Objective and strategy

The fund is seeking high current income and capital appreciation consistent with the preservation of capital. The manager does not seek the highest available return. He’s pursuing 7-8% annual returns but he will not “reach for returns” at the risk of loss of capital. The portfolio will generally contain 30-40 fixed income securities, all designated as “money good” but the majority also categorized as high-yield. There will be limited exposure to corporate debt in other developed nations and no direct exposure to emerging markets. While the manager has the freedom to invest in equities, they are unlikely ever to occupy a noticeable slice of the portfolio.

Adviser

RiverPark Advisors, LLC. RiverPark was formed in 2009 by former executives of Baron Asset Management. The firm is privately owned, with 84% of the company being owned by its employees. They advise, directly or through the selection of sub-advisers, the seven RiverPark funds.

Manager

David K. Sherman, president and founder of the subadvisor, Cohanzick Management, LLC. Mr. Sherman founded Cohanzick in 1996 after a decade spent in various director and executive positions with Leucadia National Corporation. Mr. Sherman has a B.S. in Business Administration from Washington University and an odd affection for the Philadelphia Eagles. He is also the manager of the recently soft-closed RiverPark Short Term High Yield Fund (RPHYX).

Strategy capacity and closure

The strategy has a capacity of about $2 billion but its execution requires that the fund remain “nimble and small.” As a result, management will consider asset levels and fund flows carefully as they move in the vicinity of their cap.

Management’s stake in the fund

Collectively the professionals at RiverPark and Cohanzick have invested more than $3 million in the fund, including $2.5 million in “seed money” from Mr. Sherman and RiverPark’s president, Morty Schaja. Both men are increasing their investment in the fund with a combination of “new money” and funds rebalanced from other investments.

Opening date

September 30, 2013

Minimum investment

$1,000 minimum initial investment for retail shares. There is no minimum for subsequent investments if payment is mailed by check; otherwise the minimum is $100.

Expense ratio

1.25% after waivers of 0.40% on assets of $116 million (as of December, 2013).

Comments

RiverPark Strategic Income has a simple philosophy, an understandable strategy and a hard-to-explain portfolio. The combination is, frankly, pretty compelling.

The philosophy: don’t get greedy. After a quarter century of researching and investing in distressed, high-yield and special situations fixed income securities, Mr. Sherman has concluded that he can either make 7% with minimal risk of permanent loss, or he could shoot for substantially higher returns at the risk of losing your money. He has consistently and adamantly chosen the former.

The strategy: invest in “money good” fixed-income securities. “Money good” securities are where the manager is very sure (very, very sure) that he’s going to get 100% of his principal and interest back, no matter what happens. That means 100% if the market tanks. And it means a bit more than 100% if the issuer goes bankrupt, since he’ll invest in companies whose assets are sufficient that, even in bankruptcy, creditors will eventually receive their principal plus their interest plus their interest on their interest.

Such securities take a fair amount of time to ferret out and might occur in relatively limited quantities, so that some of the biggest funds simply cannot pursue them. But, once found, they generate an annuity-like stream of income for the fund regardless of market conditions.

The portfolio: in general, the fund is apt to dwell somewhere near the border of short- and intermediate-term bonds. The fact that shorter duration bonds became the investment du jour for many anxious investors in 2013 meant that they were bid up to unreasonable levels, and Mr. Sherman found greater value in 3- to 5-year issues.

The manager has a great deal of flexibility in investing the fund’s assets and often finds “orphaned” issues or other special situations which are difficult to classify. As he and RiverPark’s president, Morty Schaja, reflected on the composition of the portfolio, they imagined six broad categories that might help investors better understand what the fund owns. They are:

- Short Term High Yield overlap – securities that are also holdings in the RiverPark Short Term High Yield Fund.

- Buy and hold – securities that hold limited credit risk, provide above market yields and might reasonably be held to redemption.

- Priority-based – securities from issuers who are in distress, but which would be paid off in full even if the issue were to go bankrupt. Most investors would instinctively avoid such issues but Mr. Sherman argues that they’re often priced at a discount and are sufficiently senior in the capital structure that they’re safe so long as an investor is willing to wait out the bankruptcy process in exchange for receiving full recompense. An investor can, he says, “get paid a lot of money for your willingness to go through the process.” Cohanzick calls these investments “above-the-fray securities of dented credits”.

- Off the beaten path – securities that are not widely-followed and/or are less liquid. These might well be issues too small or too inconvenient for a manager responsible for billions or tens of billions of assets, but attractive to a smaller fund.

- Rate expectations – securities that present opportunities because of rising or falling interest rates. This category would include traditional floating rate securities and opportunities that present themselves because of a difference between a security’s yield to maturity and yield to worst.

- Other – which is all of the … other stuff.

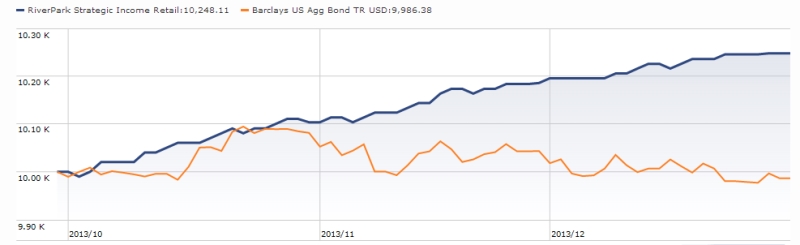

Fixed-income investing shouldn’t be exciting. It should allow you to sleep at night, knowing that your principal is safe and that you’re earning a real return – something greater than the rate of inflation. Few fixed-income funds lately have met those two expectations and the next few years are not likely to be kind to traditional fixed-income funds. RiverPark’s combination of opportunism and conservatism, illustrated in the return graph below, offer a rare and appealing combination.

Bottom Line

In all honesty, about 80% of all mutual funds could shut their doors today and not be missed. They thrive by never being bad enough to dump, nominally active funds whose strategy and portfolio are barely distinguishable from an index. The mission of the Observer is to help identify the small, thoughtful, disciplined, active funds whose existence actually matters.

David Sherman runs such funds. His strategies are labor-intensive, consistent, thoughtful, disciplined and profitable. He has a clear commitment to performance over asset gathering, and to caution over impulse. Folks navigating the question “what makes sense in fixed-income investing these days?” owe it to themselves to learn more about RSIVX.

Fund website

RiverPark Strategic Income Fund

Disclosure

While the Observer has neither a stake in nor a business relationship with either RiverPark or Cohanzick, both individual members of the Observer staff and the Observer collectively have invested in RPHYX and/or RSIVX.

© Mutual Fund Observer, 2014. All rights reserved. The information here reflects publicly available information current at the time of publication. For reprint/e-rights contact us.