Dear friends,

Given the intensity of the headlines, you’d think that Black Monday had revisited us weekly or, perhaps, that Smaug had settled his scaly bulk firmly atop our portfolios. But no, the market wandered down a few percent for the month. I have the same reaction to the near-hysterical headlines about the emerging markets (“rout,” “panic” and “sell-off” are popular headline terms). From the headlines, you’d think the emerging markets had lost a quarter of their value and that their governments were back to defaulting on debts and privatizing companies. They haven’t and they aren’t. It makes you wonder how ready we are for the inevitable sharp correction that many are predicting and few are expecting.

Where are the customers’ yachts: The power of asking the wrong question

In 1940, Fred Schwed penned one of the most caustic and widely-read finance books of its time. Where Are the Customers’ Yachts, now in its sixth edition, opens with an anecdote reportedly set in 1900 and popular on Wall Street in the 1920s.

|

An out-of-town visitor was shown the wonders of the New York financial district. When the party arrived at the Battery, one of his guides indicated some of the handsome ships riding at anchor. He said, “Look, those are the bankers’ and the brokers’ yachts.” The naïve visitor asked, “Where are the customer’s yachts?”

|

That’s an almost irresistibly attractive tale since it so quickly captures the essence of what we all suspect: finance is a game rigged to benefit the financiers, a sort of reverse Robin Hood scheme in which we eagerly participate. Disclosure of rampant manipulation of the London currency exchanges is just the most recent round in the game.

As charming as it is, it’s also fundamentally the wrong question. Why? Because “buying a yacht” was not the goal for the vast majority of those customers. Presumably their goals were things like “buying a house” or “having a rainy day cushion,” which means the right question would have been “where are the customer’s houses?”

We commit the same fallacy today when we ask, “can your fund beat the market?” It’s the question that drives hundreds of articles about the failure of active management and of financial advisors more generally. But it’s the wrong question. Our financial goals aren’t expressed relative to the market; they’re expressed in terms of life goals and objectives to which our investments might contribute.

In short, the right question is “why does investing in this fund give me a better chance of achieving my goals than I would have otherwise?” That might redirect our attention to questions far more important than whether Fund X lags or leads the S&P500 by 50 bps a year. Those fractions of a percent are not driving your investment performance nearly as much as other ill-considered decisions are. The impulse to jump in and out of emerging markets funds (or bond funds or U.S. small caps) based on wildly overheated headlines are far more destructive than any other factor.

Morningstar calculates “investor returns” for hundreds of funds. Investor returns are an attempt to answer the question, “did the investors show up after the party was over and leave as things got dicey?” That is, did investors buy into something they didn’t understand and weren’t prepared to stick with? The gap between what an investor could have made – the fund’s long-term returns – and what the average investor actually seems to have made – the investor returns – can be appalling. T. Rowe Price Emerging Market Stock (PRMSX) made 9% over the past decade, its average investor made 4%. Over a 15 year horizon the disparity is worse: the fund earned 10.7% while investors were around for 4.3% gains. The gap for Dodge & Cox Stock (DODGX) is smaller but palpable: 9.2% for the fund over 15 years but 7.0% for its well-heeled investors.

My colleague Charles has urged me to submit a manuscript on mutual fund investing to John Wiley’s Little Book series, along with such classics as The Little Book That Makes You Rich and The Little Book That Beats the Market. I might. But if I do, it will be The Little Book That Doesn’t Beat the Market: And Why That’s Just Fine. Its core message will be this:

If you spend less time researching your investments than you spend researching a new kitchen blender, you’re screwed. If you base your investments on a belief in magical outcomes, you’re screwed. And if you think that 9% returns will flow to you with the smooth, stately grace of a Rolls Royce on a country road, you’re screwed.

But if you take the time to understand yourself and you take the time to understand the strategies that will be used by the people you’re hiring to provide for your future, you’ve got a chance.

And a good, actively managed mutual fund can make a difference but only if you look for the things that make a difference. I’ll suggest four:

Understanding: do you know what your manager plans to do? Here’s a test: you can explain it to your utterly uninterested spouse and then have him or her correctly explain it back? Does your manager write in a way that draws you closer to understanding, or are you seeing impenetrable prose or marketing babble? When you have a question, can you call or write and actually receive an intelligible answer?

Alignment: is your manager’s personal best interests directly tied to your success? Has he limited himself to his best ideas, or does he own a bit of everything, everywhere? Has he committed his own personal fortune to the fund? Have his Board of Directors? Is he capable of telling you the limits of his strategy; that is, how much money he can handle without diluting performance? And is he committed to closing the fund long before you reach that sad point?

Independence: does your fund have a reason to exist? Is there any reason to believe that you couldn’t substitute any one of a hundred other strategies and get the same results? Does your fund publish its active share; that is, the amount of difference between it and an index? Does it publish its r-squared value; that is, the degree to which it merely imitates the performance of its peer group?

Volatility: does your manager admit to how bad it could get? Not just the fund’s standard deviation, which is a pretty dilute measure of risk. No, do they provide their maximum drawdown for you; that is, the worst hit they ever took from peak to trough. Are the willing to share and explain their Sharpe and Sortino ratios, key measures of whether you’re getting reasonably compensated for the hits you’ll inevitable take? Are they willing to talk with you in sharply rising markets about how to prepare for the sharply falling ones?

The research is clear: there are structural and psychological factors that make a difference in your prospects for success. Neither breathless headlines nor raw performance numbers are among them.

Then again, there’s a real question of whether it could ever compete for total sales with my first book, Continuity and Change in the Rhetoric of the Moral Majority (total 20-year sales: 650 copies).

Absolute value’s sudden charm

Jeremy Grantham often speaks of “career risk” as one of the great impediments to investment success. The fact that managers know they’re apt to be fired for doing the right thing at the wrong time is a powerful deterrent to them. For a great many, “the right thing” is refusing to buy overvalued stocks. Nonetheless, when confronted by a sharply rising market and investor ebullience, most conclude that it’s “the wrong time” to act on principle. In short, they buy when they know they probably shouldn’t.

A handful of brave souls have refused to succumb to the pressure. In general, they’re described as “absolute value” investors. That is, they’ll only buy stocks that are selling at a substantial discount to their underlying value; the mere fact that they’re “the best of a bad lot” isn’t enough to tempt them.

And, in general, they got killed – at least in relative terms – in 2013. We thought it would be interesting to look at the flip side, the performance of those same funds during January 2014 when the equity indexes dropped 3.5 – 4%. While the period is too brief to offer any major insights, it gives you a sense of how dramatically fortunes can reverse.

THE ABSOLUTE VALUE GUYS

|

|

Cash |

Relative 2013 return |

Relative 2014 return |

|

ASTON River Road Independent Value ARIVX |

67% |

bottom 1% |

top 1% |

|

Beck, Mack & Oliver Partners BMPEX |

18 |

bottom 3% |

bottom 17% |

|

Cook & Bynum COBYX |

44 |

bottom 1% |

top 8% |

|

FPA Crescent FPACX * |

35 |

top 5% |

top 30% |

|

FPA International Value FPIVX |

40 |

bottom 20% |

bottom 30% |

|

Longleaf Partners Small-Cap LLSCX |

45 |

bottom 23% |

top 10% |

|

Oakseed SEEDX |

21 |

bottom 8% |

top 5% |

|

Pinnacle Value PVFIX |

44 |

bottom 2% |

top 3% |

|

Yacktman YACKX |

22 |

bottom 17% |

top 27% |

Motion, not progress

Cynic, n. A blackguard whose faulty vision sees things as they are, not as they ought to be.

Ambrose Bierce

One of the joys of having entered the investment business in the 1980’s is that you came in at a time when the profession was still populated by some really nice and thoughtful people, well-read and curious about the world around them. They were and are generally willing to share their thoughts and ideas without hesitation. They were the kind of people that you hoped you could keep as friends for life. One such person is my friend, Bruce, who had a thirty-year career on the “buy side” as both an analyst and a director of research at several well-known money management firms. He retired in 2008 and divides his time between homes in western Connecticut and Costa Rica.

One of the joys of having entered the investment business in the 1980’s is that you came in at a time when the profession was still populated by some really nice and thoughtful people, well-read and curious about the world around them. They were and are generally willing to share their thoughts and ideas without hesitation. They were the kind of people that you hoped you could keep as friends for life. One such person is my friend, Bruce, who had a thirty-year career on the “buy side” as both an analyst and a director of research at several well-known money management firms. He retired in 2008 and divides his time between homes in western Connecticut and Costa Rica.

Here in Chicago in January, with snow falling again and the wind chill taking the temperature below zero, I see that Bruce, sitting now in Costa Rica, is the smart one. Then I reflected on a lunch we had on a warm summer day last August near the Mohawk Trail in western Massachusetts. We stay in touch regularly but this was the first time the two of us had gotten together in several years.

The first thing I asked Bruce was what he missed most about no longer being active in the business. Without hesitation he said that it was the people. For most of his career he had interacted daily with other smart investors as well as company management teams. You learned how they thought, what kind of people they were, whether they loved their businesses or were just doing it to make money, and how they treated their shareholders and investors. Some of his best memories were of one-on-one meetings or small group dinners. These were events that companies used to hold for their institutional shareholders. That ended with the implementation of Regulation FD (full disclosure), the purpose of which was to eliminate the so-called whisper number that used to be “leaked” to certain brokerage firm analysts ahead of earnings reporting dates. This would allow those analysts to tip-off favored clients, giving them an edge in buying or selling a position. Companies now deal with this issue by keeping tight control on investor meetings and what can be said in them, tending to favor multi-media analyst days (timed, choreographed, scripted, and rehearsed events where you find yourself one of three hundred in a room being spoon-fed drivel), and earnings conference calls (timed, choreographed, scripted, and rehearsed events where you find yourself one of a faceless mass listening to reporting without seeing any body language). Companies will still visit current and potential investors by means of “road shows” run by a friendly brokerage firm coincidentally looking for investment banking business. But the exchange of information can be less than free-flowing, especially if the brokerage analyst sits in on the meeting. And, to prevent accidental disclosure, the event is still heavily scripted. It has however created a new sideline business for brokerage firms in these days of declining commission rates. Even if you are a large existing institutional shareholder, the broker/investment bankers think you should pay them $10,000 – $15,000 in commissions for the privilege of seeing the management of a company you already own. This is apparently illegal in the United Kingdom, and referred to as “pay to play” there. Here, neither the SEC nor the compliance officers have tumbled to it as an apparent fiduciary violation.

Next I asked him what had been most frustrating in his final years. Again without hesitation he said that it was difficult to feel that you were actually able to add value in evaluating large cap companies, given how the regulatory environment had changed. I mentioned to him that everyone seemed to be trying to replace the on-site leg work part of fundamental analysis with screening and extensive earnings modeling, going out multiple years. Unfortunately many of those using such approaches appear to have not learned the law of significant numbers in high school chemistry. They seek exactitude while in reality adding complexity. At the same time, the subjective value of sitting in a company headquarters waiting room and seeing how customers, visitors, and employees are treated is no longer appreciated.

Next I asked him what had been most frustrating in his final years. Again without hesitation he said that it was difficult to feel that you were actually able to add value in evaluating large cap companies, given how the regulatory environment had changed. I mentioned to him that everyone seemed to be trying to replace the on-site leg work part of fundamental analysis with screening and extensive earnings modeling, going out multiple years. Unfortunately many of those using such approaches appear to have not learned the law of significant numbers in high school chemistry. They seek exactitude while in reality adding complexity. At the same time, the subjective value of sitting in a company headquarters waiting room and seeing how customers, visitors, and employees are treated is no longer appreciated.

Bruce, like many value investors, favors private market value as the best underpinning for security valuation. That is, based on recent transactions to acquire a comparable business, what was this one worth? But you need an active merger & acquisition market for the valuation not to be tied to stale inputs. He mentioned that he had observed the increased use of dividend discount models to complement other valuation work. However, he thought that there was a danger in a low interest-rate environment that a dividend discount model could produce absurd results. One analyst had brought him a valuation write-up supported by a dividend discount model. Most of the business value ended up being in the terminal segment, requiring a 15 or 16X EBITDA multiple to make the numbers work. Who in the real world pays that for a business? I mentioned that Luther King, a distinguished investment manager in Texas with an excellent long-term record, insisted on meeting as many company managements as he could, even in his seventies, as part of his firm’s ongoing due diligence. He did not want his investors to think that their investments were being followed and analyzed by “three guys and a Bloomberg terminal.” And in reality, one cannot learn an industry and company solely through a Bloomberg terminal, webcasts, and conference calls.

Bruce then mentioned another potentially corrupting factor. His experience was that investment firms compensate analysts based on idea generation, performance of the idea, and the investment dollars committed to the idea. This can lead to gamesmanship as you get to the end of the measurement period for compensation. E.g., we tell corporate managements they shouldn’t act as if they were winding up and liquidating their business at the end of a quarter or year. Yet, we incent analysts to act that way (and lock in a profitable bonus) by recommending sale of an idea much too early. Or at the other extreme, they may not want to recommend sale of the idea when they should. I mentioned that one solution was to eliminate such compensation performance assessments as one large West Coast firm is reputed to have done after the disastrous 2008 meltdown. They were trying to restore a culture that for eighty years had been geared to producing the best long-term compounding investment ideas for the clients. However, they also had the luxury of being independent.

Finally I asked Bruce what tipped him over the edge into retirement. He said he got tired of discussions about “scalability.” A brief explanation is in order. After the dot-com disaster at the beginning of the decade, followed by the debacle years of 2008-2009, many investment firms put into place an implicit policy. For an idea to be added to the investment universe, a full investment position had to be capable of being acquired in five days average trading volume for that issue. Likewise, one had to also be able to exit the position in five days average trading volume. If it could not pass those hurdles, it was not a suitable investment. This cuts out small cap and most mid-cap ideas, as well as a number of large cap ideas where there is limited investment float. While the benchmark universe might be the S&P 500, in actuality it ends up being something very different. Rather than investing in the best ideas for clients, one ends up investing in the best liquid ideas for clients (I will save for another day the discussion about illiquid investments consistently producing higher returns long-term, albeit with greater volatility).

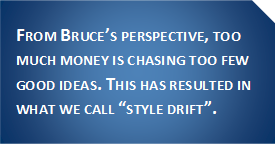

From Bruce’s perspective, too much money is chasing too few good ideas. This has resulted in what we call “style drift”. Firms that had made their mark as small cap or mid cap investors didn’t want to kill the goose laying the golden eggs by shutting off new money, so they evolved to become large cap investors. But ultimately that is self-defeating, for as the assets come in, you either have to shut down the flows or change your style by adding more and larger positions, which ultimately leads to under-performance.

From Bruce’s perspective, too much money is chasing too few good ideas. This has resulted in what we call “style drift”. Firms that had made their mark as small cap or mid cap investors didn’t want to kill the goose laying the golden eggs by shutting off new money, so they evolved to become large cap investors. But ultimately that is self-defeating, for as the assets come in, you either have to shut down the flows or change your style by adding more and larger positions, which ultimately leads to under-performance.

I mentioned to Bruce that the other problem of too much money chasing too few good new ideas was that it tended to encourage “smart guy investing,” a term coined by a mutual friend of ours in Chicago. The perfect example of this was Dell. When it first appeared in the portfolios of Southeastern Asset Management, I was surprised. Over the next year, the idea made its way in to many more portfolios at other firms. Why? Because originally Southeastern had made it a very large position, which indicated they were convinced of its investment merits. The outsider take was “they are smart guys – they must have done the work.” And so, at the end of the day after making their own assessments, a number of other smart guys followed. In retrospect it appears that the really smart guy was Michael Dell.

A month ago I was reading a summary of the 2013 annual investment retreat of a family office investment firm with an excellent reputation located in Vermont. A conclusion reached was that the incremental value being provided by many large cap active managers was not justified by the fees being charged. Therefore, they determined that that part of an asset allocation mix should make use of low cost index funds. That is a growing trend. Something else that I think is happening now in the industry is that investment firms that are not independent are increasingly being run for short-term profitability as the competition and fee pressures from products like exchange traded funds increases. Mike Royko, the Chicago newspaper columnist once said that the unofficial motto of Chicago is “Ubi est meum?” or “Where’s mine?” Segments of the investment management business seemed to have adopted it as well. As a long-term value investor in New York recently said to me, short-termism is now the thing.

The ultimate lesson is the basic David Snowball raison d’etre for the Mutual Fund Observer. Find yourself funds that are relatively small and independent, with a clearly articulated philosophy and strategy. Look to see, by reading the reports and looking at the lists of holdings, that they are actually doing what they say they are doing, and that their interests are aligned with yours. Look at their active share, the extent to which the holdings do not mimic their benchmark index. And if you cannot be bothered to do the work, put your investments in low cost index vehicles and focus on asset allocation. Otherwise, as Mr. Buffet once said, if you are seated at the table to play cards and don’t identify the “mark” you should leave, as you are it.

Edward Studzinski

Impact of Category on Fund Ratings

The results for MFO’s fund ratings through quarter ending December 2013, which include the latest Great Owl and Three Alarm funds, can be found on the Search Tools page. The ratings are across 92 fund categories, defined by Morningstar, and include three newly created categories:

Corporate Bond. “The corporate bond category was created to cull funds from the intermediate-term and long-term bond categories that focused on corporate bonds,” reports Cara Esser. Examples are Vanguard Interm-Term Invmt-Grade Inv (VFICX) and T. Rowe Price Corporate Income (PRPIX).

Preferred Stock. “The preferred stock category includes funds with a majority of assets invested in preferred stock over a three-year period. Previously, most preferred share funds were lumped in with long-term bond funds because of their historically high sensitivity to long-term yields.” An example is iShares US Preferred Stock (PFF).

Tactical Allocation. “Tactical Allocation portfolios seek to provide capital appreciation and income by actively shifting allocations between asset classes. These portfolios have material shifts across equity regions and bond sectors on a frequent basis.” Examples here are PIMCO All Asset All Authority Inst (PAUIX) and AQR Risk Parity (AQRIX).

An “all cap” or “all style” category is still not included in the category definitions, as explained by John Rekenthaler in Why Morningstar Lacks an All-Cap Fund Category. The omission frustrates many, including BobC, a seasoned contributor to the MFO board:

Osterweis (OSTFX) is a mid-cap blend fund, according to M*. But don’t say that to John Osterweis. Even looking at the style map, you can see the fund covers all of the style boxes, and it has about 20% in foreign stocks, with 8% in emerging countries. John would tell you that he has never managed the fund to a style box. In truth he is style box agnostic. He is looking for great companies to buy at a discount. Yet M* compares the fund with others that are VERY different.

In fairness, according to the methodology, “for multiple-share-class funds, each share class is rated separately and counted as a fraction of a fund within this scale, which may cause slight variations in the distribution percentages.” Truth is, fund managers or certainly their marketing departments are sensitive to what category their fund lands-in, as it can impact relative ratings for return, risk, and price.

As reported in David’s October commentary, we learned that Whitebox Funds appealed to the Morningstar editorial board to have its Tactical Opportunities Fund (WBMIX) changed from aggressive allocation to long/short equity. WBMIX certainly has the latitude to practice long/short; in fact, the strategy is helping the fund better negotiate the market’s rough start in 2014. But its ratings are higher and price is lower, relatively, in the new category.

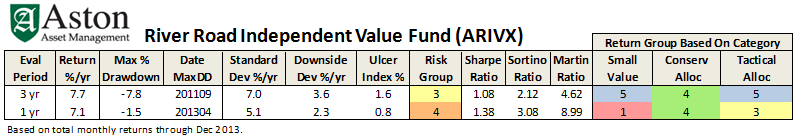

One hotly debated fund on the MFO board, ASTON/River Road Independent Small Value (ARIVX), managed by Eric Cinnamond, would also benefit from a category change. As a small cap, the fund rates a 1 (bottom quintile) for 2013 in the MFO ratings system, but when viewed as a conservative or tactical allocation fund – because of significant shifts to cash – the ratings improve. Here is impact on return group rank for a couple alternative categories:

Of course, a conservative tactical allocation category would be a perfect antidote here (just kidding).

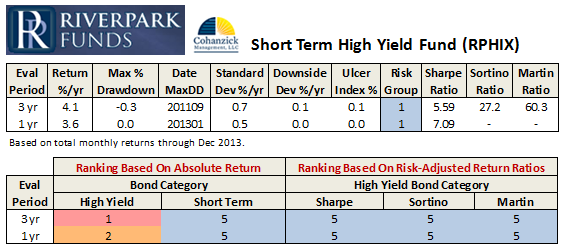

Getting It Wrong. David has commented more than once about the “wildly inappropriate” mis-categorization of Riverpark Short Term High Yield Fund (RPHIX), managed by David Sherman, which debuted with just a single star after its first three years of operation. The MFO community considers the closed fund more of a cash alternative, suited best to the short- or even ultrashort-term bond categories, but Morningstar placed it in the high yield bond category.

Exacerbating the issue is that the star system appears to rank returns after deducting for a so-called “risk penalty,” based on the variation in month-to-month return during the rating period. This is good. But it also means that funds like RPHIX, which have lower absolute returns with little or no downside, do not get credit for their very high risk-adjusted return ratios, like Sharpe, Sortino, or Martin.

Below is the impact of categorization, as well as return metrics, on its performance ranking. The sweet irony is that its absolute return even beat the US bond aggregate index!

RPHIX is a top tier fund by just about any measure when placed in a more appropriate bond category or when examined with risk-adjusted return ratios. (Even Modigliani’s M2, a genuinely risk-adjusted return, not a ratio, that is often used to compare portfolios with different levels of risk, reinforces that RPHIX should still be top tier even in the high yield bond category.) Since Morningstar states its categorizations are “based strictly on portfolio statistics,” and not fund names, hopefully the editorial board will have opportunity to make things right for this fund at the bi-annual review in May.

A Broader View. Interestingly, prior to July 2002, Morningstar rated funds using just four broad asset-class-based groups: US stock, international stock, taxable bond, and municipal bonds. It switched to (smaller) categories to neutralize market tends or “tailwinds,” which would cause, for example, persistent outperformance by funds with value strategies.

A consequence of rating funds within smaller categories, however, is more attention goes to more funds, including higher risk funds, even if they have underperformed the broader market on a risk-adjusted basis. And in other cases, the system calls less attention to funds that have outperformed the broader market, but lost an occasional joust in their peer group, resulting in a lower rating.

Running the MFO ratings using only the four board legacy categories reveals just how much categorization can alter the ratings. For example, the resulting “US stock” 20-year Great Owl funds are dominated by allocation funds, along with a high number of sector equity funds, particularly health. But rate the same funds with the current categories (Great Owl Funds – 4Q2013), and we find more funds across the 3 x 3 style box, plus some higher risk sector funds, but the absence of health funds.

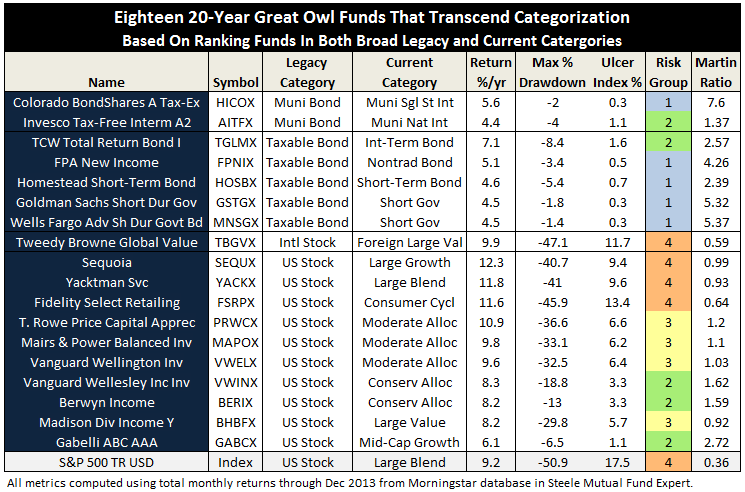

Fortunately, some funds are such strong performers that they appear to transcend categorization. The eighteen funds listed below have consistently delivered high excess return while avoiding large drawdown and end-up in the top return quintile over the past 20, 10, 5, and 3 year evaluation periods using either categorization approach:

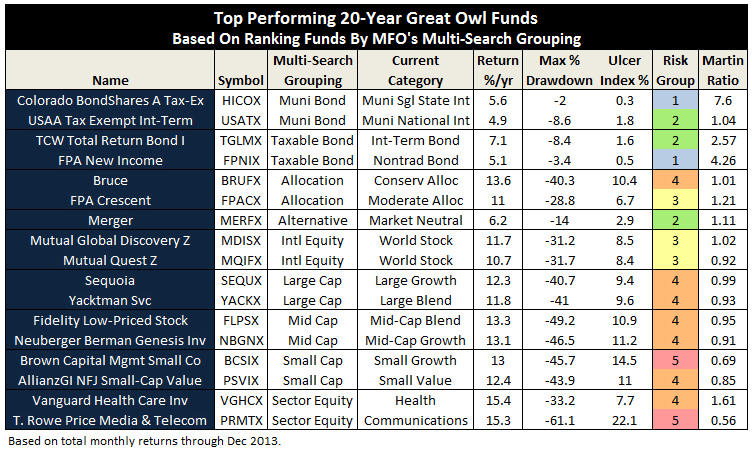

Roy Weitz grouped funds into only five equity and six specialty “benchmark categories” when he established the legacy Three Alarm Funds list. Similarly, when Accipiter created the MFO Miraculous Multi-Search tool, he organized the 92 categories used in the MFO rating system into 11 groups…not too many, not too few. Running the ratings for these groupings provides some satisfying results:

Roy Weitz grouped funds into only five equity and six specialty “benchmark categories” when he established the legacy Three Alarm Funds list. Similarly, when Accipiter created the MFO Miraculous Multi-Search tool, he organized the 92 categories used in the MFO rating system into 11 groups…not too many, not too few. Running the ratings for these groupings provides some satisfying results:

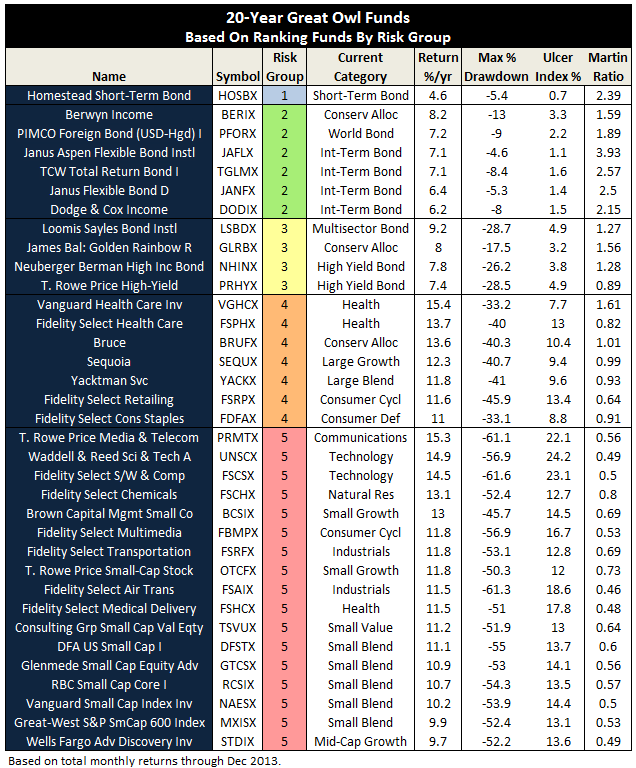

A more radical approach may be to replace traditional style categories altogether! For example, instead of looking for best performing small-cap value funds, one would look for the best performing funds based on a risk level consistent with an investor’s temperament. Implementing this approach, using Risk Group (as defined in ratings system) for category, identifies the following 20-year Great Owls:

Bottom Line. Category placement can be as important to a fund’s commercial success as its people, process, performance, price and parent. Many more categories exist today on which peer groups are established and ratings performed, causing us to pay more attention to more funds. And perhaps that is the point. Like all chambers of commerce, Morningstar is as much a promoter of the fund industry, as it is a provider of helpful information to investors. No one envies the enormous task of defining, maintaining, and defending the rationale for several dozen and ever-evolving fund categories. Investors should be wary, however, that the proliferation may provide a better view of the grove than the forest.

28Jan2014/Charles

Our readers speak!

And we’re grateful for it. Last month we gave folks an opportunity to weigh-in on their assessment of how we’re doing and what we should do differently. Nearly 350 of you shared your reactions during the first week of the New Year. That represents a tiny fraction of the 27,000 unique readers who came by in January, so we’re not going to put as much weight on the statistical results as on the thoughts you shared.

We thought we’d share what we heard. This month we’ll highlight the statistical results. In March we’ll share some of your written comments (they run over 30 pages) and our understanding of them.

Who are you?

80% identified themselves as private investors, 18% worked in the financial services industry and 2% were journalists, bloggers and analysts.

How often do you read the Observer?

The most common answer is “I just drop by at the start of the month” (36%). That combines with “I drop by once every month, but not necessarily at the start”) (14%) to explain about half of the results. At the same time, a quarter of you visit four or more times every month. (And thanks for it!)

Which features are most (or least) interesting to you?

By far, the greatest number of “great, do more!” responses came under “individual fund profiles.” A very distant second and third were the longer pieces in the monthly commentary (such as Motion, Not Progress and Impact of Category on Fund Ratings) and the shorter pieces (on fund liquidations and such) in the commentary. Folks had the least interest in our conference calls and funds in registration.

Hmmm … we’re entirely sympathetic to the desire for more fund profiles. Morningstar has an effective monopoly in the area and their institutional biases are clear: of the last 100 fund analyses posted, only 13 featured funds with under one billion in assets. Only one fund launched since January 2010 was profiled. In response, we’re going to try to increase the number of profiles each month to at least four with a goal of hitting five or six.

We’re not terribly concerned about the tepid response to the conference calls since they’re useful in writing our profiles and the audience for them continues to grow. If you haven’t tried one, perhaps it might be worthwhile this month?

And so, in response to your suggestion, here’s the freshly expanded …

Observer Fund Profiles:

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve.

ASTON/River Road Long Short (ARLSX): measured in the cold light of risk-return statistics, ARLSX is as good as it gets. We’d recommend that interested parties look at both this profile and at the conference call highlights, below.

Artisan Global Small Cap (ARTWX): what part of “phenomenally talented, enormously experienced management team now offers access to a poorly-explored asset class” isn’t interesting to you?

Grandeur Peak Emerging Opportunities (GPEOX): ditto!

RiverNorth Equity Opportunity (RNEOX): ditto! Equity Opportunity is a redesigned and greatly strengthened version of an earlier fund. This new edition is all RiverNorth and that is, for folks looking for buffered equity exposure, a really interesting option.

We try to think strategically about which funds to profile. Part of the strategy is to highlight funds that might do you well in the immediate market environment, as well as others that are likely to be distinctly out of step with today’s market but very strong additions in the long-run. We reached out in January to the managers of two funds in the latter category: the newly-launched Meridian Small Cap Growth (MSGAX) and William Blair Emerging Markets Small Cap (WESNX). Neither has responded to a request for information (we were curious about strategy capacity, for instance, and risk-management protocols). We’ll continue reaching out; if we don’t hear back, we’ll profile the funds in March with a small caution flag attached.

RiverNorth conference call, February 25 2014

RiverNorth’s opportunistic CEF strategy strikes us as distinctive, profitable and very crafty. We’ve tried to explain it in profiles of RNCOX and RNEOX. Investors who are intrigued by the opportunity to invest with RiverNorth should sign up for their upcoming webcast entitled RiverNorth Closed-End Fund Strategies: Capitalizing on Discount Volatility. While this is not an Observer event, we’ve spoken with Mr. Galley a lot and are impressed with his insights and his ability to help folks make sense of what the strategy can and cannot do.

Navigate over to http://www.rivernorthfunds.com/events/ for free registration.

Conference Call Highlights: ASTON River Road Long/Short (ARLSX)

We spoke with Daniel Johnson and Matt Moran, managers for the River Road Long-Short Equity strategy which is incorporated in Aston River Road Long-Short Fund (ARLSX). Mike Mayhew, one of the Partners at Aston Asset, was also in on the call to answer questions about the fund’s mechanics. About 60 people joined in.

The highlights, for me, were:

the fund’s strategy is sensible and straightforward, which means there aren’t a lot of moving parts and there’s not a lot of conceptual complexity. The fund’s stock market exposure can run from 10 – 90% long, with an average in the 50-70% range. The guys measure their portfolio’s discount to fair value; if their favorite stocks sell at a less than 80% of fair value, they increase exposure. The long portfolio is compact (15-30), driven by an absolute value discipline, and emphasizes high quality firms that they can hold for the long term. The short portfolio (20-40 names) is stocked with poorly managed firms with a combination of a bad business model and a dying industry whose stock is overpriced and does not show positive price momentum. That is, they “get out of the way of moving trains” and won’t short stocks that show positive price movements.

the fund grew from $8M to $207M in a year, with a strategy capacity in the $1B – 1.5B range. They anticipate substantial additional growth, which should lower expenses a little (and might improve tax efficiency – my note, not theirs). Because they started the year with such a small asset base, the expense numbers are exaggerated; expenses might have been 5% of assets back when they were tiny, but that’s no longer the case.

shorting expenses were boosted by the vogue for dividend-paying stocks, which drove valuations of some otherwise sucky stocks sharply higher; that increases the fund’s expenses because they’ve got to repay those dividends but the managers believe that the shorts will turn out to be profitable even so.

the guys have no client other than the fund, don’t expect ever to have one, hope to manage the fund until they retire and they have 100% of their liquid net worth in it.

their target is “sleep-at-night equity exposure,” which translates to a maximum drawdown (their worst-case market event) of no more than 10-15%. They’ve been particularly appalled by long/short funds that suffered drawdowns in the 20-25% range which is, they say, not consistent with why folks buy such funds.

they’ve got the highest Sharpe ratio of any long-short fund, their longs beat the market by 900 bps, their shorts beat the inverse of the market by 1100 bps and they’ve kept volatility to about 40% of the market’s while capturing 70% of its total returns.

A lot of the Q&A focused on the fund’s short portfolio and a little on the current state of the market. The guys note that they tend to generate ideas (they keep a watchlist of no more than 40 names) by paging through Value Line. They focus on fundamentals (let’s call it “reality”) rather than just valuation numbers in assembling their portfolio. They point out that sometimes fundamentally rotten firms manage to make their numbers (e.g., dividend yield or cash flow) look good but, at the same time, the reality is that it’s a poorly managed firm in a failing industry. On the flip side, sometimes firms in special situations (spinoffs or those emerging from bankruptcy) will have little analyst coverage and odd numbers but still be fundamentally great bargains. The fact that they need to find two or three new ideas, rather than thirty or sixty, allows them to look more carefully and think more broadly. That turns out to be profitable.

Bottom Line: this is not an all-offense all the time fund, a stance paradoxically taken by some of its long-short peers. Neither is it a timid little “let’s short an ETF or two and hope” offering.” It has a clear value discipline and even clearer risk controls. For a conservative equity investor like me, that’s been a compelling combination.

Folks unable to make the call but interested in it can download or listen to the .mp3 of the call, which will open in a separate window.

As with all of these funds, we have a featured funds page for ARLSX which provides a permanent home for the mp3 and highlights, and pulls together all of the best resources we have for the fund.

Would An Additional Heads Up Help?

Over 220 readers have signed up for a conference call mailing list. About a week ahead of each call, I write to everyone on the list to remind them of what might make the call special and how to register. If you’d like to be added to the conference call list, just drop me a line.

Conference Call Upcoming: Joshua B. Parker and Alan Salzbank, RiverPark / Gargoyle Hedged Value

Josh Parker and Alan Salzbank, Co-Portfolio Managers of the RiverPark/Gargoyle Hedged Value Fund (RGHVX) and Morty Schaja, RiverPark’s CEO; are pleased to join us for a conference call scheduled for Wednesday, February 12 from 7:00 – 8:00 PM Eastern. We profiled the fund in June 2013, but haven’t spoken with the managers before.

Why speak with them now? Three reasons. First, you really need to have a strategy in place for hedging the substantial gains booked by the stock market since its March 2009 low. There are three broad strategies for doing that: an absolute value strategy which will hold cash rather than overpriced equities, a long-short equity strategy and an options-based strategy. Since you’ve had a chance to hear from folks representing the first two, it seems wise to give you access to the third. Second, RiverPark has gotten it consistently right when it comes to both managers and strategies. I respect their ability and their record in bringing interesting strategies to “the mass affluent” (and me). Finally, RiverPark/Gargoyle Hedged Value Fund ranks as a top performing fund within the Morningstar Long/Short category since its inception 14 years ago. The Fund underwent a conversion from its former partnership hedge fund structure in April 2012 and is managed using the same approach by the same investment team, but now offers daily liquidity, low minimums and a substantially lower fee structure for shareholders.

I asked Alan what he’d like folks to know ahead of the call. Here’s what he shared:

Alan and Josh have spent the last twenty-five years as traders and managers of options-based investment strategies beginning their careers as market makers on the option floor in the 1980’s. The Gargoyle strategy involves using a disciplined quantitative approach to find and purchase what they believe to be undervalued stocks. They have a unique approach to managing volatility through the sale of relatively overpriced index call options to hedge the portfolio. Their strategy is similar to traditional buy/write option strategies that offer reduced volatility and some downside protection, but gains an advantage by selling index rather single stock options. This allows them to benefit from both the systemic overpricing of index options while not sacrificing the alpha they hope to realize on their bottom-up stock picking,

The Fund targets a 50% net market exposure and manages the option portfolio such that market exposure stays within the range of 35% to 65%. Notably, using this conservative approach, the Fund has still managed to outperform the S&P 500 over the last five years. Josh and Alan believe that over the long term shareholders can continue to realize returns greater than the market with less risk. Gargoyle’s website features an eight minute video “The Options Advantage” describing the investment process and the key differences between their strategy and a typical single stock buy-write (click here to watch video).

That call is scheduled for Wednesday, February 12, from 7:00 – 8:00 Eastern. We’ll provide additional details in our February issue.

HOW CAN YOU JOIN IN?

If you’d like to join in, just click on register and you’ll be taken to the Chorus Call site. In exchange for your name and email, you’ll receive a toll-free number, a PIN and instructions on joining the call. If you register, I’ll send you a reminder email on the morning of the call.

If you’d like to join in, just click on register and you’ll be taken to the Chorus Call site. In exchange for your name and email, you’ll receive a toll-free number, a PIN and instructions on joining the call. If you register, I’ll send you a reminder email on the morning of the call.

Funds in Registration

New mutual funds must be registered with the Securities and Exchange Commission before they can be offered for sale to the public. The SEC has a 75-day window during which to call for revisions of a prospectus; fund companies sometimes use that same time to tweak a fund’s fee structure or operating details.

Funds in registration this month are eligible to launch in late March or early April 2014, and some of the prospectuses do highlight that date.

This month David Welsch celebrated a newly-earned degree from SUNY-Sullivan and still tracked down 18 no-load retail funds in registration, which represents our core interest.

Four sets of filings caught our attention. First, DoubleLine is launching two new and slightly edgy funds (the “wherever I want to go” Flexible Income Fund managed by Mr. Gundlach and an emerging markets short-term bond fund). Second, three focused value funds from Pzena, a well-respected institutional manager. Third, Scout Equity Opportunity Fund which will be managed by Brent Olson, a former Aquila Three Peaks Opportunity Growth Fund (ATGAX) manager. While I can’t prove a cause-and-effect relationship, ATGAX vastly underperformed its mid-cap growth peers for the decade prior to Mr. Olson’s arrival and substantially outperformed them during his tenure.

Finally, Victory Emerging Markets Small Cap Fund will join the small pool of EM small cap funds. I’d normally be a bit less interested, but their EM small cap separate accounts have substantially outperformed their benchmark with relatively low volatility over the past five years. The initial expense ratio will be 1.50% and the minimum initial investment is $2500, reduced to $1000 for IRAs.

Manager Changes

On a related note, we also tracked down 39 sets of fund manager changes. The most intriguing of those include what appears to be the surprising outflow of managers from T. Rowe Price, Alpine’s decision to replace its lead managers with an outsider and entirely rechristen one of their funds, and Bill McVail’s departure after 15 years at Turner Small Cap Growth.

Updates

We noted a couple months ago that DundeeWealth was looking to exit the U.S. fund market and sell their funds. Through legal maneuvers too complicated for me to follow, the very solid Dynamic U.S. Growth Fund (Class II, DWUHX) has undergone the necessary reorganization and will continue to function as Dynamic U.S. Growth Fund with Noah Blackstein, its founding manager, still at the helm.

Briefly Noted . . .

Effective March 31 2014, Alpine Innovators Fund (ADIAX) transforms into Alpine Small Cap Fund. Following the move, it will be repositioned as a domestic small cap core fund, with up to 30% international. Both of Innovator’s managers, the Liebers, are being replaced by Michael T. Smith, long-time manager of Lord Abbett Small-Cap Blend Fund (LSBAX). Smith’s fund had a very weak record over its last five years and was merged out of existence in July, 2013; Smith left Lord Abbett in February of that year.

Effective April 1, 2014, the principal investment strategy of the Green Century Equity Fund (GCEQX) will be revised to change the index tracked by the Fund, so as to exclude the stocks of companies that explore for, process, refine or distribute coal, oil or gas.

The Oppenheimer Steelpath funds have decided to resort to English. It’s kinda refreshing. The funds’ current investment Objectives read like this:

The investment objective of Oppenheimer SteelPath MLP Alpha Fund (the “Fund” or “Alpha Fund”) is to provide investors with a concentrated portfolio of energy infrastructure Master Limited Partnerships (“MLPs”) which the Advisor believes will provide substantial long-term capital appreciation through distribution growth and an attractive level of current income.

As of February 28, it becomes:

The Fund seeks total return.

SMALL WINS FOR INVESTORS

The Board of Trustees of the Fund has approved an increase in the Congressional Effect Fund’s (CEFFX) expense cap from 1.50% to 3.00%. Since I think their core strategy – “go to cash whenever Congress is in session” – is not sensible, a suspicion supported by their 0.95% annual returns over the past five years, becoming less attractive to investors is probably a net good.

Driehaus Mutual Funds’ Board approved reductions in the management fees for the Driehaus International Discovery Fund (DRIDX) and the Driehaus Global Growth Fund (DRGGX) which became effective January 1, 2014. At base, it’s a 10-15 bps drop.

Effective February 3, 2014, Virtus Emerging Markets Opportunities Fund (HEMZX) will be open to new investors. Low risk, above average returns but over $7 billion in the portfolio. Technically that’s capped at “two cheers.”

CLOSINGS (and related inconveniences)

Effective February 14, 2014, American Beacon Stephens Small Cap Growth Fund (STSGX) will act to limit inflows by stopping new retirement and benefit plans from opening accounts with the fund.

Artisan Global Value Fund (ARTGX) will soft-close on February 14, 2014. Its managers were just recognized as Morningstar’s international-stock fund managers of the year for 2013. We’ve written about the fund four times since 2008, each time ending with the same note: “there are few better offerings in the global fund realm.”

As of the close of business on January 28, 2014, the GL Macro Performance Fund (GLMPX) will close to new investments. They don’t say that the fund is going to disappear, but that’s the clear implication of closing an underperforming, $5 million fund even to folks with automatic investment plans.

Effective January 31, the Wasatch International Growth Fund (WAIGX) closed to new investors.

OLD WINE, NEW BOTTLES

Effective February 1, 2014, the name of the CMG Tactical Equity Strategy Fund (SCOTX) will be changed to CMG Tactical Futures Strategy Fund.

Effective March 3, 2014, the name of the Mariner Hyman Beck Portfolio (MHBAX) has been changed to Mariner Managed Futures Strategy Portfolio.

OFF TO THE DUSTBIN OF HISTORY

On January 24, 2014, the Board of Trustees approved the closing and subsequent liquidation of the Fusion Fund (AFFSX, AFFAX).

ING will ask shareholders in June 2014 to approve the merger of five externally sub-advised funds into three ING funds.

|

Disappearing Portfolio |

Surviving Portfolio |

|

ING BlackRock Health Sciences Opportunities Portfolio |

ING Large Cap Growth Portfolio |

|

ING BlackRock Large Cap Growth Portfolio |

ING Large Cap Growth Portfolio |

|

ING Marsico Growth Portfolio |

ING Large Cap Growth Portfolio |

|

ING MFS Total Return Portfolio |

ING Invesco Equity and Income Portfolio |

|

ING MFS Utilities Portfolio |

ING Large Cap Value Portfolio |

The Board of Trustees of iShares voted to close and liquidate ten international sector ETFs, effective March 26, 2014. The decedents are:

- iShares MSCI ACWI ex U.S. Consumer Discretionary ETF (AXDI)

- iShares MSCI ACWI ex U.S. Consumer Staples ETF (AXSL)

- iShares MSCI ACWI ex U.S. Energy ETF (AXEN)

- iShares MSCI ACWI ex U.S. Financials ETF (AXFN)

- iShares MSCI ACWI ex U.S. Healthcare ETF (AXHE)

- iShares MSCI ACWI ex U.S. Industrials ETF (AXID)

- iShares MSCI ACWI ex U.S. Information Technology ETF (AXIT)

- iShares MSCI ACWI ex U.S. Materials ETF (AXMT)

- iShares MSCI ACWI ex U.S. Telecommunication Services ETF (AXTE) and

- iShares MSCI ACWI ex U.S. Utilities ETF (AXUT)

The Nomura Funds board has authorized the liquidation of their three funds:

- Nomura Asia Pacific ex Japan Fund (NPAAX)

- Nomura Global Emerging Markets Fund (NPEAX)

- Nomura Global Equity Income Fund (NPWAX)

The liquidations will occur on or about March 19, 2014.

On January 30, 2014, the shareholders of the Quaker Akros Absolute Return Fund (AARFX) approved the liquidation of the Fund which has banked five-year returns of (0.13%) annually.

The Vanguard Growth Equity Fund (VGEQX)is to be reorganized into the Vanguard U.S. Growth Fund (VWUSX) on or about February 21, 2014. The Trustees helpfully note: “The reorganization does not require shareholder approval, and you are not being asked to vote.”

Virtus Greater Asia ex Japan Opportunities Fund (VGAAX) is closing on February 21, 2014, and will be liquidated shortly thereafter. Old story: decent but not stellar returns, no assets.

In Closing . . .

Thanks a hundred times over for your continued support of the Observer, whether through direct contributions or using our Amazon link. I’m a little concerned about Amazon’s squishy financial results and the risk that they’re going to go looking for ways to pinch pennies. Your continued use of that program provides us with about 80% of our monthly revenue. Thanks, especially, to the folks at Evergreen Asset Management and Gardey Financial Advisors, who have been very generous over the years; while the money means a lot, the knowledge that we’re actually making a difference for folks means even more.

The next month will see our migration to a new, more reliable server, a long talk with the folks at Gargoyle and profiles of four intriguing small funds. Since you make it all possible, I hope you join us for it all.

As ever,