Broadmark Tactical Fund

Broadmark Tactical Fund seeks to produce, in any market environment, above-average risk-adjusted returns and less downside volatility than the S&P 500 Index. They’ll invest globally, long and short, using ETFs. Mostly. They might invest directly in stocks, go to cash, invest in fixed income securities or write options against the portfolio. Christopher Guptill, CEO and CIO of Broadmark, will run the fund. He previously ran Forward Tactical Enhanced (FTEAX), which is also a long/short fund. Good news: he has somewhat above average returns during his 20 months on the fund. Bad news: the portfolio turnover is reported as 6000%. The expense ratio is 1.80%. The minimum initial investment is $4,000, reduced to $2,000 for IRAs.

Calamos Dividend Growth Fund

Calamos Dividend Growth Fund will seek income and capital appreciation primarily through investments in dividend paying equities. They may hold common and preferred stocks Master Limited Partnerships. MLPs and foreign stocks are both capped at 25% of the portfolio. Calamos the Elder and Black the Greater will lead the investment team. The expense ratio for “A” shares is 1.35% and the front-load is 4.75%. The minimum initial investment is $2,500, reduced to $500 for IRAs.

Calamos Mid Cap Growth Fund

Calamos Mid Cap Growth Fund will seek “excess returns relative to the benchmark over full market cycles.” They’ll invest mostly in domestic mid-cap growth stocks ($440m – $28b, which doesn’t feel all that mid-cappy), and may hold stocks after they grow out of that purchase range. They also have the option of holding ADRs “in furtherance of its investment strategy.” Calamos the Elder and Black the Greater will lead a nine-person investment team. The expense ratio for “A” shares is 1.25% and the front-load is 4.75%. The minimum initial investment is $2,500, reduced to $500 for IRAs.

Forward Dynamic Income Fund

Forward Dynamic Income Fund will seek total return, with dividend and interest income being an important component of that return, while exhibiting less downside volatility than the S&P 500 Index. The plan is to mix the portfolio between a dividend-capture strategy (buy a stock shortly before it distributes a dividend, then sell it) and a tactical allocation strategy (long/short investing best on technical indicators; if the technicals aren’t clear, they’ll hold fixed-income). To add to the jollies of it, the managers may leverage the portfolio by a third. The portfolio managers will be David McGanney, Forward’s Head Trader, Jim Welsh, and Jim O’Donnell, Forward’s CIO. The minimum initial investment is $4000 unless you select eDelivery (which reduces it to $2000) or an automatic investing plan (which reduces it to $500). The expense ratio will be 2.31%.

Forward Select Income Opportunity Fund

Forward Select Income Opportunity Fund seeks total return through current income and long-term capital appreciation. It will invest in a mix of value-oriented equities (including convertibles, MLPs, ADRs, ETFs, ABCs), corporate and government debt securities from around the world, and hybrids such as convertibles. The fund is managed by a team led by Joel Beam, whose has been with Forward since 2009. The other members of the team are Forward’s CIO, Jim O’Donnell, and a bunch of guys who joined Forward with Mr. Beam from Kensington Investment Management. The minimum initial investment is $4000 unless you select eDelivery (which reduces it to $2000) or an automatic investing plan (which reduces it to $500). The expense ratio will be 1.66%.

Gold Bullion Strategy Portfolio

Gold Bullion Strategy Portfolio wants to “reflect the performance of the price of Gold bullion.” It will do so by invest in bullion-related ETFs, ETNs and futures and in fixed-income funds and ETFs. I don’t really understand what these folks are up to. They promise to invest at least 25% of the portfolio in gold bullion securities (why doesn’t that violate the 80% rule) and the rest in fixed-income funds. How do those funds help them track the price of gold? It also plans to invest up to 25% in “a subsidiary,” which I’m guessing is an offshore fund. Jerry C. Wagner, President of Flexible Plan Investments, and Dr. George Yang, its Director of Research, will run the fund. It describes itself as a mutual fund but it’s only available through life insurance company accounts and some retirement plans. The expense ratio will be 1.80%.

T. Rowe Price Target Retirement 2005 – 2055 Funds

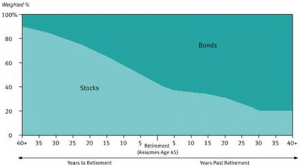

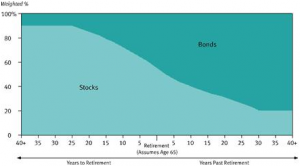

T. Rowe Price Target Retirement 2005 – 2055 Funds will pursue that usual goal of offering a one-stop retirement investing solution. Each fund invests in a mix of other T. Rowe Price funds. Each mix becomes progressively more conservative as investors approach and move through retirement. T. Rowe Price already has an outstanding collection of retirement-date funds, called “Retirement [date]” where these will be “Target Retirement [date].” The key is that the new funds will have a more conservative asset allocation than their siblings. At the target date, the new funds will have 42.5% in equities while the old funds have 55% in equities. For visual learners, here are the two glidepaths:

|

|

|

The new funds’ glidepath |

The old fund’s glidepath |

The relative weights within the asset classes (international vs domestic, for example) are essentially the same. Each fund is managed by Jerome Clark and Wyatt Lee. The opening expense ratios vary from 0.60% – 0.77%, with the longer-dated funds incrementally more expensive than the shorter-dated ones (that is, 2055 is more expensive than 2005). These expenses are within a basis point or two of the older funds’. The minimum initial investment is $2500, reduced to $1000 for various tax-advantaged accounts.

Turner Emerging Markets Fund

Turner Emerging Markets Fund will, as Turner does, invest in growth stocks. The managers plan a bottom-up, stock-by-stock portfolio that’s sector agnostic but “country aware.” They plan to hold 60-100 positions, either directly or through derivatives. Donald W. Smith and Rick Wetmore, both long-time Turner employees, will manage the fund. They’ve been investing in emerging markets through private accounts since mid-2010; the record, frankly, is undistinguished. The Fund’s minimum initial investment is $1,000,000 for Institutional Class Shares and $2,500 for Investor Shares, but is reduced to $100,000 and $1,000, respectively, for accounts set up with automatic investing plans. The opening expense ratio for Investor shares will be 1.30%.

Walden International Equity Fund

Walden International Equity Fund seeks long-term capital growth through an actively managed portfolio of mid- to large-cap international stocks. The portfolio will generally mirror the MSCI World (ex-US) index, except that the managers will apply environmental, social and governance screens in their portfolio construction. They also reserve the right to be activist shareholders. William Apfel, Executive Vice President and Director of Securities Research at Boston Trust Investment Management, will manage the fund. Mr. Apfel also manages Walden Equity (WSEFX, since 01/2012) and Walden Asset Management (WSBFX, since 08/2010) funds. Both tend to provide average returns with below-average volatility. The investment minimum is $1,000,000 but Walden funds are available through some supermarkets with a $2500 minimum. The launch should occur around the beginning of August, 2013.

Westfield Capital Dividend Growth Fund

Westfield Capital Dividend Growth Fund will pursue long-term growth by investing in 40-60 large cap stocks whose companies have “a history or prospect of paying stable or increasing dividends.” Mostly domestic common stocks, but it might invest in MLPs and ADRs as well. It appears that this fund is just absorbing an unnamed “predecessor fund,” but the predecessor was not a mutual fund The fund will be managed by William Muggia, President, CEO and CIO of the advisor. Mr. Muggia runs nine other mutual funds under the GuideMark, VantagePoint, Touchstone, Harbor, HSBC, Consulting Group and Westfield brands. The expense ratio will be 1.20%.