investment companies, their directors and advisers. Publisher David Smith has agreed to share highlights with us. For a complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

Fundfox is the only intelligence service to focus exclusively on litigation involving U.S.-registered investment companies, their directors and advisers. Publisher David Smith has agreed to share highlights with us. For a complete list of developments last month, and for information and court documents in any case, log in at www.fundfox.com and navigate to Fundfox Insider.

New Lawsuits

- Davis was hit with a new excessive-fee lawsuit regarding its N.Y. Venture Fund (the same fund already involved in another pending fee litigation). (Chill v. Davis Selected Advisers, L.P.)

- Alleging the same fee claim but for a different damages period, plaintiffs filed an “anniversary complaint” in the excessive-fee litigation regarding six Principal LifeTime funds. (Am. Chems. & Equip., Inc. 401(k) Ret. Plan v. Principal Mgmt. Corp.)

Order

- The court partly denied motions to dismiss a shareholder’s lawsuit regarding four Morgan Keegan closed-end funds, allowing misrepresentation claims under the Securities Act to proceed. (Small v. RMK High Income Fund, Inc.)

Certiorari Petition

- Plaintiffs have filed a writ of certiorari seeking Supreme Court review of the Eighth Circuit’s ruling in an ERISA class action that challenged Fidelity‘s use of the float income generated by transactions in retirement plan accounts. (Tussey v. ABB, Inc.)

Briefs

- Davis filed a motion to dismiss excessive-fee litigation regarding its N.Y. Venture Fund. (Hebda v. Davis Selected Advisers, L.P.)

- Putnam filed its opening brief in the appeal of a fraud lawsuit regarding its collateral management services to a CDO; and the plaintiff filed a reply. (Fin. Guar. Ins. Co. v. Putnam Advisory Co.)

- Plaintiffs filed their opposition to Vanguard‘s motion to dismiss a lawsuit regarding investments by two funds in offshore online gambling businesses; and Vanguard filed its reply brief. (Hartsel v. Vanguard Group, Inc.)

David Hobbs, president of Cook & Bynum, and I were talking at the Cohen Fund conference about the challenges facing fund trustees. David mentioned that he encourages his trustees to follow David Smith’s posts here since they represent a valuable overview of new legal activity in the field. That struck me as a thoughtful initiative and so I thought I’d pass David H’s suggestion along.

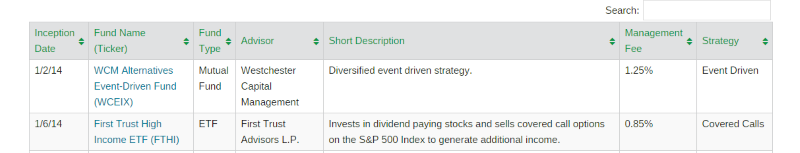

A cool resource for folks seeking “liquid alts” funds

The folks at DailyAlts maintain a list of all new hedge fund like mutual funds and ETFs. The list records 52 new funds launched between January and August 2014 and offers a handful of useful data points as well as a link to a cursory overview of the strategy.

I stumbled upon the site in pursuit of something else. It struck me as a cool and useful resource and led me to a fair number of funds that were entirely new to me. Kudos to Editor Brian Haskin and his team for the good work.

Briefly Noted . . .

Arrowpoint Asset Management LLC has increased its stake in Destra Capital Management, adviser to the Destra funds, to the point that it’s now the majority owner and “controlling person” of the firm.

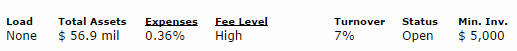

Causeway’s bringing it home: pending shareholder approval, Causeway International Opportunities Fund (CIOVX) will be restructured from a “fund of funds” to “a fund making direct investments in securities.” The underlying funds in question are institutional shares of Causeway’s two other international funds – Emerging Markets (CEMIX) and International Opportunities Value(CIVIX) – so it’s hard to see how much gain investors might expect. The downside: the fund needs to entirely liquidate its portfolio which will trigger “a significantly higher taxable distribution” than investors are used to. In a slightly-stern note, Causeway warns “taxable investors receiving the distributions should be prepared to pay taxes on them.” The effect of the change on the fund’s expense ratio is muddled at the moment. Morningstar’s reported e.r. for the fund, .36%, doesn’t include the expense ratios of the underlying funds. With the new fund’s expense ratio not set, we have no idea about whether the investors are likely to see their expenses rise or fall.

Morningstar, due to their somewhat confused reporting on the expense ratios of funds-of-funds, derides the 36 basis point fee as “high”, when they should be providing the value of the expense ratio of both the fund and it’s underlying holdings. (Thanks, Ira!)

Effective August 21, FPA Crescent Fund (FPACX) became free to invest more than 50% of its assets overseas. Direct international exposure was previously capped at 50%. No word yet as to why. Or, more pointedly, why now?

Jeffrey Gundlach, DoubleLine’s founder, is apparently in talks about buying the Buffalo Bills. I’m not sure if anyone mentioned to him that E.J. Manuel (“Buffalo head coach Doug Marrone already is lowering the bar of expectation considerably for the team’s 2013 first-round pick”) is all they’ve got for a QB, unless of course The Jeffrey is imagining himself indomitably under center. That’s far from the oddest investment by a mutual fund billionaire. That honor might go to Ned Johnson’s obsessive pursuit of tomato perfection through his ownership of Backyard Farms.

Jeffrey Gundlach, DoubleLine’s founder, is apparently in talks about buying the Buffalo Bills. I’m not sure if anyone mentioned to him that E.J. Manuel (“Buffalo head coach Doug Marrone already is lowering the bar of expectation considerably for the team’s 2013 first-round pick”) is all they’ve got for a QB, unless of course The Jeffrey is imagining himself indomitably under center. That’s far from the oddest investment by a mutual fund billionaire. That honor might go to Ned Johnson’s obsessive pursuit of tomato perfection through his ownership of Backyard Farms.

On or about November 3, 2014, the principal investment strategies of the Manning Napier Real Estate and Equity Income will change to permit the writing (selling) of options on securities.

Another tough month for Marsico. With the departure (or dismissal) of James Gendelman, Marsico International Opportunities (MIOFX) loses its founding manager and Marsico Global (MGBLX)loses the second of its three founding managers. On the same day they lost their sub-advisory role at Litman Gregory Masters International Fund (MNILX). Five other first-rate teams remain with the fund, whose generally fine record is marred by substantially losses in 2011. In April 2012, one of the management teams – from Mastholm Asset Management – was dropped and performance on other sides of 2011 has been solid.

Royce Special Equity Multi-Cap Fund (RSMCX) has declared itself, and its 30 portfolio holdings, “non-diversified.”

T. Rowe Price Spectrum Income (RPSIX) is getting a bit spicy. Effective September 1, 2014, the managers may invest between 0 – 10% of the fund’s assets in T. Rowe Price Emerging Markets Local Currency Bond Fund, Floating Rate Fund, Inflation Focused Bond Fund, Inflation Protected Bond Fund, and U.S. Treasury Intermediate Fund.

SMALL WINS FOR INVESTORS

Effective immediately, 361 Global Macro Opportunity, Managed Futures Strategy and Global Managed Futures Strategy fund will no longer impose a 2% redemption fee.

That’s a ridiculously small number of wins for our side.

CLOSINGS (and related inconveniences)

On September 19, 2014, Eaton Vance Multi-Cap Growth Fund (EVGFX) will be soft-closed. One-star rating, $162 million in assets, regrettable tendency to capture more downside (108%) than upside (93%), new manager in November 2013 with steadily weakening performance since then. This might be the equivalent of a move into hospice care.

Effective September 5, 2014, Nationwide International Value Fund (NWVAX) will close to new investors. One star rating, $22 million in assets, a record the trails 87% of its peers: Hospice!

OLD WINE, NEW BOTTLES

Effective October 1, 2014, Dunham Loss Averse Equity Income Fund (DAAVX/DNAVX) will be renamed Dunham Dynamic Macro Fund. The revised fund will use “a dynamic macro asset allocation strategy” which might generate long or short exposure to pretty much any publicly-traded security.

Effective October 31, 2014, Eaton Vance Large-Cap Growth Fund (EALCX) gets renamed Eaton Vance Growth Fund. The change seems to be purely designed to dodge the 80% rule since the principle investment strategies remain unchanged except for the “invests 80% of its assets in large” piece. The fund comes across as modestly overpriced tapioca pudding: there’s nothing terribly objectionable about it but, really, why bother? At the same time Eaton Vance Large-Cap Core Research Fund (EAERX) gains a bold new name: Eaton Vance Stock Fund. With an R-squared that’s consistently over 98 but returns that trailed the S&P in four of the past five calendar years, it might be more accurately renamed Eaton Vance “Wouldn’t You Be Better in a Stock Index Fund?” Fund.

Oh, I know why that would be a bad name. Because, the prospectus declares “Particular stocks owned will not mirror the S&P 500 Index.” Right, though the portfolio as a whole will.

Eaton Vance Balanced Fund (EVIFX) has become a fund of two Eaton Vance Funds: Growth and Investment Grade Income. It’s a curious decision since the fund has had substantially above-average returns over the past five years.

Effective on October 1, 2014. Goldman Sachs Core Plus Fixed Income Fund becomes Goldman Sachs Bond Fund

On or around October 21, 2014, JPMorgan Multi-Sector Income Fund (the “Fund”) becomes the JPMorgan Unconstrained Debt Fund. Its principal investment strategy is to invest in (get ready!) “debt.” The list of allowable investments offers a hint, in listing two sorts of bank loans first and bonds fifth.

OFF TO THE DUSTBIN OF HISTORY

If you’ve ever wondered how big the dustbin of history is, here’s a quick snapshot of it from the Investment Company Institute’s latest Factbook. In broad terms, 500 funds disappear and 600 materialize in the average year. The industry generally sees healthy shakeouts in the year following a market crash.

Ron Rowland, founder of Invest With an Edge and editor of AllStarInvestor.com, maintains the suitably macabre ETF Deathwatch which each month highlights those ETFs likeliest to be described as zombies: funds with both low assets and low trading volumes. The August Deathwatch lists over 300 ETFs that soon might, and perhaps ought to, become nothing more than vague memories.

Ron Rowland, founder of Invest With an Edge and editor of AllStarInvestor.com, maintains the suitably macabre ETF Deathwatch which each month highlights those ETFs likeliest to be described as zombies: funds with both low assets and low trading volumes. The August Deathwatch lists over 300 ETFs that soon might, and perhaps ought to, become nothing more than vague memories.

This month’s entrants to the dustbin include AMF Intermediate Mortgage Fund (ASCPX)and AMF Ultra Short Fund (AULTX), both slated to liquidate on September 26, 2014.

AllianceBernstein International Discovery Equity (ADEAX) and AllianceBernstein Market Neutral Strategy — Global (AANNX)will be liquidated and dissolved (how are those different?) on October 10, 2014.

Around December 19th, Clearbridge Equity Fund (LMQAX) merges into ClearBridge Large Cap Growth Fund (SBLGX). LMQAX has had the same manager since 1995.

On Aug. 20, 2014, the Board of Trustees of Voyageur Mutual Funds unanimously voted and approved a proposal to liquidate and dissolve Delaware Large Cap Core Fund (DDCAX), Delaware Core Bond Fund (DPFIX) and Delaware Macquarie Global Infrastructure Fund (DMGAX). The euthanasia will occur by late October but they did not specify a date.

Direxion Indexed CVT Strategy Bear Fund (DXCVX) and Direxion Long/Short Global Currency Fund (DXAFX)are both slated to close on September 8th and liquidate on September 22nd. Knowing that you were being eaten alive by curiosity, I checked: DXCVX seeks to replicate the inverse of the daily returns of the QES Synthetic Convertible Index. At base, it shorts convertible bonds. Morningstar designates the fund as Direxion Indxd Synth Convert Strat Bear, for reasons not clear, but does give a clue as to its demise: it has $30,000 in AUM and has fallen a sprightly 15% since inception in February.

Horizons West Multi-Strategy Hedged Income Fund (HWCVX) will liquidate on October 6, 2014, just six months after launch. In the interim, Brenda A. Smith has replaced Steven M. MacNamara as the fund’s president and principal executive officer.

The $100 million JPMorgan Strategic Preservation Fund (JSPAX) is slated for liquidation on September 29th. The manager may have suffered from excessive dedication to the goal of preservation: throughout its life the fund never had more than a third of its assets in stocks. That gave it a minimal beta (about 0.20) but also minimal appeal in generally rising markets.

Oddly, the fund’s prospectus warns that “The Fund’s total allocation to equity securities and convertible bonds will not exceed 60% of the Fund’s total assets except for temporary defensive positions.” They never explain when moving out of cash and into stocks qualifies as a defensive move.

Parametric Market Neutral Fund (EPRAX) ceases to exist on September 19, 2014.

PIMCO, the world’s biggest bond fund shop and happiest employer, is trimming out its ETF roster: Australia Bond, Build America Bond, Canada Bond and Germany Bond disappear on or about October 1, 2014. “This date,” PIMCO gently reminds us, “may be changed without notice at the discretion of the Trust’s officers.” At the same time iShares, the biggest issuer of ETFs, plans to close 18 small funds with a combined asset base of a half billion dollars. That includes 10 target-date funds plus several EM and real estate niche funds.

Prudential International Value Fund (PISAX), run by LSV, will be merged into Prudential International Equity Fund (PJRAX). Both funds are overpriced and neither has a consistent record of adding much value, though PJRAX is slightly less overpriced and has strung through a decent run lately.

PTA Comprehensive Alternatives Fund (BPFAX) liquidates on September 15, 2014. I didn’t even know the PTA had funds, though around here they certainly have fund-raisers.

In Closing . . .

Thanks, as always, to all of you who’ve supported the Observer either by using our Amazon link (which costs you nothing but earns us 6-7% of the value of whatever you buy using it) or making a direct contribution by check or through PayPal (which costs you … well, something admittedly). Nuts. I really owe Philip A. a short note of thanks. Uhhh … sorry, big guy! The card is in the mail (nearly).

For the first time ever, the four of us who handle the bulk of the Observer’s writing and administrative work – Charles, Chip, Ed and me – are settling down to a face-to-face planning session at the end of the upcoming Morningstar ETF Conference. Which also means that we’ll be wandering around the conference. If you’re there and would like to chat with any of us, drop me a note and we’ll get it set up.

Talk to you soon, think of you sooner!

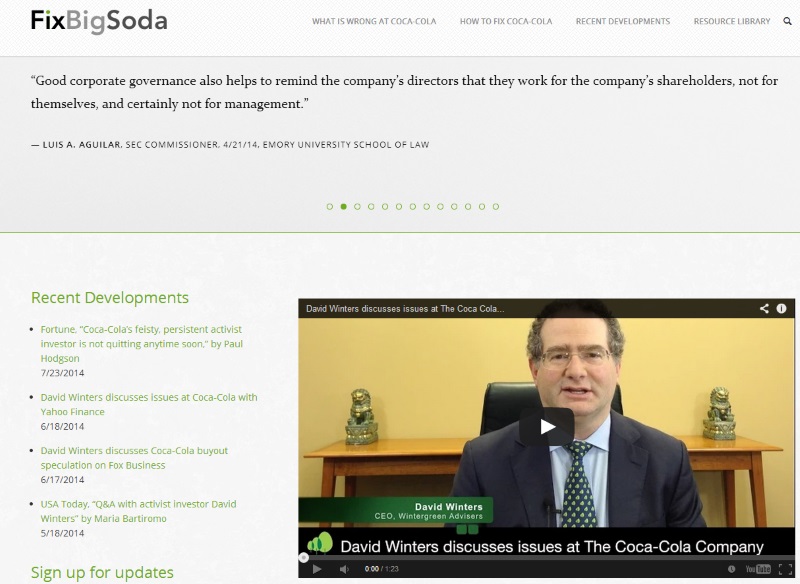

Mr. Cunnane manages Advisory Research MLP & Energy Infrastructure Fund which started life as a Fiduciary Asset Management Company (FAMCO) fund until the complex was acquired by Advisory Research. He’d been St. Louis-based FAMCO’s chief investment officer for 15 years. He’s the CIO for the MLP & Energy Infrastructure team and chair of AR’s Risk Management Committee. He also manages two closed-end funds which also target MLPs: the Fiduciary/Claymore MLP Opportunity Fund (FMO) and the Nuveen Energy MLP Total Return Fund (JMF). Here are his 200 words (and one picture) on why you might consider INFRX:

Mr. Cunnane manages Advisory Research MLP & Energy Infrastructure Fund which started life as a Fiduciary Asset Management Company (FAMCO) fund until the complex was acquired by Advisory Research. He’d been St. Louis-based FAMCO’s chief investment officer for 15 years. He’s the CIO for the MLP & Energy Infrastructure team and chair of AR’s Risk Management Committee. He also manages two closed-end funds which also target MLPs: the Fiduciary/Claymore MLP Opportunity Fund (FMO) and the Nuveen Energy MLP Total Return Fund (JMF). Here are his 200 words (and one picture) on why you might consider INFRX:

Here’s a major vote of confidence: Effective August 1, 2014, John Neff and Thomas Saberhagen were named as co-portfolio managers for the

Here’s a major vote of confidence: Effective August 1, 2014, John Neff and Thomas Saberhagen were named as co-portfolio managers for the  Citing “the lack of investment opportunities” and “high current cash levels” occasioned by the five year run-up in global stock prices, Tweedy Browne announced the impending soft close of Tweedy, Browne Global Value II (TBCUX). TBCUX is an offshoot of Tweedy, Browne Global Value (TBGVX) with the same portfolio and managers but Global Value often hedges its currency exposure while Global Value II does not. The decision to close TBCUX makes sense as a way to avoid “diluting our existing shareholders’ returns in this difficult environment” since the new assets were going mostly to cash. Will Browne planned “to reopen the Fund when new idea flow improves and larger amounts of cash can be put to work in cheap stocks.”

Citing “the lack of investment opportunities” and “high current cash levels” occasioned by the five year run-up in global stock prices, Tweedy Browne announced the impending soft close of Tweedy, Browne Global Value II (TBCUX). TBCUX is an offshoot of Tweedy, Browne Global Value (TBGVX) with the same portfolio and managers but Global Value often hedges its currency exposure while Global Value II does not. The decision to close TBCUX makes sense as a way to avoid “diluting our existing shareholders’ returns in this difficult environment” since the new assets were going mostly to cash. Will Browne planned “to reopen the Fund when new idea flow improves and larger amounts of cash can be put to work in cheap stocks.” Thanks, as always, go to The Shadow – an incredibly vigilant soul and long tenured member of the Observer’s discussion community for his contributions to this section. Really, very little gets past him and that gives me a lot more confidence in saying that we’ve caught of all of major changes hidden in the ocean of SEC filings.

Thanks, as always, go to The Shadow – an incredibly vigilant soul and long tenured member of the Observer’s discussion community for his contributions to this section. Really, very little gets past him and that gives me a lot more confidence in saying that we’ve caught of all of major changes hidden in the ocean of SEC filings.

My son Will, still hobbled after dropping his iPad on a toe, has taken to wincing every time we approach the mall. It’s festooned with “back to school sale! Sale! sale!” banners which seem, somehow, to unsettle him.

My son Will, still hobbled after dropping his iPad on a toe, has taken to wincing every time we approach the mall. It’s festooned with “back to school sale! Sale! sale!” banners which seem, somehow, to unsettle him.

feel free to resort to PayPal or the USPS. It all helps and it’s all detailed on our

feel free to resort to PayPal or the USPS. It all helps and it’s all detailed on our

For a complete list of developments last month, and for information and court documents in any case, log in at

For a complete list of developments last month, and for information and court documents in any case, log in at  One of the best expressions of the problem was offered by Leo Strauss, a 20th century political philosopher and classicist:

One of the best expressions of the problem was offered by Leo Strauss, a 20th century political philosopher and classicist: