By David Snowball

Dear friends,

We’ve been listening to REM’s “It’s the End of the World (as we know it)” and thinking about copyrighting some useful terms for the year ahead. You know that Bondpocalypse and Bondmageddon are both getting programmed into the pundits’ vocabulary. Chip suggests Bondtastrophe and Bondaster.

Bad asset classes (say, TIPs and long bonds) might be merged in the Frankenfund. Members of the Observer’s discussion board offered bond doggle (thanks, Bee!), the Bondfire of the Vanities (Shostakovich’s entry and probably our most popular), the New Fed (which Hank thinks we’ll be hearing by year’s end) which might continue the racetodebase (Rono) and bondacious (presumably blondes, Accipiter’s best). Given that snowstorms now get their own names (on the way to Pittsburgh, my son and I drove through the aftermath of Euclid), perhaps market panics, too? We’d start of course with Market Crisis Alan, in honor of The Maestro, but we haven’t decided whether that would rightly be followed by Market Crisis Ben, Barack or Boehner. Hopeful that they couldn’t do it again, we could honor them all with Crash B3 which might defame the good work done by vitamin B3 in regulating sex and stress.

Feel free to join in on the 2013 Word of the Year thread, if only if figure out how Daisy Duke got there.

The Big Bond Bubble Boomnanza?

I’m most nervous when lots of other folks seem to agree with me. It’s usually a sign that I’ve overlooked something.

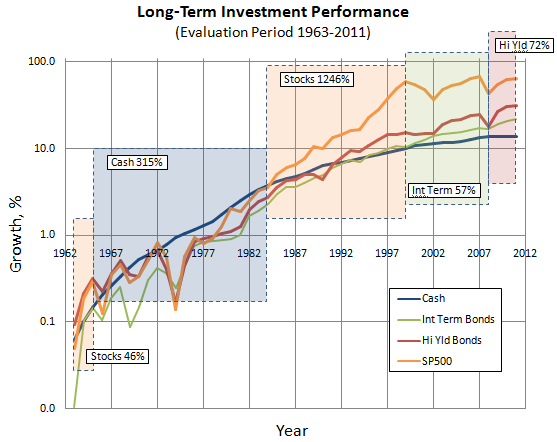

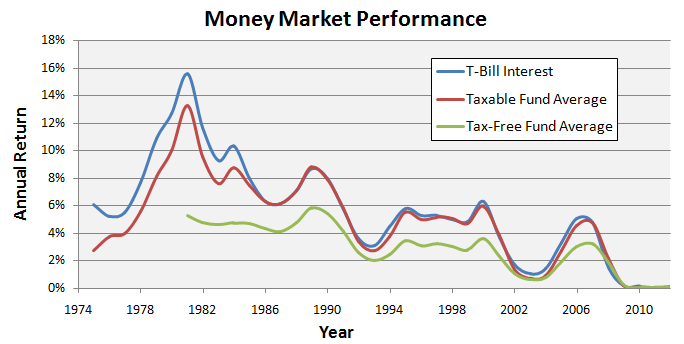

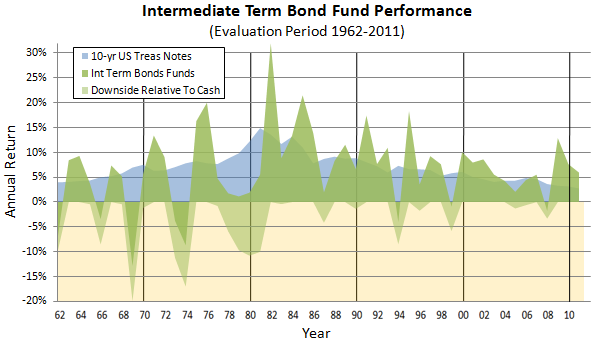

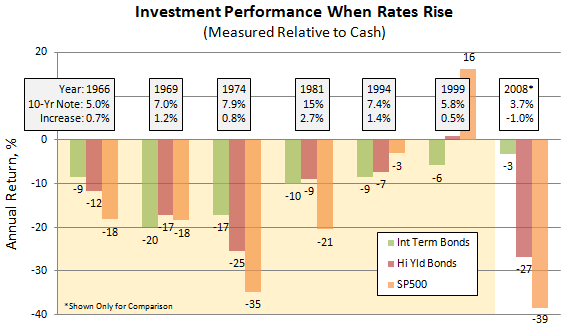

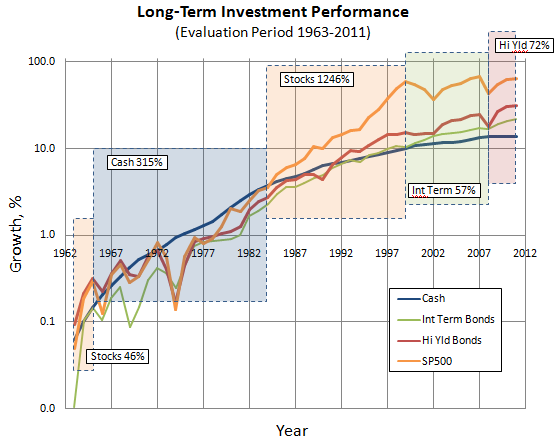

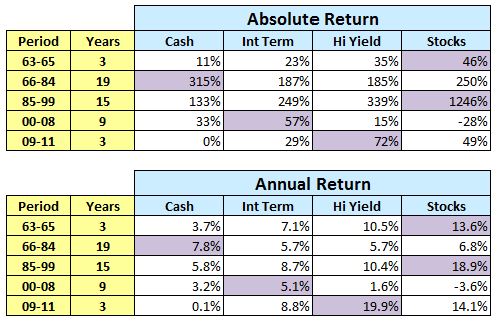

I’ve been suggesting for quite a while now that the bond market, as a whole, might be in a particularly parlous position. Within the living memory of almost the entire investing community, investing in bonds has been a surefire way to boost your portfolio. Since 1981, the bond market has enjoyed a 31-year bull market. What too many investors forget is that 1981 was preceded by a 35-year year bear market for bonds. The question is: are we at or near another turning point?

The number of people reaching that conclusion is growing rapidly. Floyd Norris of The New York Times wrote on December 28th: “A new bear market almost certainly has begun” (Reading Pessimism in the Market for Bonds). The Wall Street Journal headlined the warning, “Danger Lurks Inside the Bond Boom amid Corporate-Borrowing Bonanza, Some Money Managers Warn of Little Room Left for Gains” (12/06/2012). Separately, the Journal warned of “a rude awakening” for complacent bond investors (12/24/2012). Barron’s warns of a “Fed-inflated bond bubble” (12/17/2012). Hedge fund manager Ray Dalio claims that “The biggest opportunity [in 2013] will be – and it isn’t imminent – shorting bond markets around the world” (our friends at LearnBonds.com have a really good page of links to commentaries on the bond market, on which this is found).

I weighed in on the topic in a column I wrote for Amazon’s Money and Markets page. The column, entitled “Trees Do Not Grow to the Sky,” begins:

You thought the fallout from 2000-01 was bad? You thought the 2008 market seizure provoked anguish? That’s nothing, compared to what will happen when every grandparent in America cries out, as one, “we’ve been ruined.”

In the past five years, investors have purchased one trillion dollars’ worth of bond mutual fund shares ($1.069 trillion, as of 11/20/12, if you want to be picky) while selling a half trillion in stock funds ($503 billion).

Money has flowed into bond mutual funds in 53 of the past 60 weeks (and out of stock funds in 46 of 60 weeks).

Investors have relentlessly bid up the price of bonds for 30 years so they’ve reached the point where they’re priced to return less than nothing for the next decade.

Morningstar adds that about three-quarters of that money went to actively-managed bond funds, a singularly poor bet in most instances.

I included a spiffy graph and then reported on the actions of lots of the country’s best bond investors. You might want to take a quick scan of their activities. It’s fairly sobering.

Among my conclusions:

Act now, not later. “Act” is not investment advice, it’s communication advice. Start talking with your spouse, financial adviser, fund manager, and other investors online, about how they’ve thought about the sorts of information I’ve shared and how they’ve reacted to it. Learn, reflect, then act.

We’re not qualified to offer investment advice and we’re not saying that you should be abandoning the bond market. As we said to Charles, one of our regular readers,

I’m very sensitive to the need for income in a portfolio, for risk management and for diversification so leaving fixed-income altogether strikes me as silly and unmanageable. The key might be to identify the risks your exposing yourself to and the available rewards. In general, I think folks are most skeptical of long-term sovereign debt issued by governments that are … well, broke. Such bonds have the greatest interest rate sensitivity and then to be badly overpriced because they’ve been “the safe haven” in so many panics.

So I’d at the very least look to diversify my income sources and to work with managers who are not locked into very narrow niches.

MFWire: Stock Fund Flows Are Turning Around

MF Wire recently announced “Stock Funds Turn Around” (December 28, 2012), which might also be titled “Investors continue retreat from U.S. stock funds.” In the last full week of 2012, investors pulled $750 million from US stock funds and added $1.25 billion into international ones.

Forbes: Buy Bonds, Sleep Well

Our take might be, Observer: buy bonds, sleep with the fishes. On December 19th, Forbes published 5 Mutual Funds for Those Who Want to Sleep Well in 2013. Writer Abram Brown went looking for funds that performed well in recent years (always the hallmark of good fund selection: past performance) and that avoided weird strategies. His list of winners:

PIMCO Diversified Income (PDVDX) – a fine multi-asset fund.

MFS Research Bond R3 (MRBHX) – R3 shares are only available through select retirement plans. The publicly available “A” shares carry a sales load, which has trimmed about a percent a year off its returns.

Russell Strategic Bond (RFCEX) – this is another unavailable share class; the publicly available “A” shares have higher expenses, a load, and a lower Morningstar rating.

TCW Emerging Markets Income (TGEIX) – a fine fund whose assets have exploded in three years, from $150 million to $6.2 billion.

Loomis Sayles Bond (LBFAX) – the article points you to the fund’s Administrative shares, rather than the lower-cost Retail shares (LSBRX) but I don’t know why.

Loomis might illustrate some of the downsides to investing in the past. Its famous lead manager, Dan Fuss, is now 79 years old and likely in the later stages of his career. His heir apparent, Kathleen Gaffney, recently left the firm. That leaves the fund in the hands of two lesser-known managers.

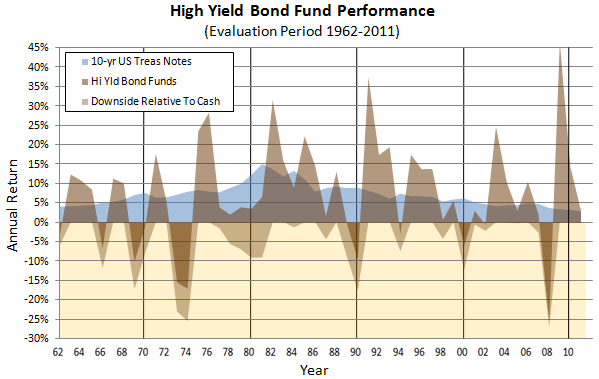

I’m not sure of how well most folks will sleep when their manager’s toting 40-100% emerging markets exposure or 60% junk bonds when the next wave crashes over the market, but it’s an interesting list.

Forbes is, by the way, surely a candidate for the most badly junked up page in existence, and one of the least useful. Only about a third of the screen is the story, the rest are ads and misleading links. See also “10 best mutual funds” does not lead to a Forbes story on the subject – it leads to an Ask search results page with paid results at top.

Vanguard: The Past 10 Years

In October we launched “The Last Ten,” a monthly series, running between now and February, looking at the strategies and funds launched by the Big Five fund companies (Fido, Vanguard, T Rowe, American and PIMCO) in the last decade.

In October we launched “The Last Ten,” a monthly series, running between now and February, looking at the strategies and funds launched by the Big Five fund companies (Fido, Vanguard, T Rowe, American and PIMCO) in the last decade.

Here are our findings so far:

Fidelity, once fabled for the predictable success of its new fund launches, has created no compelling new investment option and only one retail fund that has earned Morningstar’s five-star designation, Fidelity International Growth (FIGFX). We suggested three causes: the need to grow assets, a cautious culture and a firm that’s too big to risk innovative funds.

T. Rowe Price continues to deliver on its promises. Of the 22 funds launched, only Strategic Income (PRSNX) has been a consistent laggard; it has trailed its peer group in four consecutive years but trailed disastrously only once (2009). Investing with Price is the equivalent of putting a strong singles-hitter on a baseball team; it’s a bet that you’ll win with consistency and effort, rather than the occasional spectacular play.

PIMCO has utterly crushed the competition, both in the thoughtfulness of their portfolios and in their performance. PIMCO has, for example, about three times as many five-star funds – both overall and among funds launched in the last decade – than you’d predict.

The retirement of Gus Sauter, Vanguard’s long-time chief investment officer, makes this is fitting moment to look back on the decade just past.

Measured in terms of the number of funds launched or the innovativeness of their products, the decade has been unremarkable. Vanguard:

- Has 112 funds (which are sold in over 278 packages or share classes)

- 29 of their funds were launched in the past decade

- 106 of them are old enough to have earned Morningstar ratings

- 8 of them has a five star rating (as of 12/27/12)

- 57 more earned four-star ratings.

Morningstar awards five-stars to the top 10% of funds in a class and four-stars to the next 22.5%. The table below summarizes what you’d expect from a firm of Vanguard’s size and then what they’ve achieved.

| |

Expected Value

|

Observed value

|

|

Vanguard, Five Star Funds, overall

|

10

|

8

|

|

Vanguard, Four and Five Star Funds, overall

|

34

|

65

|

|

Five Star funds, launched since 9/2002

|

2

|

1

|

|

Four and Five Star funds, launched since 9/2002

|

7

|

18

|

What does the chart suggest? Vanguard is less likely to be “spectacular” than the numbers would suggest but more than twice as likely to be “really good.” That makes a great deal of sense given the nature of Vanguard’s advantage: the “at cost” ethos and tight budget controls means that they enter each year with a small advantage over the market. With time that advantage compounds but remains modest.

The funds launched in the past decade are mostly undistinguished, in the sense that they incorporate neither unusual combinations of assets (no “emerging markets balanced” or “global infrastructure” here) nor innovative responses to changing market conditions (as with “real return” or “inflation-tuned” ones). The vast bulk are target-date funds, other retirement income products, or new indexed funds for conventional market segments.

They’ve launched about five new actively-managed retail funds which, as a group, peak out at “okay.”

|

Ticker

|

Fund Name

|

Morningstar Rating

|

Morningstar Category

|

Total Assets ($mil)

|

|

VDEQX

|

Diversified Equity Income

|

★★★

|

Large Growth

|

1180

|

|

VMMSX

|

Emerging Markets Select Stock

|

—

|

Diversified Emerging Mkts

|

120

|

|

VEVFX

|

Explorer Value

|

—

|

Small Blend

|

126

|

|

VEDTX

|

Extended Duration Treasury Index

|

★★

|

Long Government

|

693

|

|

VFSVX

|

FTSE All-World ex-US Small Cap Index

|

★★

|

Foreign Small/Mid Blend

|

1344

|

|

VGXRX

|

Global ex-US Real Estate

|

—

|

Global Real Estate

|

644

|

|

VLCIX

|

Long-Term Corporate Bond

|

★★★★

|

Long-Term Bond

|

1384

|

|

VLGIX

|

Long-Term Gov’t Bond I

|

—

|

Long Government

|

196

|

|

VPDFX

|

Managed Payout Distribution Focused

|

★★★★

|

Retirement Income

|

592

|

|

VPGDX

|

Managed Payout Growth & Distribution Focused

|

★★★★

|

Retirement Income

|

365

|

|

VPGFX

|

Managed Payout Growth Focused

|

★★★

|

Retirement Income

|

72

|

|

VPCCX

|

PRIMECAP Core

|

★★★★

|

Large Growth

|

4684

|

|

VSTBX

|

Short-Term Corp Bond Index

|

★★★★

|

Short-Term Bond

|

4922

|

|

VSTCX

|

Strategic Small-Cap Equity

|

★★★★

|

Small Blend

|

257

|

|

VSLIX

|

Structured Large-Cap Equity

|

★★★★

|

Large Blend

|

507

|

|

VSBMX

|

Structured Broad Market Index

|

★★★★

|

Large Blend

|

384

|

|

VTENX

|

Target Retirement 2010

|

★★★★

|

Target Date 2000-2010

|

6327

|

|

VTXVX

|

Target Retirement 2015

|

★★★★

|

Target Date 2011-2015

|

17258

|

|

VTWNX

|

Target Retirement 2020

|

★★★★

|

Target Date 2016-2020

|

16742

|

|

VTTVX

|

Target Retirement 2025

|

★★★★

|

Target Date 2021-2025

|

20670

|

|

VTHRX

|

Target Retirement 2030

|

★★★★

|

Target Date 2026-2030

|

13272

|

|

VTTHX

|

Target Retirement 2035

|

★★★★

|

Target Date 2031-2035

|

14766

|

|

VFORX

|

Target Retirement 2040

|

★★★★

|

Target Date 2036-2040

|

8448

|

|

VTIVX

|

Target Retirement 2045

|

★★★★

|

Target Date 2041-2045

|

8472

|

|

VFIFX

|

Target Retirement 2050

|

★★★★

|

Target Date 2046-2050

|

3666

|

|

VFFVX

|

Target Retirement 2055

|

—

|

Target-Date 2051+

|

441

|

|

VTTSX

|

Target Retirement 2060

|

—

|

Target-Date 2051+

|

50

|

|

VTINX

|

Target Retirement Income

|

★★★★★

|

Retirement Income

|

9629

|

|

VTBIX

|

Total Bond Market II

|

★★

|

Intermediate-Term Bond

|

62396

|

This is not to suggest that Vanguard has been inattentive of their shareholders best interests. Rather they seem to have taken an old adage to heart: “be like a duck, stay calm on the surface but paddle like hell underwater.” I’m indebted to Taylor Larimore, co-founder of the Bogleheads, for sharing the link to a valedictory interview with Gus Sauter, who points out that Vanguard’s decided to shift the indexes on which their funds are based. That shift will, over time, save Vanguard’s investors hundreds of millions of dollars. It also exemplifies the enduring nature of Vanguard’s competitive advantage: the ruthless pursuit of many small, almost invisible gains for their investors, the sum of which is consistently superior results.

Celebrating Small Cap Season

The Observer has, of late, spent a lot of time talking about the challenge of managing volatility. That’s led us to discussions of long/short, covered call, and strategic income funds. The two best months for small cap funds are January and February. Average returns of U.S. small caps in January from 1927 to 2011 were 2.3%, more than triple those in February, which 0.72%. And so we teamed up again with the folks at FundReveal to review the small cap funds we’ve profiled and to offer a recommendation or two.

|

The Fund

|

The Scoop

|

2012,

thru 12/29

|

Three year

|

|

Aegis Value (AVALX):

|

$153 million in assets, 75% microcaps, top 1% of small value funds over the past five years, driven by a 91% return in 2009.

|

23.0

|

14.7

|

|

Artisan Small Cap (ARTSX)

|

$700 million in assets, a new management team – those folks who manage Artisan Mid Cap (ARTMX) – in 2009 have revived Artisan’s flagship fund, risk conscious strategy but a growthier profile, top tier returns under the new team.

|

15.5

|

13.7

|

|

ASTON/River Road Independent Value (ARIVX)

|

$720 million in assets. The fund closed in anticipation of institutional inflows, then reopened when those did not appear. Let me be clear about two things: (1) it’s going to close again soon and (2) you’re going to kick yourself for not taking it more seriously. The manager has an obsessive absolute-return focus and will not invest just for the sake of investing; he’s sitting on about 50% cash. He’s really good at the “wait for the right opportunity” game and he’s succeeded over his tenure with three different funds, all using the same discipline. I know his trailing 12-month ranking is abysmal (98th percentile in small value). It doesn’t matter.

|

7.1

|

n/a

|

|

Huber Small Cap Value (HUSIX)

|

$55 million in assets, pretty much the top small-value fund over the past one, three and five years, expenses are high but the manager is experienced and folks have been getting more than their money’s worth

|

27.0

|

19.0

|

|

Lockwell Small Cap Value Institutional (LOCSX)

|

Tiny, new fund, top 16% among small blend funds over the past year, the manager had years with Morgan Stanley before getting downsized. Scottrade reports a $100 minimum investment in the fund.

|

17.1

|

n/a

|

|

Mairs and Power Small Cap Fund (MSCFX) –

|

$40 million in assets, top 1% of small blend funds over the past year, very low turnover, very low key, very Mairs and Power.

|

27.1

|

n/a

|

|

Pinnacle Value (PVFIX)

|

$52 million in assets, microcap value stocks plus 40% cash, it’s almost the world’s first microcap balanced fund. It tends to look relatively awful in strongly rising markets, but still posts double-digit gains. Conversely tends to shine when the market’s tanking.

|

18.9

|

8.4

|

|

RiverPark Small Cap Growth (RPSFX)

|

$4 million in assets and relatively high expenses. I was skeptical of this fund when we profiled it and its weak performance so far hasn’t given me cause to change my mind.

|

5.5

|

n/a

|

|

SouthernSun Small Cap Fund (SSSFX)

|

$400 million, top 1% returns among small blend funds for the past three and five years, reasonable expenses but a tendency to volatility

|

18.0

|

21.9

|

|

Vulcan Value Partners Small Cap Fund (VVPSX)

|

$200 million, top 4% among small blend funds over the past year, has substantially outperformed them since inception; it will earn its first Morningstar rating (four stars or five?) at the beginning of February. Mr. Fitzpatrick was Longleaf manager for 17 years before launching Vulcan and was consistently placed in the top 5% of small cap managers.

|

24.3

|

n/a

|

|

Walthausen Small Cap Value Fund (WSCVX)

|

$550 million in assets, newly closed, with a young sibling fund. This has been consistently in the top 1% of small blend funds, though its volatility is high.

|

30.6

|

19.8

|

You can reach the individual profiles by clicking in the “Funds” tab on our main navigation bar. We’re in the process of updating them all during January. Because our judgments embody a strong qualitative element, we asked our resolutely quantitative friends at FundReveal to look at our small caps and to offer their own data-driven reading of some of them. Their full analysis can be found on their blog.

FundReveal’s strategy is to track daily return and volatility data, rather than the more common monthly or quarterly measures. They believe that allows them to look at many more examples of the managers’ judgment at work (they generate 250 data points a year rather than four or twelve) and to arrive at better predictions about a fund’s prospects. One of FundReveal’s key measures is Persistence, the likelihood that a particular pattern of risk and return repeats itself, day after day. In general, you can count on funds with higher persistence. Here are their highlights:

FundReveal’s strategy is to track daily return and volatility data, rather than the more common monthly or quarterly measures. They believe that allows them to look at many more examples of the managers’ judgment at work (they generate 250 data points a year rather than four or twelve) and to arrive at better predictions about a fund’s prospects. One of FundReveal’s key measures is Persistence, the likelihood that a particular pattern of risk and return repeats itself, day after day. In general, you can count on funds with higher persistence. Here are their highlights:

The MFO funds display, in general, higher volatility than the S&P 500 for both 2012 YTD and the past 5 years. The one fund that had lower volatility in both time horizons is Pinnacle Value (PVFIX). PVFIX demonstrates consistent performance with low volatility, factors to be combined with subjective analysis available from other sources.

Two other funds have delivered high ADR (Average Daily Return), but also present higher risk than the S&P. In this case Southern Sun Small Cap (SSSFX) and Walthausen Small Cap (WSCVX) have high relative volatility, but they have delivered high ADR over both time horizons. From the FundReveal perspective, SSSFX has the edge in terms of decision-making capability because it has delivered higher ADR than the S&P in 10 Quarters and lower ADR in 6 Quarters, while WSCVX had delivered higher ADR than the S&P in 7 Quarters and lower ADR in 7 Quarters.

So, bottom line, from the FundReveal perspective PVFIX and SSSFX are the more attractive funds in this lineup.

Some Small Cap funds worthy of consideration:

Small Blend

- Schwartz Value fund (RCMFX): Greater than S&P ADR, Lower Volatility (what we call “A” performance) for 2012 YTD and 2007-2012 YTD. It has a high Persistence Rating (40%) that indicates a historic tendency to deliver A performance on a quarterly basis.

- Third Avenue Small-Cap Fund (TVSVX): Greater than S&P ADR, Lower Volatility with a medium Persistence Rating (33%).

Small Growth

- Wasatch Micro Cap Value fund (WAMVX): Greater than S&P ADR, Lower Volatility 2007-2012 YTF, with a medium Persistence Rating (30%). No FundReveal covered Small Growth funds delivered “A” performance in 2012 YTD. (WAMVX is half of Snowball’s Roth IRA.)

Small Value

- Pinnacle Value Fund (PVFIX): An MFO focus fund, discussed above. It has a high Persistence Rating (50%).

- Intrepid Small Cap Fund (ICMAX ): Greater than S&P ADR, Lower Volatility for 2007-2012 YTF, with a high Persistence Rating (55%). Eric Cinnamond, who now manages Aston River Road Independent Value, managed ICMAX from 2005-10.

- ING American Century Small-Mid Cap Value (ISMSX): Greater than S&P ADR, Lower Volatility for 2007-2012 YTF, with a medium Persistence Rating (25%).

If you’re intrigued by the potential for fine-grained quantitative analysis, you should visit FundReveal. While theirs is a pay service, free trials are available so that you can figure out whether their tools will help you make your own decisions.

Ameristock’s Curious Struggle

Nick Gerber’s Ameristock (AMSTX) fund was long an icon of prudent, focused investing but, like many owner-operated funds, is being absorbed into a larger firm. In this case, it’s moving into the Drexel Hamilton family of funds.

Or not. While these transactions are generally routine, a recent SEC filing speaks to some undiscussed turmoil in the move. Here’s the filing:

As described in the Supplement Dated October 9, 2012 to the Prospectus of Ameristock Mutual Fund, Inc. dated September 28, 2012, a Special Meeting of Shareholders of the Ameristock Fund was scheduled for December 12, 2012 at 11:00 a.m., Pacific Time, for shareholders to vote on a proposed Agreement and Plan of Reorganization and Termination pursuant to which the Ameristock Fund would be reorganized into the Drexel Hamilton Centre American Equity Fund, a series of Drexel Hamilton Mutual Funds, resulting in the complete liquidation and termination of the Ameristock Fund. The Special Meeting convened as scheduled on December 12, 2012, but was adjourned until … December 27, 2012. … The Reconvened Special Meeting was reconvened as scheduled on December 27, 2012, but has again been adjourned and will reconvene on Thursday, January 10, 2012 …

Uh-huh.

Should Old Acquaintance Be Forgot and Never Brought to Mind?

Goodness, no.

How long can a fund be incredibly, eternally awful and still survive? The record is doubtless held by the former Steadman funds, which were ridiculed as the Deadman funds and eventually hid out as the Ameritor funds. They managed generations of horrible ineptitude. How horrible? In the last decade of their existence (through 2007), they lost 98.98%. That’s the transformation of $10,000 into $102. Sufficiently horrible that they became a case study at Stanford’s Graduate School of Business.

In celebrating the season of Auld Lang Syne, I set out to see whether there were any worthy successors on the horizon. I scanned Morningstar’s database for funds which trailed at least 99% of the peers this year. And over the past five years. And 10 and 15 years.

Five funds actually cropped up as being that bad that consistently. The good news for investors is that the story isn’t quite as bleak as it first appears.

|

The Big Loser’s Name

|

Any explanation?

|

|

Delaware Tax-Free Minnesota Intermediate Term, B (DVSBX) and C (DVSCX) shares

|

Expenses matter. The fund’s “A” shares are priced at 0.84% and earn a three-star rating. “C” shares cost 1.69% – that’s close to a third of the bonds’ total return.

|

|

DFA Two-Year Global Fixed Income (DFGFX)

|

DFA is among the fund world’s more exclusive clubs. Individuals can’t buy the funds nor can most advisors; advisors need to pass a sort of entrance exam just to be permitted to sell them. Bad DFA funds are rare. In the case of DFGFX, it’s a category error: it’s an ultra-short bond fund in an intermediate-term bond category. It returns 1-5% per year, never loses money and mostly looks wretched against higher return/higher risk peers in Morningstar’s world bond category.

|

|

Fidelity Select Environment and Alternative Energy (FSLEX)

|

This is a singularly odd result. Morningstar places it in the “miscellaneous sector” category then, despite a series of 99th percentile returns, gives it a four-star rating. Morningstar’s description: “this new category is a catchall.” Given that the fate of “green” funds seems driven almost entirely by politicians’ agendas, it’s a dangerous field.

|

|

GAMCO Mathers AAA (MATRX)

|

Mathers is glum, even by the standards of bear market funds. The good news can be summarized thus: high management stability (Mr. Van der Eb has been managing the fund since 1974) and it didn’t lose money in 2008. The bad news is more extensive: it does lose money about 70% of the time, portfolio turnover is 1700%, expenses are higher, Mr. Eb is young enough to continue doing this for years and an inexplicably large number of shareholders ($20 million worth) are holding on. Mr. Eb and about half of the trustees are invested in the fund. Mr. Gabelli, the “G” of GAMCO, is not.

|

|

Nysa (NYSAX)

|

This is an entirely conventional little all-cap fund. Mr. Samoraj is paid about $16,000/year to manage it. It’s lost 6.8% a year under his watch. You figure out whether he’s overpaid. He’s also not invested a penny of his own money in the fund. Smart man. Do ye likewise. (The fund’s website doesn’t exist, so you’re probably safe.)

|

Jaffe’s Year-End Explosion

I’m not sure that Chuck Jaffe is the hardest-working man in the fund biz, but he does have periods of prodigious output. December is one of those periods. Chuck ran four features this month worth special note.

I’m not sure that Chuck Jaffe is the hardest-working man in the fund biz, but he does have periods of prodigious output. December is one of those periods. Chuck ran four features this month worth special note.

- Farewell to Stupid Investments. After nearly a decade, Chuck has ended down his “Stupid Investment of the Week” column. Chuck’s closing columns echoes Cassius, in Shakespeare’s Julius Caesar: “The fault, dear Brutus, is not in our stars, But in ourselves, that we are underlings.” Or perhaps Pogo, “we have met the enemy and he is us.”

- 17th Annual Lump of Coal Awards, December 10 and December 17. This is the litany of stupidity surrounding the fund industry, from slack-wit regulators to venal managers. One interesting piece discusses Morningstar’s analyst ratings. Morningstar’s ratings roughly break the universe down into good ideas (gold, silver, bronze), okay ideas (neutral) and bad ideas (negative). Of the 1000+ funds rated so far, only 5%qualify for negative ratings. Morningstar’s rejoinder is that there are 5000 unrated funds, the vast bulk of which don’t warrant any attention. So while the 5% might be the tip of a proverbial iceberg, they represent the funds with the greatest risk of attracting serious investor attention.

My recommendation, which didn’t make Chuck’s final list, was to present a particularly grimy bit o’ bituminous to the fund industry for its response to the bond mania. Through all of 2012, the industry closed a total of four funds to new investment while at the same time launching 39 new bond funds. That’s looks a lot like the same impulse that led to the launch of B2B Internet Services funds (no, I’m not making that up) just before the collapse of the tech bubble in 2000; a “hey, people want to buy this stuff so we’ve got an obligation to market it to them” approach.

Chuck’s still podcasting, MoneyLife with Chuck Jaffe. One cool recent interview was with Doug Ramsey, chief investment officer for the Leuthold Funds.

ASTON/River Road Long-Short Conference Call

On December 17, about fifty readers joined us for an hour-long conversation with Matt Moran and Daniel Johnson, managers of ASTON/River Road Long-Short (ARLSX). For folks interested but unable to join us, here’s the complete audio of the hour-long conversation. It starts with Morty Schaja, River Road’s president, talking about the fund’s genesis and River Road’s broader discipline and track record:

| The ARLSX conference call |

|

When you click on the link, the file will load in your browser and will begin playing after it’s partially loaded. If the file downloads, instead, you may have to double-click to play it.

|

If you’d like a preview before deciding whether you listen in, you might want to read our profile of ARLSX (there’s a printable .pdf of the profile on Aston’s website and an audio profile, which we discuss below). Here are some of the highlights of the conversation:

Quick highlights:

- they believe they can outperform the stock market by 200 bps/year over a full market cycle. Measuring peak to peak or trough to trough, both profit and stock market cycles average 5.3 years, so they think that’s a reasonable time-frame for judging them.

- they believe they can keep beta at 0.3 to 0.5. They have a discipline for reducing market exposure when their long portfolio exceeds 80% of fair value. The alarms rang in September, they reduce expose and so their beta is now at 0.34, near their low.

- risk management is more important than return management, so all three of their disciplines are risk-tuned. The long portfolio, 15-30 industry leaders selling at a discount of at least 20% to fair value, tend to be low-beta stocks. Even so their longs have outperformed the market by 9%.

- River Road is committed to keeping the fund open for at least 8 years. It’s got $8 million in asset, the e.r. is capped at 1.7% but it costs around 8% to run. The president of River Road said that they anticipated slow asset growth and budgeted for it in their planning with Aston.

- The fund might be considered an equity substitute. Their research suggests that a 30/30/40 allocation (long, long/short, bonds) has much higher alpha than a 60/40 portfolio.

An interesting contrast with RiverPark, where Mitch Rubin wants to “play offense” with both parts of the portfolio. Here the strategy seems to hinge on capital preservation: money that you don’t lose in a downturn is available to compound for you during the up-cycle.

Conference Calls Upcoming: Matthews, Seafarer, Cook & Bynum on-deck

As promised, we’re continuing our moderated conference calls through the winter. You should consider joining in. Here’s the story:

- Each call lasts about an hour

- About one third of the call is devoted to the manager’s explanation of their fund’s genesis and strategy, about one third is a Q&A that I lead, and about one third is Q&A between our callers and the manager.

- The call is, for you, free. Your line is muted during the first two parts of the call (so you can feel free to shout at the danged cat or whatever) and you get to join the question queue during the last third by pressing the star key.

Our next conference call features Teresa Kong, manager of Matthews Asia Strategic Income (MAINX). It’s Tuesday, January 22, 7:00 – 8:00 p.m., EST.

Our next conference call features Teresa Kong, manager of Matthews Asia Strategic Income (MAINX). It’s Tuesday, January 22, 7:00 – 8:00 p.m., EST.

Matthews is the fund world’s best, deepest, and most experienced team of Asia investors. They offer a variety of funds, all of which have strong – and occasionally spectacular – long-term records investing in one of the world’s fastest-evolving regions. While income has been an element of many of the Matthews portfolios, it became a central focus with the December 2011 launch of MAINX. Ms. Kong, who has a lot of experience with first-rate advisors including BlackRock, Oppenheimer and JPMorgan, joined Matthews in 2010 ahead of the launch of this fund.

Why might you want to join the call?

Bonds across the developed world seem poised to return virtually nothing for years and possibly decades. For many income investors, Asia is a logical destination. Three factors support that conclusion:

- Asian governments and corporations are well-positioned to service their debts. Their economies are growing and their credit ratings are being raised.

- Most Asian debt supports infrastructure, rather than consumption.

- Most investors are under-exposed to Asian debt markets. Bond indexes, the basis for passive funds and the benchmark for active ones, tend to be debt-weighted; that is, the more heavily indebted a nation is, the greater weight it has in the index. Asian governments and corporations have relatively low debt levels and have made relatively light use of the bond market. An investor with a global diversified bond portfolio (70% Barclays US Aggregate bond index, 20% Barclays Global Aggregate, 10% emerging markets) would have only 7% exposure to Asia. However you measure Asia’s economic significance (31% of global GDP, rising to 38% in the near future or, by IMF calculations, the source of 50% of global growth), even fairly sophisticated bond investors are likely underexposed.

The question isn’t “should you have more exposure to Asian fixed-income markets,” but rather “should you seek exposure through Matthews?” The answer, in all likelihood, is “yes.” Matthews has the largest array of Asia investment products in the U.S. market, the deepest analytic core and the broadest array of experience. They also have a long history of fixed-income investing in the service of funds such as Matthews Asian Growth & Income (MACSX). Their culture and policies are shareholder-friendly and their success has been consistent. Ms. Kong has outstanding credentials and has had an excellent first year.

How can you join in?

Click on the “register” button and you’ll be taken to Chorus Call’s site, where you’ll get a toll free number and a PIN number to join us. On the day of the call, I’ll send a reminder to everyone who has registered.

Click on the “register” button and you’ll be taken to Chorus Call’s site, where you’ll get a toll free number and a PIN number to join us. On the day of the call, I’ll send a reminder to everyone who has registered.

Would an additional heads up help?

About a hundred readers have signed up for a conference call mailing list. About a week ahead of each call, I write to everyone on the list to remind them of what might make the call special and how to register. If you’d like to be added to the conference call list, just drop me a line.

Podcasts and Profiles

If you look at our top navigation bar, you’ll see a new tab and a new feature for the Observer. We’re calling it our Podcast page, but it’s much more. It began as a suggestion from Ira Artman, a talented financial services guy and a longtime member of the FundAlarm and Observer community. Ira suggested that we archive together the audio recordings of our conference calls and audio versions of the corresponding fund profiles.

If you look at our top navigation bar, you’ll see a new tab and a new feature for the Observer. We’re calling it our Podcast page, but it’s much more. It began as a suggestion from Ira Artman, a talented financial services guy and a longtime member of the FundAlarm and Observer community. Ira suggested that we archive together the audio recordings of our conference calls and audio versions of the corresponding fund profiles.

Good idea, Ira! We went a bit further and create a resource page for each fund. The page includes:

- The fund’s name, ticker symbols and its manager’s name

- Written highlights from the conference call

- A playable/downloadable .mp3 of the call

- A link to the fund profile

- A playable/downloadable .mp3 of the fund profile. The audio profiles start with the print profile, which we update and edit for aural clarity. Each profile is recorded by Emma Presley, a bright and mellifluous English friend of ours.

- A link to the fund’s most recent fact sheet on the fund’s website.

We have resource pages for RiverPark Short Term High-Yield, RiverPark Long/Short Opportunity and Aston/River Road Long Short. The pages for Matthews Asia Strategic Income, Seafarer Overseas Growth & Income, and Cook and Bynum are in the works.

Observer Fund Profiles

Each month the Observer provides in-depth profiles of between two and four funds. Our “Most Intriguing New Funds” are funds launched within the past couple years that most frequently feature experienced managers leading innovative newer funds. “Stars in the Shadows” are older funds that have attracted far less attention than they deserve. This month’s lineup features a single Star in the Shadows:

Bridgeway Managed Volatility (BRBPX): Dick Cancelmo appreciates RiverNorth Dynamic Buy-Write’s strategy and wishes them great success, but also points out that others have been successful using a similar strategy for well over a decade. Indeed, over the last 10 years, BRBPX has quietly produced 70% of the stock market’s gains with just 40% of its volatility.

BRBPX and the Mystery of the Incredible Shrinking Fund

While it’s not relevant to the merit of BRBPX and doesn’t particularly belong in its profile, the collapse of the fund’s asset base is truly striking. In 2005, assets stood around $130 million. Net assets have declined in each of the past five years from $75 million to $24 million. The fund has made money over that period and is consistently in the top third of long/short funds.

Why the shrinkage? I don’t know. The strategy works, which should at least mean that existing shareholders hang on but they don’t. My traditional explanation has been, because this fund is dull. Dull, dull, dull. Dull stocks and dull bonds with one dull (or, at least, technically dense) strategy to set them apart. Part of the problem is Bridgeway. This is the only Bridgeway fund that targets conservative, risk-conscious investors which means the average conservative investor would find little to draw them to Bridgeway and the average Bridgeway investor has limited interest in conservative funds. Bridgeway’s other funds have had a performance implosion. When I first profiled BRBPX, five of the six funds rated by Morningstar had five-star designations. Today none of them do. Instead, five of eight rated funds carry one or two stars. While BRBPX continues to have a four-star rating, there might be a contagion effect.

Mr. Cancelmo attributes the decline to Bridgeway’s historic aversion to marketing. “We had,” he reports, “the ‘if you build a better mousetrap’ mindset. We’ve now hired a business development team to help with marketing.” That might explain why they weren’t drawing new assets, but hardly explains have 80% of assets walking out the door.

If you’ve got a guess or an insight, I’d love to hear of it. (Dick might, too.) Drop me a note.

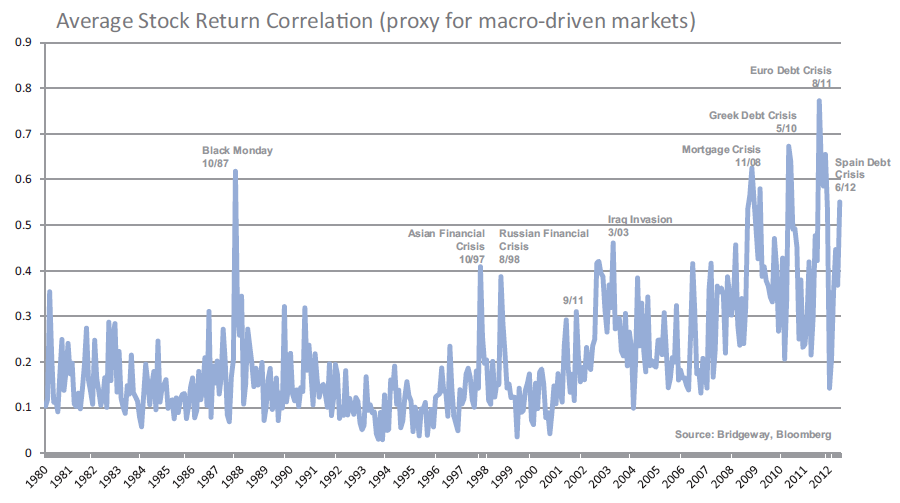

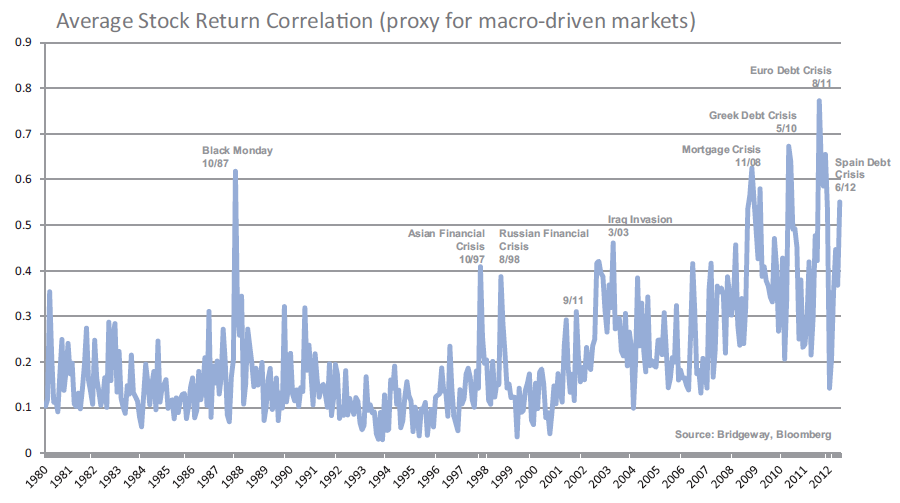

As a side note, Bridgeway probably offers the single best Annual Report in the industry. You get a startling degree of honesty, thoughtfulness and clarity about both the funds and their take on broader issues which impact them and their investors. I was particularly struck by a discussion of the rising tide of correlations of stocks within the major indices. Here’s the graphic they shared:

What does it mean? Roughly, a generation ago you could explain 20% of the movement of the average stock’s price by broader movements in the market. As a greater and greater fraction of the stock market’s trades are made in baskets of stocks (index funds, ETFs, and so on) rather than individual names, more and more of the fate of each stock is controlled by sentiments surrounding its industry, sector, peers or market cap. That’s the steady rise of the line overall. And during a crisis, almost 80% of a stock’s movement is controlled by the market rather than by a firm’s individual merits. Bridgeway talks through the significance of that for their funds and encourages investors to factor it into their investment decisions.

The report offers several interesting, insightful discussions, making it the exact opposite of – for example – Fidelity’s dismal, plodding, cookie cutter reports.

Here’s our recommendation: if you run a fund, write such like Bridgeway’s 2012 Annual Report. If you’re trying to become a better investor, read it!

Launch Alert: RiverNorth/Oaktree High Income (RNHIX, RNOTX)

RiverNorth/Oaktree High Income Fund launched on December 28. This is a collaboration between RiverNorth, whose specialty has been tactical asset allocation and investing in closed-end funds (CEFs), and Oaktree. Oaktree is a major institutional bond investor with about $80 billion under management. Oaktree’s clientele includes “75 of the 100 largest U.S. pension plans, 300 endowments and foundations, 10 sovereign wealth funds and 40 of the 50 primary state retirement plans in the United States.” Their specialties include high yield and distressed debt and convertible securities. Until now, the only way for retail investors to access them was through Vanguard Convertible Securities (VCVSX), a four-star Gold rated fund.

RiverNorth/Oaktree High Income Fund launched on December 28. This is a collaboration between RiverNorth, whose specialty has been tactical asset allocation and investing in closed-end funds (CEFs), and Oaktree. Oaktree is a major institutional bond investor with about $80 billion under management. Oaktree’s clientele includes “75 of the 100 largest U.S. pension plans, 300 endowments and foundations, 10 sovereign wealth funds and 40 of the 50 primary state retirement plans in the United States.” Their specialties include high yield and distressed debt and convertible securities. Until now, the only way for retail investors to access them was through Vanguard Convertible Securities (VCVSX), a four-star Gold rated fund.

Patrick Galley, RiverNorth’s CIO, stresses that this is “a core credit fund (managed by Oaktree) with a high income opportunistic CEF strategy managed by RiverNorth.” The fund has three investment strategies, two managed by Oaktree. While, in theory, Oaktree’s share of the portfolio could range from 0 – 100%, as a normal matter they’ll manage the considerable bulk of the portfolio. Oaktree will have the freedom to allocate between their high-yield and senior loan strategies. RiverNorth will focus on income-producing CEFs.

For those already invested in RiverNorth funds, Mr. Galley explained the relationship of RNHIX to its siblings:

We are staying true to the name and focusing on income producing closed-end funds, but unlike RNSIX (which focuses on income producing fixed income) and RNDIX (which focuses on income producing equities) and RNCOX (which doesn’t have an income mandate and only distributes once a year), RNHIX will invest across the CEF spectrum (i.e. all asset classes) but with a focus on income without sacrificing/risking total return.

The argument for considering this fund is similar to the argument for considering RiverNorth/DoubleLine Strategic Income. You’re hiring world-class experts who work in inefficient segments of the fixed-income universe.

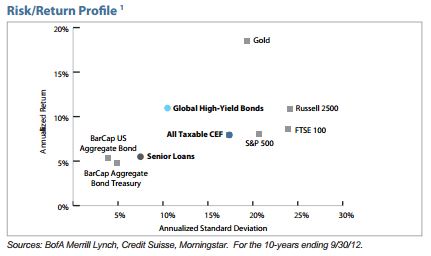

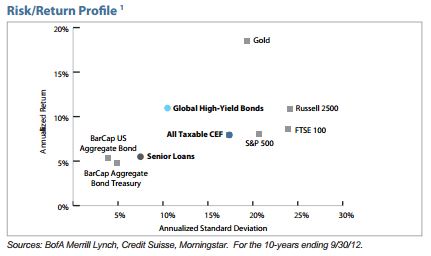

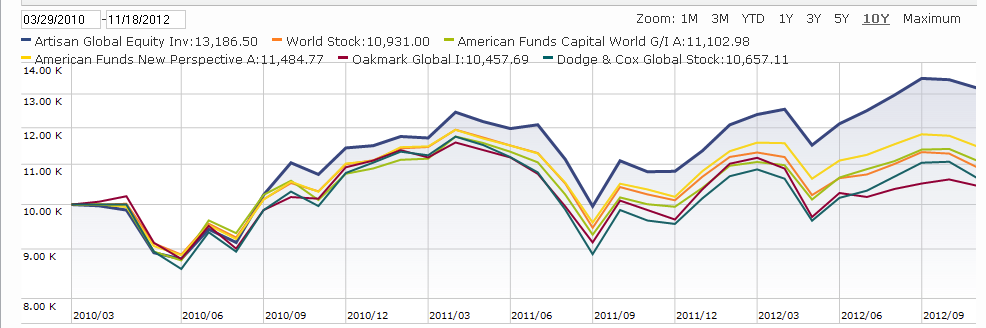

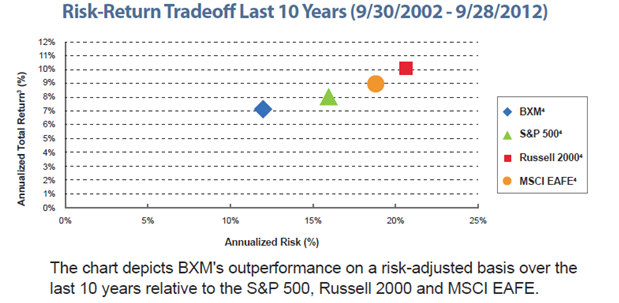

RiverNorth had the risk and return characteristics for a bunch of asset classes charted.

You might read the chart as saying something like: this is a strategy that could offer equity-like returns with more nearly bond-like volatility. In a world where mainstream, investment-grade bonds are priced to return roughly nothing, that’s an option a reasonable person would want to explore.

The retail expense ratio is capped at 1.60% and the minimum initial investment is $5000.

Funds in Registration

New mutual funds must be registered with the Securities and Exchange Commission before they can be offered for sale to the public. The SEC has a 75-day window during which to call for revisions of a prospectus; fund companies sometimes use that same time to tweak a fund’s fee structure or operating details. Every day we scour new SEC filings to see what opportunities might be about to present themselves. Many of the proposed funds offer nothing new, distinctive or interesting. Some are downright horrors of Dilbertesque babble.

Funds in registration this month won’t be available for sale until, typically, the beginning of March 2013. We found 15 funds in the pipeline, notably:

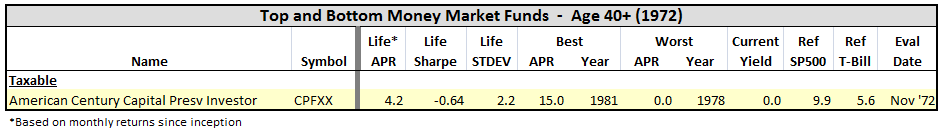

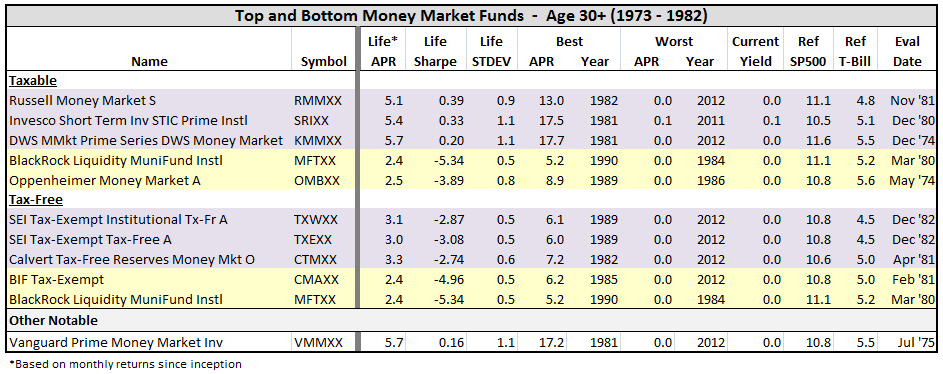

Investors Variable NAV Money Market Fund, one of a series of four money markets managed by Northern Trust, all of which will feature variable NAVs. This may be a first step in addressing a serious problem: the prohibition against “breaking the buck” is forcing a lot of firms to choose between underwriting the cost of running their money funds or (increasingly) shutting them down.

LSV Small Cap Value Fund is especially notable for its management team, led by Josef Lakonishok is a reasonably famous academic who did some of the groundbreaking work on behavioral finance, then translated that research into actual investment strategies through private accounts, hedge funds, and his LSV Value Equity Fund (LSVEX) fund.

Details on these funds and the list of all of the funds in registration are available at the Observer’s Funds in Registration page or by clicking “Funds” on the menu atop each page.

On a related note, we also tracked down 31 fund manager changes, including a fair number of folks booted from ING funds.

Briefly Noted

According to a recent SEC filing, Washington Mutual Investors Fund and its Tax-Exempt Fund of Maryland and Tax-Exempt Fund of Virginia “make available a Spanish translation of the above prospectus supplement in connection with the public offering and sale of its shares. The English language prospectus supplement above is a fair and accurate representation of the Spanish equivalent.” I’m sure there are other Spanish-language prospectuses out there, but I’ve never before seen a notice about one. It’s especially interesting given that tax-exempt bond funds target high income investors.

Effective January 1, DWS is imposing a $20/year small account service fee for shareholders in all 49 of their funds. The fee comes on top of their sales loads. The fee applies to any account with under $10,000 which is regrettable for a firm with a $1,000 minimum initial investment. (Thanks to chip for having spotted this filing in the SEC’s database. Regrets for having gotten friends into the habit of scanning the SEC database.)

Closings

Eaton Vance Atlanta Capital SMID-Cap (EAASX) is closing to new investors on Jan. 15. More has been pouring in (on the order of $1.5 billion in a year); at least in part driven by a top-notch five-year rating.

Walthausen Small Cap Value (WSCVX) closed to new investors at the end of the year. At the same time, the minimum initial investment for the $1.7 million Walthausen Select Value Investor Class (WSVIX) went from $10,000 to $100,000. WSCVX closed on January 1 at $560 million which might explain was they’re making the other fund’s institutional share class harder to access.

William Blair International Growth (WBIGX) closed to new investors, effective Dec. 31.

Old Wine in New Bottles

American Century Inflation Protection Bond (APOIX) has been renamed American Century Short Duration Inflation Protection Bond. The fund has operated as a short-duration offering since August 2011, when its benchmark changed to the Barclays U.S. 1-5 Year Treasury Inflation Protected Securities Index.

Federated Prudent Absolute Return (FMAAX) is about to become less Prudent. They’re changing their name to Federated Absolute Return and removed the manager of the Prudent Bear fund from the management team.

Prudential Target Moderate Allocation (PAMGX) is about to get a new name (Prudential Defensive Equity), mandate (growth rather than growth and income) and management structure (one manager team rather than multiple). It is, otherwise, virtually unchanged.

Prudential Target Growth Allocation (PHGAX) is merging into Prudential Jenison Equity Income (SPQAX).

U.S. Global Investors Global MegaTrends (MEGAX) is now U.S. Global Investors MegaTrends and no longer needs to invest outside the U.S.

William Blair Global Growth (WGGNX) will change its name to William Blair Global, and William Blair Emerging Leaders Growth (WELNX) will change its name to William Blair Emerging Markets Leaders.

Small wins for investors

Cook & Bynum Fund (COBYX), a wildly successful, super-concentrated value fund, has decided to substantially reduce their expense ratio. President David Hobbs reports:

… given our earlier dialogue about fees, I wanted to let you know that as of 1/1/13 the all-in expense ratio for the fund will be capped at 1.49% (down from 1.88%). This is a decision that we have been wrestling with for some time internally, and we finally decided that we should make the move to broaden the potential appeal of the fund. . . . With the fund’s performance (and on-going 5-star ratings with Morningstar and S&P Capital IQ), we decided to take a calculated risk that this new fee level will help us grow the fund.

Our 2012 profile of the fund concluded, “Cook and Bynum might well be among the best. They’re young. The fund is small and nimble. Their discipline makes great sense. It’s not magic, but it has been very, very good and offers an intriguing alternative for investors concerned by lockstep correlations and watered-down portfolios.” That makes the decreased cost especially welcome. (They also have a particularly good website.)

Effective January 2, 2013, Calamos Growth and Income and Global Growth and Income Funds re-opened to new investors. (Thanks to The Shadow for catching this SEC filing.)

ING Small Company (AESAX) has reopened. It’s reasonably large and not very good, really.

JPMorgan (JPM) launched Total Emerging Markets (TMGGX), an emerging-markets allocation fund.

Fund firms have been cutting expenses of late as they pressure to gather and hold assets builds.

Fidelity has reduced the minimum investment on its Advantage share class from $100,000 to $10,000. The Advantage class has lower expense ratios (which is good) and investors who own more than $10,000 in a fund’s retail Investor class will be moved automatically to the less-expensive Advantage class.

Fido also dropped the minimums on nearly two dozen index and enhanced index products from $10,000 to $2,500, which gives a lot more folks access to low-cost passive (or nearly-passive) shares.

Fido also cut fees on eight Spartan index funds, between one to eight basis points. The Spartan funds had very low expenses to begin with (10 basis points in some cases), so those cuts are substantial.

GMO Benchmark-Free Allocation (GBMFX) has decreased its expense ratio from 87 basis points down to 81 bps by increasing its fee waiver. The fund is interesting and important not because I intend to invest in in soon (the minimum is $10 million) but because it represents where GMO thinks that an investor who didn’t give a hoot about other people’s opinions (that’s the “benchmark-free” part) should invest.

Effective January 1, Tocqueville Asset Management L.P. capped expenses for Tocqueville International Value at 1.25% of the fund’s average daily net assets. Until now investors have been paying 1.56%.

Also effective January 1, TCW Investment Management Company reduced the management fees for the TCW High Yield Bond Fund from 0.75% to 0.45%.

Vanguard has cut fees on 47 products, which include both ETFs and funds. Some of the cuts went into effect on Dec. 21, while others went into effect on Dec. 27th. The reductions on eleven ETFs — four stock and seven bond — on December 21. Those cuts range from one to two basis points. That translates to reductions of 3 – 15%.

Off to the Dustbin of History

The board of trustees of Altrius Small Cap Value (ALTSX) has closed the fund and will likely have liquidated it by the time you read this. On the one hand, the fund only drew $180,000 in assets. On the other, the members of the board of trustees receive $86,000/year for their services, claim to be overseeing between 97 – 100 funds and apparently have been doing so poorly, since they received a Wells Notice from the SEC in May 2012. They were bright even not to place a penny of their own money in the fund. One of the two managers was not so fortunate: he ate a fair portion of his own cooking and likely ended up with a stomach cramp.

American Century will liquidate American Century Equity Index (ACIVX) in March 2013. The fund has lost 75% of its assets in recent years, a victim of investor disillusionment with stocks and high expenses. ACIVX charged 0.49%, which seems tiny until you recall that identical funds can be had for as little as 0.05% (Vanguard, naturally).

Aston Asset Management has fired the Veredus of Aston/Veredus Small Cap Growth (VERDX) and will merge the fund in Aston Small Cap Growth (ACWDX). Until the merger, it will go by the name Aston Small Cap.

The much-smaller Aston/Veredus Select Growth (AVSGX) will simply be liquidated. But were struggling.

Federated Capital Appreciation, a bottom 10% kind of fund, is merging Federated Equity-Income (LEIFX). LEIFX has been quite solid, so that’s a win.

GMO is liquidating GMO Inflation Indexed Plus Bond (GMIPX). Uhh, good move. Floyd Norris, in The New York Times, points out that recently-auctioned inflation-protected bonds have been priced to lock in a loss of about 1.4% per year over their lifetimes. If inflation spikes, you might at best hope to break even.

HSBC will liquidate two money-market funds, Tax-Tree and New York Tax-Free in mid-January.

ING Index Plus International Equity (IFIAX) has closed and is liquidating around Feb. 22, 2013. No, I don’t know what the “Plus” was.

Invesco is killing off, in April, some long-storied names in its most recent round of mergers. Invesco Constellation (CSTGX) and Invesco Leisure (ILSAX) are merging into American Franchise (VAFAX). Invesco Dynamics (IDYAX) goes into Mid Cap Growth (VGRAX), Invesco High-Yield Securities (HYLAX) into High Yield (AMHYX), Invesco Leaders (VLFAX) into Growth Allocation (AADAX), and Invesco Municipal Bond (AMBDX) will merge into Municipal Income (VKMMX). Any investors in the 1990s who owned AIM Constellation (I did), Invesco Dynamics and Invesco Leisure would have been incredibly well-off.

Leuthold Global Clean Technology (LGCTX) liquidated on Christmas Eve Day. Steve Leuthold described this fund, at its 2009 launch, as “the investment opportunity of a generation.” Their final letter to shareholders lamented the fund’s tiny, unsustainable asset base despite “strong performance relative to its comparable benchmark index” and noted that “the Fund operates in a market sector that has had challenging.” Losses of 20% per year are common for green/clean/alternative funds, so one can understand the limited allure of “strong relative performance.”

Lord Abbett plan to merge Lord Abbett Stock Appreciation (LALCX) into Lord Abbett Growth Leaders (LGLAX) in late spring, 2013.

Munder International Equity (MUIAX) is merging into Munder International Core Equity (MAICX).

Natixis Absolute Asia Dynamic Equity (DEFAX) liquidated in December. (No one noticed.)

TCW Global Flexible Allocation Fund (TGPLX) and TCW Global Moderate Allocation Fund (TGPOX) will be liquidated on or about February 15, 2013. Effective the close of business on February 8, 2013, the Funds will no longer sell shares to new investors or existing shareholders. These consistent laggards, managed by the same team, had only $10 million between them. Durn few of those $10 million came from the managers. Only one member of the management team had as much as a dollar at risk in any of TCW’s global allocation funds. That was Tad Rivelle who had a minimal investment in Flexible.

In Closing …

Thank you all for your support in 2012. There are a bunch of numerical measures we could use. The Observer hosted 78,645 visitors and we averaged about 11,000 readers a month. Sixty folks made direct contributions to the Observer and many others picked up $88,315.15 worth of cool loot (3502 items) at Amazon. And a thousand folks viewed something like 1.6 million discussion topics.

But, in many ways, the note that reads “coming here feels like sitting down with an old friend and talking about something important” is as valuable as anything we could point to.

So thanks for it all.

If you get a chance and have a suggestion about how to make the Observer better in the year ahead, drop me a note and let me know. For now, we’ll continue offering (and archiving) our monthly conference calls. During January we’ll be updating our small cap profiles and February will see new profiles for Whitebox Long Short Equity (WBLSX) and PIMCO Short Asset Investment (PAIUX).

Until then, take care.

With hopes for a blessed New Year,

In October we launched “The Last Ten,” a monthly series, running between now and February, looking at the strategies and funds launched by the Big Five fund companies (Fido, Vanguard, T Rowe, American and PIMCO) in the last decade.

In October we launched “The Last Ten,” a monthly series, running between now and February, looking at the strategies and funds launched by the Big Five fund companies (Fido, Vanguard, T Rowe, American and PIMCO) in the last decade. FundReveal’s strategy is to track daily return and volatility data, rather than the more common monthly or quarterly measures. They believe that allows them to look at many more examples of the managers’ judgment at work (they generate 250 data points a year rather than four or twelve) and to arrive at better predictions about a fund’s prospects. One of FundReveal’s key measures is Persistence, the likelihood that a particular pattern of risk and return repeats itself, day after day. In general, you can count on funds with higher persistence. Here are their highlights:

FundReveal’s strategy is to track daily return and volatility data, rather than the more common monthly or quarterly measures. They believe that allows them to look at many more examples of the managers’ judgment at work (they generate 250 data points a year rather than four or twelve) and to arrive at better predictions about a fund’s prospects. One of FundReveal’s key measures is Persistence, the likelihood that a particular pattern of risk and return repeats itself, day after day. In general, you can count on funds with higher persistence. Here are their highlights: I’m not sure that Chuck Jaffe is the hardest-working man in the fund biz, but he does have periods of prodigious output. December is one of those periods. Chuck ran four features this month worth special note.

I’m not sure that Chuck Jaffe is the hardest-working man in the fund biz, but he does have periods of prodigious output. December is one of those periods. Chuck ran four features this month worth special note. Our next conference call features Teresa Kong, manager of

Our next conference call features Teresa Kong, manager of

RiverNorth/Oaktree High Income Fund launched on December 28. This is a collaboration between RiverNorth, whose specialty has been tactical asset allocation and investing in closed-end funds (CEFs), and Oaktree. Oaktree is a major institutional bond investor with about $80 billion under management. Oaktree’s clientele includes “75 of the 100 largest U.S. pension plans, 300 endowments and foundations, 10 sovereign wealth funds and 40 of the 50 primary state retirement plans in the United States.” Their specialties include high yield and distressed debt and convertible securities. Until now, the only way for retail investors to access them was through Vanguard Convertible Securities (VCVSX), a four-star Gold rated fund.

RiverNorth/Oaktree High Income Fund launched on December 28. This is a collaboration between RiverNorth, whose specialty has been tactical asset allocation and investing in closed-end funds (CEFs), and Oaktree. Oaktree is a major institutional bond investor with about $80 billion under management. Oaktree’s clientele includes “75 of the 100 largest U.S. pension plans, 300 endowments and foundations, 10 sovereign wealth funds and 40 of the 50 primary state retirement plans in the United States.” Their specialties include high yield and distressed debt and convertible securities. Until now, the only way for retail investors to access them was through Vanguard Convertible Securities (VCVSX), a four-star Gold rated fund.

Volatility is tremendously exciting for many investment managers. You’d be amazed by the number who get up every morning, hoping for a market panic. For the rest of us, it’s simply terrifying.

Volatility is tremendously exciting for many investment managers. You’d be amazed by the number who get up every morning, hoping for a market panic. For the rest of us, it’s simply terrifying. Our next conference call features Matt Moran and Dan Johnson, co-managers of

Our next conference call features Matt Moran and Dan Johnson, co-managers of  We’re hoping to start 2013 with a conversation with Andrew Foster of

We’re hoping to start 2013 with a conversation with Andrew Foster of

On November 1, Whitebox Advisors converted their Whitebox Long Short Equity Partners hedge fund into the Whitebox Long Short Equity Fund which has three share classes. As a hedge fund, Whitebox pretty much kicked butt. From 2004 – 2012, it returned 15.8% annually while the S&P500 earned 5.2%. At last report, the fund was just slightly net-long with a major short against the Russell 2000.

On November 1, Whitebox Advisors converted their Whitebox Long Short Equity Partners hedge fund into the Whitebox Long Short Equity Fund which has three share classes. As a hedge fund, Whitebox pretty much kicked butt. From 2004 – 2012, it returned 15.8% annually while the S&P500 earned 5.2%. At last report, the fund was just slightly net-long with a major short against the Russell 2000.

The Observer is trying to help two distinct but complementary groups of folks. One group are investors who are trying to get past all the noise and hype. (CNBC’s ratings are dropping like a rock, which should help.) We’re hoping, in particular, to help folks examine evidence or possibilities that they wouldn’t normally see. The other group are the managers and other folks associated with small funds and fund boutiques. We believe in you. We believe that, as the industry evolves, too much emphasis falls on asset-gathering and on funds launched just for the sake of dangling something new and shiny (uhh … the All Cap Insider Sentiment ETF). We believe that small, independent funds run by smart, passionate investors deserve a lot more consideration than they receive. And so we profile them, write about them and talk with other folks in the media about them.

The Observer is trying to help two distinct but complementary groups of folks. One group are investors who are trying to get past all the noise and hype. (CNBC’s ratings are dropping like a rock, which should help.) We’re hoping, in particular, to help folks examine evidence or possibilities that they wouldn’t normally see. The other group are the managers and other folks associated with small funds and fund boutiques. We believe in you. We believe that, as the industry evolves, too much emphasis falls on asset-gathering and on funds launched just for the sake of dangling something new and shiny (uhh … the All Cap Insider Sentiment ETF). We believe that small, independent funds run by smart, passionate investors deserve a lot more consideration than they receive. And so we profile them, write about them and talk with other folks in the media about them.

The best book there is on the subject of practical persuasion is Robert Cialdini’s

The best book there is on the subject of practical persuasion is Robert Cialdini’s

Three out of 30 funds managed by Royce outperformed their benchmarks for the 1-year period; 4 out of 24 for the 3-year period; 12 out of 19 for the 5-year period; and all 11 outperformed for the 10-year period.

Three out of 30 funds managed by Royce outperformed their benchmarks for the 1-year period; 4 out of 24 for the 3-year period; 12 out of 19 for the 5-year period; and all 11 outperformed for the 10-year period.

Based on the success of our September conference call with David Sherman of Cohanzick Asset Management and RiverPark’s president, Morty Schaja, we have decided to try to provide our readers with one new opportunity each month to speak with an “A” tier fund manager.

Based on the success of our September conference call with David Sherman of Cohanzick Asset Management and RiverPark’s president, Morty Schaja, we have decided to try to provide our readers with one new opportunity each month to speak with an “A” tier fund manager.