Objective and strategy

Polaris Global Value attempts to provide above average return by investing in companies with potentially strong sustainable free cash flow or undervalued assets. Their goal is “to invest in the most undervalued companies in the world.” They combine quantitative screens with Graham and Dodd-like fundamental research. The fund is diversified across country, industry and market capitalization. They typically hold 50 to 100 stocks.

Adviser

Polaris Capital Management, LLC. Founded in 1995, Polaris describes itself as a “global value equity manager.” The firm is owned by its employees and, as of September 2014, managed $5 billion for institutions, retirement plans, insurance companies, foundations, endowments, high-net-worth individuals, investment companies, corporations, pension and profit sharing plans, pooled investment vehicles, charitable organizations, state or municipal governments, and limited partnerships. They subadvise four funds include the value portion of the PNC International Equity, a portion of the Russell Global Equity Fund and two Pear Tree Polaris funds.

Manager

Bernard Horn. Mr. Horn is Polaris’s founder, president and senior portfolio manager. Mr. Horn founded Polaris in April 1995 to expand his existing client base dating to the early 1980s. Mr. Horn has been managing Polaris’ global and international portfolios since the firm’s inception and global equity portfolios since 1980. He’s both widely published and widely quoted. He earned a BS from Northeastern University and a MS in Management from MIT. In 2007, MarketWatch named him their Fund Manager of the Year. Mr. Horn is assisted by six investment professionals. They report producing 90% of their research in-house.

Strategy capacity and closure

Substantial. Mr. Horn estimates that they could manage $10 billion firm wide; current assets are at $5 billion across all portfolios and funds.. That decision has already cost him one large client who wanted Mr. Horn to increase capacity by managing larger cap portfolios.

About half of the global value fund’s current portfolio is in small- to mid-cap stocks and, he reports, “it’s a pretty small- to mid-cap world. Something like 80% of the world’s 39,000 publicly traded companies have market caps under $2 billion.” If this strategy reaches its full capacity, they’ll close it though they might subsequently launch a complementary strategy.

Active share

Polaris hasn’t calculated it. It’s apt to be high since, they report “only 51% of the stocks in PGVFX overlap with the benchmark” and the fund’s portfolio is equal-weighted while the index is cap-weighted.

Management’s stake in the fund

Mr. Horn has over $1 million in the fund and owns over 75% of the advisor. Mr. Horn reports that “All my money is invested in the funds that we run. I have no interest in losing my competitive advantage in alpha generation.” In addition, all of the employees of Polaris Capital are invested in the fund.

Opening date

July 31, 1989.

Minimum investment

$2,500, reduced to $2,000 for IRAs. That’s rather modest in comparison to the $75 million minimum for their separate accounts.

Expense ratio

0.99% on $399 million in assets, as of July 2023. The expense ratio was reduced at the end of 2013, in part to accommodate the needs of institutional investors. With the change, PGVFX has an expense ratio in the bottom third of its peer group.

Comments

There’s a lot to like about Polaris Global Value. I’ll list four particulars:

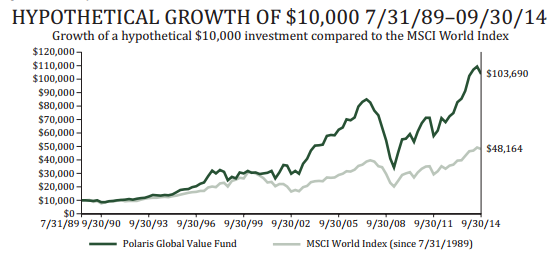

- Polaris has had a great century. $10,000 invested in the fund on January 1, 2000 would have grown to $36,600 by the end of November 2014. Its average global stock peer was pathetic by comparison, growing $10,000 to just $16,700. Focus for a minute on the amount added to that initial investment: Polaris added $26,600 to your wealth while the average fund would have added $6,700. That’s a 4:1 difference.

- It’s doggedly independent. Its median market cap – $8 billion – is about one-fifth of its peers’. The stocks in its portfolio are all about equally weighted while its peers are much closer to being cap weighted. It has substantially less in Asia and the US (50%) than its peers (70%), offset by a far higher weighting in Europe. Likewise its sector weightings are comparable to its peers in only two of 11 sectors. All of that translates to returns unrelated to its peers: in 1998 it lost 9% while its peers made 24% but it made money in both 2001 and 2002 while its peers lost a third of their money.

- It’s driven by alpha, not assets. The marketing for Polaris is modest, the fund is small, and the managers have been content having most of their assets reside in their various sub-advised funds.

- It’s tax efficient. Through careful management, the fund hasn’t had a capital gains payout in years; nothing since 2008 at least and Mr. Horn reports a continuing tax loss carry forward to offset still more gains.

The one fly in the ointment was the fund’s performance in the 2007-09 market meltdown. To be blunt, it was horrendous. Between October 2007 and March 2009, Polaris transformed a $10,000 account into a $3,600 account which explains the fund’s excellent tax efficiency in recent years. The drop was so severe that it wiped out all of the gains made in the preceding seven years.

Here’s the visual representation of the fund’s progress since inception.

Okay, if that one six quarter period didn’t exist, Polaris would be about the world’s finest fund and Mr. Horn wouldn’t have any explaining to do.

Okay, if that one six quarter period didn’t exist, Polaris would be about the world’s finest fund and Mr. Horn wouldn’t have any explaining to do.

Sadly, that tumble off a cliff does exist and we called Mr. Horn to talk about what happened then and what he’s done about it. Here’s the short version:

“2008 was a bit of an unusual year. The strangest thing is that we had the same kinds of companies we had in the dot.com bubble and were similarly overweight in industrials, materials and banks. The Lehman bankruptcy scared everyone out of the market, you’ll recall that even money market funds froze up, and the panic hit worst in financials and industrials with their high capital demands.”

Like Dodge & Cox, Polaris was buying when prices were at their low point in a generation, only to watch them fall to a three generation low. Their research screens “exploded with values – over a couple thousand stocks passed our initial screens.” Their faith was rewarded with 62% gains over the following two years.

The experience led Mr. Horn and his team to increase the rigor of their screening. They had, for example, been modeling what would happen to a stock if a firm’s growth flat lined. “Our screens are pretty pessimistic; they’re designed to offer very, very conservative financial models of these companies” but 2008 sort of blindsided them. Now they’re modeling ten and twenty percent declines as a sort of stress test. They found about five portfolio companies that failed those tests and which they “kinda got rid of, though they bounced back quite nicely afterward.” In addition they’ve taken the unconventional step of hiring private investigators (“a bunch of former FBI guys”) to help with their due diligence on corporate management, especially when it comes to non-U.S. firms.

He believes that the “soul-searching after 2008” and a bunch of changes in their qualitative approach, in particular greater vigilance for the sorts of low visibility risks occasioned by highly-interconnected markets, has allowed them to fundamentally strengthen their risk management.

As he looks ahead, two factors are shaping his thinking about the portfolio: deflation and China.

On deflation: “We think the developed world is truly in a period of deflation. One thing we learned in investing in Japan for the past 5 plus years, we were able to find companies that were able to raise their operating revenue and free cash flows during what most central bankers would consider the scourge of the economic Earth.” He expects very few industries to be able to raise prices in real terms, so the team is focusing on identifying deflation beating companies. The shared characteristic of those firms is that they’re able to – or they help make it possible for other firms – to lower operating costs by more than the amount revenues will fall. “If you can offer a company product that saves them money – only salvation is lowering cost more dramatically than top line is sinking – you will sell lots.”

On China: “There’s a potential problem in China; we saw lots of half completed buildings with no activity at all, no supplies being delivered, no workers – and we had to ask, why? There are many very, very smart people who are aware of the situation but claim that we’re more worried than we need to be. On whole, Chinese firms seem more sanguine. But no one offers good answers to our concerns.” Mr. Horn thinks that China, along with the U.S. and Japan, are the world’s most attractive markets right now. Still he sees them as a potential source of a black swan event, perhaps arising from the unintended consequences of corruption crackdowns, the government ownership of the entire banking sector or their record gold purchases as they move to make their currency fully convertible on the world market. He’s actively looking for ways to guard against potential surprises from that direction.

Bottom Line

There’s a Latin phrase often misascribed to the 87-year-old titan, Michelangelo: Ancora imparo. It’s reputedly the humble admission by one of history’s greatest intellects that “I am still learning.” After an hour-long conversation with Mr. Horn, that very phrase came to mind. He has a remarkably probing, restless, wide-ranging intellect. He’s thinking about important challenges and articulating awfully sensible responses. The mess in 2008 left him neither dismissive nor defensive. He described and diagnosed the problem in clear, sharp terms and took responsibility (“shame on us”) for not getting ahead of it. He seems to have vigorously pursued strategies that make his portfolio better positioned. It was a conversation that inspired our confidence and it’s a fund that warrants your attention.