At the time of publication of this profile, the fund was named Zeo Strategic Income.

Objective and strategy

Zeo seeks “income and moderate capital appreciation.” They describe themselves as a home for your “strategic cash holdings, with the goals of protecting principal and beating inflation by an attractive margin.” While the prospectus allows a wide range of investments, the core of the portfolio has been short-term high yield bonds, secured floating rate loans and cash. The portfolio is unusually compact for a fixed-income fund. As of June 2014, they had about 30 holdings with 50% of their portfolio in the top ten. Security selection combines top-down quantitative screens with a lot of fundamental research. The advisor consciously manages interest rate, default and currency risks. Their main tool for managing interest rate risk is maintaining a short duration portfolio. It’s typically near a one year duration though might be as high as four in some markets. They have authority to hedge their interest rate exposure but rather prefer the simplicity, transparency and efficiency of simply buying shorter dated securities.

Adviser

Zeo Capital Advisors of San Francisco. Zeo provides investment management services to the fund but also high net worth individuals and family offices through its separately managed accounts. They have about $146 million in assets under management, all relying on some variation of the strategy behind Zeo Strategic Income.

Managers

Venkatesh Reddy and Bradford Cook. Mr. Reddy is the founder of Zeo Capital Advisors and has been the Fund’s lead portfolio manager since inception. Prior to founding Zeo, Mr. Reddy had worked with several hedge funds, including Pine River Capital Management and Laurel Ridge Asset Management which he founded. He was also the “head of delta-one trading, and he structured derivative products as a portfolio manager within Bank of America’s Equity Financial Products group.” As a guy who specialized in risk management and long-tail risk, he was “the guy who put the hedging into the hedge fund.” Mr. Cook’s career started as an auditor for PricewaterhouseCoopers, he moved to Oaktree Capital in 2001 where he served as a vice president on their European high yield fund. He had subsequent stints as head of convertible strategies at Sterne Agee Group and head of credit research in the convertible bond group at Thomas Weisel Partners LLC before joining Zeo in 2012. Mr. Reddy has a Bachelor of Science degree in Computer Science from Harvard University and Mr. Cook earned a Bachelor of Commerce from the University of Calgary.

Strategy capacity and closure

The fund pursues “capacity constrained” strategies; that is, by its nature the fund’s strategy will never accommodate multiple billions of dollars. The advisor doesn’t have a predefined bright line because the capacity changes with market conditions. In general, the strategy might accommodate $500 million – $1 billion.

Management’s stake in the fund

As of the last Statement of Additional Information (April 2013), Mr. Reddy and Mr. Cook each had between $1 – 10,000 invested in the fund. The manager’s commitment is vastly greater than that outdated stat reveals. Effectively all of his personal capital is tied up in the fund or Zeo Capital’s fund operations. None of the fund’s directors had any investment in it. That’s no particular indictment of the fund since the directors had no investment in any of the 98 funds they oversaw.

Opening date

May 31, 2011.

Minimum investment

$5,000 and a 15 minute suitability conversation. The amount is reduced to $1,500 for retirement savings accounts. The minimum for subsequent investments is $1,000. That unusually high threshold likely reflects the fund’s origins as an institutional vehicle. Up until October 2013 the minimum initial investment was $250,000. The fund is available through Fidelity, Schwab, Scottrade, Vanguard and a handful of smaller platforms.

Expense ratio

The reported expense ratio is 1.50% which substantially overstates the expenses current investors are likely to encounter. The 1.50% calculation was done in early 2013 and was based on a very small asset base. With current fund assets of $104 million (as of June 2014), expenses are being spread over a far larger investor pool. This is likely to be updated in the next prospectus.

Comments

ZEOIX exists to help answer a simple question: how do we help investors manage today’s low yield environment without setting them up for failure in tomorrow’s rising rate one? Many managers, driven by the demands of “scalability” and marketing, have generated complex strategies and sprawling portfolios (PIMCO Short Term, for example, has 1500 long positions, 30 shorts and a 250% turnover) in pursuit of an answer. Zeo, freed of both of those pressures, has pursued a simpler, more elegant answer.

The managers look for good businesses that need to borrow capital for relatively short periods at relatively high rates. Their investable universe is somewhere around 3000 issues. They use quantitative screens for creditworthiness and portfolio risk to whittle that down to about 150 investment candidates. They investigate those 150 in-depth to determine the likelihood that, given a wide variety of stressors, they’ll be able to repay their debt and where in the firm’s capital structure the sweet spot lies. They end up with 20-30 positions, some in short-term bonds and some in secured floating-rate loans (for example, a floating rate loan at LIBOR + 2.8% to a distressed borrower secured by the borrower’s substantial inventory of airplane spare parts), plus some cash.

Mr. Reddy has substantial experience in risk management and its evident here.

This is not a glamorous niche and doesn’t promise glamorous returns. The fund returned 3.6% annually over its first three years with essentially zero (-0.01) correlation to the aggregate bond market. Its SMA composite has posted negative returns in six of 60 months but has never lost money in more than two consecutive months (during the 2011 taper tantrum). The fund’s median loss in a down month is 0.30%.

The fund’s Sharpe ratio, the most widely quoted calculation of an investment’s risk/return balance, is 2.35. That’s in the top one-third of one percent of all funds in the Morningstar database. Only 26 of 7250 funds can match or exceed that ratio and just six (including Intrepid Income ICMUX and the closed RiverPark Short Term High Yield RPHYX funds) have generated better returns.

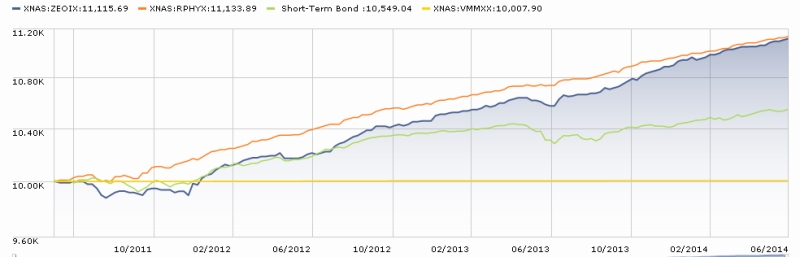

Zeo’s managers, like RiverPark’s, think of the fund as a strategic cash management option; that is, it’s the sort of place where your emergency fund or that fraction of your portfolio that you have chosen to keep permanently in cash might reside. Both managers think of their funds as something appropriate for money that you might need in six months, but neither would be comfortable thinking of it as “a money market on steroids” or any such. Both are intensely risk-alert and have been very clear that they’d far rather protect principal than reach for yield. Nonetheless, some bumps are inevitable. For visual learners, here’s the chart of Zeo’s total returns since inception (blue) charted against RPHYX (orange), the average short-term bond fund (green) and a really good money market fund (Vanguard Prime, the yellow line).

Bottom Line

All funds pay lip service to the claim “we’re not for everybody.” Zeo means it. Their reluctance to launch a website, their desire to speak directly with you before you invest in the fund and their willingness to turn away large investments (twice of late) when they don’t think they’re a good match with their potential investor’s needs and expectations, all signal an extraordinarily thoughtful relationship between manager and investor. Both their business and investment models are working. Current investors – about a 50/50 mix of advisors and family offices – are both adding to their positions and helping to bring new investors to the fund, both of which are powerful endorsements. Modestly affluent folks who are looking to both finish ahead of inflation and sleep at night should likely make the effort to reach out and learn more.

Fund website

Effectively none. Zeo.com contains the same information you’d find on a business card. (Yeah, I know.) Because most of their investors come through referrals and personal interactions it’s not a really high priority for them. They aspire to a nicely minimalist site at some point in the foreseeable future. Until then you’re best off calling and chatting with them.

© Mutual Fund Observer, 2014. All rights reserved. The information here reflects publicly available information current at the time of publication. For reprint/e-rights contact us.